Impact of Xiaomi's Business Boundary Expansion on Valuation Model Reconstruction: Reassessment of Value Creation and Dilution

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

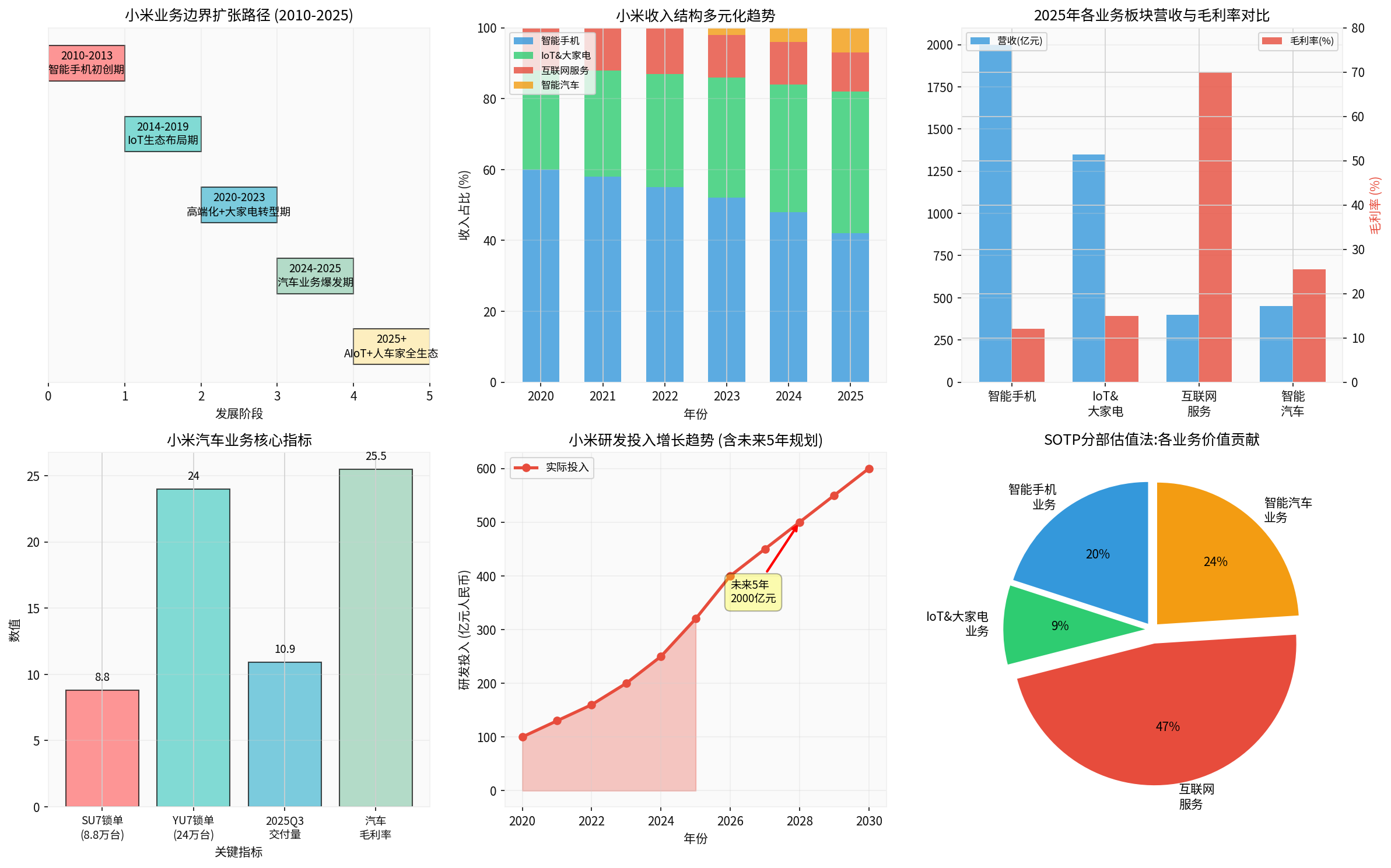

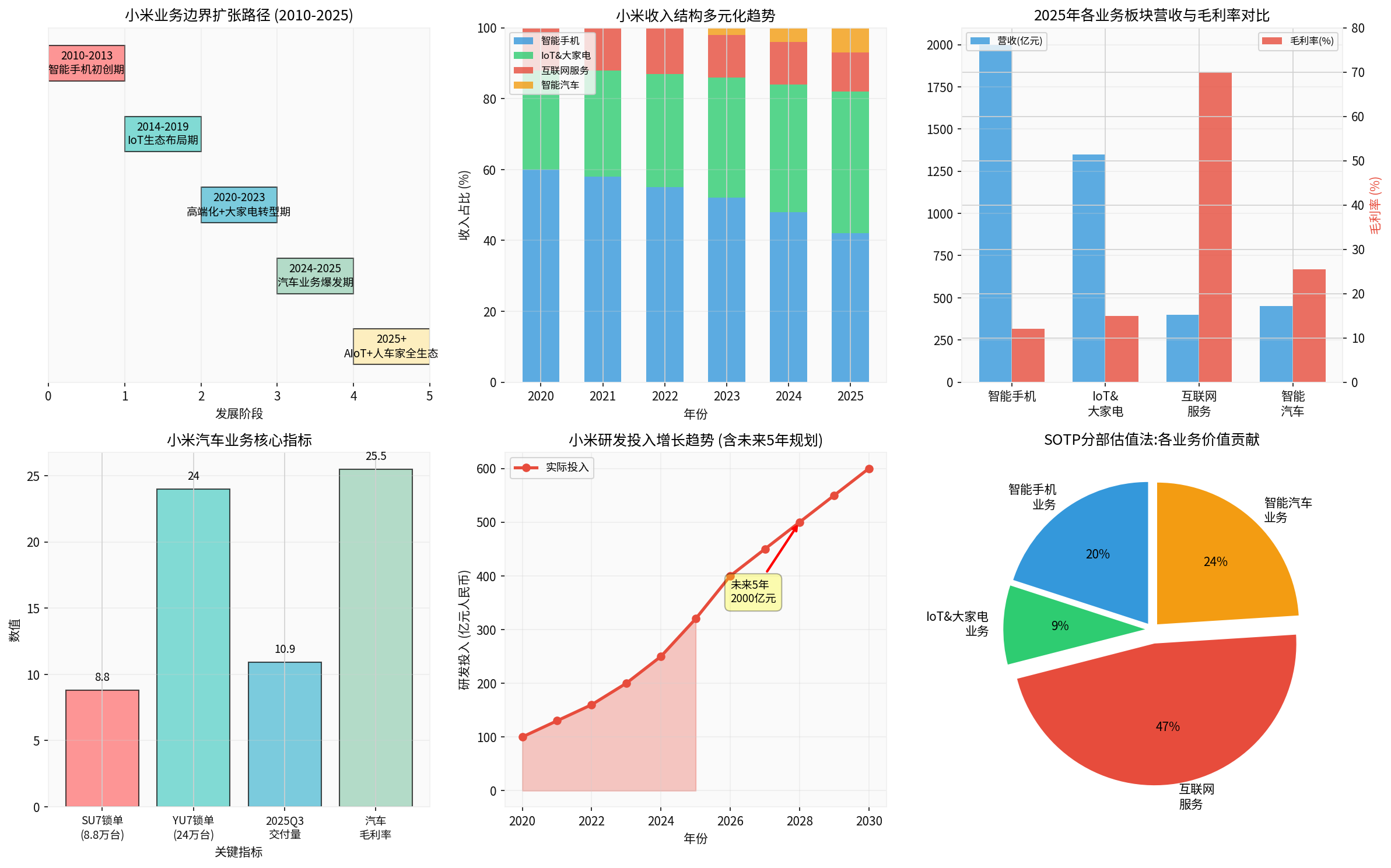

Based on Xiaomi’s development history and public information, its business boundary expansion shows a clear five-phase path:

- Core focus on smartphones, breaking market patterns with the ‘cost-effectiveness + internet model’

- Accumulated user base and brand awareness for subsequent ecosystem expansion

- Deployed smart hardware and IoT via investment + ecosystem chain model

- Initially formed the prototype of the ‘Smartphone + AIoT’ dual-engine strategy

- Invested in smartphone high-endization strategy (cumulative R&D investment exceeding 100 billion yuan)

- Built its own home appliance factories, launching high-endization and intelligent upgrading of large home appliance business

- SU7 launched in March 2024, deliveries started in July 2024

- YU7 launched in June 2025, with locked orders exceeding 240,000 units in 18 hours

- In Q3 2025, the automotive business delivered 109,000 units in a single quarter, generated revenue of 29 billion yuan, with a gross margin of 25.5%, achieving operating profit of 700 million yuan in a single quarter for the first time

- The 500,000th vehicle rolled off the production line in November 2025, setting a new domestic new energy record in 1 year and 7 months

- Launched the self-developed 3nm flagship SoC ‘Xuanjie O1’, becoming the fourth company globally and the first in mainland China with independent R&D and design capabilities for 3nm flagship SoCs

- The ‘Human-Vehicle-Home’ full ecosystem strategy was officially closed-loop, with three growth curves (smartphones, automobiles, large home appliances) advancing in parallel

From 2020 to 2025, Xiaomi’s revenue structure continued to diversify (data is based on estimates and trend judgments from public information and web searches, not precise figures):

Key Data Support (Brokerage API and Web Search):

- Total group revenue in the first three quarters of 2025 was 340.4 billion yuan, up 32.5% YoY

- IoT business revenue in the first three quarters of 2025 increased by 34.6% YoY

- Automotive business revenue in the first three quarters of 2025 was approximately 29 billion yuan (Q3), achieving single-quarter profit of 700 million yuan for the first time

- IoT + Large Home Appliances business revenue in 2025 is expected to exceed 135 billion yuan, with YoY growth of ~30% (web search context)

| Business Segment | Revenue Scale | YoY Growth | Gross Margin | Value Characteristics |

|---|---|---|---|---|

| Smartphones | ~2000 | Mid-single-digit growth | ~12% | Cash cow, user ecosystem entrance |

| IoT & Large Home Appliances | ~1350 | +30% YoY | ~15% | High growth, strong ecosystem synergy |

| Internet Services | ~400 | Double-digit growth | ~70% | High margin, ecosystem value monetization |

| Smart Automobiles | ~450 (annualized) | Rapid ramp-up phase | 25.5% (Q3) | High growth, strategic business |

Note: The above is a trend summary based on web search information and financial report disclosures, not precise figures; automotive gross margin is from Q3 disclosure.

Expanded from a single smartphone business to four-wheel drive:

- Smartphones (CAGR ~5%):Achieved counter-trend breakthrough in a highly saturated stock market, ranking second in domestic sales from January to November with a 16.82% market share, realizing net user inflow from all top 5 domestic brands, including over 4.5 million Apple switchers (web search)

- IoT & Large Home Appliances (CAGR ~27%):IoT + Large Home Appliances business revenue in 2025 is expected to exceed 135 billion yuan, up ~30% YoY (web search context); self-built smart home appliance factories put into production, driving simultaneous improvement in average price and gross margin

- Internet Services (CAGR ~12%):Contributes considerable profit (high margin ~70%) with ~11% revenue share, a key monetization channel for ecosystem value

- Smart Automobiles (CAGR 200%+):Automotive business revenue in the first three quarters of 2025 surged 199.2% YoY, achieving first single-quarter profit of 700 million yuan in Q3; YU7 locked 240,000 orders in 18 hours; strong delivery rhythm for SU7/YU7

- Internet Services:Contribute ‘ecosystem premium’ with ~70% gross margin

- Automotive Business:Q3 gross margin reached 25.5% and achieved single-quarter profit of 700 million yuan for the first time, proving the profitability path is viable

- IoT & Large Home Appliances:Gross margin ~15%, continuously improving via self-built factories and high-endization

- Smartphones:Gross margin ~12%, steadily increasing via high-endization and self-developed chips

Comprehensive Effect: Overall profitability is shifting from ‘hardware low profit + service monetization’ to ‘increased share of high-margin businesses + improved hardware profitability’

As of 2025:

- MIUI Monthly Active Users (MAU) reached 742 million

- IoT-connected devices exceeded 1.04 billion units

- Global AIoT developer ecosystem continues to grow

Web search references indicate that the value of the ‘Human-Vehicle-Home full ecosystem × AI’ intelligent organism has not been fully priced by the market; the strategic value of the closed-loop ecosystem far exceeds the financial contribution of a single product.

- PE Valuation (current 20.25x):Only reflects existing profits, does not fully price high-growth businesses like automobiles prospectively, significantly underestimating ecosystem value and growth options

- DCF Valuation (fair value ~HK$21.00):Sensitive to cash flow fluctuations, industry cycles, and capital expenditure rhythm; conservative for high-growth businesses; cash flow parameters based on historical 5-year averages cannot fully capture the rapid volume of automotive business and accelerated ecosystem monetization

- PS Valuation:Can reflect growth but lacks profit quality and risk adjustment, easily overly optimistic

Based on web search and public data, the SOTP framework better reflects the hierarchical composition of Xiaomi’s ecosystem value:

| Business Segment | Revenue Share (Estimate) | Value Contribution Share (Example) | Valuation Multiple |

|---|---|---|---|

| Internet Services | ~11% | ~47% | ~25× P/E |

| Smart Automobiles | ~7% | ~24% | ~1.5× P/S (based on volume rhythm) |

| Smartphones | ~42% | ~20% | ~15× P/E |

| IoT & Large Home Appliances | ~40% | ~9% | ~15× P/E |

Note: The above is an exemplary breakdown based on web search SOTP analysis, showing methods and magnitudes, not formal valuation conclusions.

- Internet Services account for ~11% of revenue but contribute ~47% of value in SOTP (web search example), reflecting high premium for ecosystem monetization

- Automotive business has considerable value share (~24% in the example), reflecting market expectations for its volume rhythm and ecosystem synergy; as delivery and profit are realized, the weight of this segment is expected to increase

- Valuation multiples for smartphones and IoT & Large Home Appliances are relatively stable, serving as cash flow support

Xiaomi has built a unique valuation paradigm of ‘Human-Vehicle-Home full ecosystem × AI’:

- 742 million MIUI MAUs and 1.04 billion IoT-connected devices form an extremely difficult-to-replicate ecosystem foundation

- Cross-terminal data accumulation and scenario linkage capabilities form a unique moat in the AI era

- Self-developed 3nm flagship SoC, MiMo large model, Pengpai OS iteration, forming ‘Chip + OS + AI’ three-core drive

- AI empowers hardware experience and ecosystem monetization, improving user stickiness and ARPU, bringing non-linear growth potential

$$Valuation = \sum(Each Business Segment SOTP) × (1 + AI Synergy Coefficient) × (1 + Ecosystem Network Effect)$$

- Smartphone business achieved counter-trend breakthrough in the stock market, with net inflow from all top 5 domestic brands, including over 4.5 million Apple switchers (web search)

- Automotive business, relying on internet-style product thinking and traffic tactics, locked 240,000 orders in 18 hours, becoming a genuine domestic SUV challenging Model Y; Q3 gross margin of 25.5% and first single-quarter profit prove that ‘sales + price + profit’ can be achieved simultaneously

- R&D investment in 2025 was approximately 32-33 billion yuan, with R&D personnel increasing to 24,871

- Planned R&D investment of 200 billion yuan from 2026 to 2030, focusing on chips, OS, and AI

- ‘Sending two children to college at the same time’ (automotive and chips), but R&D efficiency and execution speed are leading in the industry (web search context)

- Openvela partners exceeded 100, empowering over 1,500 categories and 160 million devices

- CarIoT open categories exceeded 30, with in-depth cooperation with 4 car companies including BYD and GAC Toyota

- The ecosystem closed-loop has moved from concept to implementation, forming irreversible competitive barriers

- Multi-scenario coverage extends user lifetime, reducing customer acquisition costs

- Cross-selling and scenario linkage improve ARPU and repurchase rate

- Self-developed 3nm SoC fills the gap in high-endization, forming cost and experience advantages

- MiMo large model completes multi-modal matrix layout, forming competitiveness in inference efficiency and cost

- Automotive business crossed the profit threshold in 6 quarters, setting a new record for Chinese new forces in speed

- In Q3 2025, automotive business generated 29 billion yuan in revenue, 25.5% gross margin, and 700 million yuan in operating profit, proving that large-scale profitability is feasible

##5. Core Conclusions and Outlook

###5.1 Impact on Valuation Model Reconstruction

| Dimension | Traditional Perspective | New Valuation Framework |

|---|---|---|

| Core Value Driver | Hardware Sales | Ecosystem Network Effect |

| Key Valuation Indicator | PE/PS | SOTP + AI Synergy Coefficient |

| Growth Source | Single Product | Diversified Growth Engines |

| Competitive Barrier | Cost Advantage | Ecosystem Closed-loop + AI Capability |

###5.2 Judgment on Investment Value of Diversification (Calibrated via Web Search SOTP Information)

Based on web search SOTP examples (Internet Services contribute ~47% value, EV segment ~24%):

- Value Creation:Internet Services occupy nearly half of the value in SOTP due to high margin and ecosystem monetization; automotive business, though small in revenue share, supports ~1/4 value with volume and profit realization, reflecting market premium awareness of automotive and ecosystem

- Risk Diversification:Four-wheel drive (smartphones, IoT, automotive, internet services) smooths fluctuations in a single business; rapid growth of automotive and IoT hedges against the cyclical nature of the smartphone business

- Growth Resilience:Automotive CAGR 200%+ (ramp-up phase), IoT & Large Home Appliances CAGR ~27%, Internet Services double-digit growth, multi-curve relay

- Ecosystem Premium:The combination of ‘Human-Vehicle-Home full ecosystem × AI’ brings cross-terminal synergy and non-linear growth potential

###5.3 Future Valuation Upgrade Path

- With the capacity ramp-up of the second-phase factory and model iteration (SU7, YU7, SU7 Ultra), gross margin remains high, and scale effect further amortizes early R&D and factory investment

- The weight in valuation is expected to continue to increase, driving the overall valuation multiple upward

- AI empowers scenario linkage and personalized services, improving monetization efficiency of advertising, games, finance, etc.

- Automotive and home appliance scenarios bring new service entrances and monetization opportunities

- Cross-terminal data accumulation improves AI model capabilities and service accuracy

- User stickiness and ARPU increase, further strengthening the ecosystem moat

- 200 billion yuan R&D investment from 2026 to 2030, focusing on three tracks: chips, OS, AI

- Mass production and iteration of self-developed SoCs build long-term technical moats

##6. Investor Perspective: How to View the ‘Valuation Reconstruction’ Opportunity

###6.1 Current Market Perception Bias

- Smartphone shipments, automotive delivery volume, quarterly financial fluctuations

- Concerns about peer competition and industry cyclicality

- Closed-loop of the ‘Human-Vehicle-Home’ ecosystem strategy, bringing cross-scenario synergy and ecosystem network effect

- User experience and monetization efficiency leap driven by AI

- Diversified growth engine relay and profitability structure optimization

Web search points out: The current market’s perception of Xiaomi is still stuck in the ‘old map’, over-focusing on short-term indicators, while the huge potential of ecosystem synergy in the AI era has not been fully priced, forming a ‘valuation blind spot’

###6.2 Risk Tips and Key Assumptions

- Intensified Competition in the Automotive Industry:Fierce competition from Tesla, BBA, new forces, etc., leading to fluctuations in gross margin and delivery rhythm

- Uncertainty of R&D Investment:200 billion yuan R&D investment has a long cycle, and commercialization rhythm is uncertain

- Macroeconomic Fluctuations:Consumer electronics and automotive demand are sensitive to macroeconomics

- Supply Chain Risks:External factors such as geopolitics and chip supply

- Automotive business continues to be profitable from 2026 to 2027 and maintains delivery growth

- Internet Services ARPU steadily increases, ecosystem monetization efficiency enhances

- Smartphone high-endization trend continues, gross margin stabilizes and rises

- R&D investment is converted into technical barriers and product competitiveness as scheduled

###6.3 Investment Advice: Embrace the ‘Valuation Reconstruction’ Opportunity

- Focus on segment value提升 under the SOTP framework, especially the rising weight of automotive business and Internet Services

- Attach importance to the long-term growth space of ‘Ecosystem Value × AI’, tolerate short-term fluctuations

- Focus on the rhythm of automotive business volume and profit realization

- Pay attention to AI technology landing and commercialization progress of ecosystem synergy

- Wait for further confirmation of automotive business profit (continuous quarterly profit)

- Evaluate the impact of macro environment on consumption and automotive demand

[0] Jinling API Data (Xiaomi Company Overview, Real-Time Quotes, Financial Analysis, DCF Valuation, Stock Price Performance)

[1] Eastmoney.com - Looking Back at 2025: Xiaomi Remains One of China’s Most Growth-Potential Tech Companies (https://caifuhao.eastmoney.com/news/20251226093327853955760)

[2] NetEase - Review 2025|Xiaomi’s Success, Oscillating Between Red and Black (https://www.163.com/dy/article/KHHO9IOG052782VM.html)

[3] Sina Finance - Xiaomi Group’s Total Revenue in the First Three Quarters of 2025 Was 340.4 Billion Yuan, Up 32.5% YoY (https://finance.sina.com.cn/tech/roll/2025-12-17/doc-inhcavhm7552800.shtml)

[4] Time Weekly - Giants Compete in ‘Human-Vehicle-Home’: Xiaomi Plans to Invest 200 Billion Yuan in the Next 5 Years! Huawei, BYD and Others Cross-border Entry (https://news.qq.com/rain/a/20251217A06WEG00)

[5] NetEase - Annual Investment Review: When Xiaomi’s ‘Human-Vehicle-Home’ Meets the New Starting Point of AI (https://www.163.com/dy/article/KHPCSS9205394MBC.html)

[6] LinkedIn - Xiaomi Corporation Sum-of-the-Parts (SOTP) Valuation Analysis (https://www.linkedin.com/pulse/xiaomi-corporation-sum-of-the-parts-sotp-valuation-analysis-zeng-wd9rc)

[7] Sina Finance - Domestic Phones Join Hands with Leica Imaging to Upgrade Again, High-end Path Upward to Break Through (https://finance.sina.com.cn/tech/roll/2025-12-26/doc-inheaqmt2881141.shtml)

[8] 36Kr - Lei Jun: 2025, Welcome the Storm (https://m.36kr.com/p/3604845942670594)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.