2025 Energy Metals Supply-Demand Pattern and Investment Value Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the context you provided and the latest market data I obtained, I will comprehensively analyze the 2025 energy metals supply-demand pattern and investment value evolution for you.

Lithium carbonate prices have experienced a dramatic ‘roller coaster’ trend: plummeting from a peak of 600,000 CNY/ton to 58,000 CNY/ton, a drop of over 90%, and currently rebounding to 120,000 CNY/ton[0]. This price fluctuation reflects the market’s transition from extreme supply shortage to oversupply, then to the current gradual balance of supply and demand.

-

Impact of CATL Yichun Lithium Mine Resumption: Yichun lithium mica mines were previously suspended due to environmental protection and cost issues, causing disturbances to market supply. If CATL resumes production, it will:

- Increase market supply by approximately 10-15万吨/year LCE (Lithium Carbonate Equivalent)

- Put pressure on the price of 120,000 CNY/ton

- However, considering cost line support, there is limited room for further decline

-

Cost Support Line: The industry average cost line is between 80,000-100,000 CNY/ton, and the cost of high-quality mines is about 50,000-70,000 CNY/ton, which provides a bottom support for prices

- Slowdown in NEV Growth: The global new energy vehicle growth rate dropped from over 100% in 2022 to about 30-35% in 2024, showing a significant slowdown

- Rise of Energy Storage Demand: The energy storage market has become a new growth point for lithium demand, with energy storage battery demand growing at a rate of over 50% from 2024 to 2025

- Total Demand Forecast: Global lithium demand is expected to grow by 25-30% in 2025, lower than the explosive growth in previous years

- Stock price has risen 78.85% year-to-date, current price is 57.93 CNY

- Market capitalization is 94.87 billion CNY, P/E ratio is -46.94x (in loss status)

- ROE is -4.82%, net profit margin is -19.46%, profitability is under pressure

- However, the company has high-quality lithium mine resources (Greenbushes, Atacama) with significant cost advantages

- Investment View: The short-term rebound reflects the market’s expectation of a bottoming out and recovery of lithium prices, but current valuations still need to be verified by performance recovery. It is recommended to pay attention to whether the price of 120,000 CNY/ton can stabilize and the company’s cost control capabilities

- DR Congo Export Ban: As the world’s largest cobalt producer (accounting for over 70% of global supply), changes in export policies will directly affect global supply

- High Supply Concentration: Geopolitical risks and ESG issues in DR Congo continue to affect supply stability

- Plummeting Ternary Battery Share: From a peak of 60% to less than 20%, this is the biggest challenge facing cobalt demand

- Rise of Lithium Iron Phosphate (LFP) Batteries: Mainstream car companies like Tesla and BYD have shifted to LFP batteries, reducing dependence on cobalt

- High Nickel Low Cobalt Trend: High nickel low cobalt battery technologies like NCM811 and NCM905 further reduce cobalt usage per unit battery

- Stock price has surged 132.31% year-to-date, current price is 66.00 CNY

- Market capitalization is 110.44 billion CNY, P/E ratio is 21.21x

- ROE is 13.20%, net profit margin is 7.19%, profitability is stable

- The company has transformed from a single cobalt enterprise to a full industrial chain layout of ‘nickel-cobalt-lithium-precursor-recycling’

- Investment View: The sharp rise in stock price reflects market recognition of its industrial chain integration, but structural changes in cobalt demand remain a long-term concern. The company has reduced its dependence on a single metal through diversification into nickel and lithium businesses, but still needs to be alert to the risk of further decline in the ternary battery market share

- Indonesia accounts for about 40-50% of global nickel supply, and its share is still increasing

- Chinese enterprises like Tsingshan Group have laid out a large number of nickel iron and HPM projects in Indonesia

- Historical Risk Warning: The 2022 Tsingshan nickel short squeeze incident exposed the risk of price manipulation

- The delisting case of Jien Nickel reflects the risk of high-leverage operation in the industry

- Accounts for about 70% of nickel demand, highly correlated with the macroeconomic cycle

- The downturn in China’s real estate industry has put pressure on stainless steel demand

- Accounts for about 10-15% of nickel demand, but has the fastest growth rate (over 30% annual growth)

- High nickel battery technologies like NCM811 and NCA drive nickel demand

- However, it is affected by the overall decline in ternary battery market share

- Stock price has risen 26.34% year-to-date, current price is 8.01 CNY

- Market capitalization is 40.85 billion CNY, P/E ratio is 33.38x

- The company is a leader in nickel resource recycling and utilization, benefiting from the circular economy trend

- Investment View: Nickel prices are suppressed by increasing supply from Indonesia, but the recycling business has certain defensive properties. It is recommended to pay attention to the progress of the company’s waste battery recycling business

- Opportunities: The price of 120,000 CNY/ton is close to the industry average cost line, with limited downside space; the rise of energy storage demand provides a new growth point

- Risks: CATL’s production resumption increases supply; slowdown in NEV growth

- Strategy: Focus on leading enterprises with cost advantages (like Tianqi Lithium), avoid high-cost mine enterprises

- Opportunities: Supply risk premium in DR Congo; short-term price rebound

- Risks: Continuous decline in ternary battery share; deterioration of demand structure

- Strategy: Focus on enterprises with integrated industrial chains (like Huayou Cobalt), avoid pure cobalt targets

- Opportunities: High nickel battery technology route; recycling value

- Risks: Continuous increase in supply from Indonesia; weak stainless steel demand

- Strategy: Focus on enterprises with cost advantages and recycling technologies

- The 120,000 CNY/ton lithium price is a sensitive position; pay attention to whether it can stabilize effectively

- Huayou Cobalt’s stock price has fully reflected industrial chain value, with short-term correction risks

- Tianqi Lithium needs to pay attention to performance recovery progress

- Pay attention to monthly NEV sales data to determine whether growth rate stabilizes

- Pay attention to the pull of energy storage market development on lithium demand

- Monitor the progress of nickel project commissioning in Indonesia

- Energy metals enter a balance period of ‘both supply and demand growth’, bid farewell to the era of high profits

- Focus on leading enterprises with cost advantages and resource control capabilities

- Pay attention to opportunities in the circular economy and recycling utilization fields

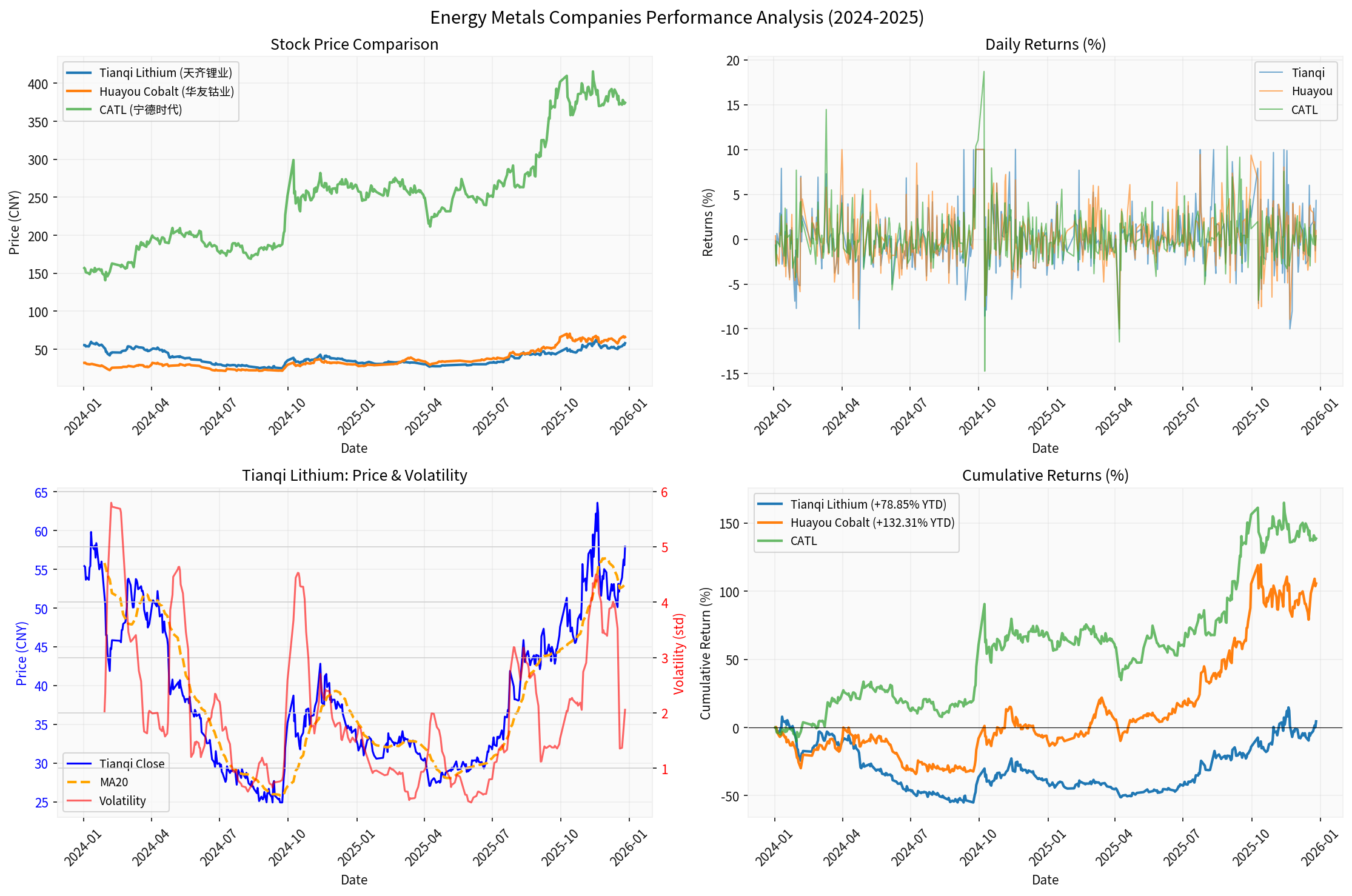

The chart shows the comparison of stock price performance of major energy metal companies from 2024 to 2025. From the chart:

- Huayou Cobalt has the highest cumulative return (+132.31% YTD), reflecting market recognition of its industrial chain integration

- Tianqi Lithium performs strongly (+78.85% YTD), benefiting from expectations of lithium price bottoming and rebound

- CATL’s stock price rises steadily (+138.75% YTD), performing stably as a battery leader

- Current volatility is in a reasonable range; Tianqi Lithium’s 20-day volatility is 2.06

- Macroeconomic Risk: Global economic recession may affect NEV and energy storage demand

- Technology Route Risk: New technologies like solid-state batteries may change the metal demand pattern

- Geopolitical Risk: Policy changes in resource countries like DR Congo and Indonesia

- Price Volatility Risk: Sharp fluctuations in metal prices affect the stability of enterprise profits

- Environmental Policy Risk: Higher environmental standards increase mining costs

[0] Jinling API Data

- Tianqi Lithium (002466.SZ) stock price, financial data and company overview

- Huayou Cobalt (603799.SS) stock price, financial data and company overview

- CATL (300750.SZ) stock price and market data

- GEM (002340.SZ) stock price, financial data and company overview

- S&P 500 and NASDAQ market index data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.