Pop Mart In-Depth Investment Analysis: IP Operation System and Long-Term Investment Value Evaluation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Your two core questions are very critical:

- Can Pop Mart’s IP operation system support it to become a long-term investment target like Tencent Games?

- Is the logic of its IP matrix strategy to hedge against single IP risk valid?

This will conduct a comprehensive analysis from multiple dimensions such as the nature of the business model, IP lifecycle, financial quality, and risk hedging mechanisms.

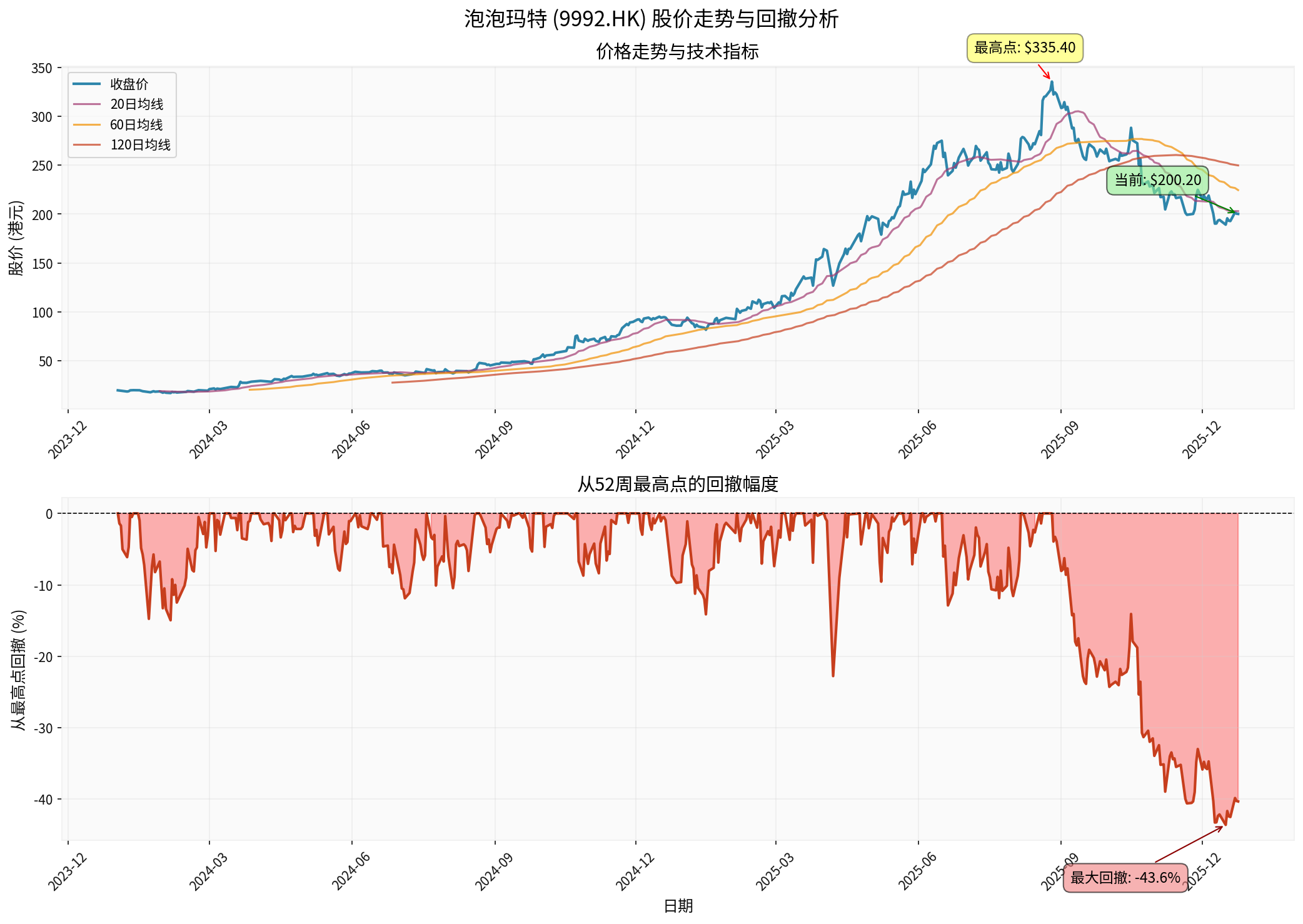

- 52-week high: HK$335.40 →current price: HK$200.20

- Retracement from high: -40.3% (highly consistent with Bloomberg’s report of “40% stock price crash” [1])

- Maximum retracement: -43.6%

- Annualized volatility: 56.9% (extremely high volatility)

- Market capitalization: HK$265.89 billion (approximately US$34.1 billion)

-

Positive signals:

- Andrew Wu, President of LVMH China, joined the board of directors (December 2025), strengthening the brand’s high-end strategy [2]

- Q3 2025 revenue surged 245%-250% YoY (China market +185-190%, overseas +365-370%) [2]

-

Negative concerns:

- Disappointing US Black Friday sales, triggering concerns about growth slowdown [1]

- Cooling demand in the secondary market, with obvious signs of Labubu’s popularity fading [1]

- Analysts expect revenue growth to slow down in 2026 [3]

- Everbright analysts even see a drop to HK$100 [3]

| Dimension | Tencent Games (Honor of Kings) | Pop Mart (Labubu) |

|---|---|---|

Product form |

Digital virtual goods | Physical collectibles |

Business model |

Free + in-app purchases (sustained monetization) | One-time sales + repurchase-driven |

User lifecycle |

Long-term (average 2-3 years) | Short-term (popularity cycle 6-18 months) |

Marginal cost |

Extremely low (close to zero) | Relatively high (production, inventory, logistics) |

Network effect |

Strong (social fission) | Weak (niche circle) |

Content iteration |

High-frequency updates (weekly/monthly) | Low-frequency (quarterly/annual) |

Competitive barrier |

Ecology + data + social relationship chain | IP image + design + channels |

Tencent Games’ core competitiveness lies in:

- Extremely high user stickiness: Social relationship chain + in-game sunk cost

- Sustained monetization capability: Continuous launch of skins, heroes, and props

- Diminishing marginal cost: Profit margin continues to increase after scaling

- Ecological moat: WeChat/QQ traffic entrance + payment system

- Still maintains strong revenue after 8 years of launch (since 2015)

- DAU stabilizes at 50-100 million

- Annual revenue contribution exceeds US$10 billion

- Quarterly average ARPU (Average Revenue Per User): $50-100

Pop Mart’s business model is more like a hybrid of

- Blind box mechanism: Gambling psychology stimulates consumption (5-10 minutes of dopamine release)

- Social currency attribute: Sharing, exchanging, and circle identity

- Expected collection value: Secondary market premium drives primary market consumption

- IP iteration demand: Continuously launch new IP to maintain popularity

Based on market data [1][2][3]:

- Labubu birth time: 2015 (10-year history)

- Boom period: 2023-2024 (global trendy toy boom)

- Cooling period: Second half of 2025 (US Black Friday weakness + secondary market cooling)

- Short-term speculative hype

- Collection value expectation-driven

- Price crash after rapid popularity decline [1]

| Factor | Tencent Games | Pop Mart |

|---|---|---|

Continuous content output |

✓ (weekly updates) | ✗ (quarterly new releases) |

Community culture precipitation |

✓ (e-sports, UGC) | △ (Xiaohongshu/Douyin) |

Cross-media expansion |

✓ (animation, film and television) | △ (in trial) |

User co-creation mechanism |

✓ (MOD, guides) | ✗ (one-way consumption) |

Depth of emotional connection |

Strong (growth memory) | Medium (collection hobby) |

Based on the company’s operation model [0]:

- Head IP: Labubu, Molly, Dimoo, Skullpanda

- Mid-tier IP: Newly signed artist IP

- Incubated IP: Internal designer team + external cooperation

-

Resource allocation problem:

- Labubu contributes over 50% of revenue (estimated)

- Other IPs are difficult to reach the same popularity

- Marketing resources are concentrated on head IP

-

IP replication problem:

- Artist styles are difficult to standardize

- Explosive IP depends on “timing, location, and people”

- High cold start cost for new IP

-

User fatigue risk:

- Diminishing freshness of blind box mechanism

- Limited collection space/economic budget

- Niche user growth reaches ceiling

- Even with multiple IPs, Labubu’s cooling still led to a 40% stock price crash [1]

- Indicates that the market believes single IP dependence risk has not been truly dispersed

Tencent Games’ IP matrix:

- Self-developed IP: Honor of Kings, Peacekeeper Elite, Tianya Mingyue Dao

- Agent IP: PUBG, COD, DNF

- Investment matrix: Riot, Supercell, Epic

- Tencent IPs have synergistic effects(traffic, technology, user data)

- Pop Mart IPs compete with each other(user wallet share)

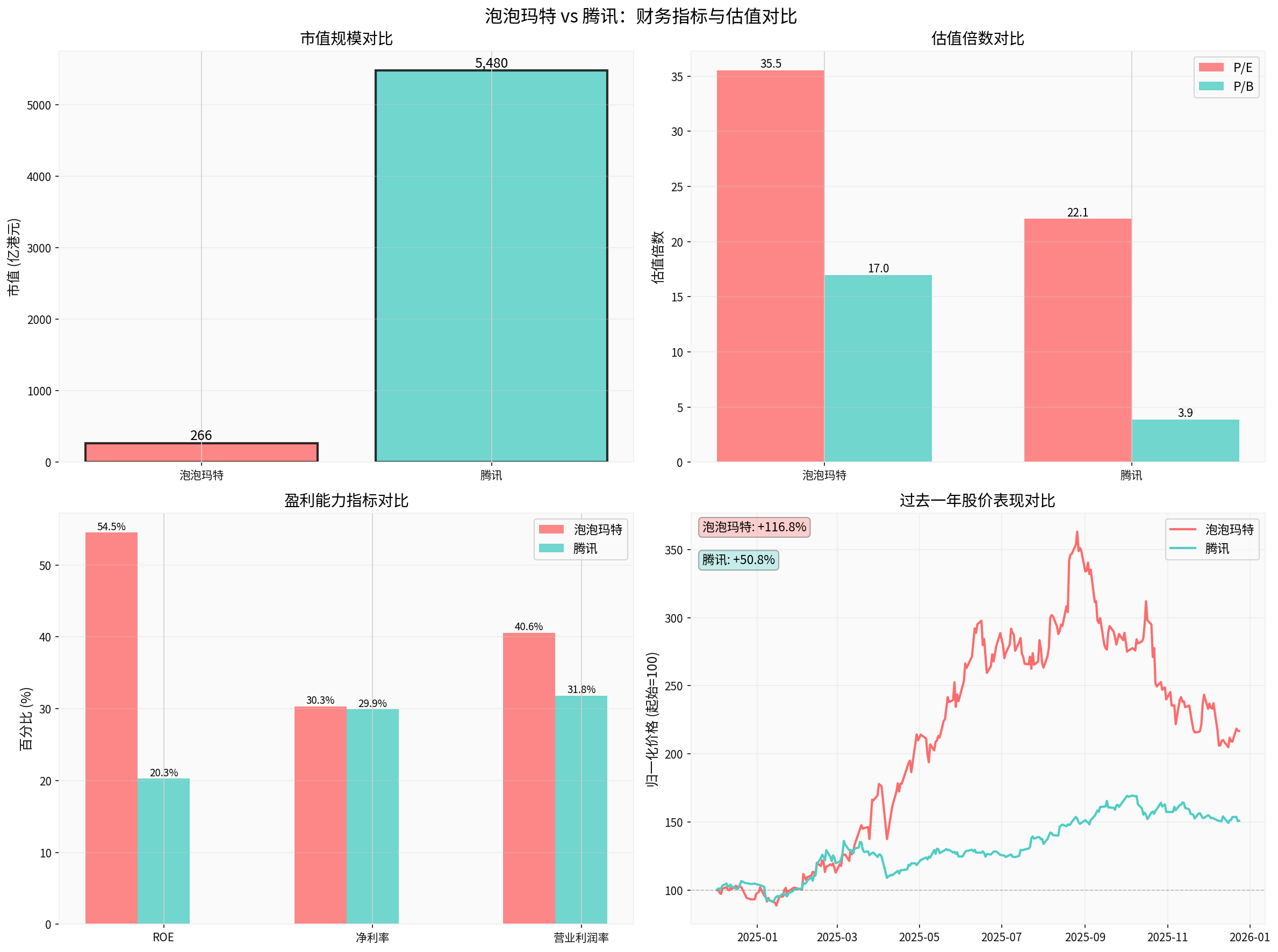

| Indicator | Pop Mart | Tencent | Difference Analysis |

|---|---|---|---|

Market capitalization |

HK$265.8 billion | HK$5.48 trillion | Tencent is 20.6 times that of Pop Mart |

P/E |

35.53x | 22.08x | Pop Mart has a 61% premium (high growth expectation) |

P/B |

16.98x | 3.86x | Pop Mart has a 340% premium (asset quality difference) |

ROE |

54.52% | 20.29% | Pop Mart is higher (light asset) |

Net profit margin |

30.32% | 29.93% | Similar |

Operating profit margin |

40.58% | 31.84% | Pop Mart is higher |

Current ratio |

3.01 | 1.36 | Pop Mart has stronger liquidity |

- YTD increase: +119.64%

- 1-year increase: +132.79%

- 3-year increase: +910.09% (extremely volatile)

-5-year increase: +157.82%

- YTD increase: +44.95%

-1-year increase: +44.47%

-3-year increase: +94.63%

-5-year increase: +26.03%

- Pop Mart is a high Betastock (high volatility, high elasticity)

- Tencent is a stable blue chip(low volatility, sustained growth)

- Extremely high ROE (54.52%): Light asset + high turnover

- Excellent net profit margin (30.32%): Strong brand premium

- Healthy cash flow: No debt risk [0]

- High dependence on Labubu (single IP risk)

- Whether overseas expansion can continue (365% growth is difficult to maintain)

- Blind box regulatory risk (domestic supervision has been strengthened)

##7. Risk Factors and Uncertainties

###7.1 Core Risks

-

IP obsolescence risk:

- Labubu’s popularity has shown signs of cooling [1]

- New IP has not yet proven its ability to take over

- Consumer aesthetic fatigue

-

Valuation risk:

- P/E 35.53x, far higher than Tencent’s 22.08x

- If growth slows down, valuation will be under pressure

- Large historical retracement (-43.6%)

-

Business model sustainability:

- Blind box mechanism may be regulated (gambling nature)

- Consumption downgrade affects non-essential consumption

- Intensified competition (52Toys, TOP TOY, etc.)

-

Overseas expansion risk:

- Poor US Black Friday performance [1]

- Cultural differences and localization challenges

- Geopolitical risks

###7.2 Risk Comparison with Tencent Games

| Risk Type | Tencent Games | Pop Mart |

|---|---|---|

Policy risk |

High (game version number) | Medium (blind box supervision) |

Technological disruption |

Medium (VR/AR) | Low (physical products) |

User churn |

Medium (competitors) | High (aesthetic changes) |

IP obsolescence |

Low (continuous iteration) | High (fashion cycle) |

Competitive barrier |

Strong (ecology) | Medium (channels + IP) |

##8. Investment Conclusion: Can It Become a Long-Term Target?

###8.1 Answers to Core Questions

-

Different nature of business models:

- Tencent: Platform ecology + sustained monetization + network effect

- Pop Mart: Product sales + hotspot-driven + no network effect

-

IP lifecycle differences:

- Tencent Games: 8+ years of continuous operation (Honor of Kings)

- Trendy toy IP: 2-3 year popularity cycle (Labubu is 10 years old, but boom only lasted 2 years)

-

Different moat depth:

- Tencent: Social relationship chain + data + ecology

- Pop Mart: IP image + channels + brand

- The company has multiple head IPs (Molly, Dimoo, Skullpanda)

- Continuously signs new artists

- Internal incubation team

- Labubu contributes over 50% of revenue (high concentration)

- Other IPs are difficult to reach the same popularity

- Resource allocation is difficult to balance

- Market validation failure: Even with an IP matrix, Labubu’s cooling still led to a 40% stock price crash [1]

###8.2 Valuation and Investment Recommendations

- Stock price: HK$200.20 (40% retracement from high)

- P/E:35.53x (still expensive)

- Market capitalization: HK$265.89 billion

| Dimension | Rating | Explanation |

|---|---|---|

Business model |

★★☆☆☆ | Lack of moat, dependent on hotspots |

Growth |

★★★☆☆ | High growth but difficult to sustain |

Profit quality |

★★★★☆ | High ROE, good cash flow |

Valuation rationality |

★★☆☆☆ | Too high P/E, implying high growth expectations |

Long-term certainty |

★★☆☆☆ | High risk of IP obsolescence |

-

Long-term value investors:

- Not recommended as core holdings

- If optimistic about Chinese trendy toys going overseas, can allocate a small position (<5%)

-

Short-term traders:

- High volatility provides trading opportunities

- Pay attention to IP release cycles and earnings seasons

- Strict stop-loss (volatility 56.9%)

-

Wait for better entry points:

- If stock price pulls back to HK$100-150 range

- And new IP proves successful in taking over

- Overseas expansion continues to exceed expectations

###8.3 Key Observation Indicators

- New IP successfully takes over (non-Labubu revenue accounts for >50%)

- Sustained high growth in overseas markets (>100% YoY)

- Successful cross-media IP expansion (animation, games, film and television)

- Valuation pulls back to below P/E 25x

- Revenue growth <50% for 2 consecutive quarters

- Decline in Labubu series revenue

- Tightening of blind box regulatory policies

- Competitors seize market share

##9. In-Depth Investment Research Recommendations

Given that you are researching Pop Mart, it is recommended to deepen the research from the following dimensions:

-

IP health monitoring:

- Track secondary market price trends

- Social media discussion热度

- User repurchase rate data

-

IP matrix quality:

- Revenue contribution ratio of each IP

- Success rate of new IP incubation

- Artist signing and retention status

-

In-depth research on overseas markets:

- Specific data on US Black Friday performance

- Localization strategies in Southeast Asian markets

- Store efficiency per square meter of direct stores

-

Competitive landscape analysis:

- Performance of competitors like TOP TOY and 52Toys

- Strategies of international trendy toy brands (Bearbrick, Funko) in China

- Supply chain and channel advantage comparison

[0] Jinling API Data - Financial data, stock price data and company overview of Pop Mart (9992.HK) and Tencent (0700.HK)

[1] Bloomberg - “Pop Mart’s 40% Stock Rout Shows Growing Worry Over Labubu Crash” (December 17, 2025)

https://www.bloomberg.com/news/articles/2025-12-17/pop-mart-s-40-stock-rout-shows-growing-worry-over-labubu-crash

[2] Forbes - “Labubu Maker Pop Mart’s Shares Rise After LVMH China Chief Joins Board” (December 14, 2025)

https://www.forbes.com/sites/forbeschina/2025/12/14/labubu-maker-pop-marts-shares-rise-after-lvmh-china-chief-joins-board/

[3] Forbes - “Chinese Toymaker Mogul Loses Billions As Shares Of Labubu Maker Slide” (December 22, 2025)

https://www.forbes.com/sites/ywang/2025/12/22/chinese-toymaker-mogul-loses-billions-as-shares-of-labubu-maker-slide/

[4] Yahoo Finance - “LVMH’s Andrew Wu Joins Labubu’s Maker Pop Mart as Nonexecutive Director” (December 2025)

https://finance.yahoo.com/news/lvmh-andrew-wu-joins-labubu-145155242.html

[5] Bloomberg - “Pop Mart Shares Plunge 8% as Sales Concerns Fuel Short Bets” (December 8, 2025)

https://www.bloomberg.com/news/articles/2025-12-08/pop-mart-shares-plunge-8-as-sales-concerns-fuel-short-bets

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.