Assessment of the Impact of U.S. Infrastructure Policy Changes on Infrastructure Investment and Construction Industry Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

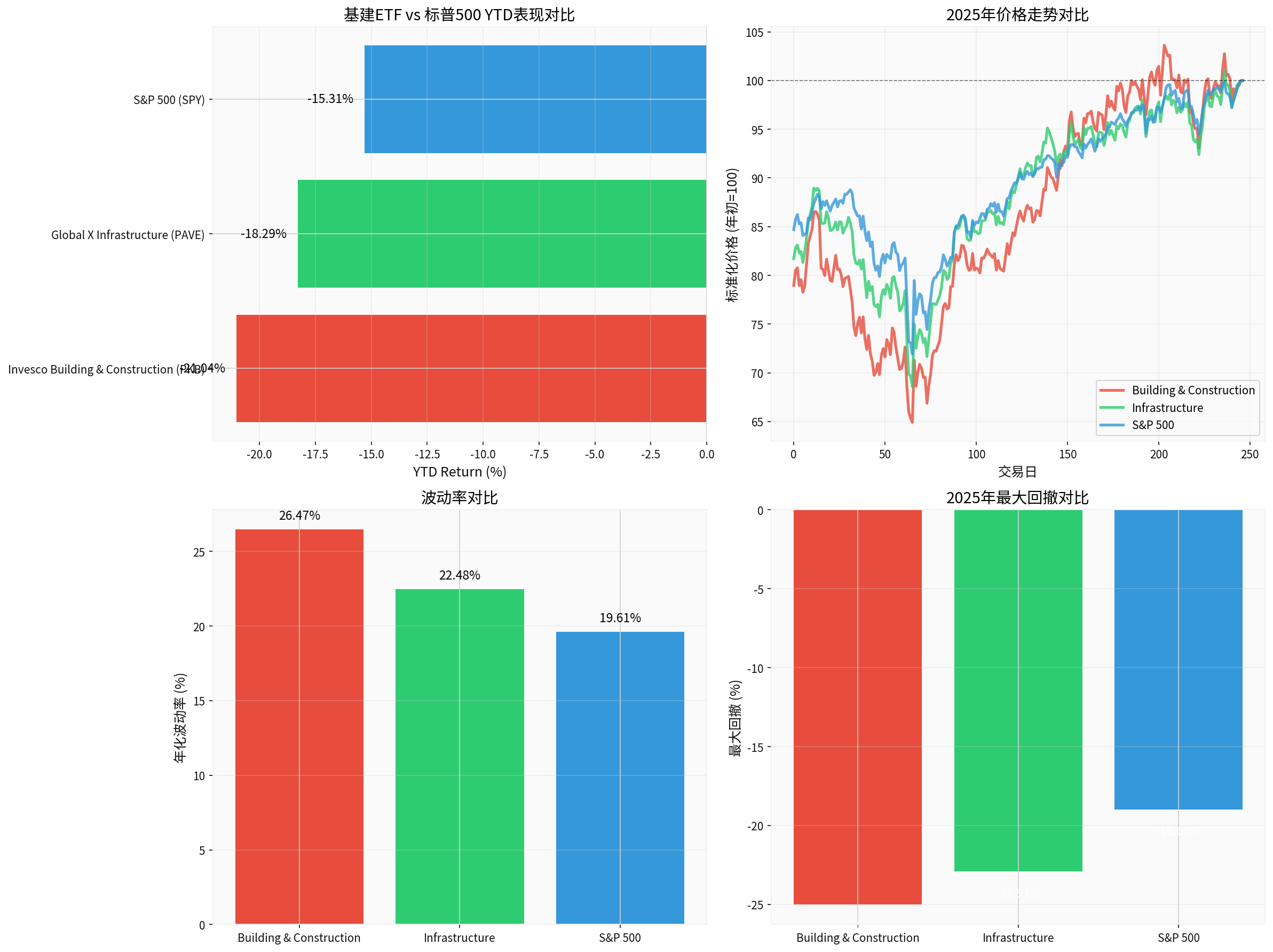

According to the latest data analysis, U.S. infrastructure policy uncertainty has had a significant negative impact on infrastructure and construction industry stocks in 2025.

The California high-speed rail project originally received approximately $4 billion in federal funding support, but the Trump administration later revoked this funding. The California state government initially filed a lawsuit but eventually chose to abandon it. This decision reflects:

- Federal Level: Adjustment of infrastructure spending priorities, leaning towards reducing direct federal funding for large transportation projects

- State Level: Facing fiscal pressure, even if the lawsuit is won, there may be delays or difficulties in implementing the funding

- Political Impact: Infrastructure investment has become an important area of power博弈 between federal and state governments

| Indicator | Construction ETF (PKB) | Infrastructure ETF (PAVE) | S&P500 (SPY) |

|---|---|---|---|

YTD Return |

-21.04% | -18.29% | -15.31% |

Annualized Volatility |

26.47% | 22.48% | 19.61% |

Maximum Drawdown |

-25.02% | -22.91% | -19.00% |

- Infrastructure sector overall underperformed the broader marketby 5-6 percentage points

- Volatility is higher than the broader market, reflecting risk premiums from policy and project uncertainty

- Deeper maximum drawdown indicates investors are more inclined to avoid infrastructure risks during periods of policy uncertainty

- Delay or cancellation of large projects: Funding uncertainty for large infrastructure projects like California High-Speed Rail directly reduces demand for construction equipment and services

- State-level fiscal pressure: State governments face budget constraints and may postpone non-urgent infrastructure projects

- Hesitation in private sector investment: Policy uncertainty leads private investors to take a wait-and-see attitude towards PPP projects

- Decline in material demand: Poor performance of Vulcan Materials (construction materials) and Nucor (steel) reflects weak demand for infrastructure materials

- Delay in equipment orders: Sharp declines in Caterpillar and Deere share prices indicate extended construction equipment procurement cycles

- Inventory adjustment pressure: Contractors may reduce equipment purchases and material inventories

- Rising risk premium: Infrastructure sector volatility is higher than the broader market, and investors demand higher returns

- Increased financing costs: Policy uncertainty may lead to difficulties in project financing, especially for projects relying on federal funding

- Valuation compression: P/E ratios of infrastructure companies are generally under pressure, although some companies still have solid fundamentals

- Financial Attitude: Neutral - Maintains balanced accounting practices

- Debt Risk: Medium risk

- Free Cash Flow: $8.82 billion (latest fiscal year)

- Current Valuation: P/E 29.94x, Market Capitalization $273.12B

- Despite the sharp share price decline, financial conditions are sound with abundant free cash flow

- As a global leader in construction equipment, it will benefit from long-term global infrastructure demand

- Short-term pressure mainly comes from U.S. market policy uncertainty

- Financial Attitude: Aggressive - Low depreciation/capital expenditure ratio

- Debt Risk: Low risk

- Free Cash Flow: $664 million (latest fiscal year)

- Current Valuation: P/E 2.06x (unusually low), Market Capitalization $6.58B

- Best performance in 2025 (+20.70%), market认可 its asset-light strategy

- Recent sale of Zhuhai Shipyard ($122 million) improved liquidity[0]

- Institutional investor Aristides Capital established a new position of $9.46 million in Q3[0]

-

Persistent policy uncertainty: Federal infrastructure spending priorities may continue to adjust

- Risk Level: High

- Impact Degree: Negative

-

State-level fiscal pressure: May face fiscal austerity after election year

- Risk Level: Medium-High

- Impact Degree: Negative

-

Interest rate environment: High interest rates increase project financing costs

- Risk Level: Medium

- Impact Degree: Negative

-

Aging infrastructure: U.S. roads, bridges, and water systems urgently need upgrades

- Estimated infrastructure investment gap of $2-3 trillion over the next 10 years

-

Energy transition demand: Grid upgrades and new energy infrastructure construction bring new opportunities

- Power infrastructure, charging networks, renewable energy transmission

-

AI-driven power demand: Data center construction requires corresponding infrastructure support

- Energy industry reports indicate AI development drives power infrastructure investment[0]

- Prioritize companies with strong cash flow: Such as Caterpillar (FCF $8.82B), United Rentals

- Focus on international business exposure: Diversified geographic distribution can partially hedge U.S. policy risks

- Consider increasing bond allocation: Infrastructure-related investment-grade bonds provide stable returns

- Buy优质 leaders on dips: Long-term beneficiaries like Caterpillar, Vulcan Materials

- Focus on M&A integration opportunities: Industry downturns may present integration opportunities

- Private infrastructure funds: Participate in long-term stable return infrastructure projects

- Infrastructure ETFs flat to slightly up (0-10%) within 12 months

- Equipment manufacturer demand gradually recovers, share prices stabilize and rise

- Construction service companies benefit from project execution and consulting demand

- Infrastructure ETFs continue to underperform, possibly falling another 10-15%

- Large projects delayed or canceled, equipment demand remains weak

- Industry consolidation accelerates, weaker companies face acquisition risks

- Infrastructure ETFs rebound strongly, possibly rising 25-40%

- Equipment orders surge, Caterpillar and other companies benefit significantly

- New energy infrastructure investment drives related sector growth

U.S. infrastructure policy changes are having a

- Short-term pressure: Policy uncertainty will continue to suppress infrastructure sector valuations, expected to face pressure over the next 6-12 months

- Structural opportunities: Aging U.S. infrastructure and energy transition demand create long-term investment opportunities

- Increased divergence: Companies with strong cash flow and international exposure will be more resilient

- Investor strategy: Recommenddefensive allocation + selective offensestrategy, focusing on cash flow quality in the short term and long-term infrastructure upgrade themes

- Review infrastructure holdings, increase allocation to high-quality companies with strong cash flow

- Closely monitor 2025 federal budget and infrastructure policy trends

- Consider sector allocation via ETFs (PAVE, PKB) to reduce individual stock risk

- Be patient, wait for valuation recovery after policy uncertainty eases

[0] Gilin API Data - Including real-time stock quotes, financial analysis, market index data and Python calculation results

[1] Motley Fool - “Why a New $10 Million Fluor Stock Buy Signals Confidence After a Rough Year” (https://www.fool.com/coverage/filings/2025/12/26/why-a-new-usd10-million-fluor-stock-buy-signals-confidence-after-a-rough-year/)

[2] Business Wire - “Fluor Streamlines Portfolio With $122M Zhuhai Yard Sale” (https://finance.yahoo.com/news/fluor-streamlines-portfolio-122m-zhuhai-171900479.html)

[3] Business Wire - “AECOM selected as a preferred bidder for Scottish Water’s multi-billion-dollar Enterprise Alliance” (http://www.businesswire.com/news/home/20251223615762/en/AECOM-selected-as-a-preferred-bidder-for-Scottish-Water’s-multi-billion-dollar-Enterprise-Alliance/)

[4] Substack - “Time to Buy Caterpillar (CAT)?” (https://tikstocks.substack.com/p/time-to-buy-caterpillar-cat)

[5] Business Wire - “United Rentals Scales AI Applications with AWS” (http://www.businesswire.com/news/home/20251218100030/en/United-Rentals-Scales-AI-Applications-with-AWS/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.