Disney (DIS) Comprehensive Analysis: Box Office Impact of Zootopia 2 and China Market Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

As of the close on December 27, 2025, Disney’s (DIS) stock price was

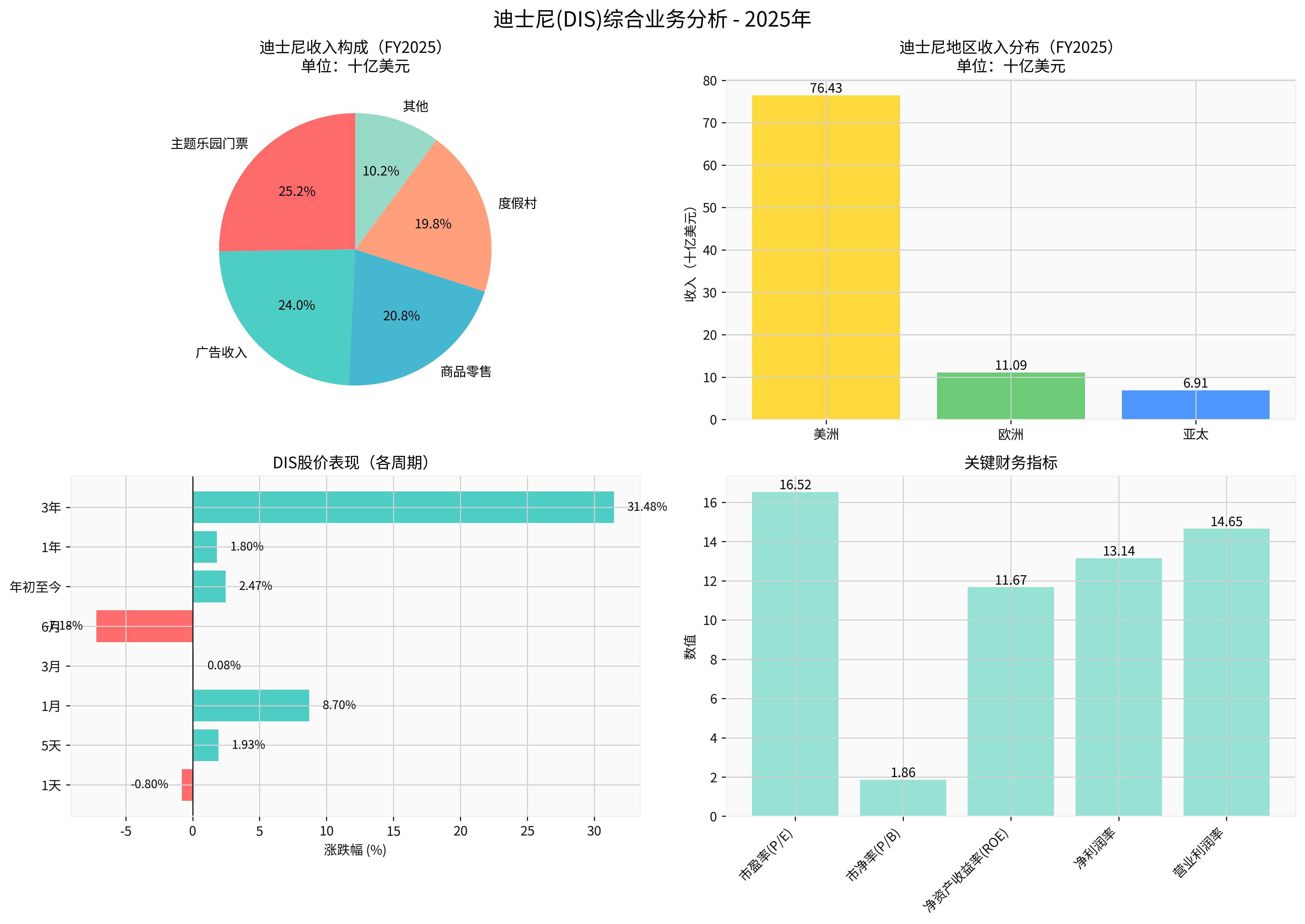

| Financial Indicator | Value | Evaluation |

|---|---|---|

| Price-to-Earnings (P/E) | 16.52x | Reasonable range |

| Price-to-Book (P/B) | 1.86x | Low |

| Return on Equity (ROE) | 11.67% | Good |

| Net Profit Margin | 13.14% | Healthy |

| Operating Profit Margin | 14.65% | Healthy |

- 1-month gain: +8.70%- Shows recent recovery signs [0]

- 3-month gain: +0.08%- Short-term consolidation [0]

- 6-month decline: -7.18%- Adjustment in mid-year [0]

- Year-to-date: +2.47%- Overall stable performance [0]

Technical analysis shows that DIS is currently in a

Analysts maintain a

- Consensus target price: $139.00(22.4% upside from current price) [0]

- Rating distribution:60.3% Buy, 33.3% Hold, 6.3% Sell [0]

- Recent developments:Institutions like Jefferies, Evercore ISI, and Wells Fargo have all maintained Buy/Outperform ratings [0]

Disney has diversified revenue sources, mainly including:

| Business Segment | Revenue (Billion USD) | Proportion | Characteristics |

|---|---|---|---|

| Theme Park Tickets | $11.71 | 22.1% | Stable cash flow |

| Advertising Revenue | $11.12 | 21.0% | Affected by macroeconomics |

| Merchandise Retail | $9.64 | 18.2% | Strongly related to IP |

| Resorts | $9.21 | 17.4% | High value-added business |

| Others | $4.72 | 8.9% | Diversified revenue [0] |

| Region | Revenue (Billion USD) | Proportion |

|---|---|---|

| Americas | $76.43 | 80.9% |

| Europe | $11.09 | 11.7% |

| Asia-Pacific | $6.91 | 7.3% [0] |

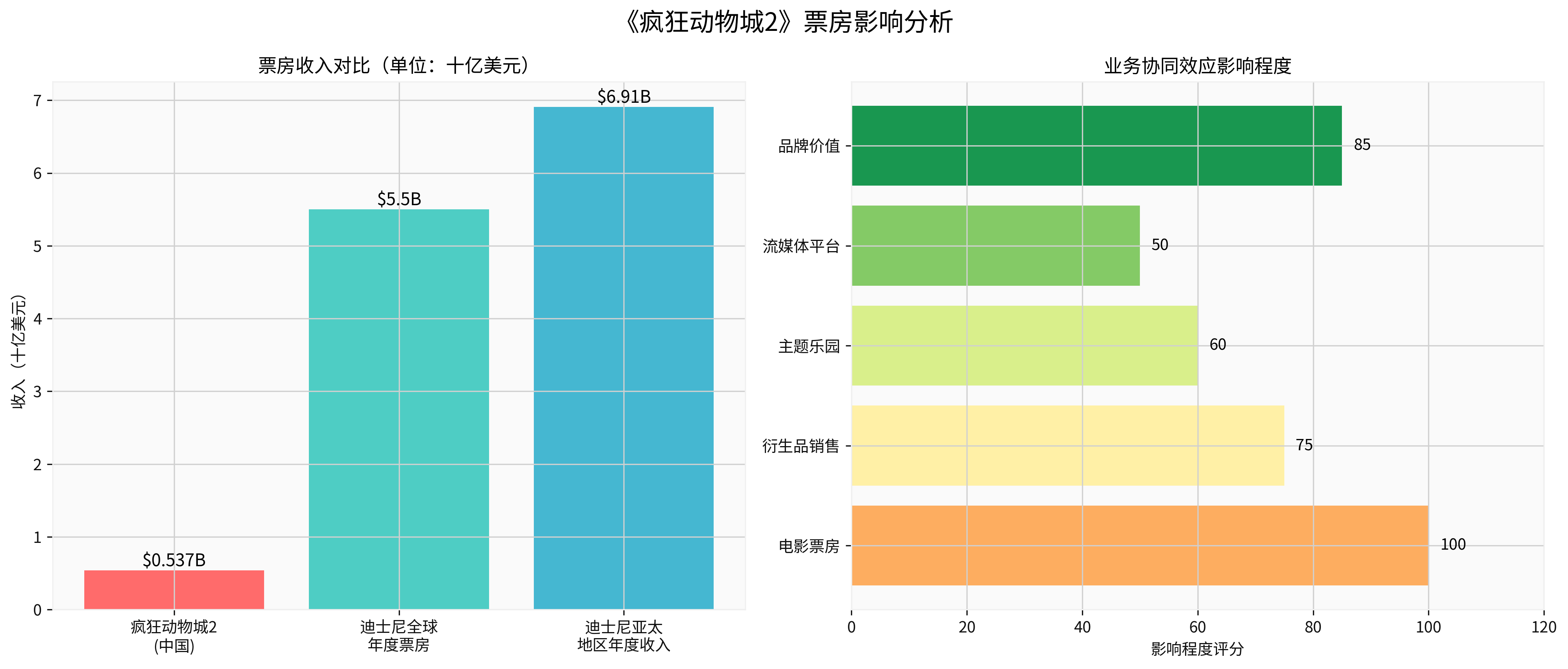

Zootopia 2 achieved a box office of

- Box office revenue proportion:$537 million accounts for9.8%of Disney’s global annual box office revenue (about $5.5 billion)

- Contribution to Asia-Pacific revenue:7.8% of Disney’s Asia-Pacific annual revenue ($6.91B)

- Contribution to total revenue:Approximately 0.6% of Disney’s total revenue ($91.3B)

-

Derivatives Sales (Impact Score: 75/100)

- Zootopia IP-related toys, clothing, stationery, etc.

- Expected derivative revenue to reach 30-50%of the box office

- Long-term IP licensing revenue

-

Theme Park Linkage (Impact Score: 60/100)

- Shanghai Disney Resort added Zootopia-themed area

- Enhances visitor willingness to enter and spend

- Successful verification of China localization IP strategy

-

Streaming Content (Impact Score: 50/100)

- Subscription pull after the movie is launched on Disney+ platform

- Although Disney+ is not available in mainland China, the value of the content library increases

-

Brand Value Enhancement (Impact Score: 85/100)

- Consolidates Disney Animation’s leading position in the Chinese market

- Lays foundation for future IP development

- Improves overall brand awareness and favorability

Compared to the first installment’s 1.53 billion RMB box office, Zootopia 2’s 3.9 billion box office achieved a

- Continuity of IP vitality- Proves excellent IP has sustained commercial value

- Consumption power of the Chinese market- Strong demand for high-quality animated films

- Success of localization strategy- Disney’s understanding of the Chinese market is deepening

As the world’s second-largest film market, China is strategically significant for Disney:

- Large middle-class group and growing cultural consumption demand

- Strong demand for high-quality animated films

- Successful operation case of Shanghai Disney Resort

- Asia-Pacific revenue accounts for only 7.3%, market penetration still has room to improve

- Disney+ streaming platform has not entered mainland China

- Competition from rising local animation companies

The Chinese market has huge box office growth potential:

- Annual growth rate of the animated film market exceeds 15%

- High loyalty of Chinese audiences to Disney animation

- Serialized development (like Zootopia, Frozen) can generate compound effects

The success of Shanghai Disney Resort lays the foundation for expansion in the Chinese market:

- Opening of Zootopia-themed park area

- Continuous investment in Hong Kong Disney

- Possible future Beijing Disney project

Development of IP derivative market:

- Growth of authorized retail business

- Co-branding with local brands

- Expansion of e-commerce channels

Assuming the comprehensive effects of Zootopia 2 continue to release:

| Item | Estimated Revenue (1 Year) | Explanation |

|---|---|---|

| Box Office Share | $2.7B | 50% split ratio |

| Derivative Sales | $1.6B | 30% conversion from box office |

| Theme Park Increment | $0.5B | Driven by visitor growth |

Total Impact |

$4.8B |

About 5.3% of total revenue |

- Analysts are generally optimistic- 60.3% of analysts give Buy rating, target price $139 [0]

- Reasonable valuation- P/E 16.52x is in historical reasonable range [0]

- Strong cash flow- Free cash flow reaches $10.077 billion [0]

- Strong IP portfolio- Owns the world’s richest entertainment IP library

- Chinese market potential- Low proportion of Asia-Pacific revenue, large growth space

- Macroeconomic pressure- Consumer spending may be affected by economic cycle

- Streaming competition- Netflix and other competitors intensify market competition

- Geopolitical risks- Sino-US relations may affect business operations

- Content production costs- Production costs of top animated films continue to rise

- Concentrated market dependence- 80.9% of revenue comes from the Americas [0]

- Technical indicators show consolidation, waiting for breakout direction

- Support level $109.43, resistance level $114.64 [0]

- Suggest considering building positions when回调 to support level

- With more IP films released, theme park business recovers

- Target price $139 is achievable (+22.4% upside) [0]

- Chinese market growth may exceed expectations

- Disney’s IP ecosystem has a strong moat

- Profitability of streaming business improves

- Deep development of the Chinese market will bring structural growth

-

Limited direct contribution- Single movie box office ($537 million) contributes less than 1% to Disney’s total revenue ($91.3B)

-

Significant strategic significance- The success of Zootopia 2 verifies strong demand for Disney IP in the Chinese market, laying the foundation for subsequent business expansion

-

Significant synergistic effects- Box office success can drive derivatives, theme parks, brand licensing and other businesses, with overall value up to 2-3 times the box office

-

Considerable growth space- Asia-Pacific revenue accounts for only 7.3%, even if it increases to 10-12%, it will bring billions of dollars in revenue increment

-

Long-term value is considerable- The Chinese market not only provides revenue growth, but also helps Disney build a global IP ecosystem

- Performance of Disney’s subsequent films in the Chinese market in 2026

- Visitor growth data of Shanghai Disney Resort

- Progress of Disney’s business expansion in the Asia-Pacific region

The Chinese market will become an important growth engine for Disney in the next 5 years, but this requires continuous content investment, localization strategy and long-term brand building. The success of Zootopia 2 is just a start; the key is whether Disney can replicate this success to more IPs and business segments.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.