Analysis of the Impact of 2025 Year-End Box Office Record High on the Investment Value of the Film and Media Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Year-End Box Office exceeds 5 billion yuan(premise fact provided by users), a new high for the same period in nearly 8 years.

- China’s cumulative box office from January to Decemberis approximately 7.18 billion US dollars, up 23.4% year-on-year (Variety report) [3].

- “Zootopia 2”has accumulated approximately 537 million US dollars in China (as of the end of December) [3].

- Disney’s 2025 global box office exceeds 6 billion US dollars, one of the best years since the pandemic (Forbes/Variety reports) [6].

- Enlight Media (300251):Current price 16.20 yuan (+0.50%), market cap ~47.5 billion yuan, TTM P/E≈21.9, net profit margin 57.6%, ROE 21.3%, past 3 months -17.2%, YTD +74.4% [0].

- Huayi Brothers (300027):Current price 2.17 yuan (+0.46%), market cap ~6 billion yuan, negative P/E, negative ROE, past 3 months -16.5%, YTD -16.2% [0].

- Wanda Film (002739):Current price 11.08 yuan (-0.36%), market cap ~23.4 billion yuan, negative P/E, past 3 months -9.3%, YTD -8.4% [0].

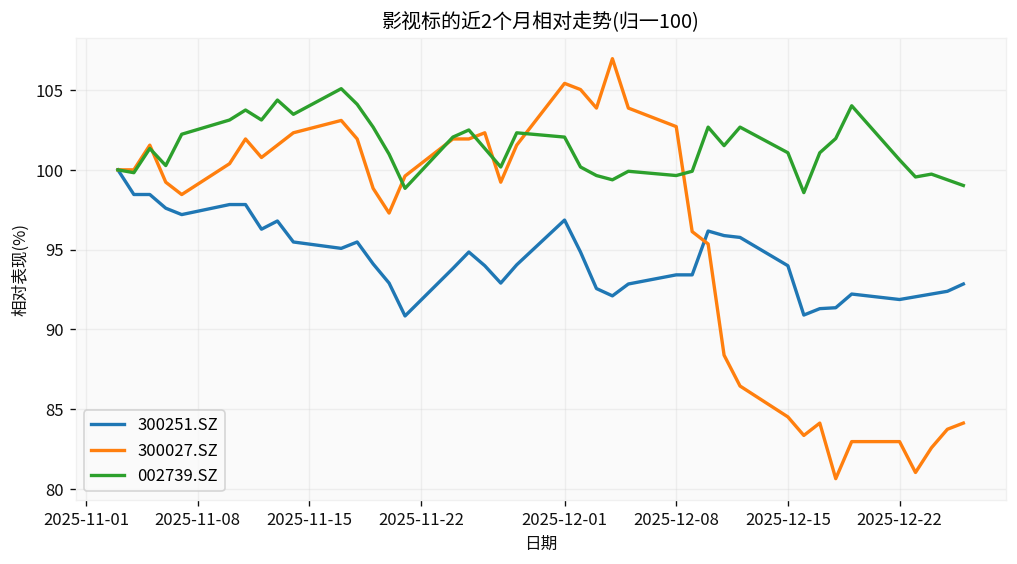

- Relative performance in the past 2 months(benchmarked against Enlight): Huayi lags by ~9.4%, Wanda outperforms by ~6.7% [0][Chart 2].

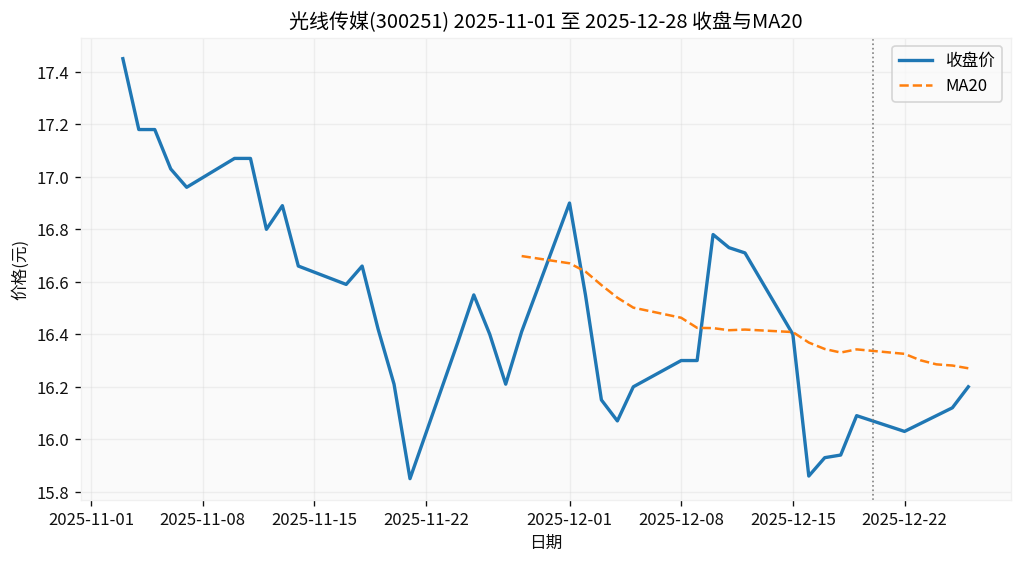

- Enlight has fallen by ~7.2% in the past 2 months, and recent trading volume is down ~35% compared to the average of the interval[0][Chart 1].

- Rebound in movie-going willingness:High Year-End and full-year box office verify the resilience of movie-going demand, especially the obvious pulling effect of top content on offline movie-going.

- Content types:Family-friendly/special effects-driven films (e.g., animations and visual effects blockbusters) are more attractive to family and young audiences, driving schedule elasticity [3][6].

- Macro level:Moderate recovery of domestic consumption + improved schedule supply form a resonance, but offline consumption scenarios still face long-term pressure of traffic diversion to streaming media (WSJ report mentions structural pressure on cinemas) [11].

- Content companies:Companies with project reserves like Enlight are expected to realize revenue sequentially during the Year-End and Spring Festival schedules, with high net profit margins and ROE providing a safety cushion for subsequent profit recovery [0].

- Cinema companies:Leading cinemas like Wanda benefit from passenger flow recovery and synergy between concessions/advertising, but the recovery pace is constrained by per-screen output and cost structure; negative P/E indicates that performance has not yet been fully realized [0].

- Elasticity ranking:Content > Cinemas, Top-tier > Bottom-tier, project cycle and schedule rhythm will amplify short-term performance fluctuations.

- Prioritize content leaders:Companies like Enlight with continuous production capabilities in animation, youth-oriented, and comedy genres, supported by project reserves and distribution capabilities to capture schedule dividends [0].

- Concentration of top-tier cinemas:Wanda, with its cinema network and scheduling advantages, has greater elasticity during passenger flow recovery, but needs to be alert to rigid capital expenditure and rent costs [0].

- Balance between elasticity and stability:Content companies with medium-high net profit margins + strong cash flow + low debt are more likely to convert box office into profits; companies with high leverage and low gross margins face greater difficulty in improvement.

- Concept stock games:Some small-cap companies and low-liquidity targets are prone to pulse rallies driven by schedule news, but lack fundamental support and have high volatility.

- Valuation and performance matching:

- Enlight: Large YTD gains but valuation matches profitability; need to pay attention to project scheduling and cost control [0].

- Huayi: Sustained losses, balance sheet pressure, longer recovery cycle, more suitable for distress games rather than stable allocation [0].

- Wanda: Cinema recovery but profit margin pressure, negative P/E; need to track per-screen output and cost optimization progress [0].

- Improved content supply:Top content companies increase investment, with diversified types (animation, visual effects, realistic themes) reducing schedule dependence.

- Schedule linkage:Year-End, Spring Festival, Summer schedules form a “schedule rotation”, which helps smooth cash flow and project revenue distribution.

- Cinema upgrading and experience improvement:High-end halls like IMAX, 4DX, and Dolby Cinema increase ticket prices and movie-going experience, forming a positive cycle for high-spec visual effects films.

- Streaming media impact:Short windows and streaming media release shorten the cinema profit cycle, and the number of cinema releases shows a downward trend (WSJ report hints at long-term pressure) [11].

- Project costs and revenue sharing:Rising production and distribution costs + 50-50 revenue sharing structure require box office to be “2.5 times production cost” to be profitable, reducing fault tolerance [6].

- Macro and policy:Macro economic rhythm and regulatory orientation affect box office and schedule scheduling.

- Valuation and liquidity:Some targets have large YTD gains, leading to increased short-term volatility; overall liquidity differentiation in the sector is obvious.

- Short-term (3-6 months):Year-End and Spring Festival schedules form double catalysts, and content leaders with project reserves have a performance realization window.

- Medium-term (6-12 months):The sector enters the stage of “quality over quantity”, and project quality and cost control will determine who truly benefits from recovery.

- Long-term:The trend of structural concentration to the top is clear; content IPization, cinema chainization, technological upgrading (IMAX, etc.), and diversified monetization (derivatives, streaming media linkage) will reshape the profit structure.

- Prioritize allocation:Content-leading companies with high net profit margins, strong cash flow, and rich project reserves (e.g., Enlight), appropriately layout before the schedule, and evaluate the realization degree after the performance realization period.

- Moderate participation:Leading cinemas (e.g., Wanda) have elasticity during passenger flow recovery, but need to observe cost structure and per-screen output, and control position rhythm.

- Be cautious:Companies with sustained losses, high debt, and lack of project reserves are more suitable for short-term event games rather than medium-to-long-term holdings.

- Event-driven window:The 1-month period before and after the Year-End and Spring Festival schedules is usually the period of emotional and expectation strengthening; pay attention to preview and pre-sale data.

- Valuation safety margin:Focus on 2025-2026 performance expectations, combined with P/E, P/B, ROE, and net profit margin, avoid chasing highs.

- Liquidity management:Small-cap stocks have high volatility;布局 in batches/take profits, set stop-loss lines to cope with emotional fluctuations.

- Regulatory and content review:Film scheduling and themes face policy uncertainty.

- Overseas impact:Strategy adjustments of streaming giants, exchange rate fluctuations, and import rhythm of overseas blockbusters.

- Macro fluctuations:Changes in residents’ disposable income and consumption tendency affect movie-going frequency.

- Performance realization deviation:Project delays, cost overruns, or box office below expectations will amplify stock price fluctuations.

- Chart 1:Enlight Media (300251) closing price and MA20 trend from November 1, 2025 to December 28, 2025. Shows a cumulative decline of ~7.2% in the past 2 months, and recent trading volume is down ~35% compared to the interval average [0].

- Chart 2:Relative performance of three film and television targets in the past 2 months (normalized to 100). Benchmarked against Enlight, Huayi lags by ~9.4%, Wanda outperforms by ~6.7%, reflecting internal differentiation and fundamental differences in the sector [0].

- [0] Gilin API Data (A-share real-time quotes, company overview, Python calculations and charts)

- [1] Forbes — “‘Avatar’ And ‘Marty Supreme’ Lead Best Post-Covid Christmas Day Box Office” (https://www.forbes.com/sites/conormurray/2025/12/26/avatar-and-marty-supreme-lead-best-post-covid-christmas-day-box-office/)

- [2] Variety — “‘Avatar: Fire and Ash’ Opens on Top as ‘Zootopia 2’ Continues Strong Performance at China Box Office” (https://variety.com/2025/film/box-office/avatar-fire-andash-china-box-office-1236614714/)

- [3] Variety — Same as above (includes data like China’s cumulative box office of 7.18 billion US dollars, 23.4% year-on-year growth)

- [4] Disney — “‘Avatar: Fire and Ash’ Burns Bright at the Box Office with $347.1 Million Global Opening” (https://thewaltdisneycompany.com/avatar-fire-andash-opening-weekend/)

- [5] Forbes — “Disney Studios Has Already Grossed Over $6 Billion At Box Office in Best Year Since 2019” (https://www.forbes.com/sites/zacharyfolk/2025/12/24/disney-studios-had-best-year-at-box-office-since-before-the-pandemic-heres-why/)

- [6] Variety — “Disney Box Office Hits $6 Billion for First Time Since COVID Thanks to ‘Lilo & Stitch’ and ‘Zootopia 2’” (https://variety.com/2025/film/box-office/disney-box-office-milestone-6-billion-globally-1236617135/)

- [7] Bloomberg — “China’s Market Revival Hinges on Gloomy Economy Turning …” (https://www.bloomberg.com/news/articles/2025-12-16/china-s-market-revival-hinges-on-gloomy-economy-turning-corner)

- [8] WSJ Chinese — “Warner Acquisition: The Last Straw to Crush Cinemas?” (https://cn.wsj.com/articles/warner收购案-压垮电影院的最后一根稻草-87c0579f)

(The above analysis is based on public data and available information and does not constitute investment advice. Investment involves risks; please enter the market with caution.)

美联储2025年利率路径预期与资产配置策略分析

巴奴火锅IPO投资风险评估分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.