Meta vs. OpenAI Talent War: In-depth Analysis of AI Competition Pattern Restructuring and Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to

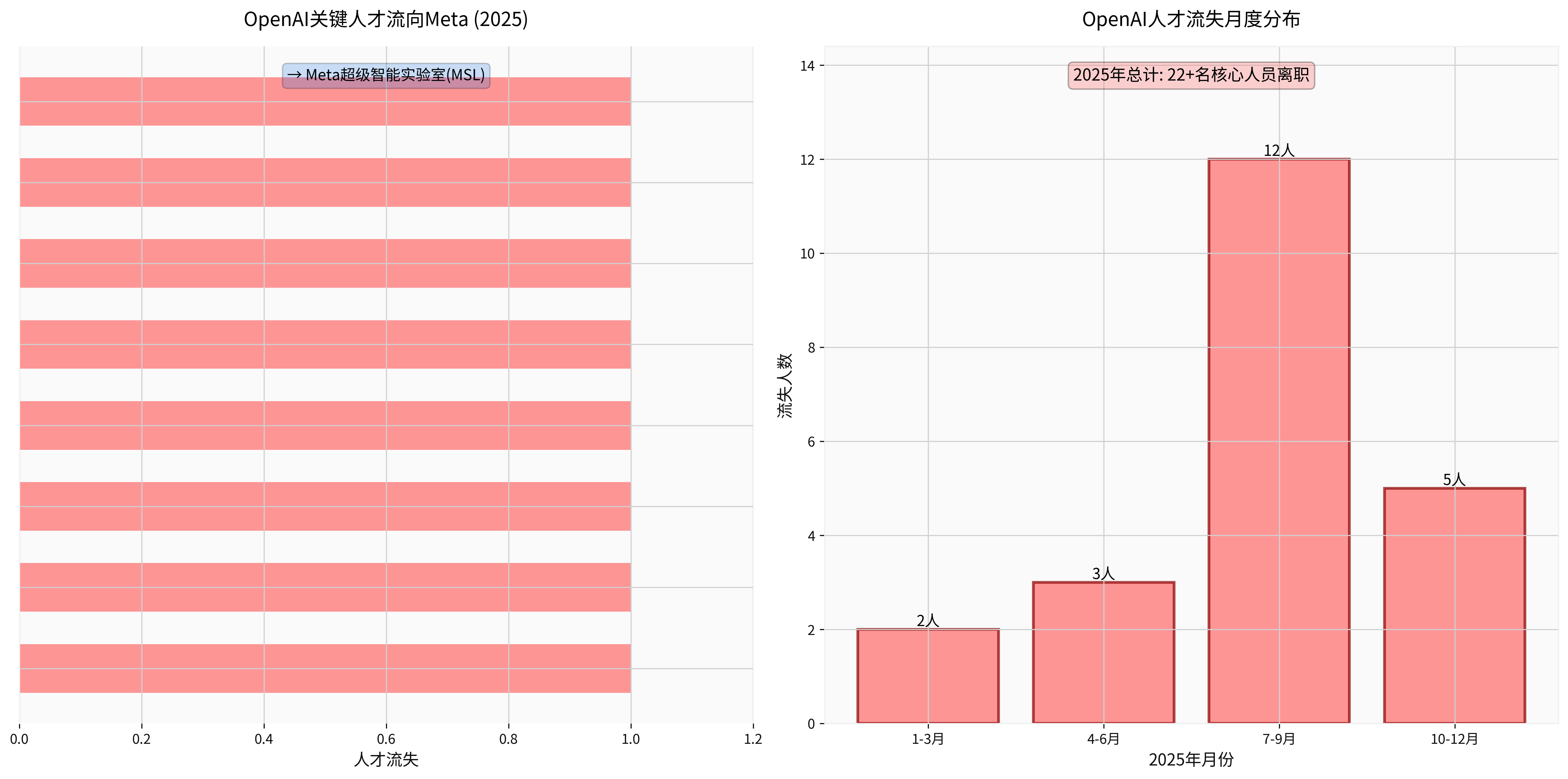

- Shengjia Zhao: Former OpenAI Chief Scientist, co-founder of ChatGPT and GPT-4, now Chief Scientist at Meta MSL, reporting directly to Zuckerberg [1]

- Jason Wei: Father of Chain-of-Thought, core scientist for OpenAI o1 and deep research models

- Hyung Won Chung: OpenAI Research Scientist

- Hongyu Ren: Core contributor to GPT-4o

- Jiahui Yu: Head of OpenAI’s Perception Team, responsible for developing the “perception” capabilities (images, audio, sensors) of large language models

Of OpenAI’s original 11-person founding team, only

As shown in the chart above,

Under Zuckerberg’s direct command, Meta established the

-

Founder-level Attention: Zuckerberg personally participates in core talent recruitment; top scientists like Shengjia Zhao report directly to him, which is extremely rare in large tech companies [1]

-

Aggressive Compensation: Reportedly offers the highest industry compensation, including:

- Signing bonuses up to $10 million

- Monthly salaries for top researchers can reach over $12,000 (intern level) [1]

- Compensation packages comparable to professional athletes [3]

-

Rapid Team Building: Zuckerberg stated in the Q3 2025 earnings call: “We have built the lab with thehighest talent density in the industry” [3]

According to

- Mango: AI model focused on images and videos

- Avocado: Next-generation text large language model, aiming to surpass the Llama series

This marks Meta’s shift from an open-source strategy (Llama series) to

Meta invested over

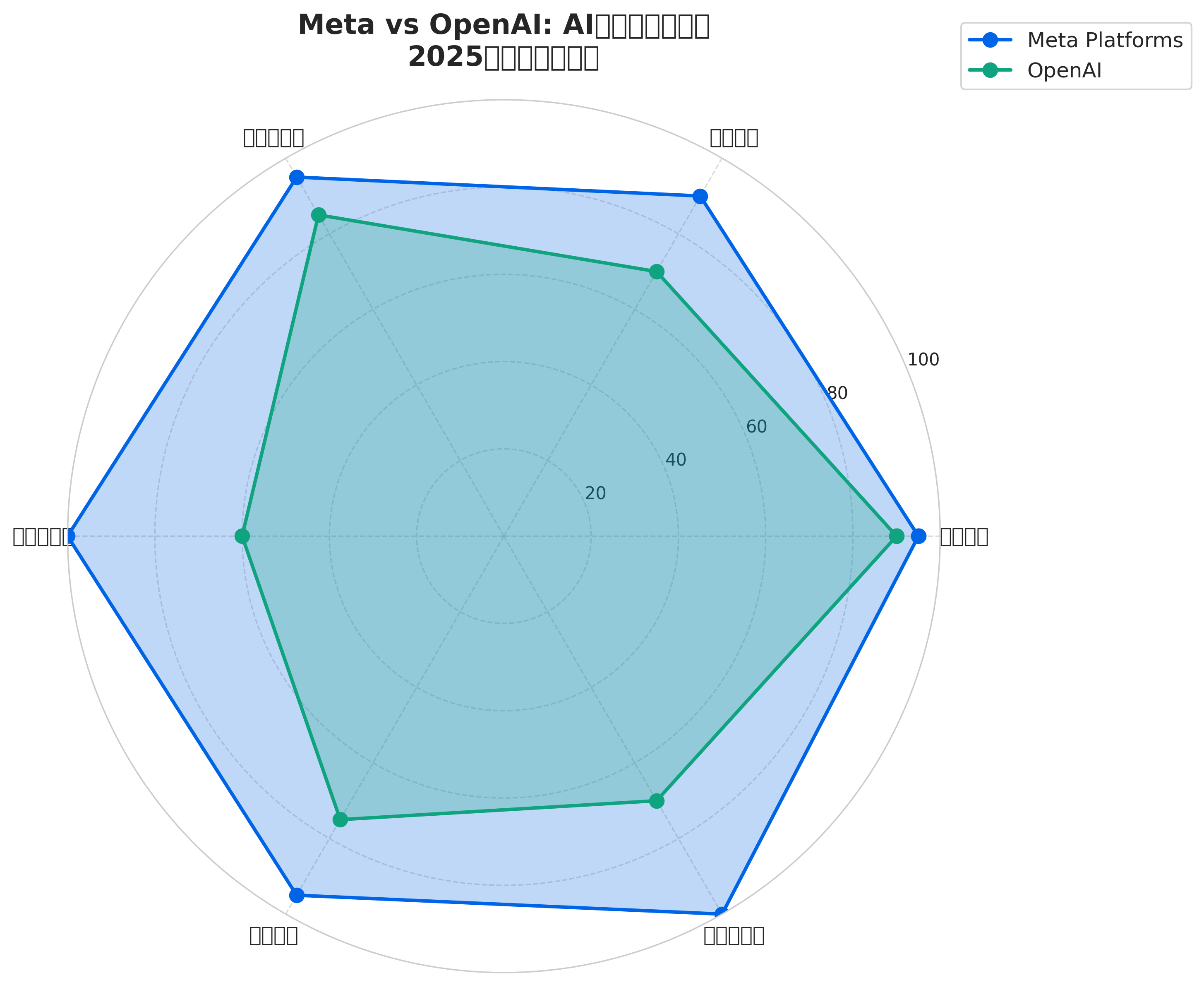

The chart above compares the competitiveness of Meta and OpenAI across six key dimensions:

- Market Cap: $1.67 trillion(December 2025) [0]

- Cash Reserves: Over $65 billion

- Free Cash Flow: $54.07 billion(2024) [0]

- Provides unlimited ammunition for AI R&D

- Fully independent public company, not constrained by external investors

- Zuckerberg holds super voting rights, enabling long-term strategic investments

- Unlike OpenAI, not受制于 strategic partners like Microsoft

- Mature advertising business model

- 2024 Revenue: $164.5 billion, year-over-year growth

- Net Profit Margin: 30.89%, ROE:30.93%[0]

- Can quickly integrate AI technology into products like Facebook, Instagram, WhatsApp

- Large open-source model ecosystem for the Llama series

- Attracts global developers to contribute

- In sharp contrast to OpenAI’s closed strategy

- GPT-4 series is still considered the most advanced large language model

- Cumulative consumer spending on ChatGPT mobile app reaches $3 billion, growing408%in 2025 [5]

- Enterprise Adoption Rate: 36% of U.S. enterprises are ChatGPT enterprise customers [6]

- Message volume of ChatGPT Enterprise Edition has increased 8xsince November 2024 [6]

- Employees report saving 40-60 minutes of work time daily

- Core R&D team systematically dismantled by Meta

- Impaired research continuity and knowledge accumulation

- Founding team collapse leads to cultural dilution

- Constrained by Microsoft (computing power support) and investors like Thrive Capital

- Internal conflicts arising from transition from non-profit to for-profit

- Need to balance safety and commercialization pressures

- Latest financing rumors value it at $83 billion[7]

- Not yet profitable, still needs large-scale financing

- Increased investor exit pressure (VC investments require returns after 5-8 years) [6]

- Stock Price: $663.29(December 27, 2025) [0]

- P/E Ratio: 28.52x

- P/B Ratio: 8.60x

- Analyst Target Price: $825(upside potential of+24.4%) [0]

- Rating: 41 Buy vs 3 Sell(80.4% Buy ratio) [0]

- Financial Attitude: Conservative(high depreciation/capital expenditure ratio, reserving profits for future growth) [0]

- Debt Risk: Low(strong debt-servicing capacity)

- Cash Flow: Strong(free cash flow of $54.07 billion) [0]

Positive Factors:

- Increased Talent Density: Establishment of MSL is seen as key to narrowing the technical gap with OpenAI

- Product Integration Potential: AI can be quickly monetized in existing products (advertising, recommendations, content generation)

- Long-term Competitiveness: Transition from social media company to AI platform company, valuation logic may be restructured

Risk Factors:

- Increased R&D Investment: AI infrastructure expenditure may reach $30-50 billion in 2025-2026

- Profit Pressure: Short-term AI commercialization may drag down profit margins

- Technical Route Uncertainty: Shift from open-source to closed may alienate developer community

- Current Rumored Valuation: $83 billion[7]

- Compared to Meta: Only 5%of Meta’s market cap

- But growth rate far exceeds traditional tech companies

- Secondary Market Shares: Through employee share resales or early investor exits

- IPO Expectation: Likely to go public in 2026-2027

- Strategic Investment: Co-invest with Microsoft, Thrive Capital, etc.

- Accelerating Talent Drain: Departure of core technical personnel may affect technical leadership

- Intensified Competition: Competition from Meta, Google, Anthropic, etc.

- Commercialization Pressure: Investors demand faster profitability, which may affect R&D investment

| Indicator | Current Value | Observation Point |

|---|---|---|

| MSL Talent Size | Unpublished | Can it maintain “highest industry talent density”? |

| Avocado Model Progress | Expected H1 2026 release | Can it challenge GPT-5? |

| AI Return on Invested Capital | To be observed | Is advertising revenue growth driven by AI empowerment? |

| Cash Burn | Expected $30-50 billion/year | Will it affect overall profitability? |

| Indicator | Current Value | Observation Point |

|---|---|---|

| Talent Drain Rate | 12+ in 2025 | Will it slow down in 2026? |

| GPT-5 Release Time | Unpublished | Can it maintain technical leadership? |

| Enterprise Revenue Share | <50% | Can it rapidly expand B2B business? |

| Profit Timeline | Unpublished | Will investor patience run out? |

- MSL releases breakthrough model in 2026

- OpenAI slows down due to talent drain and technical iteration

- Outcome: Meta’s market cap exceeds $2 trillion, OpenAI’s valuation is constrained

- GPT-5 maintains technical advantages

- Rapid expansion of enterprise market

- Outcome: OpenAI’s IPO valuation reaches $100 billion+, Meta’s stock price remains flat

- Four-way competition between Google Gemini, Anthropic Claude, Meta, and OpenAI

- Technical gap narrows, application scenarios differentiate

- Outcome: Overall industry valuation rises, but individual company dominance declines

##6. Investment Recommendations

###6.1 Meta (META): Buy and Hold

- Strong Financial Strength: $1.67 trillion market cap, strong cash flow supports long-term AI investment [0]

- Successful Talent Strategy: MSL has attracted OpenAI’s core team, significantly enhancing research capabilities [1][3]

- Reasonable Valuation: P/E 28.52x, lower than AI industry average, analysts are unanimously bullish [0]

- Product Integration Potential: AI technology can be quickly monetized in existing products

- Short-term AI investment may affect profit margins

- If Avocado model underperforms, it will hit market confidence

- Need to pay attention to AI investment ROI in Q2 2026 earnings report

###6.2 OpenAI: High Risk High Return

- High risk tolerance

- Accept non-listed company liquidity risk

- Believe in long-term technical value of AI rather than short-term profitability

- Not Recommended: Buying employee shares at a premium through secondary market

- Recommended: Wait for IPO or participate via professional VC/PE funds

- Key Observation: Whether talent drain slows down in H1 2026

###6.3 Industry Allocation Recommendations

- Meta (META): 60-70% of tech exposure

- Microsoft (MSFT): Benefit from AI through cloud computing

- NVIDIA (NVDA): Necessity for AI infrastructure

- Meta (META):40%

- Private AI Funds (OpenAI, Anthropic etc.):30%

- Other AI Concept Stocks:30%

##7. Conclusion

Meta’s harvesting of OpenAI’s core talent is

- OpenAI will still maintain technical leadership (GPT-4 series)

- Meta is in the investment phase, financial pressure increases

- Investors should focus on Meta’s AI investment efficiency and OpenAI’s talent drain trend

- Meta’s Avocado model may challenge OpenAI

- OpenAI needs to prove innovation capability with GPT-5

- Enterprise B2B market will be the key to victory

- The winner will gain trillion-dollar market dominance

- Meta has higher odds with its financial strength and product ecosystem

- OpenAI needs to successfully transform and stabilize the team to maintain independent value

For investors,

[0] Jinling API Data - Meta Stock Real-time Quotes, Financial Analysis, Technical Analysis, Company Overview (data as of December 28,2025)

[1] Business Insider - “12 executives, researchers, and others who left OpenAI in 2025 — mostly to Meta Superintelligence Lab” (https://www.businessinsider.com/executives-board-members-and-researchers-who-left-openai-in-2025-2025-12)

[2] Business Insider - “The AI talent wars have come for the interns” (https://www.businessinsider.com/top-paying-ai-internships-fellowships-residencies-openai-anthropic-meta-google-2025-12)

[3] CNBC - “From Llamas to Avocados: Meta’s shifting AI strategy is causing internal confusion” (https://www.cnbc.com/2025/12/09/meta-avocado-ai-strategy-issues.html)

[4] Wall Street Journal - “Meta bets on ‘Mango’ and ‘Avocado’ in AI race” (https://finance.yahoo.com/news/meta-bets-mango-avocado-ai-224956071.html)

[5] Yahoo Finance - “ChatGPT’s mobile app hits new milestone of $3B in consumer spending” (https://finance.yahoo.com/news/chatgpt-mobile-app-hits-milestone-195002576.html)

[6] Yahoo Finance - “Why OpenAI dominated the AI trade in 2025” (https://finance.yahoo.com/video/why-openai-dominated-ai-trade-115537283.html)

[7] Wall Street Journal - “OpenAI’s New Fundraising Round Could Value Startup at as much as $830 billion” (https://www.wsj.com/tech/ai/openais-new-fundraising-round-could-value-startup-at-as-much-as-830-billion-93de9f7c)

传统能源企业新能源转型对油气行业估值和投资价值的影响

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.