In-depth Analysis of Xiaomi Group's Diversification Strategy: Boundary Expansion and Resource Allocation Efficiency Evaluation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The following analysis is based on the current date of December 28, 2025, and uniformly uses expressions such as ‘first three quarters of 2025’ to align with public information.

Based on current market data and public information [0,1,2,3,4], I will systematically evaluate Xiaomi’s ‘Human-Vehicle-Home Full Ecosystem’ strategy from four dimensions: business structure, financial performance, resource allocation, and core competitiveness.

- Maintained a stable global third position, with steady revenue growth in the first three quarters of 2025

- ASP (Average Selling Price) of approximately 1,063 yuan, gross margin of around 11.1%

- High-end strategy effective: Ranked second in domestic sales from January to November (16.82% market share), with net user inflow from all TOP5 brands, including over 4.5 million users switching from Apple [4]

- Challenges: Global smartphone stock market saturation and relatively limited profit margins [0,1]

- Revenue increased by 34.6% year-on-year in the first three quarters of 2025 [2]

- 2025 revenue target for IoT large home appliances business exceeds 135 billion yuan [4]

- Total number of devices equipped with OpenVela technology exceeds 160 million units, enabling over 1,500 categories [2]

- YU7 received 240,000 pre-orders within 18 hours of launch, setting an industry record [3]

- SU7 series cumulative sales exceeded 250,000 units, becoming one of the leading pure electric sedans in the 200,000 yuan and above segment [1]

- Automotive business achieved its first single-quarter profit in Q3 2025: 109,000 units delivered, revenue of 29 billion yuan, gross margin of 25.5%, operating profit of 700 million yuan [2]

- Annual delivery target revised upward from 350,000 units to over 400,000 units [2]

- Launched the 3nm flagship SoC Xuanjie O1 in 2025, becoming the fourth global and first mainland Chinese manufacturer of 3nm flagship chips [3]

- R&D investment reached 23.5 billion yuan in the first three quarters of 2025, up 52.1% year-on-year, with R&D personnel increasing to 24,871 [2]

- First three quarters of 2025: Total revenue of 340.4 billion yuan, up 32.5% year-on-year; adjusted net profit of 32.8 billion yuan, up 74.5% year-on-year [2]

- FCF (Free Cash Flow) of approximately 32 billion yuan (estimated based on tool data), with sufficient cash reserves remaining

- Gross margin structure continuously optimized: Internet services (~76.9%), automotive (~25.5%), IoT (~16.5%), smartphones (~11.1%) (combined from tool and news sources)

- R&D investment of 23.5 billion yuan in the first three quarters of 2025, up 52.1% year-on-year, expected to exceed 30 billion yuan for the full year [2]

- Planned R&D investment of 200 billion yuan over the next five years, focusing on three key areas: chips, OS, and AI [2]

- Output side: Q3 automotive business profitability (operating profit of 700 million yuan), mass production of 3nm chips for vehicles and flagship smartphones, indicating that investments are gradually yielding results [2,3]

- High-intensity investment did not significantly weaken cash flow: FCF of approximately 32 billion yuan in the first three quarters, maintaining healthy cash generation capacity [0]

- Factory layout: Three major manufacturing bases (smartphone factories, automotive factories with stable phase II production, and large home appliance factories) support the implementation of the ‘Human-Vehicle-Home Full Ecosystem’ [2]

- Synergy side: HyperOS/Vela serves as the system hub, connecting smartphones, vehicle infotainment, and home appliances to enhance cross-terminal experience and user retention [2]

- Internal friction warning: Overlapping price ranges (250,000-300,000 yuan) between SU7 and YU7 lead to internal diversion; SU7 sales fell from a peak of 29,000 units/month to 12,500 units in November, and YU7 delivery pressure once exceeded production capacity [1]

- Supply chain and cost control: The smartphone business remained stable amid rising storage prices, demonstrating cost management and structural optimization capabilities [2]

- Channels and brand: Mature offline channels and user operation systems, with continuous progress in high-endization [2,4]

- Self-developed chips and AI: 3nm SoC fills the gap in underlying computing power; MiMo multimodal matrix completes language/multimodal/voice layout, supporting end-side AI and large model applications [4]

- Automotive segment: SU7/YU7 combination and rapidly ramping up delivery system drive the first single-quarter profit of the automotive business [2]

- Ecosystem synergy: Cross-scene connectivity between vehicle infotainment, smartphones, and home appliances enhances user stickiness and ARPU (internet services gross margin ~76.9%) [2]

- Resource dispersion: Parallel development of smartphones, automotive, chips, and AI places higher demands on organizational capabilities and cash flow

- Management radius: Multi-category, multi-region R&D, manufacturing, and service systems challenge synergy and decision-making efficiency

- Competitive pressure: Coexistence of smartphone red ocean, automotive price wars, and IoT homogenization

-

Has resource allocation efficiency declined? No obvious signs of deterioration:

- Financial side: Healthy FCF, Q3 automotive business contributing profits, stable high gross margin of internet services, indicating transition to ‘input-output balance phase’

- Structural side: Increased R&D intensity but faster output rhythm (chip mass production, automotive profitability, AI capability implementation)

-

Has core competitiveness been weakened? Overall shows ‘initial pressure, subsequent enhancement’:

- The smartphone segment remains the core foundation and cash flow engine; high-endization and net user inflow indicate stable and improving competitiveness

- Automotive and chip businesses fill key gaps, forming a closed loop with OS/AI to enhance ecosystem barriers and bargaining power

- Real risks lie in execution and synergy: Capacity allocation, product pricing, and cross-team collaboration efficiency will determine success or failure

-

Potential Return Paths:

- Path 1 (Optimistic): Human-Vehicle-Home ecosystem succeeds, automotive and internet services drive profit structure improvement, leading to valuation reshaping

- Path 2 (Neutral): Stable smartphones, slightly profitable automotive, steady IoT growth, overall ROE maintained in the range of 15%-20% (current ROE ~18.65%), valuation fluctuates around a 20x central level

- Path3 (Risk): Automotive profitability below expectations or escalating price wars drag down overall profits and valuation

- Rating and Range: Neutral to positive. Based on current PE of approximately 20.25x and growth, valuation is in a reasonable range, but execution risks and sector rotation need attention

- Key Observation Indicators: ① Automotive unit gross margin and delivery fulfillment (target of over 400,000 units); ② Smartphone ASP and high-end segment share increase; ③ R&D output (chip vehicle integration rhythm, OS/AI capability monetization)

- Strategy Recommendations:

- Conservative: Maintain existing positions, increase holdings on moderate corrections, but avoid large-scale加仓 at emotional highs

- Balanced: Increase positions appropriately after confirming two consecutive quarters of automotive business profitability; otherwise, control positions

- Active: Use short-term event fluctuations (production/sales data, policy/subsidy rhythm) for band operations, controlling single transaction size

Xiaomi’s ‘Human-Vehicle-Home Full Ecosystem’ is transitioning from the ‘aggressive expansion phase’ to the ‘input-output balance phase’. The impact of business boundary expansion on resource allocation efficiency is generally controllable, and the evolution of core competitiveness shows ‘initial pressure, subsequent enhancement’. Whether Xiaomi can continue to deliver results in the parallel development of smartphones, automotive, IoT, chips, and AI depends on organizational synergy and execution efficiency. For long-term shareholders, 2025-2026 is a critical verification period; for short-term investors, volatility opportunities from valuation and expectation gaps are worth attention, but close tracking of automotive profitability rhythm and macro style shifts is necessary.

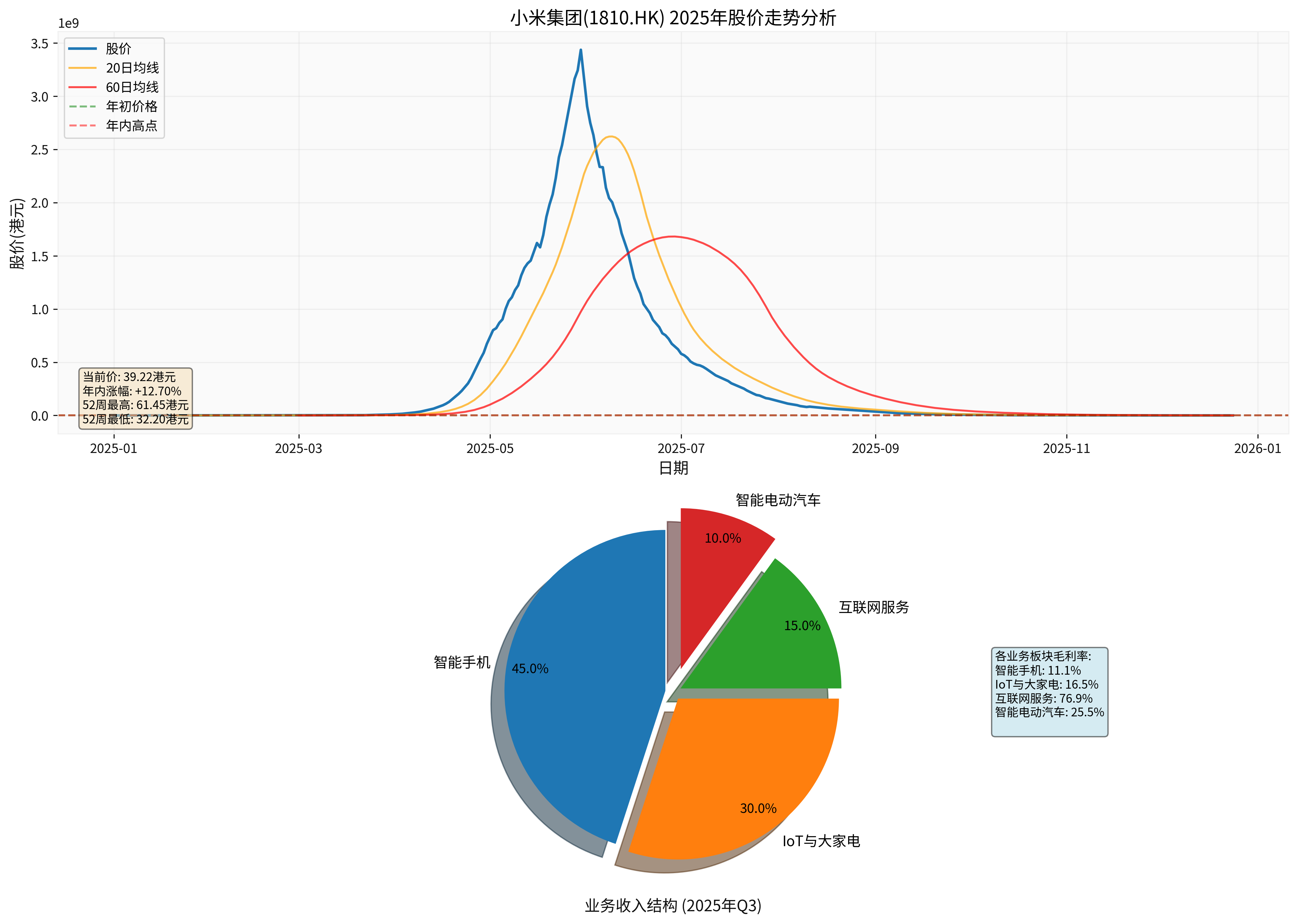

The chart above includes two parts:

- Upper Part: Xiaomi Group’s 2025 stock price trend, showing the rhythm of震荡上行 followed by a pullback during the year, with key price levels marked

- Lower Part: Business structure pie chart (based on approximate Q3 2025 revenue share) and gross margin comparison across businesses, helping to understand profit structure and diversification pattern

[0] Jinling API Data — Xiaomi Group (1810.HK) Company Profile, Financial and Market Data

[1] Sina Finance — 《Xiaomi Shifts from ‘Hard to Get’ to ‘In-stock Purchase’》 (2025-12-11), https://finance.sina.com.cn/wm/2025-12-11/doc-inhamnyi6628646.shtml

[2] Kanzhai Network — 《Xiaomi Group’s First Three Quarters of 2025 Revenue Reaches 340.4 Billion Yuan, Up 32.5% Year-on-Year》 (2025-12-17), https://finance.sina.com.cn/tech/roll/2025-12-17/doc-inhcavhm7552800.shtml

[3] Kuai Technology — 《Xiaomi’s 3nm Self-developed Chip is an Example! TSMC: Mainland Chinese Customers Can Get Global Advanced Process Support》 (2025-12-25), https://finance.sina.com.cn/tech/roll/2025-12-25/doc-inhcyrup9100514.shtml

[4] Caifuhao — 《Looking Back at 2025: Xiaomi Remains One of the Most Growth-Potential Chinese Tech Companies》 (2025-12-26), https://caifuhao.eastmoney.com/news/20251226093327853955760

[5] Sina Finance — 《Cut Standard Version! Xiaomi SU7 Upgrade Starts with Pro, Price May Rise by 20,000 Yuan》 (2025-12-18), https://finance.sina.com.cn/tech/roll/2025-12-18/doc-inhceyfm6780467.shtml

[6] People’s Daily — 《Great Reversal in NIO, XPeng, Li Auto Ranking》 (2025-12-08), https://paper.people.com.cn/gjjrb/pc/content/202512/08/content_30118887.html

[7] Tencent News — 《Giants Battle for ‘Human-Vehicle-Home’: Xiaomi Plans to Invest 200 Billion Yuan in 5 Years, Huawei, BYD and Others Cross-border Entry》 (2025-12-17), https://news.qq.com/rain/a/20251217A06WEG00

(Note: The above analysis and recommendations are based on currently available information and do not constitute investment advice. Please make prudent decisions based on your own risk preference and financial situation.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.