Lithium Stocks Valuation Analysis: Tianqi Lithium (002466) & Ganfeng Lithium (002460)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

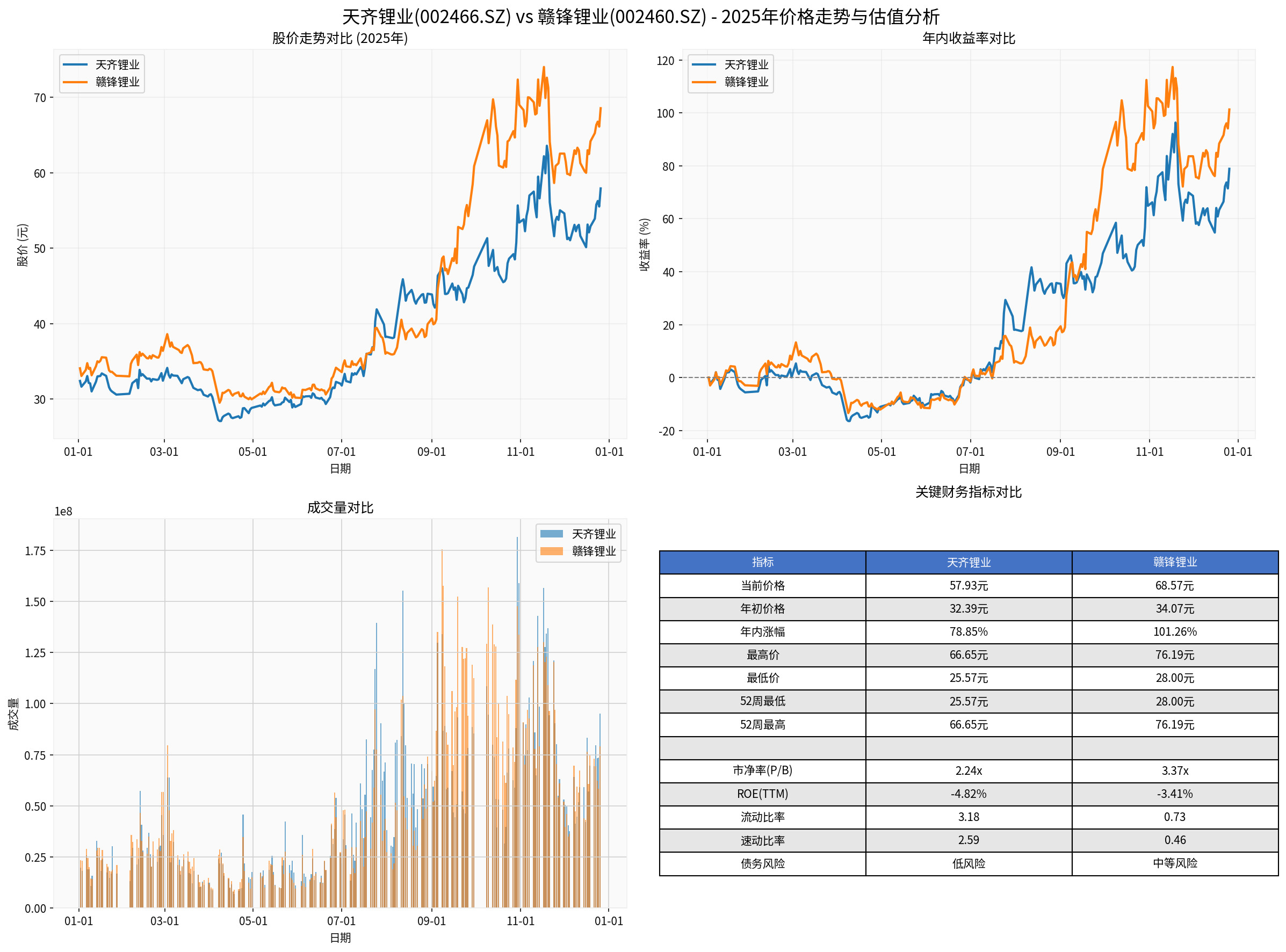

- Tianqi Lithium (002466.SZ) and Ganfeng Lithium (002460.SZ) closed at 57.93 Yuan and 68.57 Yuan respectively as of December 27, 2025. [0] Both companies rose approximately 78.9% and 101.3% in 2025, still having significant room to retrace from their 2022 highs (see attached chart), though their market capitalizations have returned to the high range in recent years.

- In terms of financial indicators, both companies remain in a loss-making period: Tianqi’s ROE is -4.82%, Ganfeng’s ROE is -3.41%, and their TTM P/E ratios are negative, making traditional valuation methods inapplicable directly. [0] Ganfeng’s current and quick ratios are below 1, with slightly higher short-term debt repayment pressure; Tianqi has a higher liquidity buffer of 3.18/2.59. [0]

- The attached chart [2025 Price-Volume and Key Indicator Comparison] shows full-year price, trading volume, and financial data like ROE/PB ratio. It can be seen that after hitting a bottom in mid-year, both companies gradually recovered from the bottom up, while their PB ratios stayed in the range of 2.2~3.4 times, not yet returning to high valuation levels. [0]

- Currently, lithium carbonate prices hover at historical lows (they hit a 4-year low in June and rebounded by 50% afterward), but the industry has not fully escaped oversupply. [1][2] Energy storage demand is seen as the next incremental driver; the industry expects 55% YoY growth in energy storage lithium demand in 2026, which may gradually free the market from the ‘supply-to-shortage’ constraint from the supply side. [1]

- However, supply expansion remains strong: some high-cost enterprises have exited production capacity due to price compression. If prices further approach the marginal cost range of 50,000~60,000 Yuan/ton, integration will accelerate; if downstream inventory replenishment is slow, prices still face continuous correction risks. [2] Meanwhile, some mainland production capacities are still planned to expand, which may suppress price stability in the short term. [3]

- Since both current PE and ROE are negative, directly calculating PR is meaningless; we need to wait for the 2026 Q1 report to confirm ROE turning positive before using PR as a valuation reference. The user’s plan (taking ROE as the core after the Q1 report) is logical: once ROE returns to 8~12%, PR can provide a valuation coordinate.

- Example: If Tianqi’s ROE reaches 10% in the 2026 Q1 report, assuming the market gives it a PE of 15 times (considering industry prosperity and cash flow improvement), PR=15/(10/100)=150. If the corresponding ‘Earnings Yield Ratio’ is below the historical reasonable level (e.g., 50~70), it means there is still room for valuation repair; for Ganfeng, if ROE rises to 12% and PE is 18, PR=150, and it also needs to be compared with its historical PR range to judge discount status.

- The key variable remains lithium carbonate prices: if futures and spot prices steadily break through 100,000 Yuan/ton (consistent with judgments from institutions like Morgan Stanley and UBS), significantly boosting profit margins of ore and chemical segments, ROE is expected to turn positive, thereby lowering PR to a reasonable or undervalued level; conversely, if prices fall back to the cost range again, ROE will still be hard to turn positive, making PR irrelevant. [1][2]

- ROE Signal Confirmation:Wait for the 2026 Q1 report to confirm ROE turning from negative to positive and observe sustainability (whether accompanied by gross and net profit margin improvements). If ROE reaches over 8%, initial participation is feasible.

- Price-ROE Pair Observation:Monitor whether lithium carbonate futures (e.g., Guangzhou Futures Exchange main contract) stay above 70,000~90,000 Yuan/ton. If prices break 80,000 Yuan with inventory destocking trends, it will directly drive quarterly profit margin improvements in the lithium salt sector. [3]

- Capital Utilization Logic:Funds from futures profits can enter at undervalued points—when PR is below the target range (e.g., PR<60), lithium carbonate prices are expected to break key levels, and ROE can be confirmed positive within two quarters. Adopt phased buying, prioritizing targets with better cash flow and asset quality.

- Risk Measures:Pay attention to production capacity release pace, whether downstream electric vehicle and energy storage purchases start synchronously, and possible macro policy changes. If lithium carbonate prices return to the 60,000~70,000 Yuan range again, quickly check if ROE rebound is passive and consider profit-taking or hedging.

Currently, lithium mining stock valuation is dominated by repair: P/E/ROE have not turned positive synchronously, and PR valuation needs to wait for ROE to turn positive for dynamic measurement. If lithium carbonate prices stabilize continuously in 2026 and gradually break through 100,000 Yuan/ton, combined with rapid energy storage demand growth, it will be the fundamental driver of ROE improvement. Wait for Q1 report data, formulate entry points using PR method and lithium carbonate price trends, and use futures profit funds to chase gains in a risk-reward balanced way—the core is to actively follow up only when the three conditions of ‘ROE confirmation + lithium carbonate price confirmation + PR undervaluation’ are met.

[0] Jinling API Data

[1] Yahoo Finance Hong Kong - “Energy Storage Demand Explodes! Lithium Prices Bid Farewell to Lows, Expected to ‘Shift from Supply to Shortage’ in 2026” (https://hk.finance.yahoo.com/news/儲能需求大爆發!鋰價告別低谷2026年可望將「由供轉缺」-130003982.html)

[2] Yahoo Finance Hong Kong - “Lithium Prices Mired in Lows, Ganfeng Lithium’s Fundamental Pressures Remain Unresolved” (https://hk.finance.yahoo.com/news/鋰價深陷低谷贛鋒鋰業基本面壓力未解-003107879.html)

[3] Yahoo Finance Hong Kong - “CATL’s Jianxiawo Lithium Mine Suspends Production for at Least Three Months” (https://hk.finance.yahoo.com/news/宁德时代枧下窝锂矿停产为期至少三个月-093623263.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.