In-depth Analysis of Luzhou Laojiao's Response to Industry Transformation: From the 'Official Consumption Era' to the 'Personal Baijiu Era'

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

China’s baijiu industry is undergoing profound changes driven by the shift in consumption generations. With the decline of official consumption scenarios, the consumption logic has shifted from traditional ‘face consumption’ to ‘quality consumption’, and the industry is moving from the ‘Official Consumption Era’ to the ‘Personal Baijiu Era’ [0][1].

According to the prediction of the China Alcoholic Drinks Association, the low-alcohol liquor market size will exceed 74 billion yuan by 2025, with a compound annual growth rate of 25%, far higher than the overall growth rate of the baijiu industry, becoming the core engine of industry growth [1][2][3]. This trend confirms the management’s judgment on consumption changes.

Luzhou Laojiao’s management clearly stated at the second extraordinary general meeting of shareholders in 2025 that the first quarter of 2026 will be the ‘ghost gate’ for the baijiu industry. This judgment is based on:

- Decline of official alcohol consumption scenarios: Contraction of traditional high-end baijiu consumption scenarios

- Changes in generational consumption habits: Generation Z (post-1995) becoming the new main consumer force

- Pain period of market transformation: Transition from high-end government affairs to popularization and personalization

From the market performance of the three major baijiu leaders, industry adjustments are already underway:

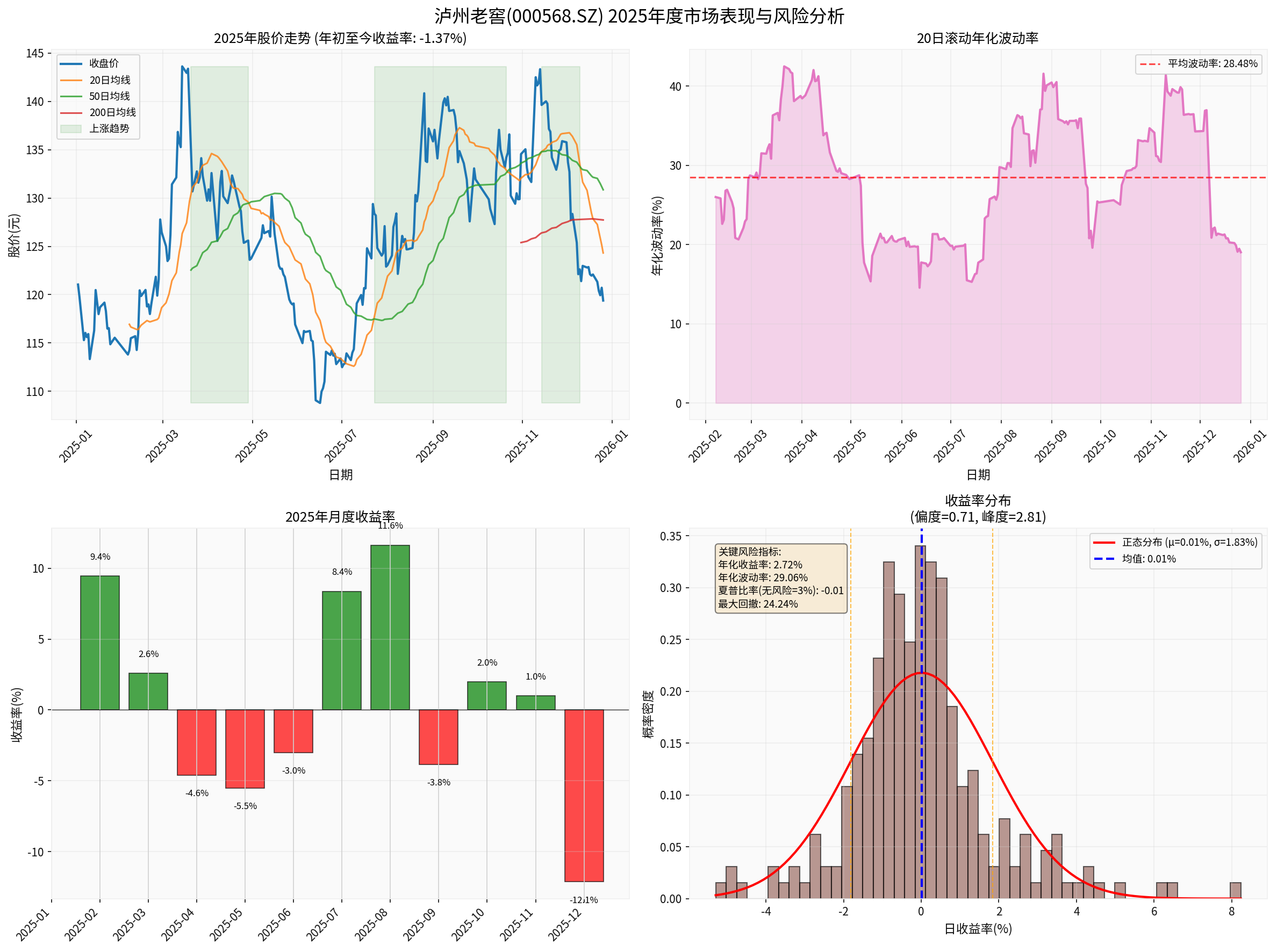

The above chart shows that Luzhou Laojiao’s stock price fluctuated significantly in 2025, showing high volatility and oscillation by quarter (Q1:+7.16%, Q2:-13.36%, Q3:+17.26%, Q4:-8.06%) [0], with an annualized volatility of about 29.06% and a maximum drawdown of 24.24% [0].

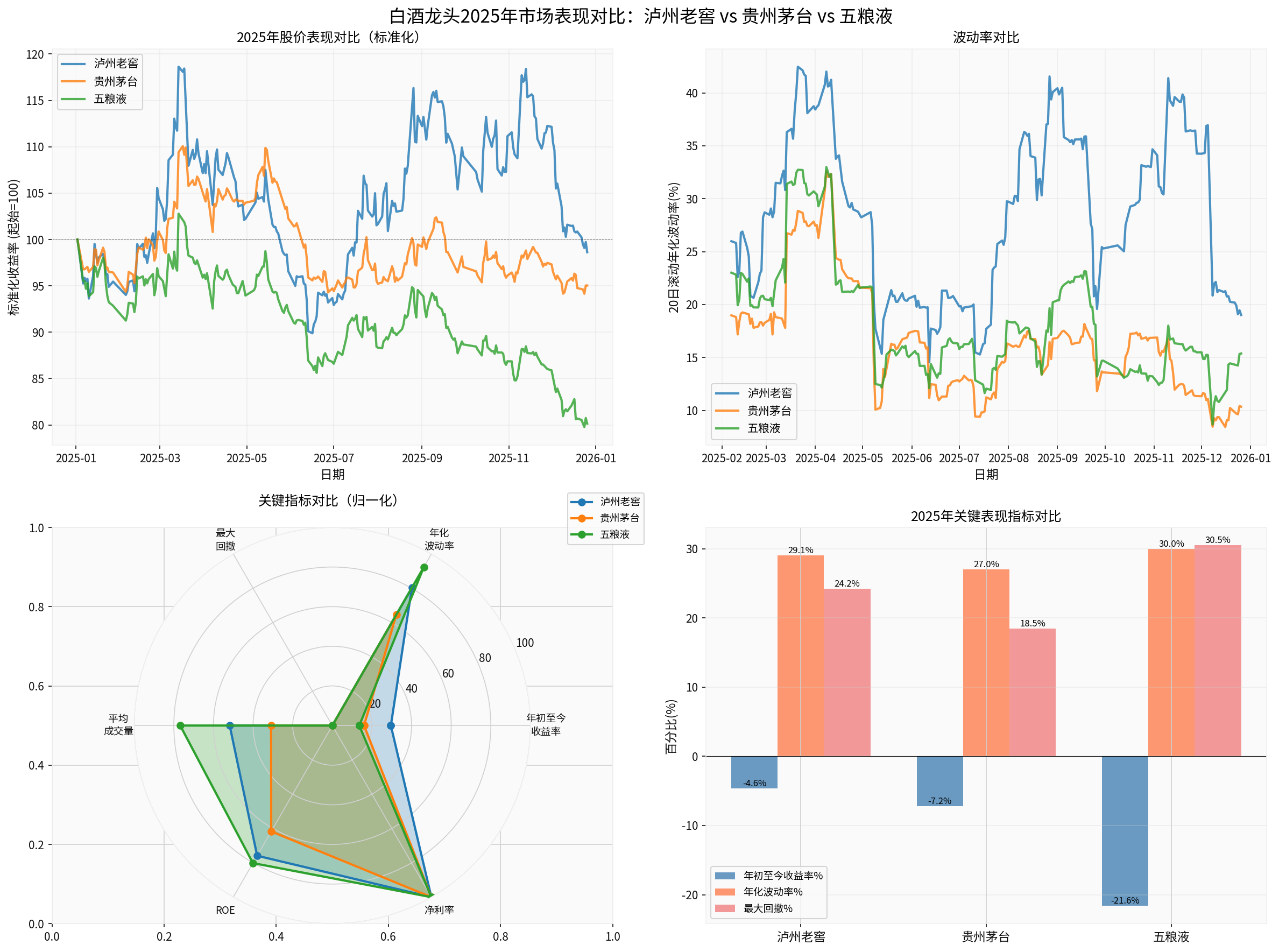

Comparison data shows:

- Luzhou Laojiao: Year-to-date return -1.37%, volatility about 29.06%, maximum drawdown about 24.24% [0]

- Kweichow Moutai: Year-to-date return -4.96%, volatility about 17.00%, maximum drawdown about14.47% [0]

- Wuliangye: Year-to-date return -19.86%, volatility about18.92%, maximum drawdown about22.39% [0]

Luzhou Laojiao is more elastic in terms of return and volatility than Moutai, and better than Wuliangye in terms of downward range [0], reflecting the company’s relatively stable response posture in industry adjustments.

Luzhou Laojiao’s low-alcohol layout has first-mover advantages and differentiated barriers:

- Became the first low-alcohol baijiu blockbuster product with sales reaching 10 billion yuan in the industry [1]

- Current sales account for nearly 50% (company disclosure) [4]

- Showed a ‘benign rapid growth trend’ in 2025 [1][3]

- 28-degree Guojiao1573 has been successfully developed and will be launched at the right time [1][2][3]

- Currently promoting the testing of ultra-low-alcohol products such as 16-degree and 6-degree [1]

- Based on technical accumulation traceable to the 1970s, it has overcome three technical problems: turbidity, blandness, and hydrolysis [1]

- Wuliangye: Launched the29-degree ‘Love at First Sight’ (‘Yi Jian Qing Xin’), with sales exceeding 100 million yuan within two months of launch (company disclosure) [2][3]

- Gujing Gongjiu: Released the26-degree ‘Light Gu 20’ [1]

- Shede Liquor: Launched the29-degree ‘Shede Zizai’ [1][2]

- Luzhou Laojiao’s advantage: Took the lead in forming brand and market barriers in the low-alcohol track [1][3]

###2.2 Digital Transformation: Building an Intelligent Operation Base

- Investment amount:2.136 billion yuan [1]

- Filling speed:15,000 bottles/hour [1]

- Technical features: Five-code integration, full-process digital management, and industrial chain connection with the brewing ecological park [1]

- Positioning: The first ‘Lighthouse Factory’ in the baijiu industry [1]

- During the ‘14th Five-Year Plan’ period, it has covered brewing production, internal supply chain, marketing system, and headquarters management, building a digital operation base (company management disclosure) [4]

- Cooperation with instant retail platforms (Meituan, Ele.me) to achieve ‘30-minute delivery’ [1]

###2.3 Youth-oriented Marketing and Scene Reconstruction

- Content matrix: Build a ‘short video + live broadcast + interaction’ matrix on platforms such as Douyin and Xiaohongshu

- UGC stimulation: Launched the ‘Guojiao1573 Special Blend Challenge’

- Mixing education: Carry out live broadcast teaching with bartenders to integrate baijiu with young elements such as fruit juice and sparkling water [1]

- ‘Jiaozhu Festival’ IP: Combine leisure and entertainment, food and wine, peripheral purchases, and theme day marketing

- Penetration into emerging scenes: Low-alcohol Guojiao1573 enters youth consumption fields such as small bars and Livehouses [1]

- Innovation in drinking methods: Promote new drinking methods such as iced drinking and mixed drinking [4]

- In the first half of 2025, ‘emerging channel’ revenue increased by 27.55% year-on-year (company disclosure) [1]

- Promote youth-oriented development through ‘dual-track parallel’ of products and scenes (management disclosure) [4]

###2.4 ‘15th Five-Year Plan’ Ecological Chain Strategy

The company’s management disclosed the ‘15th Five-Year Plan’ development plan at the investor relations event on December24,2025 [4]:

- Strategic positioning: Move towards a chain-leading enterprise

- Internal: Focus on deepening core capabilities, optimizing resource allocation and synergy efficiency

- External: Strengthen core competitiveness, seize the strategic window of industrial structure adjustment and consumption change, and promote systematic transformation of strategic positioning, business layout, and operation mode

###3.1 Sound Financial Fundamentals

Based on the latest financial data [0]:

- ROE (Return on Equity):26.10%

- Net profit margin:42.11%

- Operating profit margin:56.50%

- The company’s profitability remains strong in the industry [0]

- Current ratio:3.61

- Quick ratio:2.57

- Debt risk classification: Low risk (financial analysis tool rating) [0]

- Financial attitude: Neutral, no extreme accounting treatment tendency [0]

- P/E ratio:13.88x

- P/B ratio:3.53x

- Current stock price:119.39 yuan [0]

- Relative to profitability and growth potential, the valuation is in a reasonable range [0]

###3.2 Technical signals: Oscillation and consolidation

Technical analysis shows [0]:

- Trend state: Sideways (SIDEWAYS), no clear direction

- Key price levels: Support level at 118.12 yuan, resistance level at124.32 yuan

- Technical indicators: MACD has no clear crossover, KDJ and RSI both show oversold signals, indicating potential rebound opportunities [0]

- Beta value:0.81, volatility lower than the market average [0]

###4.1 Strategy implementation effect: Partially verified

-38-degree Guojiao1573:10-billion-level blockbuster product, accounting for nearly50% [1][3]

- Emerging channel revenue increased by 27.55% year-on-year [1]

- Formation of low-alcohol product matrix layout and technical barriers [1][3]

- Low-alcohol Guojiao1573 has been recognized as a ‘popular choice’ in emerging scenes such as small bars and Livehouses (channel feedback) [1]

- The company’s layout in content marketing and instant retail is close to Gen Z’s ‘impromptu economy’ and ‘mixing autonomy’ [1][3]

###4.2 Differentiated advantages over competitors

- Wuliangye’s Q3 2025 revenue and profit declined sharply, and its industry ranking is under pressure (public disclosure) [3]

- Luzhou Laojiao performed more stably in terms of return and volatility (as mentioned in the previous comparison) [0]

- Moutai emphasizes ‘not being young for the sake of being young’ and focuses more on stratified cultivation of 18-45-year-olds [3]

- Luzhou Laojiao has formed first-mover advantages and market awareness in low-alcohol products and technology (10-billion-level blockbuster product) [1][3]

- Technical barriers: Took the lead in solving three technical problems of low-alcohol liquor (turbidity, blandness, hydrolysis) and led the formulation of national standards for low-alcohol baijiu [1]

- Market first-mover advantage: 38-degree Guojiao1573 achieved 10-billion-level scale, forming brand and cognitive advantages [1][3]

- Complete closed loop: Systematic layout of products + scenes + content + channels [1]

- Digital support: Intelligent packaging center provides support for precise reach and operational efficiency [1][4]

###5.1 Scenario analysis of the 2026 ‘ghost gate’

- Youth-oriented strategy is implemented beyond expectations, and low-alcohol liquor grows rapidly

- Digital transformation brings efficiency improvement and cost optimization

- After the first quarter of2026, the industry stabilizes, and the company seizes market share with differentiated advantages

- Low-alcohol and youth-oriented development progresses steadily, but the overall contribution is limited

- Experienced a pain period in Q12026, but the company passed the adjustment with healthy financial fundamentals and brand advantages

- Macro consumption weakness叠加 deep industry adjustment

- Intensified competition leads to pressure on profit margins

###5.2 Investment advice: Prudent evaluation based on existing data

- Sound financials: Low debt risk, high profitability (ROE26.10%, net profit margin42.11%) [0]

- Strategic first-mover: Low-alcohol layout forms technical and market barriers [1][3]

- Digital base: Intelligent packaging center provides support for long-term efficiency improvement [1]

- Youth-oriented closed loop: Systematic layout of products + scenes + content + channels [1]

- Uncertainty of macro pressure from the ‘ghost gate’ in Q12026

- Market acceptance of ultra-low-alcohol products remains to be verified

- Intensified industry competition and homogenization risks

- The technical side is in a sideways consolidation phase, and short-term volatility is still large [0]

- Valuation is relatively reasonable (P/E13.88x) [0]

- Sound financial fundamentals

- Youth-oriented strategy has been verified in some dimensions (10-billion-level low-alcohol blockbuster product, high growth of emerging channels) [1]

- But need to pay close attention to the fundamental and technical signals in Q12026 (such as management performance guidance, sales data, industry prosperity)

- Q12026 performance and sales situation

- Market feedback of ultra-low-alcohol products (28-degree, etc.)

- Efficiency transformation results of digital transformation

- Competitor dynamics and industry pattern evolution

Luzhou Laojiao’s strategic layout to respond to the transformation of the baijiu industry shows forward-looking and systematicness. The company relies on:

- Low-alcohol product innovation and technical barriers[1][3]

- Efficiency base of digital transformation[1][4]

- Complete closed loop of youth-oriented scene and content reach[1]

It has relative competitive advantages during the industry’s ‘ghost gate’ period. However, the market acceptance of ultra-low-alcohol products, the macro environment and depth of industry adjustment in Q12026, and the sustainability of strategic implementation are still key variables that need continuous tracking. Investors are advised to dynamically evaluate based on the company’s subsequent announcements, channel feedback, and technical signals.

[0] Gilin API Data (including real-time quotes, financial indicators, technical analysis, etc.)

[1] Caifuhao - 《Luzhou Laojiao’s Path of ‘Stability’ and ‘Solidity’: Building a Low-Alcohol Liquor Matrix to Activate the Gen Z Market》

https://caifuhao.eastmoney.com/news/20251225084612997494440

[2] Caifuhao - 《New Appearance of Luzhou Laojiao’s 38-degree Guojiao1573, Anchoring the Development Model of Low-Alcohol Baijiu》

https://caifuhao.eastmoney.com/news/20251224183617775913110

[3] Sina Finance - 《Leading Liquor Enterprises Accelerate ‘Youth-oriented’ Strategic Transformation》

https://finance.sina.com.cn/tech/roll/2025-12-09/doc-inhaeiwi3130084.shtml

[4] Sina Finance - 《Luzhou Laojiao Received Research from 28 Institutions Including CICC, ‘15th Five-Year Plan’ Focuses on Ecological Chain Strategy, Low-Alcohol Liquor and Youth-oriented Layout Become Highlights》

https://finance.sina.com.cn/stock/aigc/jgdy/2025-12-26/doc-inhecwez7827273.shtml

[5] NetEase - 《Review 2025 | Baijiu ‘Old-timers’ Begin to ‘Pleasing’ Young People》

https://www.163.com/dy/article/KHIQA24M0514B2R0.html

[6] Sina Finance - 《In 2026, Liquor Enterprises Are Still Trapped in ‘Youth-oriented’》

https://finance.sina.com.cn/jjxw/2025-12-16/doc-inhaywri8391372.shtml

[7] Economic Reference News - 《Performance of Baijiu Listed Companies Generally Declined in the First Three Quarters, Accelerating Digital and Intelligent Transformation to Seek Breakthroughs》

http://jjckb.xinhuanet.com/20251202/5ef3d6af35aa4f2d8aa118a81fe8c84a/c.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.