Analysis of Cyclical Bottom Characteristics in the Baijiu Industry: Moutai's Bottoming Signals and Industry Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data analysis, the baijiu industry is in a deep adjustment phase:

- Moutai (600519.SS):Current stock price is 1414.13 yuan, down about 18% since 2023, in a sideways fluctuation state. Technical analysis shows the trend is “SIDEWAYS” [0]

- Wuliangye (000858.SZ):Down 39.35% sharply since 2023, with weaker performance [0]

- Industry Overall:The baijiu index has experienced a significant correction, and market sentiment is low

- Feitian Moutai falls below guidance price:Bulk single bottle reference price is 1485 yuan, which has fallen below the official guidance price of 1499 yuan; original case single bottle is 1495 yuan, also below the guidance price [1]

- Wuliangye’s first official price cut in a decade:The opening price of the 8th generation Wuliangye has dropped from 1019 yuan to 900 yuan (a decrease of 119 yuan), and can drop to the range of over 800 yuan if subsidies are included. The last official price cut dates back to2014—this is an important signal [1]

- Price inversion is widespread:Ex-factory price higher than market price has become a common phenomenon in the industry [1]

- Wuliangye official price cut:This is the first official price cut since 2014, marking that manufacturers have started to transfer profits to dealers to ease inventory and capital pressure [1]

- Price subsidy policy:Manufacturers have变相 reduced prices through various subsidy forms, and the actual transaction price is lower than the ex-factory price [1]

- Feitian production cut:Moutai has not yet announced a production cut plan

- Significant reduction in dealer recruitment standards:There has been no substantive decline in dealer thresholds

- Moutai’s Beta coefficient is only 0.72, showing strong defensive attributes, but it also means that the market’s growth expectations for it have decreased [0]

- The stock price is in a sideways fluctuation state, and the market lacks a clear direction [0]

- Fund allocation drops to freezing point:Whether the proportion of public funds allocated to baijiu drops to a historical low

- Well-known analysts are fully bearish:Whether there is consistent pessimistic expectation in industry research reports

- Market panic selling:Whether there is irrational stampede-like decline

- Moutai’s financial indicators are still sound:ROE reaches 36.48%, net profit margin is 51.51%, cash flow is abundant, and debt risk is low [0]

- But growth pressure emerges:The stock price has fallen by 18.40% in the past 3 years and 24.50% in 5 years, reflecting the market’s concern about future growth [0]

- Moutai’s performance growth rate returns to zero or negative growth:As an industry benchmark, Moutai’s performance stagnation will mark the industry entering a deep recession phase

- Wuliangye and Luzhou Laojiao sharply revise down their performance:The sharp revision of performance by second-tier leaders reflects channel inventory clearance

- Channel inventory reaches healthy level:Dealer inventory returns to the normal level of 1-2 months

The old baijiu market is still adjusting. Price stabilization is an important signal because:

- It reflects the recovery of real consumption demand

- It represents the stability of collection investment sentiment

- It is a barometer of high-end consumption confidence

As a representative of aged Moutai, the price trend of 15-year Moutai has leading significance:

- Price stabilization and rise → mean the recovery of high-end consumption demand

- Continuous decline → indicate that market confidence has not yet recovered

- Narrowing of price inversion → mean that channel inventory clearance is near the end

- Currently, the wholesale price of Feitian Moutai is below the guidance price [1]

- Bottom signal:Wholesale price stabilizes and rises above the ex-factory price

- Extreme bottom signal:Wholesale price falls below the ex-factory price and then stabilizes (reflecting complete channel clearance)

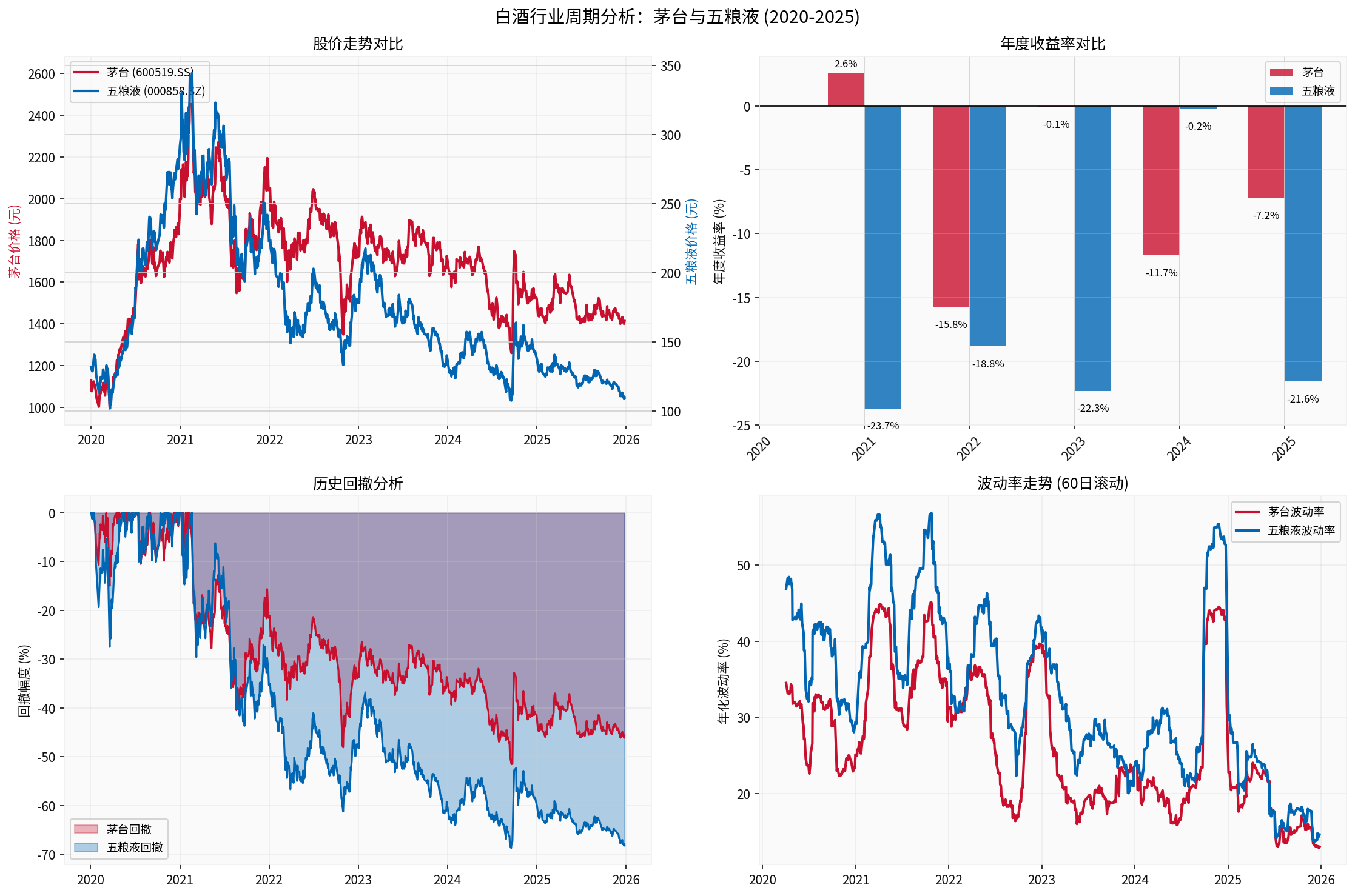

Chart description: The chart shows the stock price trend comparison, annual return, historical retracement and volatility analysis of Moutai and Wuliangye from 2020 to 2025. It can be seen from the chart that Wuliangye’s adjustment range is much larger than Moutai’s—Wuliangye has fallen by 39.35% since 2023, while Moutai has fallen by 18% [0]. Retracement analysis shows that both companies have experienced significant retracement, but Moutai’s retracement range is relatively small, reflecting its strong resilience as an industry leader.

- Price system collapse:Wuliangye had an official price cut in 2014, similar to the current situation [1]

- High channel inventory:Dealers have serious inventory backlogs

- Demand shrinkage:Government consumption restrictions and missing consumption scenarios

- Moutai’s fundamentals are more solid:Current ROE (36.48%) and net profit margin (51.51%) of Moutai are far better than those in 2014 [0]

- Different consumption structure:Current mass consumption accounts for a higher proportion, and government consumption dependency is reduced

- Increased industry concentration:Leaders have expanded market share and stronger risk resistance

Based on the analysis framework provided by users, the current market has not fully met the bottom conditions:

✓

✓

✗

✗

✗

- Cautious wait-and-see:Wait for all bottom signals from the three dimensions to appear

- Focus on Moutai’s wholesale price:Stabilization of Feitian Moutai’s wholesale price is an important leading indicator

- Monitor channel inventory:The progress of dealer inventory clearance is the key to industry recovery

- Moutai is still a core asset:Healthy finances, abundant cash flow, ROE as high as 36.48% [0]

- Wait for right-side entry opportunity:Intervene after the bottom signal is confirmed

- Focus on second-tier leaders:Clearance opportunities for Wuliangye and Luzhou Laojiao after performance revision

- [x] Wuliangye price cut

- [ ] Feitian Moutai production cut or shipment control

- [ ] Significant reduction in dealer recruitment standards

- [ ] Fund allocation drops to historically extremely low level

- [ ] Well-known analysts fully turn bearish

- [ ] Moutai’s performance growth rate returns to zero or negative

- [ ] Wuliangye and Luzhou Laojiao sharply revise down their performance

The baijiu industry is replicating the characteristics of the 2012-2014 cycle, but

- Moutai’s performance growth rate slows significantly or turns negative—this is a sign of industry recession confirmation

- Extreme pessimism in market sentiment—fund allocation drops to freezing point, and analysts are collectively bearish

- Stabilization and rise of old baijiu prices—especially the stability of the price trend of 15-year Moutai

For investors,

[0] Gilin API Data - Guizhou Moutai (600519.SS) and Wuliangye (000858.SZ) stock price, financial and technical analysis data

[1] Yahoo Finance - “Wuliangye cuts price by 119 yuan per bottle for the first time in a decade” (https://hk.finance.yahoo.com/news/中國拓具身機械人-手握三大優勢-全產業鏈結合ai-人才應用場景廣闊-200900984.html)

[1] Yahoo Finance - “Baijiu Feitian Moutai falls below 1499 yuan guidance price” (https://hk.finance.yahoo.com/news/白酒飛多茅台跌破1499元指導價-185300398.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.