In-depth Investment Analysis of Xiaomi's 'Human-Vehicle-Home Full Ecosystem' Strategic Transformation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Xiaomi has successfully transformed from a single smartphone company into a “Human-Vehicle-Home Full Ecosystem” technology company. Based on the Sum-of-the-Parts (SOTP) valuation method, the company’s target market capitalization is approximately HK$2,184 billion, with an

Xiaomi completed the historic leap from car manufacturing to large-scale delivery in less than two years. As of December 2025, Xiaomi Auto’s

This milestone marks the official realization of the

- Human: Smartphones rank top 3 globally, with a domestic market share of 16.82% in January-November 2025, ranking second [3]

- Vehicle: SU7+YU7 dual hit models, with monthly deliveries exceeding 40,000 units in September 2025 [1]

- Home: IoT and large appliance business revenue is expected to exceed 135 billion yuan in 2025 [0]

- HyperOS 3, built on Android 16, was released in August 2025 [4]

- Enables seamless flowbetween mobile phones, cars, and home devices

- Core capabilities: In-car access to home cameras, remote air conditioning activation, one-click push of mobile navigation to car infotainment [1]

- The 3nm flagship SoC chip Xuanjie O1 entered mass production in 2025, filling the gap in advanced process chip design in mainland China [3]

- Experience from the Hyper P-series power management chips will be extended to the automotive field [1]

- Completed full matrix layout of language, multimodal, and voice capabilities

- Achieved extreme inference efficiency and cost advantages through architectural innovation [3]

- Global shipment volume remains top 3 [0]

- Second in domestic sales in January-November 2025, with a market share of 16.82%

- Net user inflow from all domestic TOP5 brands, including over 4.5 million users switching from Apple [3]

- Gross margin: 15-20% [0]

- High-end strategy has achieved significant results, becoming the only domestic high-end brand that can compete head-on with Apple

- As a cash cow business, it provides stable cash flow for automotive and IoT R&D

- High-end breakthrough enhances brand premium capability

- Forms channel synergy with the automotive business (Xiaomi Home transformed into car showrooms)

- Revenue of approximately 40 billion yuan in 2024

- Expected revenue of over 135 billion yuan in 2025, with a growth rate of over 200% [0]

- Gross margin: 10-15%

- World’s largest consumer AIoT platform, with over 800 million connected devices

- HyperOS enables deep cross-device collaboration

- Full coverage of smart home, smart office, and smart travel

- Enhances user stickiness and ecosystem locking

- Forms cross-selling with the mobile phone business

- Provides massive scenarios and data for the automotive business

- 137,000 units delivered in 2024

- Over 350,000 units delivered in 2025, with a year-on-year growth rate of over 220% [1][2]

- Cumulative deliveries of 500,000 units, reaching 200,000 units in only 348 days (Tesla Model 3 took 14 months) [1]

- SU7: Pure electric mid-to-large sedan, user satisfaction score of 82, tied for first place with BMW i5 [5]

- YU7: Pure electric SUV, with over 240,000 units locked in 18 hours, becoming the first domestic SUV to truly dethrone Model Y [3]

- SU7 Ultra: Fastest mass-produced electric vehicle at the Nürburgring (7:04.957) [3]

- First quarterly operating profit achieved in Q3 2025 [3]

- Capacity ramp-up and scale effects gradually emerge

- Ecosystem Advantage: Unlike traditional car companies, Xiaomi Auto’s cockpit system is deeply connected with mobile phones and home devices

- R&D Strategy: Mature solutions as the foundation, gradual penetration of self-developed technologies, reducing R&D risks

- Brand Effect: Xiaomi’s young and tech-savvy brand image naturally fits the smart electric vehicle audience

According to Gilin API data [0]:

| Valuation Indicator | Value | Industry Comparison |

|---|---|---|

| Stock Price | HK$39.22 | - |

| Market Capitalization | HK$10,171 billion | - |

| P/E Ratio | 20.24x | Lower than Apple (28x), Tesla (85x) |

| P/B Ratio | 3.16x | Reasonable range |

| P/S Ratio | 1.99x | At historical low |

| ROE | 18.65% | Excellent |

| Net Profit Margin | 9.84% | Stable |

- YTD 2024 growth: +151.41%[0]

- 3-year growth: +249.55%

-5-year growth: +25.91%

- Current trend: Sideways consolidation, trading range [HK$38.59, HK$41.09] [0]

- KDJ indicator shows oversold, with rebound opportunities

- Beta coefficient of 0.96, moderate correlation with Hang Seng Index

###3.2 Sum-of-the-Parts (SOTP) Valuation Analysis

| Business Segment | 2025E Revenue (100 million yuan) | Valuation Multiple | Valuation (1 billion HK$) |

|---|---|---|---|

| Smart Phone | 850 | 1.2x P/S | 1020 |

| IoT & Large Appliance | 580 | 0.8x P/S | 464 |

| Automotive Business | 350 | 2.0x P/S | 700 |

Total |

1780 |

- | 2184 |

- Target Market Capitalization: 2184 billion HK$

- Current Market Capitalization:1017 billion HK$

- Upside Potential: +114.7%

- Smart Phone:1.2x P/S (lower than Apple (3x), Samsung (1.5x), reflecting hardware valuation discount)

- IoT Business:0.8x P/S (consistent with hardware platform valuation level)

- Automotive Business:2.0x P/S (significantly lower than Tesla (8x), Li Auto (4x), reflecting growth and risk discount)

###3.3 Key Parameters of DCF Valuation

- WACC:9.5%

- Perpetual Growth Rate:3.0%

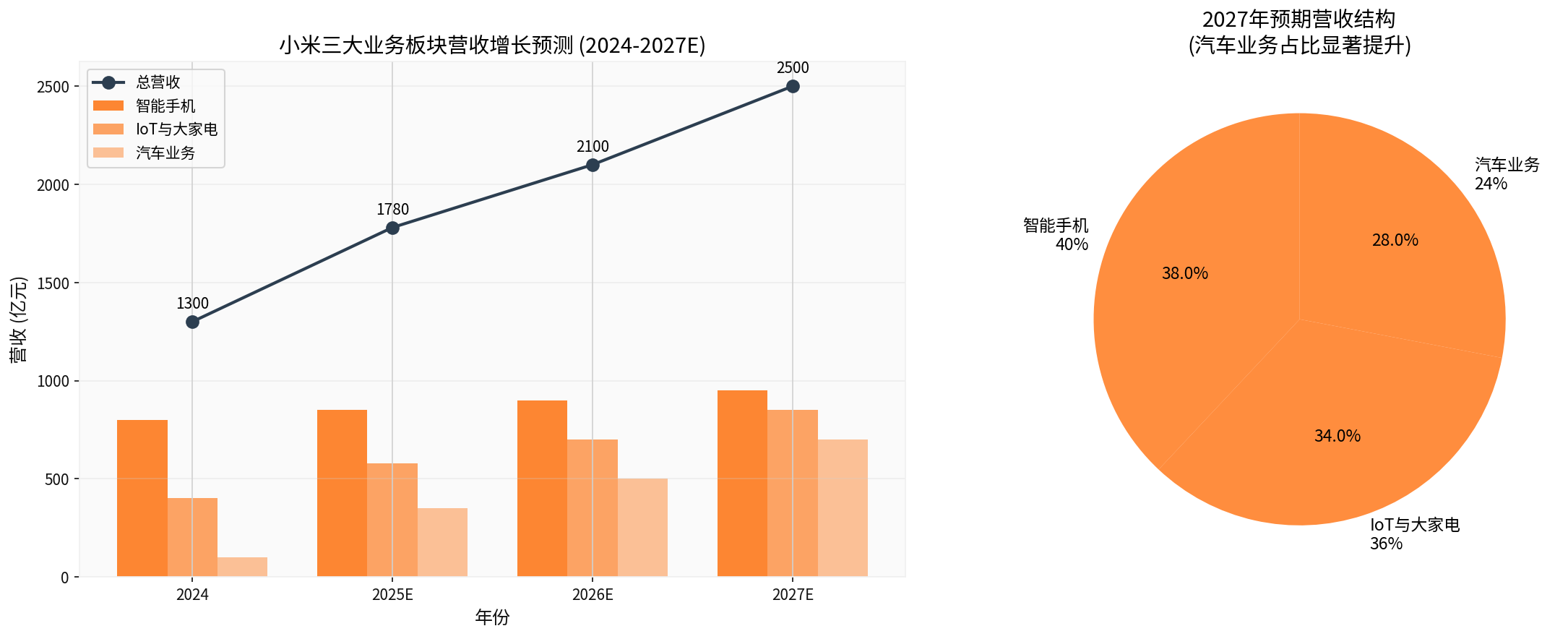

- Next 5-year Revenue CAGR:15-20%

- Long-term Net Profit Margin:8-10%

- Terminal Value Multiple:15x

- Optimistic Scenario (20% CAGR): Target Price HK$60

- Base Scenario (15% CAGR): Target Price HK$48

- Conservative Scenario (10% CAGR): Target Price HK$35

###4.1 Ecosystem Synergy Effect:1+1+1>3

- Single Phone User LTV: ~3000 yuan

- Phone+IoT User LTV: ~8000 yuan

- Human-Vehicle-Home Full Ecosystem User LTV: Over 200,000 yuan

- User behavior data feeds AI large models

- AI optimizes user experience

- Better experience improves retention rate

- Higher retention rate increases data volume

- Phone users buying cars: ~3%

- Car users buying IoT products: Over80%

- IoT users upgrading phones: ~40%

###4.2 Technical Barriers and Moat

- 3nm Xuanjie O1 chip breaks international monopoly [3]

- Reduces dependence on external supply chain

- Improves hardware profit margin (chip cost accounts for30%)

- HyperOS becomes the system-level hub of the ‘Human-Vehicle-Home Full Ecosystem’ [3]

- Hardware differentiation carrier

- Software service monetization platform

- Young, tech-savvy brand image

- High cost-performance but not cheap

- Strong brand loyalty from Mi Fan community

###4.3 Quantitative Analysis of Growth Space

- Domestic market share from16.82%→target 25%

- Global market share from14%→target18%

- High-end model proportion from30%→target50%

-2025:135 billion yuan→2027:200 billion yuan+

- Incremental market of large appliances and office equipment

-2025:350,000 units→2027:1 million units

- Market share from1%→5%

- Target top5 global electric vehicle companies

###5.1 Automotive Business Risks

- SU7 delivery delays in2025, disconnect between pre-orders and deliveries [2]

- Capacity ramp-up below expectations

- Key chip supply shortages

- Intensified price competition (Tesla price cuts)

- Battery cost fluctuations

- After-sales system pressure (repair queues, parts shortages) [2]

- Price cuts by leaders like Tesla and BYD

-围剿 by new forces like NIO, XPeng, Li Auto - Accelerated electrification transformation of traditional car companies

###5.2 Overall Risks

- Weak demand for consumer electronics

- New energy vehicle subsidy withdrawal

- Geopolitical risks (US sanctions, EU tariffs)

- Autonomous driving technology route selection

- Solid-state battery technology disruption

- Operating system ecosystem competition

- Insufficient liquidity in Hong Kong stock market

- Low valuation of hardware companies by the market

- Valuation re-rating due to automotive business underperformance

###6.1 Rating:

- Human-Vehicle-Home Full Ecosystem strategy has been verified by the market, with explosive growth in automotive business

- SOTP valuation shows 115% upside potential, current valuation is significantly undervalued

- Technical barriers build long-term competitive advantages, self-developed chips + operating system enhance moat

- Ecosystem synergy effect not fully reflected in valuation, with continuous re-rating potential in the future

###6.2 Target Price:

Based on comprehensive judgment of DCF valuation (base scenario) and SOTP valuation.

**Time Horizon:**12-18 months

###6.3 Key Observation Indicators

- 2026Q1 auto delivery volume (target:100,000 units/quarter)

- YU7 capacity ramp-up situation

- HyperOS3 user feedback

- Quarterly profitability of automotive business

- Penetration rate of self-developed3nm chips

- Overall revenue growth rate in2026

- Annual delivery volume of automotive business rushing to1 million units

- Commercialization progress of MiMo large model

- Ecosystem user retention rate

###6.4 Operation Recommendations

- Can build positions in batches at current prices

- Target position:5-10% portfolio weight

- Holding period:3-5 years

- Focus on technical support level: HK$38.59

- Breakthrough resistance level: HK$41.09

- Stop-loss level: HK$35

Xiaomi’s ‘Human-Vehicle-Home Full Ecosystem’ strategic transformation is essentially a business model upgrade from

For long-term investors,布局 Xiaomi at the current point is essentially betting on Xiaomi becoming

[0] Gilin API Data - Xiaomi (1810.HK) Financial Data, Stock Price Information, Technical Analysis

[1] Youjia - “Xiaomi Auto Delivered Over350,000 Units in2025, Lu Weibing Reveals Ecosystem Closed Loop” (https://youjia.baidu.com/view/articleDetail/8821857242352509889)

[2] Sohu - “Dare to Predict! The Panoramic Competition of New Forces in the First Half of2026 May Become Like This” (https://m.sohu.com/a/968922750_157493)

[3] Caifuhao - “Looking Back at2025, Xiaomi Remains One of the Most Growth-Potential Chinese Tech Companies” (https://caifuhao.eastmoney.com/news/20251226093327853955760)

[4] Sohu - “The Soul of Xiaomi! HyperOS3 Named2025 ‘New Benchmark for Ecosystem Integration’” (https://m.sohu.com/a/969204578_115831)

[5] Electronic Engineering Album - “Lei Jun Announces, Xiaomi Auto Wins First Again!” (https://www.eet-china.com/mp/a457400.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.