Analysis of Valuation Repair Opportunities and Allocation Optimization Strategies in the Hong Kong Stock Market Consumer Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the professional analysis of Jinling AI, I will systematically and comprehensively analyze the valuation repair opportunities and allocation optimization strategies of the Hong Kong stock market consumer sector for you.

According to the latest market data, the Hong Kong stock market consumer sector is currently in the

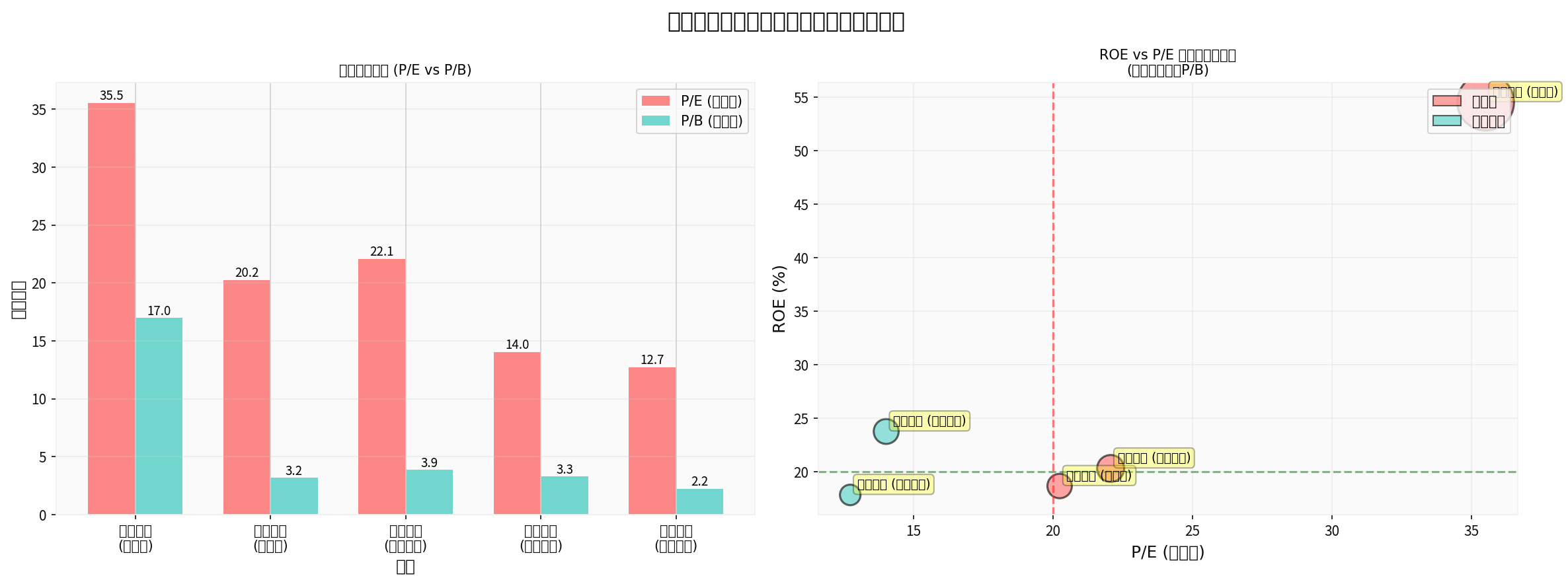

| Company | Type | P/E | P/B | ROE | Investment Value |

|---|---|---|---|---|---|

Shenzhou International |

Traditional Consumption | 12.73x | 2.23x | 17.82% | High |

Anta Sports |

Traditional Consumption | 14.02x | 3.28x | 23.75% | High |

Xiaomi Group |

New Consumption | 20.24x | 3.16x | 18.65% | Medium |

Tencent Holdings |

Tech Consumption | 22.07x | 3.85x | 20.29% | Medium |

Pop Mart |

New Consumption | 35.52x | 16.98x | 54.52% | Medium |

- High Valuation, High Growth: Pop Mart’s P/E ratio reaches35.52x, but its ROE is as high as54.52%, and PEG is 0.65 (<1 indicates reasonable valuation still exists) [0]

- High Volatility: The increase reached904.01% during2024-2025, but the annualized volatility was56.87% and the maximum drawdown was43.59% [0]

- Liquidity Sensitive: When liquidity in Hong Kong stocks is loose, it is easy to rise to dizzying heights, and short-term valuation overdraft is obvious [1]

- Low Valuation, High Dividend: Shenzhou International’s P/E ratio is only12.73x, Anta Sports’ P/E ratio is14.02x, which is significantly lower than new consumption [0]

- Stable Performance: Shenzhou International’s net profit margin is21.16%, Anta Sports’ is19.71%, with high profit quality [0]

- Relatively Low Volatility: Anta Sports’ annualized volatility is37.29% and maximum drawdown is29.86% [0]

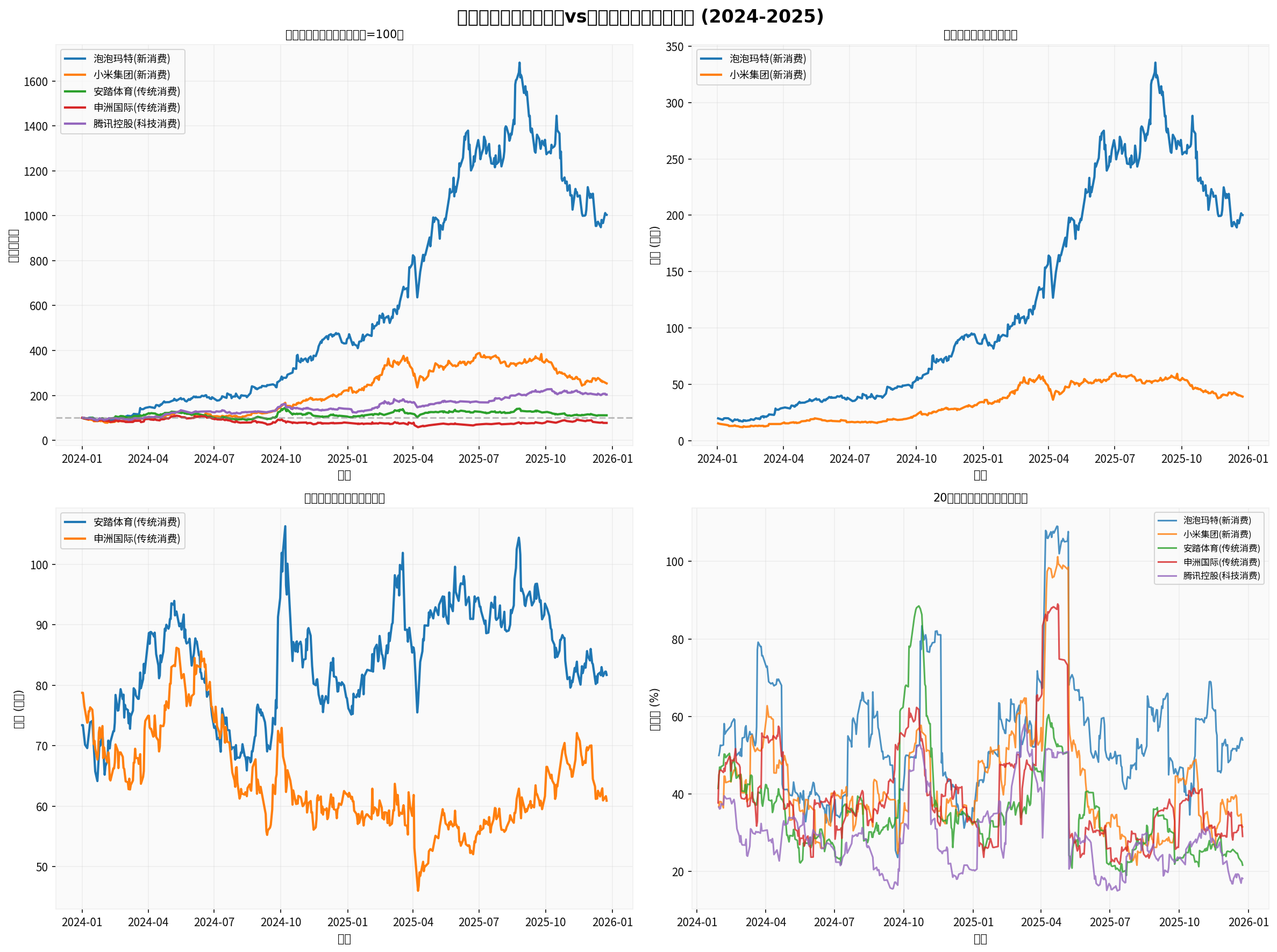

The above chart shows the differences in price performance of representative stocks of new consumption and traditional consumption during2024-2025 [0]:

| Stock | Initial Price | End Price | Total Return | Annualized Volatility | Maximum Drawdown |

|---|---|---|---|---|---|

| Pop Mart | HK$19.94 | HK$200.20 | +904.01% |

56.87% | 43.59% |

| Xiaomi Group | HK$15.48 | HK$39.22 | +153.36% |

44.98% | 37.37% |

| Anta Sports | HK$73.40 | HK$81.70 | +11.31% |

37.29% | 29.86% |

| Shenzhou International | HK$78.75 | HK$60.90 | -22.67% |

40.86% | 46.64% |

| Tencent Holdings | HK$296.60 | HK$603.00 | +103.30% |

30.96% | 23.49% |

- Explosive Growth of New Consumption: Pop Mart and Xiaomi Group achieved amazing increases of over150% during2024-2025 [0]

- Traditional Consumption Lags Behind: Anta Sports and Shenzhou International had limited increases, and Shenzhou International even declined [0]

- Significant Volatility Differences: The volatility of new consumption is significantly higher than that of traditional consumption and tech consumption [0]

###1.

- Current Price: HK$200.20

- Fair Value Range: HK$76.08 -453.40

- Neutral Scenario: HK$284.70 (+42.2% upside potential)

- Conservative Scenario: HK$76.08 (-62.0% downside risk)

- Optimistic Scenario: HK$453.40 (+126.5% upside potential)

- Historical Growth:5-year revenue CAGR of50.9%, net profit margin of18.3%

- Current Price: HK$60.90

- Fair Value Range: HK$58.93 -100.43

- Neutral Scenario: HK$71.43 (+17.3% upside potential)

- Conservative Scenario: HK$58.93 (-3.2% downside risk)

- Optimistic Scenario: HK$100.43 (+64.9% upside potential)

- Historical Growth:5-year revenue CAGR of5.6%, net profit margin of18.6%

- Policy Support: The Central Economic Work Conference listed “expanding domestic demand” as the top of the eight key tasks for China’s economic work in2026, and the Ministry of Commerce, the Central Bank, and the Financial Regulatory Administration jointly issued11 policy measures to boost consumption

- Low Valuation: The valuation quantile of the Hong Kong stock market consumer sector is at a historical low (about9.78%), with a foundation for repair

- Capital Return: Global capital reallocation, Hong Kong stocks benefit from the expectation of overseas capital return and domestic demand boost

- Style Rotation: Technology and consumption show a “seesaw” effect, and the current consumption style has the logic of catching up

The above chart shows the relationship between P/E, P/B, and ROE of major consumer stocks, with the bubble size representing the P/B multiple [0]:

Based on the above analysis, it is recommended to adopt the

-

Anta Sports (2020.HK):

- P/E14.02x, ROE23.75%, ROE/PB ratio of7.24 [0]

- Strong profitability, net profit margin of19.71% [0]

- Stable performance during2024-2025 (+11.31%), volatility of37.29% [0]

- Allocation Recommendation:20-25%

-

Shenzhou International (2313.HK):

- P/E12.73x, lowest valuation level, ROE/PB ratio of7.99 [0]

- Net profit margin of21.16%, strong free cash flow [0]

- 17.3% upside potential under DCF neutral scenario [0]

- Allocation Recommendation:15-20%

-

Pop Mart (9992.HK):

- Although the P/E ratio is high (35.52x), the ROE is as high as54.52% and the PEG is only0.65 [0]

- Accelerated overseas expansion, with new stores opening intensively in the Middle East, Canada, the UK, etc. [1]

-42.2% upside potential under DCF neutral scenario, but need to be alert to high valuation risks [0] - Allocation Recommendation:10-15%

-

Xiaomi Group (1810.HK):

- P/E20.24x, ROE18.65%, relatively reasonable valuation [0]

- New businesses such as Xiaomi Auto bring growth expectations

-153.36% increase during2024-2025, but recent correction is large (-33.47% in the past6 months) [0] - Allocation Recommendation:10-15%

- Tencent Holdings (0700.HK):

- P/E22.07x, ROE20.29%, lowest volatility (30.96%) [0]

-103.30% increase during2024-2025, maximum drawdown only23.49% [0] - Combines consumption and tech attributes, providing stable growth

- Allocation Recommendation:10-20%

- P/E22.07x, ROE20.29%, lowest volatility (30.96%) [0]

| Market Environment | New Consumption Allocation | Traditional Consumption Allocation | Adjustment Logic |

|---|---|---|---|

| Early Stage of Market Rise | 25-30% | 30-35% | New consumption has high elasticity, prioritize allocation |

| Market High Volatility | 15-20% | 40-45% | Increase defensive positions, lock in gains |

| Market Adjustment Period | 10-15% | 45-50% | Traditional consumption has strong anti-fall ability |

| Policy Favorable Period | 20-25% | 35-40% | Benefit from domestic demand stimulus policies |

- Single Stock Weight Control: No single stock should exceed15-20% to avoid concentration risk

- Batch Position Building Strategy: New consumption sector has high volatility, it is recommended to build positions in3-4 batches to reduce costs

- Stop-Loss Discipline: Set a stop-loss line of20-25% for new consumption stocks and15-20% for traditional consumption stocks

- Dynamic Rebalancing: Review the allocation ratio quarterly and rebalance when the deviation exceeds5 percentage points

According to the views of private equity institutions, the investment environment in2026 presents the following characteristics [2]:

- Economic Structure: China’s economy maintains structural growth, industries deeply tied to real estate are under pressure, andthe recovery pace of traditional consumption is slow

- Industry Trends:The AI industry chain and new consumption are expected to maintain high prosperity, becoming important highlights of economic growth

- Market Performance: Hong Kong stocks have achieved a large increase in2025, andstructural opportunities will be the core focus in2026

- Investment Logic:Industry prosperity is still the core of stock selection, and attention should be paid to the matching degree of corporate profitability and valuation

| Track | Representative Companies/Fields | Investment Logic |

|---|---|---|

| IP Economy | Pop Mart, BLOKS | Z-generation consumption upgrade, overseas expansion |

| Pet Economy | Pet food, medical manufacturers | Driven by “she economy”, consumption upgrade |

| Discount Retail | Miniso, Pinduoduo | Cost-effective choice under consumption downgrade |

| Domestic Beauty | Proya, Mao Geping | Benefit from the trend of affordable beauty products |

| Outdoor Economy | Sanfo Outdoor, Toread | Lifestyle change after the pandemic |

- New Consumption Valuation Risk: Although new consumption stocks such as Pop Mart have strong growth, their P/E ratio exceeds35x, so we need to be alert tovaluation bubble squeezingandbusiness model questioning[1]

- Liquidity Risk: Hong Kong stocks are amarket that relies heavily on liquidity; when global liquidity tightens, popular sectors are prone to sharp corrections [1]

- Policy Uncertainty: The effect of consumption stimulus policies still needs to be observed;the CPI recovery trend has initially emerged but the foundation is not solid[2]

- Increased Industry Competition: The hot new consumption track attracts a large number of competitors;single hit products are difficult to sustain, so attention should be paid to the diversification ability of enterprises [1]

-

Hong Kong Stock Market Consumer Sector Has a Foundation for Valuation Repair: Current valuation is at a historical low, policy support is increasing, and global capital is returning to emerging markets [1][2]

-

Allocation Ratio Between New Consumption and Traditional Consumption:

- Conservative Investors: Traditional consumption 60-70%, new consumption20-30%

- Balanced Investors: Traditional consumption50-60%, new consumption30-40%

- Aggressive Investors: Traditional consumption40-50%, new consumption40-50%

-

Investment Strategy: Uselow-valued traditional consumption as a defensive base position,high-growth new consumption as an offensive spear, and tech consumption asstable income enhancement

-

Key Timing: Pay attention to the verification of consumption data in Q2 2026 and the overseas expansion results of new consumption leaders (such as Pop Mart), and consider further adjusting the allocation ratio at that time

[0] Jinling API Data - Hong Kong stock market consumer sector market data, corporate financial indicators, valuation analysis, price trend statistics

[1] Securities Times - “Hong Kong Stock ‘New Consumption Three Sisters’ Stock Prices Continue to Adjust, Diversified Growth Capability Will Become the Cornerstone of Valuation Repair” (2025-12-19)

[2] China Fund News - “Six Private Equity Firms Analyze 2026: Stock Market Still Has Good Opportunities, Growth and Value Styles Tend to Be Balanced” (2025-12-21)

[3] Sina Finance - “Low Valuation + Policy ‘Combination Punch’ Launch, Focus on Medium and Long-Term Allocation Value of Consumer Sector” (2025-12-18)

[4] Sina Finance - “Style and Trend Resonance: New Consumption Investment Landscape” (2025-12-16)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.