In-depth Analysis Report on the Cycle Bottom of the Baijiu Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

According to the latest market data, the baijiu industry is in a deep adjustment period of ‘price inversion’:

-

Moutai Feitian’s wholesale price fell below the guidance price: In December 2025, the wholesale reference price of loose bottles of 53% ABV 500ml Moutai Feitian once fell to1485 yuan per bottle, lower than the official guidance price of 1499 yuan per bottle, a drop of about35%from over 2200 yuan at the beginning of the year [1]. Under the ‘10-billion subsidy’ on e-commerce platforms, prices as low as1399 yuan per bottleeven appeared [2].

-

Wuliangye’s price inversion is severe: The wholesale price of the 8th-generation Wuliangye Pu Wu fell from around 950 yuan per bottle at the beginning of the year to around850 yuan per bottle, far below the ex-factory price of 1019 yuan per bottle. The retail market price is about 800 yuan per bottle, and the inversion range with the suggested retail price of 1499 yuan per bottle further expanded [2].

-

Leading enterprises actively control volume to protect prices:

- Moutai: Stopped the release of all products in December, and will drastically cut the quota of non-standard liquor and reform the ‘pricing + distribution’ model in 2026 [1]

- Wuliangye: Starting from 2026, while keeping the ex-factory price at 1019 yuan per bottle unchanged, it will give dealers a subsidy of119 yuan per bottle, reducing the dealer’s invoicing price to900 yuan per bottle[1]

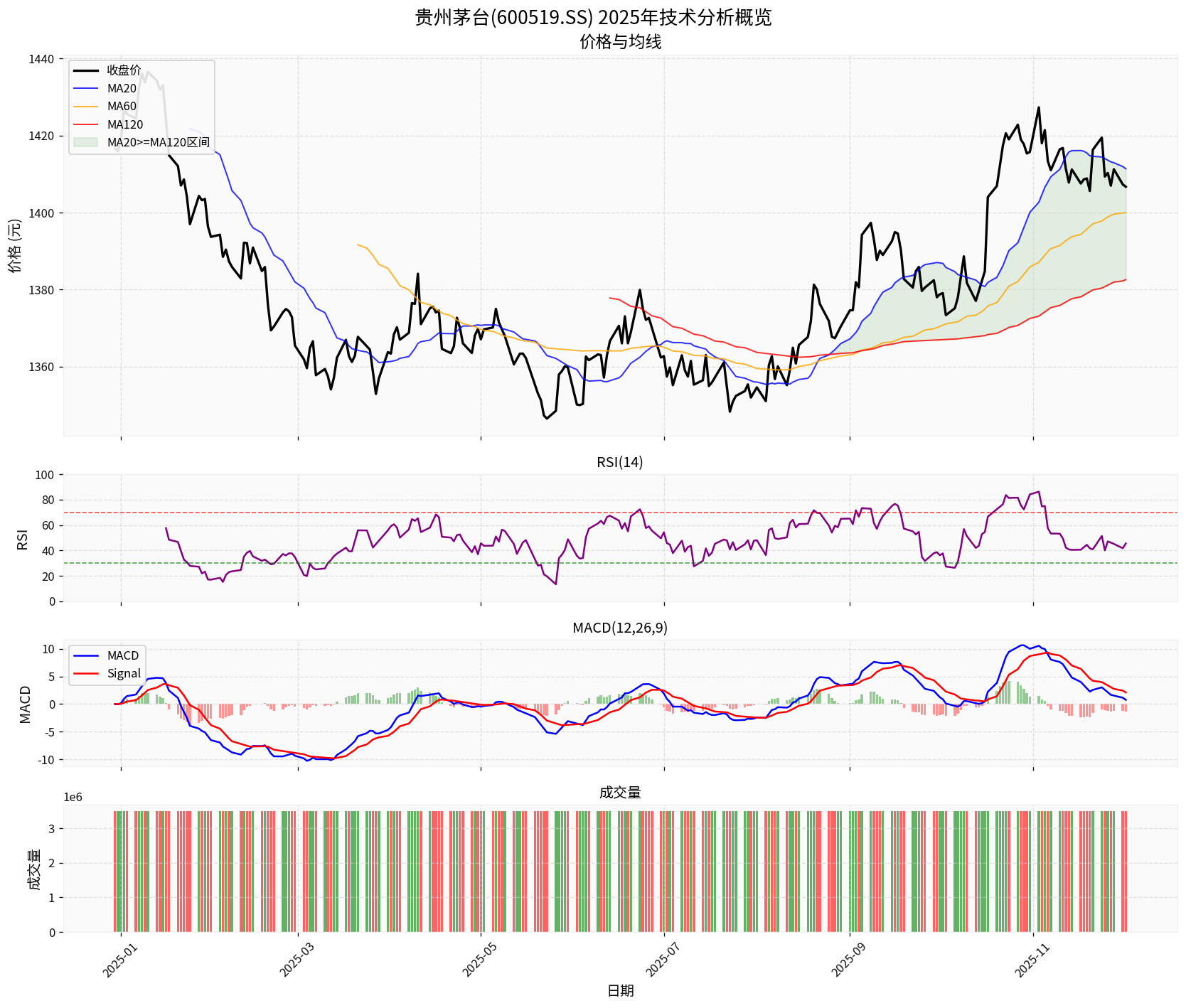

Figure 1: Guizhou Moutai’s 2025 technical analysis shows that the stock price fluctuates in the range of 1383-1658 yuan, currently at a relatively low level

-

The industry-wide inventory turnover days reached 900 days: Equivalent totwo and a half yearsto sell all inventory liquor [3]. In 2024, the inventory of 20 baijiu listed companies in A-shares reached168.389 billion yuan, an increase of 19.29 billion yuan year-on-year [2].

-

In the first half of 2025, 58.1% of dealers reported continued inventory increase, the degree of price inversion intensified, and dealers’ cash flow pressure became prominent [2].

-

The number of above-scale baijiu enterprises decreased rapidly: The loss ratio reached a new high of36.1%in the first half of 2025, industry concentration continued to increase, and the market share of CR6 (top 6 enterprises in the industry) rose from 55% in 2014 to86%[4].

According to brokerage API data [0]:

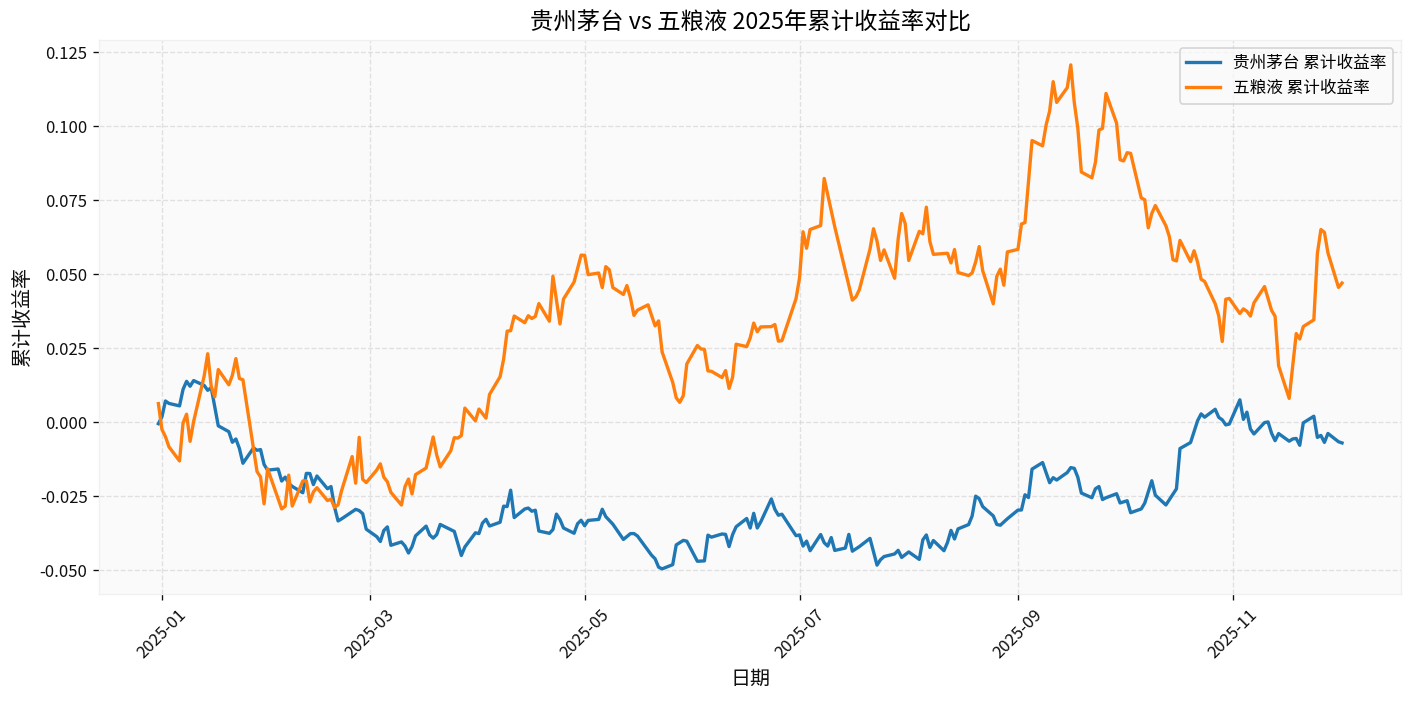

- Moutai: Current stock price is 1414.13 yuan, down4.96%year-to-date,7.27%in the past year,18.40%in the past 3 years, and24.50%in the past 5 years

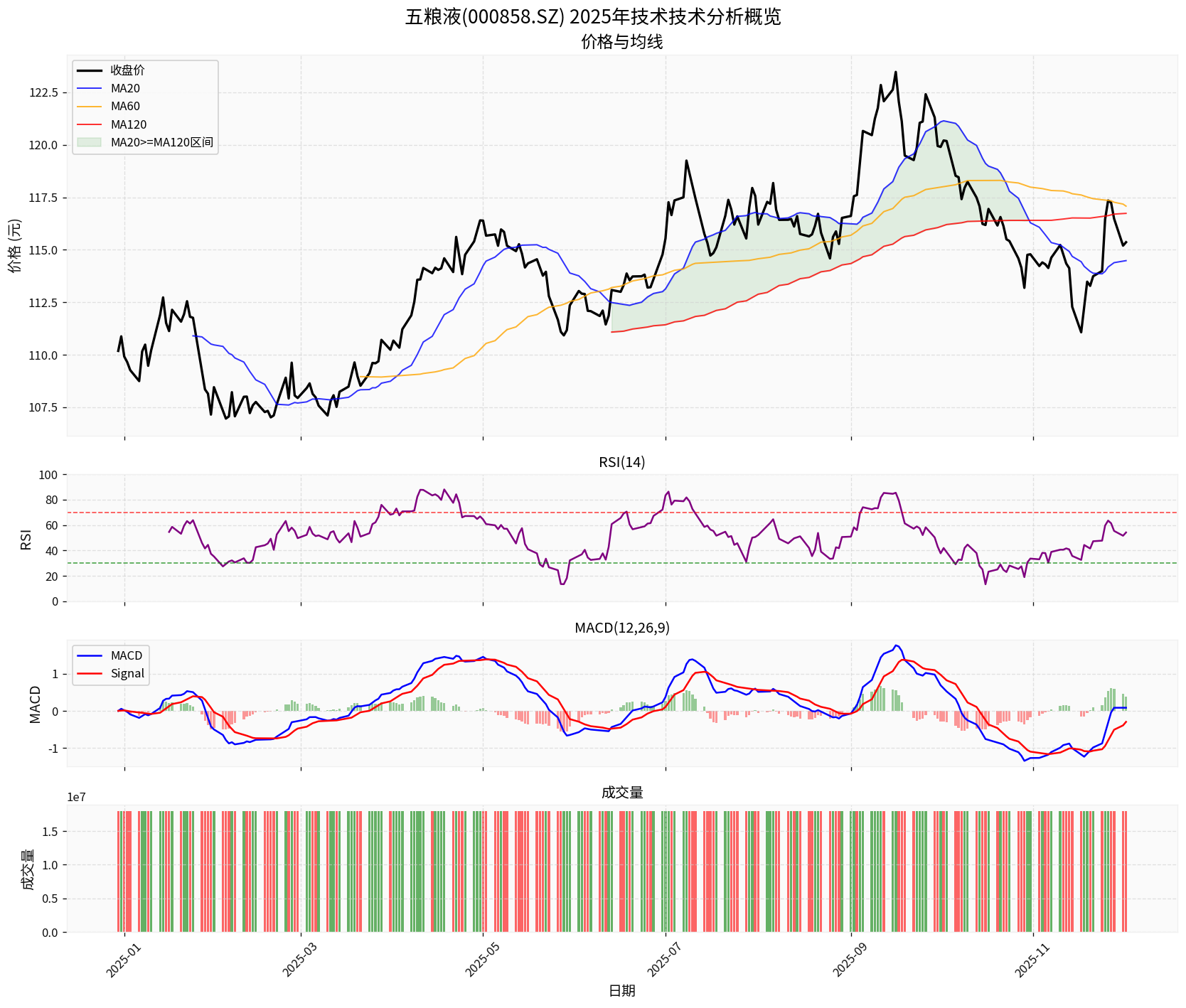

- Wuliangye: Current stock price is 109.78 yuan, down19.86%year-to-date,22.26%in the past year,39.07%in the past 3 years, and61.61%in the past 5 years

Figure 2: Wuliangye’s 2025 technical analysis shows that the stock price is under heavier pressure, but still maintains a certain bullish structure

In the first three quarters of 2025, among the 20 baijiu listed companies in A-shares, only Guizhou Moutai and Shanxi Fenjiu maintained positive growth, while the remaining 18 fell into negative growth [5].

According to web search data [6]:

-

Stock price bottom time: The CSI Baijiu Index hit a bottom at 1579.10 points onFebruary 7, 2014, then oscillated upward all the way, reaching a historical high of 21663.85 points on February 18, 2021—an increase of nearly14 timesin just 7 years.

-

Performance bottom time: The industry basically came out of the trough in themid-2014-2015. Taking Luzhou Laojiao as an example:

- 2013: Revenue 10.43 billion yuan, down 9.74% year-on-year; net profit 3.438 billion yuan, down 21.69% year-on-year

- 2014: Revenue 5.353 billion yuan, down 48.68% year-on-year (nearly halved); net profit 880 million yuan, down 74.41% year-on-year

- Q3 2015: Finally achieved a turnaround: Revenue 1.318 billion yuan, up 15.90% year-on-year; net profit 304 million yuan, up 5.31% year-on-year

-

Key difference: Stock prices usually bottom1 to 1.5 years earlierthan performance. Luzhou Laojiao’s stock price bottomed as early asearly June 2014, while performance did not reverse until Q3 2015.

Dimension |

Previous Cycle (2013-2015) |

Current Cycle (2023-2025?) |

Differences |

|---|---|---|---|

Adjustment Trigger Factors |

“‘Three Public Consumption’ Restriction Policy + Plasticizer Incident” | “Weak Consumption Recovery Post-Pandemic + Economic Downward Pressure + Supply-Demand Imbalance” | “Policy Shock vs Economic Cycle” |

Price Drop Range |

“Moutai Feitian fell from over 2000 to around 800” | “Moutai Feitian fell from over 2200 to 1485” | “Previous cycle was deeper” |

Leading Enterprise Response |

“Passive adjustment, volume for price” | “Active volume control to protect prices, abandon volume for price” | “More mature response” |

Inventory Pressure |

“High channel inventory” | “Industry-wide inventory turnover days of 900 days” | “Current cycle is more severe” |

Industry Concentration |

“CR6 around 55%” | “CR6 reaches 86%” | “Higher concentration in current cycle” |

Financial Attribute |

“Relatively weak” | “Strong financial attribute, serious scalper hoarding” | “Bigger bubble in current cycle” |

Figure 3: The cumulative return comparison between Moutai and Wuliangye in 2025 shows that Moutai performed relatively more resilient, reflecting the defensive attribute of leading enterprises

According to web search data [1][2][7]:

-

Current Status: The wholesale price of loose bottles of Moutai Feitian is 1485 yuan per bottle, only 14 yuan lower than the guidance price of 1499 yuan

-

Industry Views:

- Xiao Zhuqing, Independent Liquor Industry Commentator: “1499 yuan has been lost,around 1300 yuan has ‘hard support’, and the time will be delayed until after Q2 2026 at least”

- Key Signal: The recovery of Moutai Feitian’s wholesale price is an important sign of the end of the previous cycle and the collective reversal of stock prices

-

Support Logic:

- Supply Side: The CAGR of available sales volume will be only 1% in the next 5 years

- Demand Side: Residents’ purchasing power for Moutai is at a historical high, and the proportion of the general public is increasing rapidly

- Cost Side: The comprehensive cost of Feitian is between 1700-1800 yuan

- Current Status: Industry-wide inventory turnover days are about900 days

- Historical Comparison: At the bottom of the previous cycle, channel inventory was gradually digested to normal levels, and market expectations improved in advance

- Key Signal: Terminal inventory is expected to complete de-stockingafter the 2026 Spring Festival, while dealer inventory de-stocking will last untilthe end of 2026[8]

- Current Status: In Q3 2025, the baijiu industry’s revenue/attributable net profit/cash collection were-18.4%/-22.2%/-26.7%year-on-year, and the single-quarter revenue decline was the largest since 2012 [4]

- Historical Rule: Stock prices usually bottom1-1.5 years earlierthan performance

- Key Signal: Pay attention to whether the performance in Q1-Q2 2026 shows second-derivative improvement (narrowing decline or turning positive)

According to brokerage API data [0]:

- Moutai: P/E 19.72x, P/B 6.89x

- Wuliangye: P/E 13.04x, P/B 2.99x

Brokerage research reports point out [9]:

According to web search data [10]:

- Fund Positions: Baijiu fund positions hit a 10-year low, and the “left-side layout” signal emerged

- Market Differentiation: First-tier famous liquor enterprises can barely maintain with their deep brand accumulation, while more regional liquor enterprises and “pseudo-high-end” brands face survival crises

Based on historical rules, current data and institutional views, comprehensively judge the time window of the baijiu industry cycle bottom:

- Valuation Bottom Has Appeared: Sector valuation and institutional allocation are at historical lows, fully reflecting pessimistic expectations [9]

- Technical Indicators Show Oversold: Moutai’s RSI is about 45, Wuliangye’s RSI is about 54, both in the neutral偏弱 area

- Policy Expectations: Many places issue consumer coupons to stimulate catering scene recovery, and the year-on-year decline in baijiu sales in 2026 is expected to narrow [10]

- Historical Rule: Stock prices usually bottom 1-1.5 years earlier than performance. If the performance bottom is in mid-2026, the stock price bottom should be at the end of 2025

- Base Effect: Q3 2025 performance declined sharply, and improvement under the low base in H2 2026 will be more obvious [9]

- Inventory De-stocking: Terminal inventory is expected to complete de-stocking after the 2026 Spring Festival, while dealer inventory de-stocking will last until the end of 2026 [8]

- Sales Improvement: Institutions expect the year-on-year decline in baijiu sales in the 2026 Spring Festival to narrow from 15%-20% in 2025 to5%-10%[10]

- Historical Rule: Stock prices usually bottom 1-1.5 years earlier than performance

- Inventory Cycle Completion: Dealer inventory de-stocking to healthy levels, significant improvement in supply-demand pattern [8]

- Price System Stabilization: Moutai Feitian’s wholesale price finds support around 1500 yuan [7]

- Consumption Scene Recovery: Economic recovery drives the recovery of business, banquet and other consumption scenes

- Concentration Improvement: Industry reshuffle completed, market share of leading enterprises further concentrated

- Core Logic: Short-term trends are driven by two factors: “Double Festival Sales + Leading Enterprise Price Control”, showing the characteristics of “pulse-like recovery”

- Key Indicators:

- Whether the year-on-year decline in 2026 Spring Festival sales narrows to 5%-10%

- Whether Moutai Feitian’s wholesale price can stabilize around 1500 yuan

- Effect of channel policies of leading enterprises like Wuliangye

- Investment Recommendations:In the short term (1-3 months), it is recommended to focus on the wholesale price trends of high-end liquor leaders (Moutai, Wuliangye) and Spring Festival sales data[10]

- Core Logic: The 2026 sector rhythm is expected to below in the first half and high in the second half, with the Spring Festival peak season, price index recovery, and H2 low-base improvement forming three buying points

- Recommended Targets:

- Brand Depth, Cycle Resilience: Guizhou Moutai, Shanxi Fenjiu—with the improvement of market liquidity, the valuation center is expected to rise [9]

- Obvious Share Advantage, Time for Space: Luzhou Laojiao,古井贡酒 (Gujing Gongjiu), 金徽酒 (Jinhui Liquor)—have mastered price band or regional share advantages [9]

- Bottom Reversal Targets: 迎驾贡酒 (Yingjia Gongjiu), 舍得酒业 (Shede Liquor), 洋河股份 (Yanghe Co., Ltd.)—adjustment is sufficient, short-term actions are correct [9]

- High Comprehensive Shareholder Return: Wuliangye—high cash flow safety margin, 2026 dividend yield of 4% supports valuation [9]

- Demand Recovery Less Than Expected: If Spring Festival sales data are lower than expected (e.g., high-end liquor sales still decline by more than 10% year-on-year), it will lead to sector sentiment correction [10]

- Slow Inventory De-stocking: If the dealer inventory de-stocking cycle is extended to 2027, it will suppress liquor enterprises’ 2026 collection and delivery plans [10]

- Policy Supervision Risk: If policies such as baijiu industry consumption tax reform and “Three Public Consumption” restrictions are further tightened, it will directly impact high-end liquor demand [10]

- Price War Risk: Some regional liquor enterprises may adopt “low-price dumping” strategies to de-stock. If it triggers an industry-wide price war, it will further impact the profit margins of leading enterprises [10]

Based on historical rules, current data and institutional views, the following conclusions are drawn:

- ✅ Valuation Bottom: Sector valuation is at historical lows, fully reflecting pessimistic expectations

- ✅ Policy Bottom: Leading enterprises actively control volume to protect prices, supply-side clearing begins

- ⏳ Technical Bottom: Stock prices oscillate at low levels, waiting for an upward breakthrough

- ⏳ Sales Improvement: Year-on-year decline in Spring Festival sales narrows

- ⏳ Inventory De-stocking: Terminal inventory drops to healthy levels

- ⏳ Price Stabilization: Moutai Feitian’s wholesale price finds support around 1500 yuan

- ⏳ Healthy Inventory: Industry-wide inventory turnover days drop to historical normal levels

- ⏳ Price System Reconstruction Completed: New balance points found in various price bands

- ⏳ Consumption Scene Recovery: Demand in core scenes such as business and banquets recovers

Cai Xuefei, a baijiu marketing expert, said [5]:

- Left-Side Investors(Valuation Investors): Currently have layout value, prioritize high-certainty and high-dividend targets like Moutai

- Right-Side Investors(Trend Investors): It is recommended to wait until Q1 2026 after the Spring Festival sales data and performance forecast are confirmed before entering

- Cycle Investors: Focus on the performance inflection point in Q2-Q3 2026, and grasp the main upward wave of industry recovery

[0] Jinling API Data

[1] Pengpai News - “1500 yuan! Moutai Feitian’s wholesale price ‘returns’ to the guidance price, Wuliangye lowers dealer invoicing price” (https://www.thepaper.cn/newsDetail_forward_32148020)

[2] Sina Finance - “Wuliangye Disguised Price Reduction” (https://finance.sina.com.cn/roll/2025-12-08/doc-inhacaaz2202608.shtml)

[3] Investing.com - “Baijiu Trapped in 900 Days of Inventory, Still Account for 22 Seats in Hurun Top 100 List” (https://cn.investing.com/news/stock-market-news/article-3139688)

[4] Sina Finance - “[China Merchants Food | Baijiu Annual Strategy] More Positive at the Bottom” (https://finance.sina.com.cn/stock/stockzmt/2025-12-25/doc-inhcymnt3777920.shtml)

[5] Sina Finance - “Baijiu Glitz Disappears, Industry Seeks New Home | 2025 China Economic Annual Report” (https://finance.sina.com.cn/roll/2025-12-25/doc-inhcznyf3425852.shtml)

[6] East Money Wealth Account - “Has the Baijiu Industry Hit Bottom? Looking at Industry Inflection Points from Historical Rules and Current Signals” (https://caifuhao.eastmoney.com/news/20251116215422521317110)

[7] 21st Century Business Herald - "Moutai’s Wholesale Price Fell Below

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.