Deep Analysis of Pop Mart's IP Operation Model: Can It Replicate Tencent Games' Evergreen Growth Path?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest 2025 financial report data and market analysis, my core judgment is:

- H1 2025 revenue reached 4.814 billion yuan, a year-on-year surge of 668%, accounting for34.7%of total revenue [1]

- Soared from 627 million yuan in H1 2024 to 4.814 billion yuan in H1 2025, growing nearly 7 times in just one year

- Half-year revenue of a single IP approached 5 billion yuan, exceeding 75% of Pop Mart’s total annual revenue in 2023

- Created a myth of hidden editions being scalped to a ‘sky-high price’ of 1.08 million yuan in the secondary market; although prices have dropped significantly, it successfully achieved brand出圈 (going viral beyond its niche)

- Launched in 2015, has been in operation for 10 years, with daily average revenue exceeding100 million yuanand daily active users over100 million[2]

- Skin system contributes over 50%of revenue, and user lifetime value (LTV) is3-5 timesthat of similar games [2]

- Maintains long-term user stickiness through continuous content updates, esports events, and social ecology, achieving true ‘evergreen growth’

The chart shows the revenue comparison of Pop Mart’s top five IPs. It can be seen that THE MONSTERS’ revenue in H1 2025 far exceeded other IPs, reaching 4.814 billion yuan, while MOLLY, SKULLPANDA, CRYBABY, and DIMOO achieved 1.357 billion yuan, 1.221 billion yuan, 1.218 billion yuan, and 1.105 billion yuan respectively. The top five IPs accounted for 79.4% of total artist IP revenue, indicating that Pop Mart has shifted from relying on a single MOLLY IP to a multi-IP matrix with multiple growth points.

- Tencent Games: Virtual content × social fission × scale effect, relying on user interaction and competition to maintain long-term popularity

- Pop Mart: Physical products × emotional value × scarcity premium, maintaining popularity through collection attributes and secondary market speculation

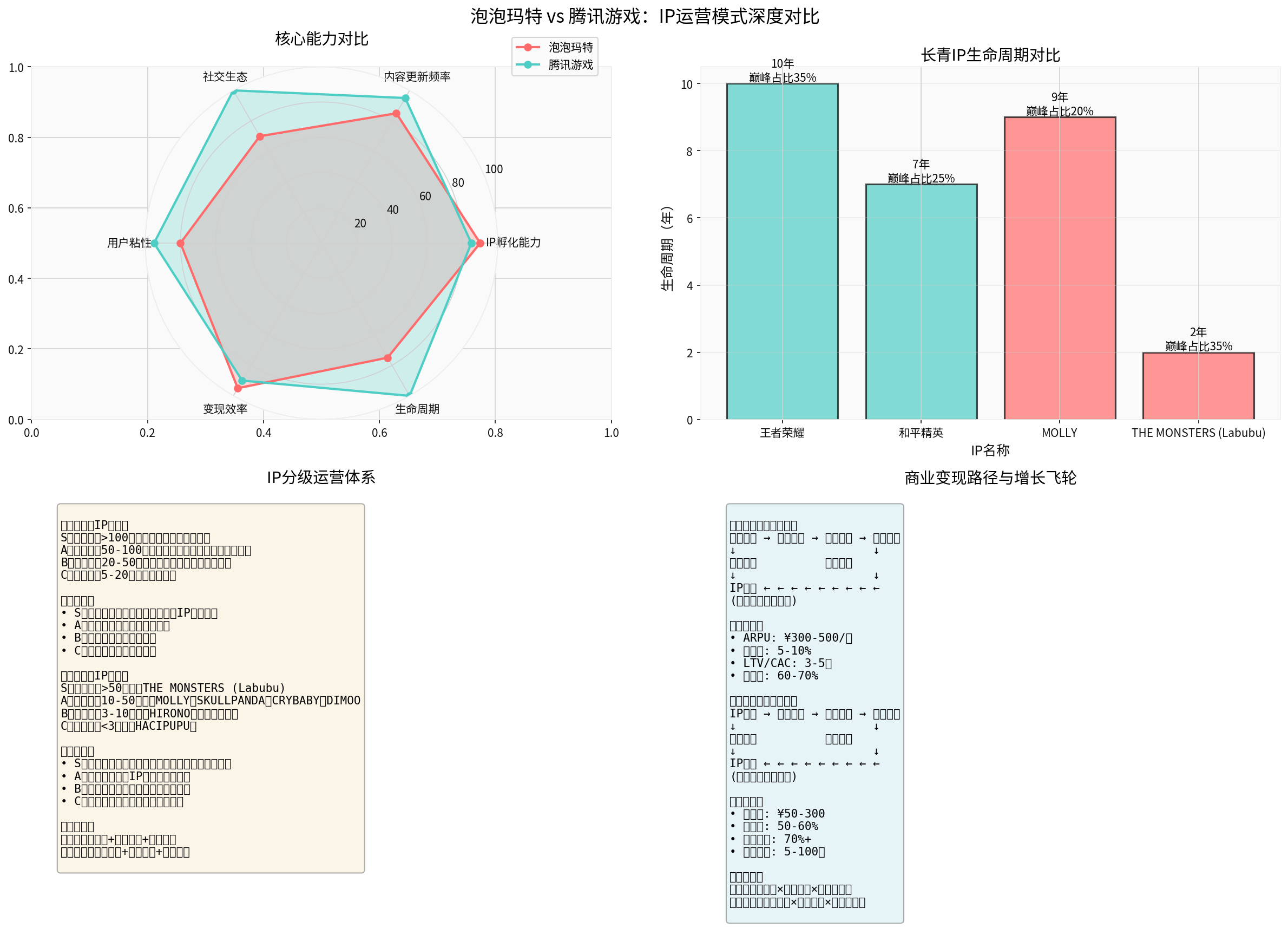

The chart compares the core capabilities of Pop Mart and Tencent Games from six dimensions. It can be seen that Tencent Games is stronger in social ecology, user stickiness, and lifecycle management, while Pop Mart performs well in IP incubation capability and monetization efficiency.

-

S/A/B/C Dynamic IP Hierarchical System

- Tencent: S-level (annual revenue >10 billion yuan), A-level (5-10 billion yuan), B-level (2-5 billion yuan), C-level (0.5-2 billion yuan)

- Pop Mart: S-level (annual revenue >5 billion yuan, THE MONSTERS), A-level (1-5 billion yuan, MOLLY/SP/CRYBABY/DIMOO), B-level (300 million-1 billion yuan), C-level (<300 million yuan)

- Both dynamically allocate resources based on market feedback to maximize the value of successful IPs and timely stop losses for underperforming IPs [3]

-

Closed-Loop Full Industry Chain

- Tencent: Game R&D studio group → distribution and operation system → social traffic channels (WeChat/QQ)

- Pop Mart: Artist discovery (PTS International Trend Toy Exhibition) → design and production → omni-channel sales (stores + robots + online)

- No obvious weaknesses in the business chain, forming a positive cycle of ‘larger scale → stronger barriers’ [3]

-

Multi-IP Matrix to Smooth Cycle Fluctuations

- Tencent has 14 evergreen games with annual revenue exceeding 4 billion yuan

- Pop Mart had 13 IPs with revenue exceeding 100 million yuanin H1 2025; the top five IPs accounted for 79.4% of revenue, but it has shifted from single MOLLY dependence to multi-point growth [1]

| Dimension | Tencent Games | Pop Mart |

|---|---|---|

Product Form |

Virtual digital goods | Physical products |

Core Driving Force |

Social fission × competitive confrontation | Emotional value × collection attributes |

User LTV |

300-500 yuan/year, repurchase rate 60-70% | Average spending per customer:50-300 yuan, repurchase rate:50-60% |

Evergreen Mechanism |

PVP real-time competition × season mechanism × UGC ecology | Scarcity premium × secondary market speculation × cultural identity |

Marginal Cost |

Almost zero, strong scale effect | Fixed production cost, but high inventory risk |

- MOLLY’s emergence in 2016 → THE MONSTERS’ explosion in 2023 → CRYBABY,小野 (Xiaoye), 星星人 (Xingxingren) and others taking over

- Successfully built 5 S/A-level IPs with annual revenue exceeding 1 billion yuan in 7 years, proving this is not ‘accidental luck’ but replicable systematic capability[1]

- Artist IP revenue soared from 3.688 billion yuan in H1 2024 to 12.229 billion yuan in H1 2025, an increase of 231.6%, accounting for88.1%of total revenue [1]

- Through high-frequency new product launches via blind box machines, mini-programs, and live streaming rooms, shortening the new product launch frequency from ‘monthly’ to ‘weekly’

- Member private domain operation, using marketing methods like ‘countdown to launch’ and ‘unannounced launch’ to accurately grasp user psychology

- 30 million member system with 58% repurchase rate, forming a stable user base

- Overseas revenue reached 5.59 billion yuan in H1 2025, accounting for 40%of total revenue, with year-on-year growth of1142.3%(Americas) and729.2%(Europe) [1]

- Asia-Pacific region grew by 257.8%, with 88 global stores covering 14 countries

- Overseas average spending per customer is 1.8 timesthat of the domestic market, with stronger profitability

- Exploring city parks, game collaborations, and film/TV content to enter the larger IP derivative market (domestic IP-licensed merchandise retail totaled 155.09 billion yuan in 2024)

- Referencing the ‘reverse Disney’ path: first build brand and user base through products, then reverse-fill content and experiences

- THE MONSTERS (Labubu) from phenomenal explosion to significant price drop in the secondary market, exposing the ‘availability paradox’: after expanding production capacity, scarcity premium disappears, and IP quickly transitions from trend product to mass consumer goods [5]

- Deutsche Bank warned that Labubu is rapidly transitioning from a scarce trend IP to mass consumer goods, and scarcity premium is disappearing [5]

- Tencent’s Honor of Kings maintains 10-year evergreen growth through social competition and UGC ecology, while Pop Mart’s IP lifecycle is currently only 2-3 years

- Generation Z preferences change rapidly, and the social attribute of blind boxes is weakening

- Although consumers aged 30-45 have an average spending per customer 40% higher than Generation Z, whether they can continue to attract new users is questionable

- Trend toys are directly linked to the ‘emotional consumption’ of young groups, and the volatility of emotions determines the uncertainty of IP lifecycle [4]

- H1 2025 revenue reached 13.876 billion yuan (year-on-year +204.4%), net profit 4.574 billion yuan (year-on-year +396.5%), exceeding full-year 2024 performance [1]

- However, the stock price dropped 43% from the August high of HKD339.8 to HKD192.9 on December 19, with market value evaporating HKD197.2 billion[5]

- This reflects the market’s deep concern about growth sustainability: investors question ‘whether high growth can continue’ and ‘where the next Labubu will come from’

- Multiple challenges such as cultural adaptation, supply chain management, and cost control

- Although current growth rate is astonishing (Americas +1142%, Europe +729%), the base is small, and whether high growth can be sustained is questionable

- Morgan Stanley predicts that Pop Mart’s revenue growth rate will slow significantly in 2026, transitioning from ‘explosive growth’ to ‘sustainable growth’ [5]

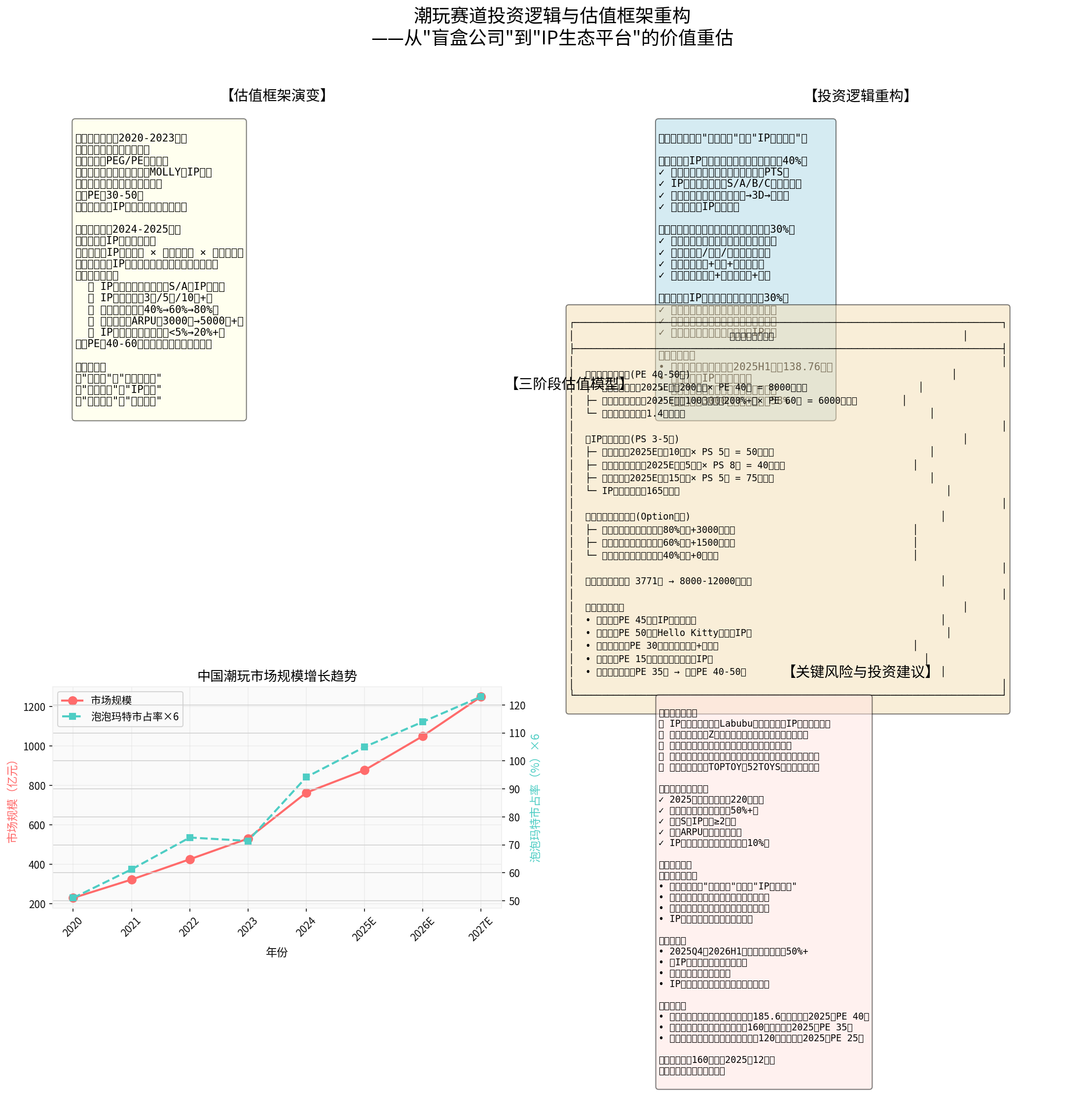

- Valuation logic: Single consumer goods company, PEG/PE relative valuation

- Core assumptions: Blind box dividend continues, single MOLLY dependence

- Main risks: Aesthetic fatigue, regulatory policies

- Typical PE: 30-50x

- Ignores IP ecological value (IP derivative market size of 155 billion yuan)

- Underestimates globalization potential (overseas revenue share from 3.38% →40%)

- Fails to reflect certainty premium brought by systematic operation capabilities

The chart shows China’s trend toy market size growing from 22.9 billion yuan in 2020 to an estimated 87.7 billion yuan in 2025, with a CAGR of 35.1%. Pop Mart’s market share also increased from 8.5% to an estimated 17.5%, showing strong market expansion capability.

- Domestic mature market (2025E revenue:20 billion yuan) × PE40x = HKD800 billion

- Overseas high-growth market (2025E revenue:10 billion yuan, growth rate +200%) × PE60x = HKD600 billion

- Total core business valuation: HKD1.4 trillion

- Park business (2025E revenue:1 billion yuan) × PS5x = HKD5 billion

- Game and content collaboration (2025E revenue:500 million yuan) × PS8x = HKD4 billion

- Co-branding and licensing (2025E revenue:1.5 billion yuan) × PS5x = HKD7.5 billion

- Total IP ecological valuation: HKD16.5 billion

- Successful scenario (overseas revenue share:80%): +HKD300 billion

- Neutral scenario (overseas revenue share:60%): +HKD150 billion

- Failure scenario (overseas revenue share:40%): +HKD0 billion

- Current market value: HKD377.1 billion (December 2025, stock price HKD200)

- Target market value: HKD800-1200 billion

- Upside potential: 112%-218%

| Traditional Indicator | New Indicator | 2025 Target |

|---|---|---|

| PE Multiple | IP Incubation Success Rate | ≥2 new S/A-level IPs per year |

| Revenue Growth Rate | Overseas Revenue Share | 40% →60% →80% |

| Gross Margin | Member ARPU | 300 yuan →400 yuan →500 yuan |

| Same-Store Growth | IP Derivative Revenue Share | <5% →10% →20% |

| Store Count | Global Brand Influence | Selected into Time Magazine’s 100 Most Influential Companies in the World (achieved) |

- Disney: PE45x (mature IP ecology, closed-loop of film + park + derivatives)

- Sanrio: PE50x (classic IPs like Hello Kitty, IP licensing为主)

- Bandai Namco: PE30x (toys + game IPs like Gundam)

- Hasbro: PE15x (traditional IPs like Transformers, slow growth)

- ✓ Artist discovery network (International Trend Toy Exhibition PTS)

- ✓ IP hierarchical operation system (S/A/B/C dynamic adjustment)

- ✓ Design and supply chain industrialization (sketch →3D →mass production)

- ✓ Data-driven IP operation decisions

- ✓ China: Saturated first- and second-tier cities, space in sinking markets

- ✓ Overseas: Explosive growth in Asia-Pacific/Americas/Europe

- ✓ Online: Blind box machines + Douyin + Xiaohongshu private domain

- ✓ Offline: Landmark stores + robot shops + parks

- ✓ Short-term: Category expansion (plush, mecha, assembly)

- ✓ Medium-term: Content filling (animation, games, film/TV)

- ✓ Long-term: Park economy, co-branding licensing, IP derivatives

###5.2 Key Hypothesis Verification Points

✓

✓

✓

✓

✓

###5.3 Core Risk Points

❶

❷

❸

❹

❺

❻

- 2023 Guidelines for the Regulation of Blind Box Operation Behavior (Trial) requires mandatory disclosure of key information and strengthened protection of minors

- Policies in various provinces and cities show a pattern of ‘both regulation and innovation, linkage between local and international’ [6]

- Future policies will focus more on cultural value excavation and global competition

###5.4 Investment Advice

- Pop Mart has evolved from a ‘blind box company’ to an ‘IP ecological platform’

- Systematic operation capability is the core barrier, with strong replicability

- Overseas market space is broad, growth ceiling not yet reached

- IP ecological expansion will open new valuation space

- Whether H2 2025 and H1 2026 growth rates can maintain 50%+

- Performance of new IPs (Xiaoye, Xingxingren, etc.)

- Overseas store efficiency and new store count

- Progress of IP derivative business (parks, games, content)

- Optimistic Scenario(overseas exceeds expectations): Target price HKD185-470, corresponding to 2025 PE40-50x

- Neutral Scenario(meets expectations): Target price HKD160, corresponding to2025 PE35x

- Pessimistic Scenario(overseas underperforms): Target price HKD120, corresponding to2025 PE25x

Can Pop Mart achieve continuous evergreen IP output like Tencent Games? My answer is:

- Tencent Gamesextends the lifecycle of a single IP to 10+ years through virtual content and social fission

- Pop Martachieves continuous growth through multi-IP matrix and global expansion, using ‘multiple short-cycle IPs’

The core is not whether a single IP can be evergreen, but whether

For investors, the key is to shift from speculative thinking of ‘betting on hits’ to long-term thinking of ‘investing in IP infrastructure’. Pop Mart’s valuation framework should shift from PEG/PE to a comprehensive logic of

The investment logic of the trend toy track is essentially a double bet on

[1] Gilin API Data - Pop Mart 2025 Interim Results Report

[2] Xueqiu - Honor of Kings: Business Insights from 10-Year Evergreen Growth (https://xueqiu.com/8321460154/331626014)

[3] Sina Finance - Labubu to Pop Mart is like Honor of Kings to Tencent Games

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.