How Oklo's Fair Value Model Predicts a 42% Stock Price Decline and Its Implications for the Reliability of AI Valuation Tools

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on Jinling API data and web search results, InvestingPro’s fair value model predicts a 42% decline in Oklo’s stock price, identifying five key fundamental risks: 1) Extreme valuation significantly deviating from industry averages (P/B ratio of approximately 15.47x vs. the U.S. utility sector average of approximately 1.9x) [0]; 2) Negative earnings and no revenue, with an unproven profit model (TTM EPS of approximately -$0.56, negative P/E ratio) [0]; 3) High regulatory and execution uncertainty (long NRC approval cycle, licensing and deployment risks) [1][3][5]; 4) Competitors have obvious capital and licensing advantages (e.g., X-energy received $500 million in equity investment from Amazon) [1]; 5) Significant equity dilution and capital pressure (submitted a $3.5 billion new stock issuance plan on October 30) [1][2].

The reliability of AI-driven valuation tools for nuclear energy companies shows a “two poles” pattern: they are effective in capturing obvious valuation mismatches and financial hard constraints, but have limited performance in highly uncertain scenarios such as regulatory policies and technical execution, market demand and cash flow paths.

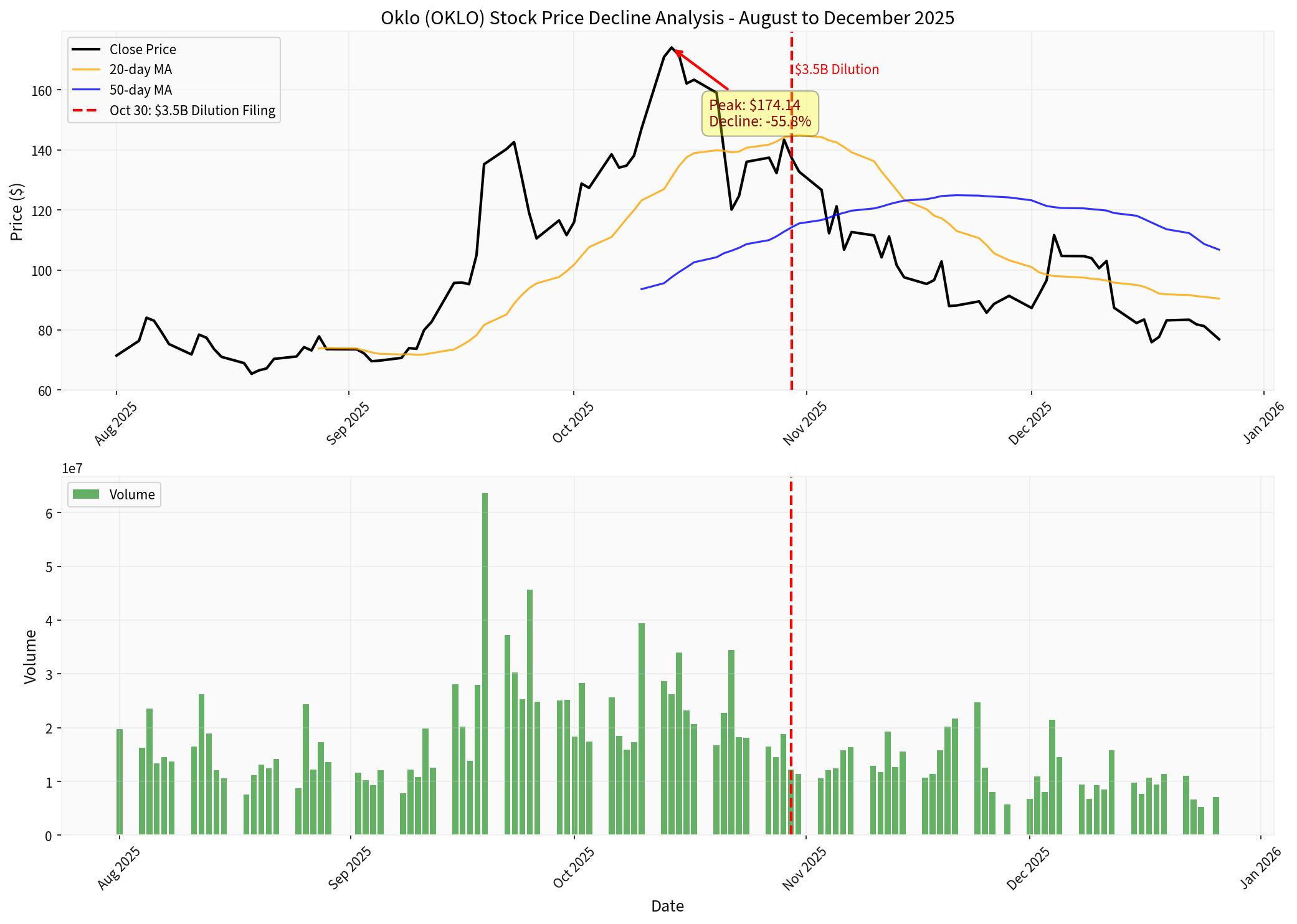

- Peak: October 14, 2025, closed at approximately $174.14, corresponding to a market capitalization significantly exceeding $14B (per online reports) [1][2][0].

- Current: December 28, 2025, closed at $76.92, with a market capitalization of approximately $12.02B [0].

- Cumulative decline from peak: approximately 55.8% [chart data].

- Possible window for the “42% decline”: from $174.14 (October 14) to around $100, the decline is close to 42%. Subsequently, it further dropped to the current $76.92, with the cumulative decline deepening to approximately 55.8%.

- X-axis: Date (August 1, 2025 to December 28, 2025)

- Y-axis (top chart): Price in USD, with 20-day and 50-day moving averages overlaid

- Y-axis (bottom chart): Trading volume

- Red dashed line: October 30, 2025, $3.5B dilution announcement date

- Key annotations: Peak and decline range, trading volume changes

-

Extreme Valuation and Deviation from Comparables

- P/B ratio of approximately 15.47x, significantly higher than the U.S. utility (electric power) sector average of approximately 1.9x [0][1].

- Compared to Constellation Energy (trading at approximately 38x earnings) which has actual operational nuclear assets, Oklo’s valuation is “infinite times”, reflecting the market’s high expectations for its future growth and valuation bubble risk [1].

-

Negative Earnings and No Revenue, Unproven Business Model

- TTM EPS of approximately -$0.56, negative P/E ratio; no or extremely low revenue, continuous net losses [0][1].

- Difficult to anchor value using conventional earnings methods (e.g., PE, EV/EBITDA), forcing the model to rely more on scenario/probability-based methods.

-

Long Regulatory Path and High Execution Complexity

- Long NRC approval cycle; Oklo’s license application was rejected in 2022 [5].

- Although there have been subsequent progress such as NRC preliminary assessment and approval of the A3F facility safety analysis [4][5], there is still significant uncertainty before commercialization.

- If the model incorporates regulatory time and probability parameters (e.g., license approval probability, time delay penalty), it will significantly discount the valuation.

-

Competition and “Paper Reactor” Risk

- Media such as Forbes refer to Oklo as a “$14 billion paper reactor”, pointing out that its valuation anchor relies on the narratives of “AI needs electricity” and “Sam Altman” but has not yet achieved commercial operation and considerable revenue [1][2].

- X-energy received $500 million in direct investment from Amazon, with relative advantages in capital and licensing progress [1].

-

Equity Dilution and Capital Structure Pressure

- Submitted a $3.5 billion new stock issuance plan on October 30, triggering dilution concerns; subsequent Q3 results were below expectations [1][2].

- If the AI model considers the dilution of EPS and equity value, it will automatically lower the target price range.

-

Negative Free Cash Flow and Long-Term Investment Needs

- The latest free cash flow is negative (approximately -$38.7M), reflecting continuous investment and capital expenditure pressure [0].

- SMR projects are long-cycle heavy asset investments; the model needs to conduct sensitivity tests on capital structure and refinancing risks.

Advantages (Effective Scenarios)

- Batch multi-dimensional financial scanning: Can quickly identify valuation anomalies (e.g., extreme P/B ratio, negative earnings, cash flow gaps) [0].

- Scenario and sensitivity analysis: Supports multi-scenario discounting/Monte Carlo simulation, covering variables such as regulatory approval rate, deployment timing, and cost overruns.

- Comparable benchmark calibration: Identifies extreme valuation deviations by comparing with peers and mature nuclear assets.

- Knowledge graph and event-driven: Integrates event signals such as licensing, policies, orders, and collaborations to make event-driven adjustments.

Limitations (Unique Challenges for Nuclear Energy/SMR)

- Non-linear regulatory and technical paths: Inflection points of licensing paths, safety standards, and policy support (e.g., ADVANCE Act, administrative orders) are difficult to extrapolate using historical data [4][5].

- Highly uncertain cash flow paths: First reactor schedule, first commercial reactor deployment progress, contract structure, and electricity price mechanism are variable, making DCF assumptions prone to distortion.

- Sentiment and narrative-driven: Factors such as “AI-nuclear energy linkage” and “star investor effect” are difficult to fully quantify.

- Scarce and incomparable data: No mature commercial samples for SMR, limited comparable assets.

Reliability Recommendations (Best Practices)

- Hybrid modeling: Combine AI multi-factor screening with scenario DCF, and overlay expert judgments on regulatory/technical aspects.

- Phased valuation: Set phased discount rates and cash flow assumptions according to “licensing-first reactor-commercialization”.

- Dynamic monitoring and backtesting: Trigger dynamic model updates based on licensing progress, policy events, and capital expenditure rhythm.

- Risk factor exposure: Set independent factors for dilution, licensing delays, cost overruns, and lower-than-expected demand.

- Short-term: Driven by market sentiment and “expectation gap”, fluctuating around news of licensing progress, policies (e.g., NRC process reform, DOE-related support), and capital expenditures [4][5].

- Medium to long-term: If licensing is successfully completed, first projects are launched, and large-scale contracts are signed, the valuation can be re-evaluated; otherwise, it will still be suppressed by the “paper reactor” doubt.

- Model application: AI tools are suitable for continuous monitoring of fundamental and valuation mismatch changes, but should combine nuclear energy expert opinions and give sufficient scenario weights to regulatory and technical risks.

The 42% decline prediction of Oklo by InvestingPro’s fair value model corely captures key hard constraints such as extreme valuation, no revenue/negative earnings, regulatory and execution uncertainty, competition, and dilution [0][1][2][4][5]. AI valuation tools can efficiently identify valuation anomalies and perform sensitivity analysis in the nuclear energy/SMR field, but their reliability is limited by non-linear regulatory paths and technical path uncertainty. It is recommended to adopt a “data-driven + expert correction” hybrid approach to improve the prediction robustness of high-volatility, long-cycle assets.

[0] Jinling API Data (OKLO Company Profile, Price and Financial Indicators)

[1] Forbes - Is Oklo A $14 Billion “Paper Reactor” Bubble? (Valuation Bubble, $3.5B Dilution, X-energy Comparison and Competition) https://www.forbes.com/sites/greatspeculations/2025/12/02/is-oklo-a-14-billion-paper-reactor-bubble/

[2] Yahoo Finance - Financial Analysis for OKLO (Financial Summary, Price and Valuation Indicators) https://finance.yahoo.com/quote/OKLO/

[3] Yahoo Finance - Oklo (OKLO): Assessing Valuation After a Year of Triple-Digit Gains (High Valuation Risk and Comparable Discussion) https://finance.yahoo.com/news/oklo-oklo-assessing-valuation-triple-171222099.html

[4] Markets.ft.com - Oklo Advances Licensing with Completion of NRC Readiness Assessment (NRC Licensing Progress) https://markets.ft.com/data/announce/detail?dockey=600-202507170837BIZWIRE_USPRX____20250717_BW644425-1

[5] Utility Dive - Oklo looks to Trump to hasten nuclear permitting (Regulatory Reform and Timeline Impact) https://www.utilitydive.com/news/oklo-trump-nuclear-permitting-reactor-regulatory/748357/

The chart above shows the stock price trend and trading volume of Oklo (OKLO) from August to December 2025. It marks the price peak ($174.14) on October 14 and the event point of submitting a $3.5 billion new stock issuance plan on October 30. Since the peak on October 14, the stock price has dropped by approximately 55.8% to $76.92 on December 28, corresponding to a market capitalization shrinkage of approximately $9.7 billion, accompanied by significant volume expansion and increased volatility.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.