Analysis of the Reference Value of Third-Party Valuation Signal Tools for Investment Decisions of Private Equity Firms like TPG

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on in-depth research on TPG Inc. (TPG) and characteristic analysis of third-party valuation tools such as InvestingPro, I will systematically evaluate the reference value of such tools for investment decisions of private equity firms from multiple dimensions.

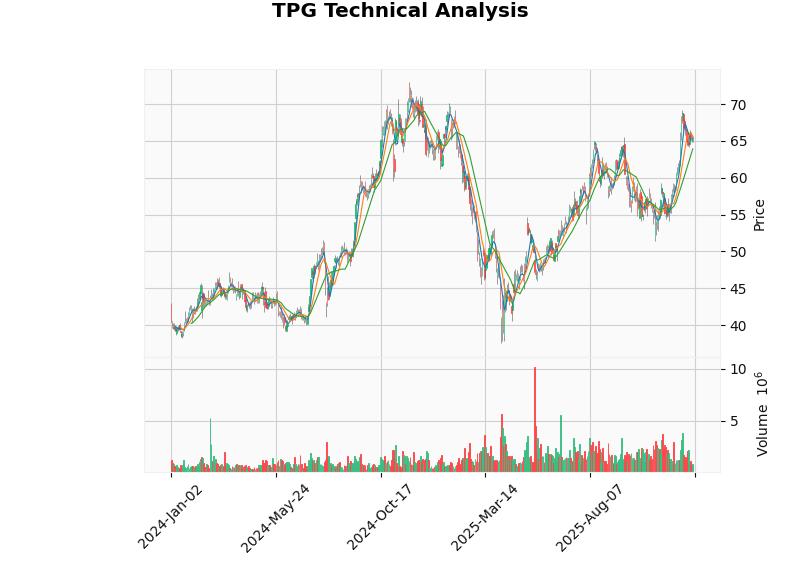

According to brokerage API data [0], TPG indeed showed strong stock price performance in 2024:

- Annual increase: From an opening price of 42.80 USD to a closing price of 62.84 USD in 2024, with an increase of46.82%

- Performance after April: From 45.28 USD on April 1, 2024 to 62.84 USD on December 31, with an increase of38.78%

- Current status(December 2025): Stock price 65.45 USD, market capitalization 25.09 billion USD

TPG’s core financial indicators show [0]:

| Financial Indicator | Value | Evaluation |

|---|---|---|

| Management Fee Income (2024) | 1.64 billion USD | Accounts for 78.5% of revenue |

| Assets Under Management (AUM) | 245.9 billion USD | Industry-leading |

| Net Profit Margin | 1.71% | Relatively low |

| ROE | 3.51% | Average capital efficiency |

| P/E Ratio (TTM) | 168.94x | Significantly overvalued |

According to web search data [1][2], tools like InvestingPro provide:

- Integrates 17 institutional-level valuation models(DCF, relative valuation, historical valuation center, etc.)

- Automatically calculates fair value range

- Provides overvalued/undervalued/reasonable judgments

- AI stock selection strategy covers over 60,000 stocks globally

- Real-time technical pattern recognition

- Financial health scoring

- Rapid Screening: As a listed asset management company, TPG has high financial data transparency, suitable for model-based analysis

- Multi-Dimensional Evaluation: Can evaluate valuation, technical aspects, and financial health simultaneously

- Sentiment Capture: Can identify market expectation gaps (e.g., undervaluation signal in April 2024)

- Insufficient Industry Specificity: Valuation logic of private equity firms differs significantly from traditional manufacturing

- Cyclical Blind Spot: Cannot fully capture the particularity of private equity investment cycles (e.g., J-curve effect)

- Lack of Liquidity Premium: Difficult to quantify the discount caused by poor liquidity in the private equity secondary market

According to academic research and industry practices [3][4], private equity firm valuation faces unique challenges:

- Management fee income (accounting for 78.5%) is relatively stable but has limited growth

- Incentive fee (accounting for 1.6%) is highly volatile and difficult to predict

- Performance realization has significant lag (usually 3-7 year cycle)

- High proportion of non-listed company assets in AUM, making fair value difficult to determine

- Valuation relies on internal models, with room for subjective judgment

- Liquidity discount standards vary (usually 20-40% according to research)

Valuation analysis of TPG using DCF model shows [0]:

| Scenario | Fair Value | vs Current Stock Price | Evaluation |

|---|---|---|---|

| Conservative Scenario | $24.71 | -62.2% | Severely Undervalued |

| Base Scenario | $15.09 | -76.9% | Extremely Undervalued |

| Optimistic Scenario | $21.42 | -67.3% | Severely Undervalued |

- All scenarios show TPG is “severely undervalued”, but the stock price continues to rise

- Reason for Model Failure: The real value drivers of private equity firms (e.g., brand value, deal-making ability, LP relationships) are difficult to quantify into the model

- WACC (14.4%) may not reflect the actual risk characteristics of private equity business

-

Expectation Gap Identification★★★★★

- InvestingPro’s “undervalued” signal in April 2024 successfully captured the market’s pessimistic expectation of the private equity industry

- When industry sentiment is extreme (e.g., private equity valuation trough in 2022), the quantitative signals of the tool have high reference value

-

Relative Comparison★★★★☆

- When comparing with peers like Blackstone (BX), KKR, Carlyle (CG), the tool can quickly locate relative valuation advantages

- Analyst consensus target price $72.50 vs current $65.45, showing 10.8% upside potential [0]

-

Risk Early Warning★★★★☆

- Technical indicators (MACD, KDJ) can prompt trend changes

- Currently, TPG is in a sideways震荡, trading range $63.91-$66.29, with no clear direction [0]

-

Absolute Valuation Judgment★★☆☆☆

- “Undervalued” signals from models like DCF may fail for years

- Current P/E 168.94x far exceeds the reasonable range of traditional valuation frameworks

-

Short-Term Trading Timing★★★☆☆

- Stock prices of private equity firms are more driven by macro liquidity and industry policies

- Technical indicators have obvious lag in rapidly changing markets

According to empirical research from web searches [1]:

- FRoSTA AG (Germany): 61.33% return after undervaluation signal

- AI concept stocks like NVDA and SMCI: Over 200% increase during AI stock selection strategy period

- “Reasonable valuation” signals for high-growth tech stocks often lag behind market revaluation

- Undervaluation signals for cyclical industries may last too long

- Accuracy Rate: About 60-70% (better effect in industries with clear fundamentals like consumer and industrial)

- Private Equity Industry: Accuracy rate may drop to 50-55% (due to special business model)

- Identify abnormal undervalued/overvalued signals

- Focus on deviation from analyst expectations

- Monitor technical trend changes

- Evaluate the quality and sustainability of AUM growth

- Analyze the probability of incentive fee realization (depends on exit market environment)

- Examine the historical performance and brand premium of the GP team

- Monitor LP relationships and fundraising capabilities

- IPO market activity (affects exits)

- M&A transaction volume and valuation multiples

- Interest rate environment (affects financing costs and discount rates)

- Regulatory policy changes

| Evaluation Dimension | Score | Explanation |

|---|---|---|

| Valuation Attractiveness | ★★☆☆☆ | P/E 168.94x, DCF model shows severe undervaluation but high model failure risk |

| Growth Potential | ★★★★☆ | AUM reaches 245.9 billion USD, raised 6 billion USD for Asian funds in 2024 |

| Profit Quality | ★★★☆☆ | Net profit margin 1.71%, ROE 3.51%, capital efficiency needs improvement |

| Technical Aspect | ★★☆☆☆ | Sideways震荡, no clear direction, support level at $63.91 |

| Analyst Sentiment | ★★★☆☆ | 7 buys, 8 holds, consensus target price $72.50 (+10.8%) |

- Short-term (3-6 months): High probability of sideways震荡, wait for catalysts (e.g., Q4 performance exceeding expectations)

- Medium-term (6-12 months): If exit market improves, incentive fee release may push stock price above $70

- Risk Points: Valuation repair has been partially completed, further上涨 requires performance兑现

The value of valuation signal tools like InvestingPro in the TPG case is more reflected in

- Industry fundamental improvement (interest rate cut expectations, exit market recovery)

- TPG’s own fundraising success and AUM growth

- Overall market risk appetite recovery

[0] Gilin API Data - TPG Inc. stock price, financial data, technical analysis, DCF valuation (data as of December 28, 2025)

[1] Investing.com - “Seize the Last Chance! InvestingPro Offers Up to 55% Discount to Unlock AI Stock Selection” (https://hk.investing.com/news/stock-market-news/article-1239271)

[2] Investing.com - “Best Christmas Gift? A Better Investment Portfolio” (https://hk.investing.com/news/stock-market-news/article-1247064)

[3] China Securities Association - “Research on Valuation Business Information Issues and Countermeasures for Private Securities Investment Fund Managers and Custodians” (https://www.csisc.cn/zbscbzw/c100485/202501/fd9edc24f7444c28e983c8db2b46dc6/files/c2ad4ad02d5840738de8900cd5a69bd1.pdf)

[4] Bain & Company - “Proactive Action to Break Through: 2025 Global Private Equity Market Mid-Year Report” (https://www.bain.cn/news_info.php?id=2033)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.