2026 Market Outlook: Tech Concentration Risk and AI-Driven Commodity Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

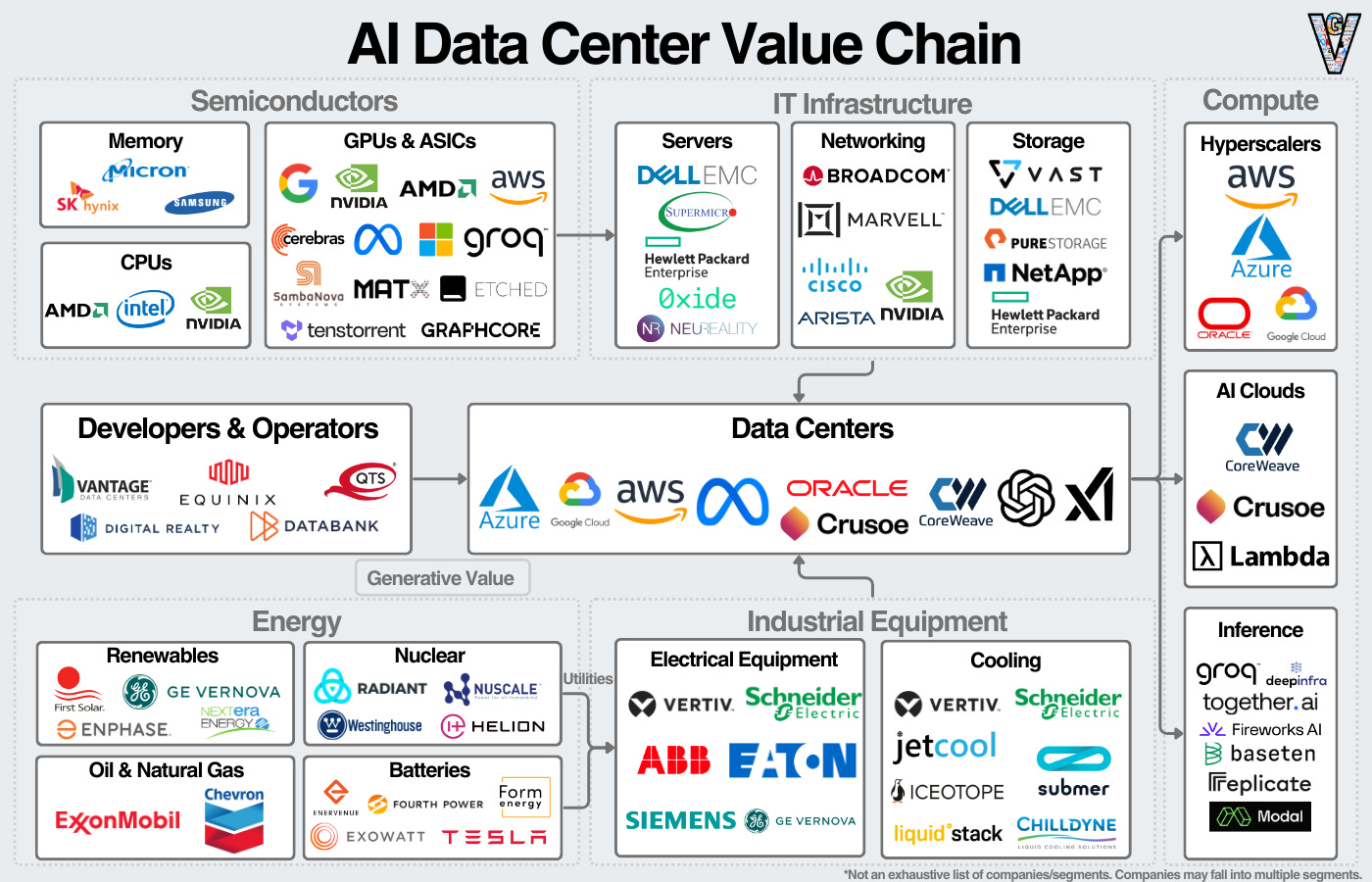

This analysis leverages both the Seeking Alpha 2026 market outlook [1] and internal market data [0]. Generative AI has been a dominant catalyst for 2025 tech stock gains, with leading names like NVDA, AAPL, and MSFT posting double-digit year-to-date (YTD) returns [0]. However, this growth has concentrated 34.4% of the S&P 500 in the “Magnificent Seven” tech stocks, creating systemic index concentration risk [0]. Concurrently, AI data center electricity demand is driving a bullish outlook for uranium, copper, and natural gas—commodities critical to powering and building these facilities. Commodity producers have responded with strong YTD performance, including CCJ (uranium, +77.99%) and FCX (copper, +40.02%) [0]. A valuation comparison reveals a disconnect: while some tech stocks carry elevated P/E ratios (NVDA 46.72x, AAPL 36.49x) [0], commodity producers exhibit more attractive cash flow metrics via lower EV/OCF ratios (FCX 12.74x, CHK 7.61x) relative to tech’s higher EV/OCF (NVDA 55.77x, AAPL 36.94x) [0].

- S&P 500 concentration risk is systemic: The 34.4% weight of the Magnificent Seven means a downturn in tech could disproportionately impact the broader index, amplifying market volatility [0].

- AI’s cross-sector spillover effect: The often-overlooked energy demand from AI data centers creates a direct link between tech growth and commodity markets—an underappreciated trend for 2026 [1].

- Valuation efficiency in commodities: Despite some elevated P/E ratios (e.g., CCJ 104.01x), commodities’ lower EV/OCF ratios signal better cash flow efficiency compared to high-flying tech stocks [0].

- Tech sector: High P/E ratios may be vulnerable if earnings growth slows; regulatory scrutiny could impact valuations [0].

- S&P 500: Concentration risk could amplify downside volatility if tech underperforms [0].

- Commodities: Price volatility due to supply/demand dynamics and geopolitical risks; environmental regulatory pressure on producers [0].

- Commodity demand: Uranium, copper, and natural gas stand to benefit from AI data center energy needs [1].

- Valuation plays: Commodity producers’ attractive cash flow metrics offer alternative opportunities to tech [0].

- Generative AI drove 2025 tech stock gains but concentrated the S&P 500 [0][1].

- AI data center electricity demand is a bullish catalyst for uranium, copper, and natural gas [1].

- Commodities exhibit more favorable cash flow valuations compared to high-valuation tech stocks [0].

- Risks include tech valuation vulnerability, S&P 500 concentration, and commodity price volatility [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.