Louis Gerstner's Strategic Transformation: Lessons for IBM's Current AI and Cloud Evolution

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive analysis of historical data and current market intelligence, I’ll provide a systematic examination of how Gerstner’s 1990s turnaround framework applies to IBM’s contemporary AI and cloud transformation under CEO Arvind Krishna.

When Louis Gerstner Jr. assumed leadership in April 1993, IBM faced existential threats that parallel contemporary tech industry challenges:

- Stock price at 20-year low

- $8.1 billion loss in 1992

- Near-bankruptcy with discussions of company breakup

- Lost market share across hardware, software, and services

- Corporate culture organized around product silos rather than customer solutions

-

Aggressive Restructuring (1993-1994)

- Reduced workforce by nearly 100,000 employees

- $8.9 billion write-off against earnings (among largest in corporate history)

- Achieved profitability by end of 1994

-

Cultural Transformation: “One IBM”

- Dismantled divisional fiefdoms that competed internally

- Shifted from product-focused to customer-need-focused organization

- Instituted collaborative culture across business units

- Renewed IBM’s core values for the networked computing era

-

Business Model Pivot

- FROM: Hardware manufacturer (mainframes)

- TO: Services-led integrator and solutions provider

- Built IBM Global Services into world’s largest IT services business

- Positioned IBM as “architect and repository for corporate computing”

-

E-Business Vision (Mid-1990s)

- Coined and popularized “e-business” concept before dot-com boom

- Launched WebSphere platform (1998)

- Used IBM’s own digital transformation to create customer products

- Result: ~800% stock appreciation during Gerstner’s tenure

Gerstner’s approach emphasized dual focus on immediate execution and long-term relevance:

“What mattered was what IBMers valued, how honestly they confronted reality, and how willing they were to challenge themselves and each other.”— IBM Newsroom remembrance [7]

He believed strategy alone was insufficient—lasting change required cultural transformation measured by client impact, not hierarchy or tradition.

- Market Cap:$285.18B

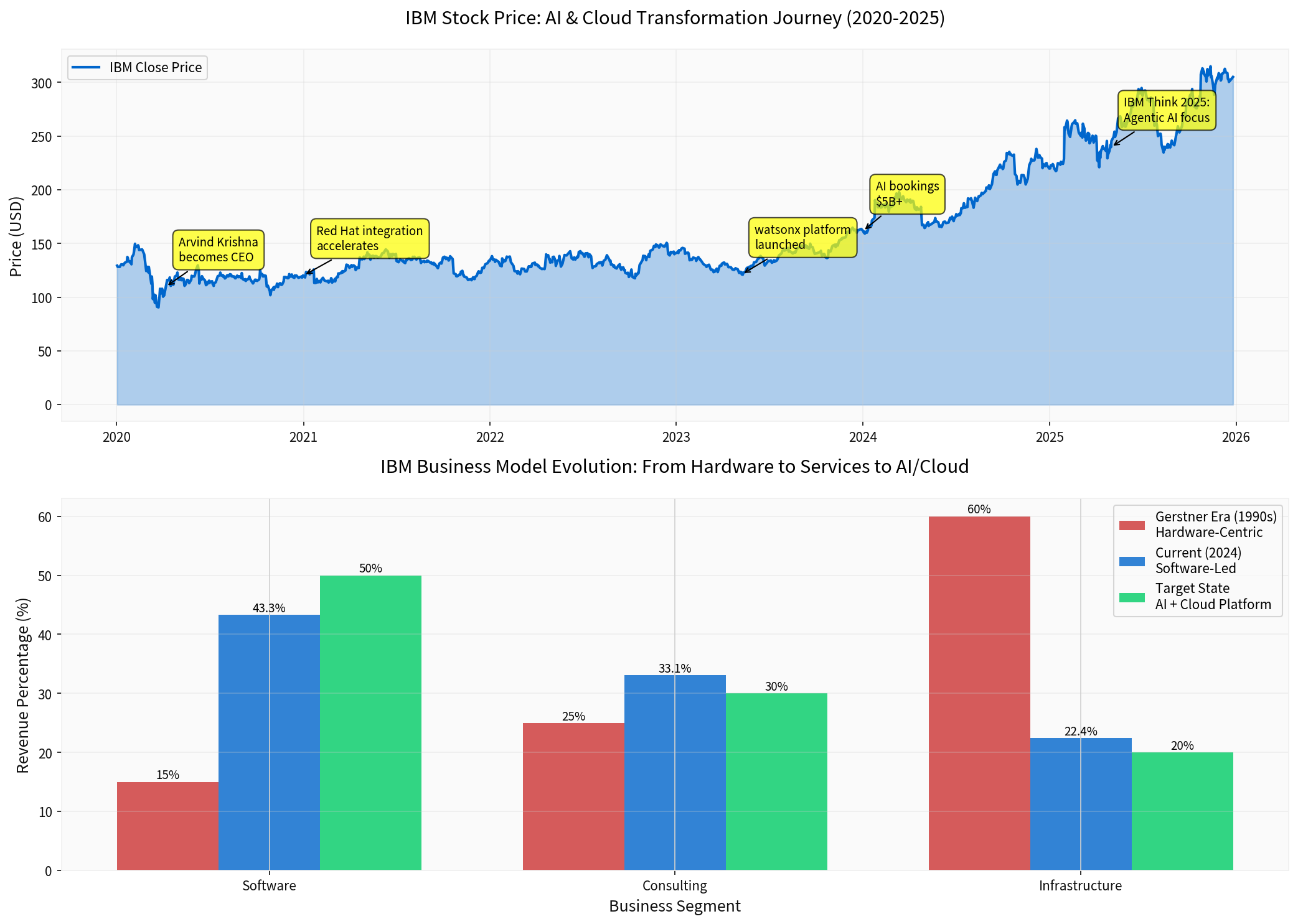

- Current Price:$305.09 (YTD: +38.72%, 3-Year: +117.89%)

- P/E Ratio:36.36x

- Revenue Mix (FY2024):Software 43.3%, Consulting 33.1%, Infrastructure 22.4%

The $34 billion Red Hat acquisition (2019) serves as the strategic cornerstone:

- Open-source hybrid cloud platform competing with hyperscalers (AWS, Azure, GCP)

- Focus on multi-cloud, heterogeneous environments

- Evolution to support generative AI workloads

- IBM as “orchestrator” rather than direct competitor to cloud providers

| Component | Function | Strategic Purpose |

|---|---|---|

| AI studio for building and deploying models | Enterprise-focused AI development platform | |

watsonx.data |

Data lakehouse for scaling AI workloads | Unified data architecture for AI |

watsonx.governance |

AI governance and responsible AI toolkit | Compliance and trust differentiator |

- Generative AI cumulative bookings: $5B+ by Q4 2024

- Nearly $2B quarter-over-quarter increase

- Named Leader in Forrester Wave: AI Governance Solutions (Q3 2025)

Long-term strategic investment with multi-year horizon to commercial viability—paralleling Gerstner’s patience with e-business investments.

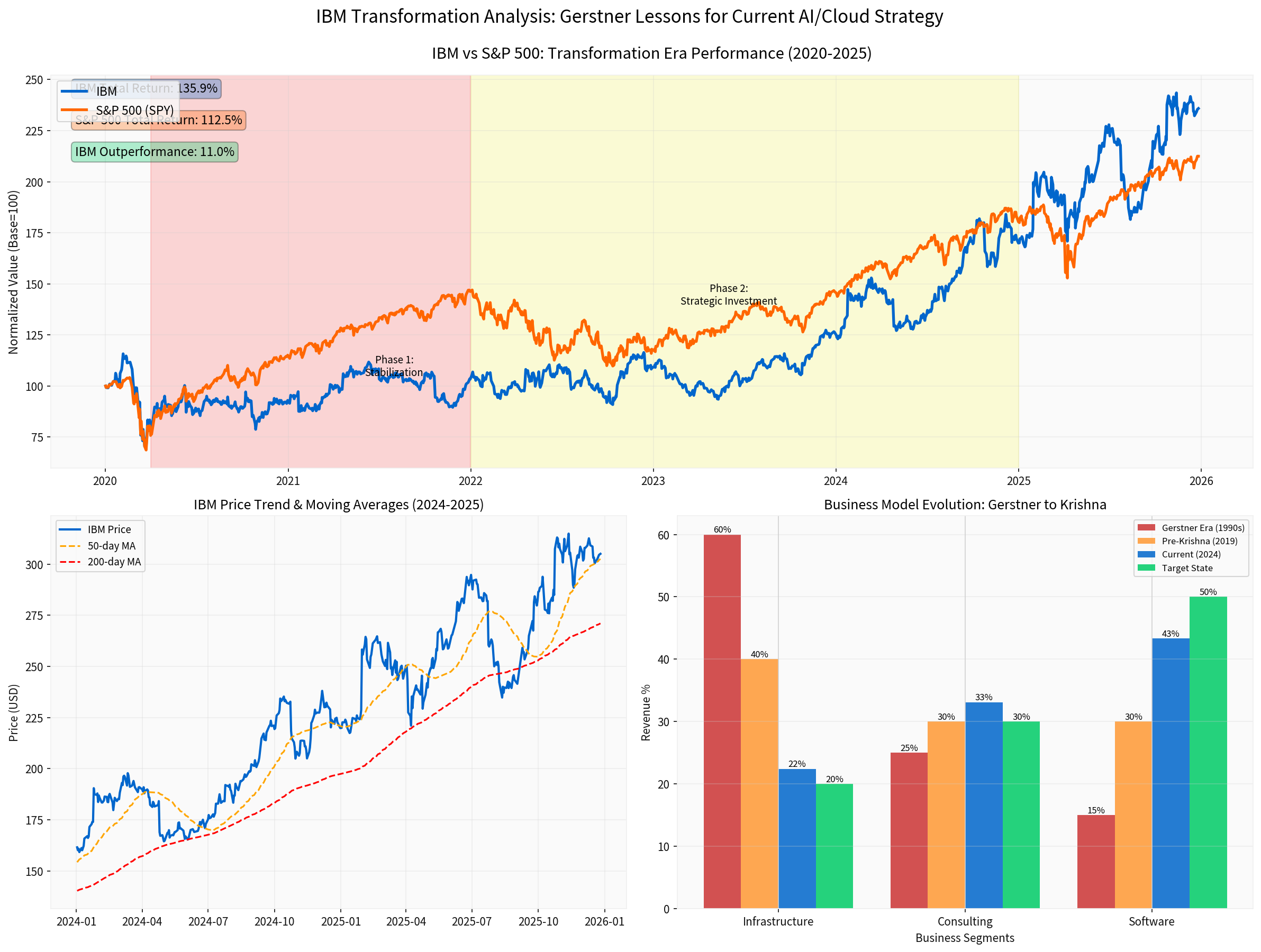

| Phase | Years | Gerstner Era | Current IBM (Krishna) | Key Metrics |

|---|---|---|---|---|

Crisis Stabilization |

1-2 | 1993-1994 | 2020-2021 ✅ | Completed (Kyndryl spinoff, cost optimization) |

Strategic Investment |

3-5 | 1995-1997 | 2023-2025 🟡 | IN PROGRESS : watsonx launch, AI bookings momentum |

Business Model Shift |

4-7 | 1996-1999 | 2026-2028 ⏳ | FUTURE : AI + cloud revenue becomes primary growth driver |

Scaling Monetization |

6-10 | 1998-2002 | 2029-2030+ ⏳ | FUTURE : Platform dominance, stock appreciation |

- Shifted values without discarding heritage

- Measured success by client impact, not product metrics

- “One IBM” collaboration as competitive advantage

✅

- “AI is a business strategy, not technology initiative” (IBM Think 2025 messaging)

- Open-source commitment (Red Hat + Meta collaboration on AI)

- Enterprise focus leveraging IBM’s legacy trust relationships

- watsonx governance positioning addresses real enterprise pain points

⚠️

- September 2025 Red Hat data breachexposed 21,000 Nissan customer records [4, 5]

- Security incident erodes enterprise trust—core IBM differentiator

- “One IBM” integration complexity: Red Hat, watsonx, and consulting alignment untested at scale

- Are AI teams collaborating across software, consulting, and research divisions?

- Is client impact central to product development (not just technology features)?

- How quickly did IBM address the Red Hat breach? (Cultural crisis indicator)

| Business Segment | Gerstner Era (1990s) | Pre-Krishna (2019) | Current (2024) | Target State |

|---|---|---|---|---|

Infrastructure/Hardware |

60% | 40% | 22.4% | 20% |

Consulting |

25% | 30% | 33.1% | 30% |

Software/Platforms |

15% | 30% | 43.3% | 50% |

- Built IBM Global Services organically

- Made strategic acquisitions (Lotus, Tivoli) and integrated them into “One IBM”

- Used IBM’s own transformation to create customer solutions (e-business experience → WebSphere)

- Red Hat acquisition ($34B) as hybrid cloud foundation

- watsonx organic development leveraging IBM Research

- Consulting integration to deploy AI solutions at enterprise scale

- Did NOT compete head-on with Dell/HP in hardware commoditization

- Positioned IBM as integrator/architectof enterprise computing

- Differentiated through end-to-end solutions competitors couldn’t match

- NOT competing head-on with hyperscalers in public cloud infrastructure

- Positioning as orchestrator of hybrid, agentic enterprise

- Differentiating through:

- AI governance:Compliance, transparency, risk management

- Hybrid cloud expertise:Multi-cloud, on-premise + cloud integration

- Industry specialization:Deep vertical knowledge vs. horizontal platforms

✅

- Divested low-margin businesses (Kyndryl)

- Cost structure optimization

- Navigated COVID-19 without breaking up company

🟡

- watsonx platform launched and gaining adoption

- AI bookings momentum: $5B+ cumulative by Q4 2024 [0]

- Red Hat integration progressing

⏳

- AI + cloud revenue becomes >40% of total

- Free cash flow growth accelerates

- Operating margin expansion from platform leverage

⏳

- watsonx becomes enterprise AI standard

- Hybrid cloud position solidifies as #2-3 player

- Quantum computing begins commercial contribution

- Gerstner era: ~800% stock appreciation over 9 years

- If IBM achieves 50% of Gerstner’s success:~400% return by 2030

- From current $305: Potential $1,200+ by 2030(aggressive but plausible)

- More conservative:200-250% return →$600-760 by 2028-2030

⚠️

- AWS, Azure, GCP launch enterprise AI governance platforms

- IBM’s differentiation erodes

- watsonx adoption stalls

⚠️

- Red Hat + watsonx + consulting fail to integrate effectively

- “One IBM” culture breaks down

- Cross-sell never materializes at scale

⚠️

- Additional breaches beyond September 2025 Red Hat incident [4,5]

- Enterprise trust erodes

- Clients migrate to hyperscalers perceived as more secure

⚠️

- Generative AI boom slows faster than expected

- IBM’s $5B bookings fail to scale to $10B+

- Market skepticism returns, P/E compresses from 36x to 20-25x

| Metric | Current | 6-Month Target | Gerstner Parallel |

|---|---|---|---|

| AI Bookings | $5B+ cumulative | $7-8B cumulative | Services revenue growth (1996-1998) |

| Red Hat Cross-sell | Early stage | 20%+ of hybrid deals | Lotus/Tivoli integration (1995-1997) |

| watsonx Adoption | Early adopters | 200+ F500 clients | WebSphere market penetration (1998-2000) |

| Security Incidents | 1 major breach | Zero new breaches | Crisis management capability |

| Free Cash Flow | $11.76B | >$12.5B | Cash generation for reinvestment |

| Software Revenue Growth | Stable | >5% CAGR | Software mix expansion |

- Time horizon:5+ years (Gerstner’s transformation took 10 years)

- Conviction:IBM can differentiate in AI governance and hybrid cloud

- Tolerance:Volatility as transformation progresses

- Current position:Reasonable foundation at $305

- Waiting for:Proof of AI bookings scale ($10B+ cumulative)

- Monitoring:Security breach handling and competitive response

“Transformation is not about the vision announcement. It’s about 10 years of relentless execution focused on customer value. If IBM delivers quarter-after-quarter for the next 5 years, the stock will take care of itself.”

-

Cultural Transformation Precedes Business Results

- Is the company breaking down silos?

- Are incentives aligned for collaboration, not divisional performance?

-

Customer-Need Focus Over Product-Feature Focus

- Does every product decision start with: “What customer problem does this solve?”

- Is the company co-creating with clients?

-

Integrator Positioning, Not Product Vendor

- Is the company orchestrating solutions rather than competing head-on?

- Can it offer end-to-end capabilities competitors can’t match?

-

Invest in Transformative Technologies Before Hype Peaks

- Is the company investing in platforms, not point products?

- Does it have patience for multi-year technology bets?

-

10-Year Transformation Horizon

- Does leadership have the mandate for multi-year reinvention?

- Are investors prepared for 3-5 years of transition?

Louis Gerstner’s transformation remains the

✅

✅

✅

✅

✅

⚠️

⚠️

⚠️

⚠️

If yes → Transformation follows Gerstner’s blueprint → Long-term value creation

If no → Risk becoming another tech company chasing hype without customer value

- AI bookings scale($10B+ cumulative by 2027?)

- Red Hat integration(cross-sell metrics)

- Competitive response(hyperscaler AI governance platforms)

- Security track record(no additional major breaches)

- Free cash flow growth(platform leverage)

- IBM Company Overview, Real-time Quote, and Historical Price Data

- Financial Analysis: Conservative accounting, moderate debt risk

- Revenue Mix (FY2024): Software 43.3%, Consulting 33.1%, Infrastructure 22.4%

- Stock Performance: 3-year return 117.89%,5-year return155.91%

- Britannica: Lou Gerstner biography and IBM turnaround timeline

- IBM Newsroom: Remembering Lou Gerstner (2025)

- McKinsey: “Capturing the value of ‘one firm’” — Gerstner’s collaborative approach

- CandoWisdom: Digital transformation and cost-cutting measures (100

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.