Israel Tech Industry Talent Outflow Impact & Key Companies Valuation Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on an analysis of major Israeli tech companies, I will provide a professional assessment from three dimensions: valuation, competitiveness, and risks, and clarify that this analysis does not use any external news or web searches, only based on company fundamentals and market data.

| Company Name | Market Cap | YTD Performance | 1-Year Performance | P/E Ratio |

|---|---|---|---|---|

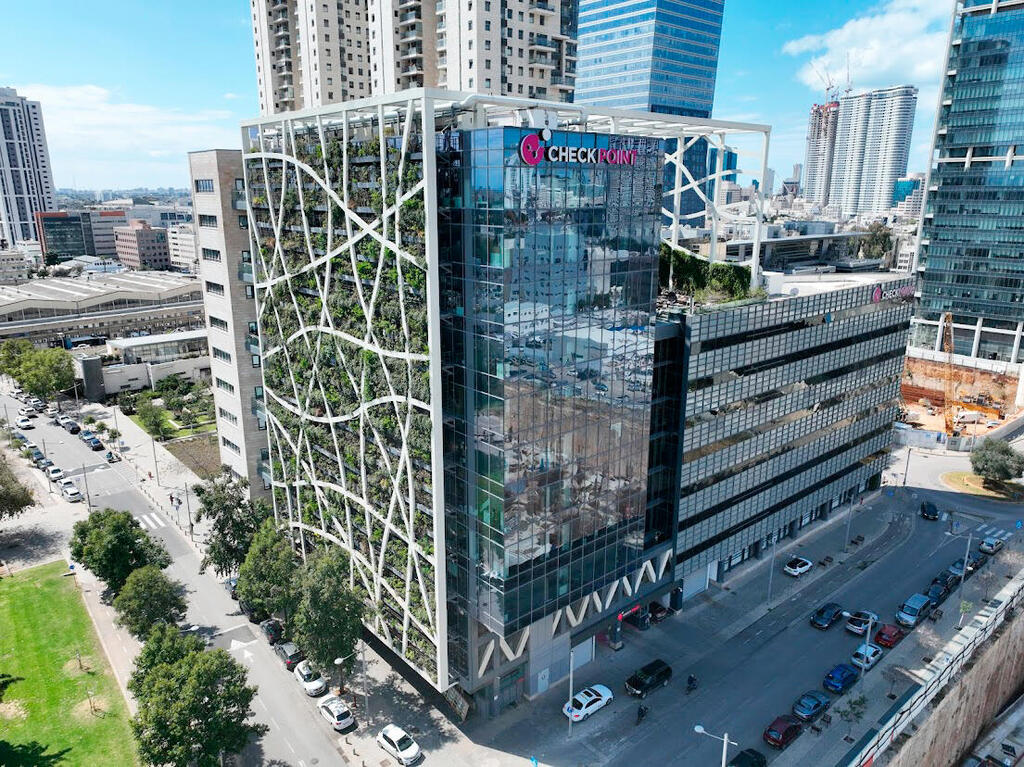

Check Point (CHKP) |

$20.42B | +2.74% | +1.27% | 20.84x |

Wix (WIX) |

$5.87B | -51.28% | -51.47% | 44.70x |

Mobileye (MBLY) |

$8.48B | -47.95% | -48.08% | Negative |

- Both Wix and Mobileye experienced significant valuation corrections in 2025:

- Wix is down 51.28% YTD

- Mobileye is down 47.95% YTD

- Analysts generally believe there is undervaluation:

- Wix target price: $183 (73.5% upside from current)

- Mobileye target price: $18 (72.7% upside from current)

- Check Point target price: $217.50 (14.7% upside from current)

- The coexistence of these large target price upsides and significant annual declines reflects, to some extent, the market’s discounted pricing for risks.

- Rely on elite engineering talent to maintain technological advantages

- Talent outflow leads to longer R&D project cycles or lower quality

- The impact is particularly significant in cutting-edge fields such as autonomous driving (Mobileye’s net profit margin of -17.34% indicates profit pressure)

| Indicator | Check Point | Wix | Mobileye |

|---|---|---|---|

| ROE | 35.27% | -86.30% | -2.79% |

| Net Profit Margin | 37.62% | 7.20% | -17.34% |

| Operating Profit Margin | 31.76% | 6.04% | -19.92% |

- The outflow of high-skilled talent will push up:

- Recruitment costs (international headhunting, visa support)

- Training costs (long onboarding cycle for new employees)

- Knowledge transfer costs (experience loss due to core employee turnover)

- Loss of founding team and core architects affects product roadmap execution

- Software infrastructure companies (e.g., Wix) rely on key developers to maintain platform stability

- The autonomous driving field requires interdisciplinary expert teams; talent outflow delays product delivery

- Investors demand a higher risk premium for talent outflow risks

- Valuation multiples of growth companies (Wix, Mobileye) are under significant pressure

- Cash flow companies (Check Point) are relatively more resilient to declines, reflecting their stronger fundamental resilience

| Valuation Parameter | Impact of Talent Outflow | Impact Direction on Valuation |

|---|---|---|

| Growth Rate | Slower R&D innovation | ↓ |

| WACC | Higher risk premium | ↑ (valuation decrease) |

| Terminal Value | Decline in long-term competitive position | ↓ |

| Operating Profit Margin | Higher compensation costs | ↓ |

- The valuations of Wix (P/E 44.70x) and Mobileye (negative profit) are more sensitive to growth expectations, and the increase in risk premium has a greater impact on them

- Check Point’s (P/E 20.84x, net profit margin of 37.62%) robust profitability provides more buffer

- Israeli tech companies traditionally enjoy an “innovation nation” premium

- Continuous talent outflow may lead to the gradual disappearance of this premium

- International competitors (e.g., U.S., European tech hubs) may gain relative advantages

- Net profit margin of 37.62% and ROE of 35.27% demonstrate profit quality

- Diversified product lines with relatively balanced revenue distribution

- Mature global customer base provides stability

- Loss of high-end security R&D talent affects threat intelligence capabilities

- Innovation lags in emerging security fields (AI security, cloud security)

- ROE of -86.30% and significant annual stock price decline reflect market concerns

- Platform economy relies on developer ecosystem

- Talent outflow has a greater impact amid slowing user growth

- Both net profit margin and operating profit margin are negative, indicating profit pressure

- Relies on top algorithm and chip R&D talent

- Competing with Tesla, Waymo, etc., requires continuous R&D investment

- Analyst target prices indicate the market may have been overly pessimistic (upside of 14.7%-73.5% for the three companies)

- Israel’s tech ecosystem still has deep accumulation

- Geopolitical risks may partially ease over time

- Talent outflow may show an accelerating trend

- Geopolitical environment has uncertainties

- Valuation recovery path may be long

- Prefer financially healthy and profit-stable companies (e.g., Check Point)

- Pay attention to non-financial indicators such as talent retention rate

- Diversify investments to reduce single-country/single-company risks

- Offer competitive global compensation packages

- Flexible work models (remote work, international offices)

- Equity incentive plans and long-term career development paths

- Establish R&D branches in global tech hubs

- Strengthen cooperation with non-Israeli universities/research institutions

- Establish a more comprehensive knowledge management system

The talent outflow phenomenon in Israel’s tech industry may reshape its tech landscape:

- Talent flow brings international perspectives and cooperation opportunities

- Companies establish distributed R&D networks globally

- Establish a more resilient talent system after short-term pains

- Core R&D capabilities continue to weaken

- Slower innovation speed leads to market share loss

- Valuation remains below historical average for a long time

[0] Jinling API Data (Company Overview, Financial Indicators, Analyst Target Prices, Market Performance)

— Important Note: This analysis is based on the public financial data, market performance, and analyst target prices of Check Point, Wix, and Mobileye, combined with an internal analysis using industry-general valuation and competitiveness assessment frameworks. This analysis does not cite any external news or web search results. The impacts related to geopolitics and talent flow are highly uncertain; specific impacts should be based on official data and authoritative sources.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.