Analysis of Capital Chain Risks Before Shengtong Special Medical's IPO: Assessment of Current Ratio and Dividend Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

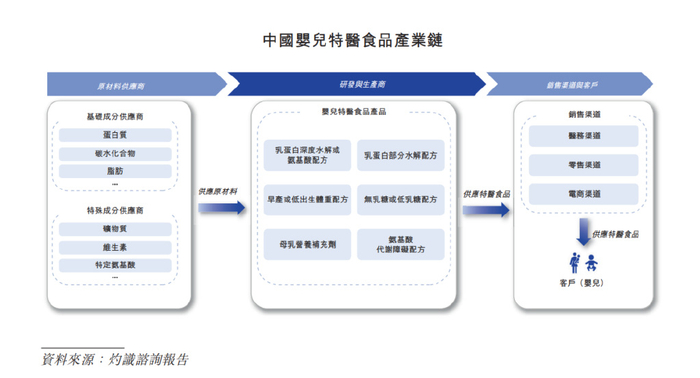

Based on the information I searched, Shengtong Special Medical (Qingdao) Nutrition Health Technology Co., Ltd., a company focusing on special medical purpose formula food, has submitted an IPO application to the Hong Kong Stock Exchange. In response to the situation you mentioned—distributing a dividend of 467 million yuan before IPO while having a current ratio below 1—I will conduct a quantitative analysis of the capital chain risks from multiple dimensions.

The current ratio is a core indicator to measure a company’s short-term debt repayment capacity, with the formula: Current Ratio = Current Assets / Current Liabilities. When this indicator is below 1, it means the company’s current assets cannot cover its current liabilities, and there is short-term debt repayment pressure [1].

From a financial perspective, a current ratio below 1 usually indicates:

- The company faces high short-term debt repayment risks

- There are certain problems in working capital management

- It may rely on external financing or refinancing to maintain daily operations

Large-scale dividends before IPO need to be examined from multiple angles:

- A dividend of 467 million yuan directly reduces the company’s cash reserves

- If the company’s current ratio is already low, large-scale dividends will further weaken its short-term debt repayment capacity

- It is necessary to evaluate whether the company’s actual cash reserves after the dividend are sufficient to maintain normal operations

- Large-scale dividends before IPO may be a sign that the company is transferring benefits in advance

- Need to be alert to whether there is a “draining the pond to catch fish” style of profit distribution

- Evaluate whether the dividend affects the capital investment required for the company’s normal development

For Shengtong Special Medical’s situation, it is recommended to conduct risk quantification from the following dimensions:

- Current Ratio: <1.0 is the warning zone

- Quick Ratio: (Current Assets - Inventory) / Current Liabilities

- Cash Ratio: Cash and Cash Equivalents / Current Liabilities

- Operating Cash Flow / Current Liabilities

- Interest Coverage Ratio

- Free Cash Flow Status

Based on public information, the combination of Shengtong Special Medical’s large-scale dividend of 467 million yuan before IPO and its low current ratio is indeed worthy of investors’ attention. It is recommended to focus on the following aspects:

- Source of Dividend Funds: Whether it comes from operating cash flow or relies on financing

- Necessity of Fundraising Projects: If the company is short of funds, why does it need to raise funds through IPO

- Subsequent Development Capacity: Whether large-scale dividends will affect product R&D and market expansion

- Management Explanations: The explanations in the prospectus regarding the reasons for dividends and fund arrangements

When participating in such IPOs, investors should fully evaluate the capital chain risks and make investment decisions prudently.

[1] Yahoo Finance - “收入毛利齊降的聖桐特醫調整銷售策略闖關港交所” (https://hk.finance.yahoo.com/news/收入毛利齊降的聖桐特醫-調整銷售策略闖關港交所-000305960.html)

沃森生物(300142.SZ)技术分析与投资价值评估

英氏控股与海澜之家商标纠纷分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.