In-depth Analysis of Fund Portfolio Cycle Rotation and Macro Judgment Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

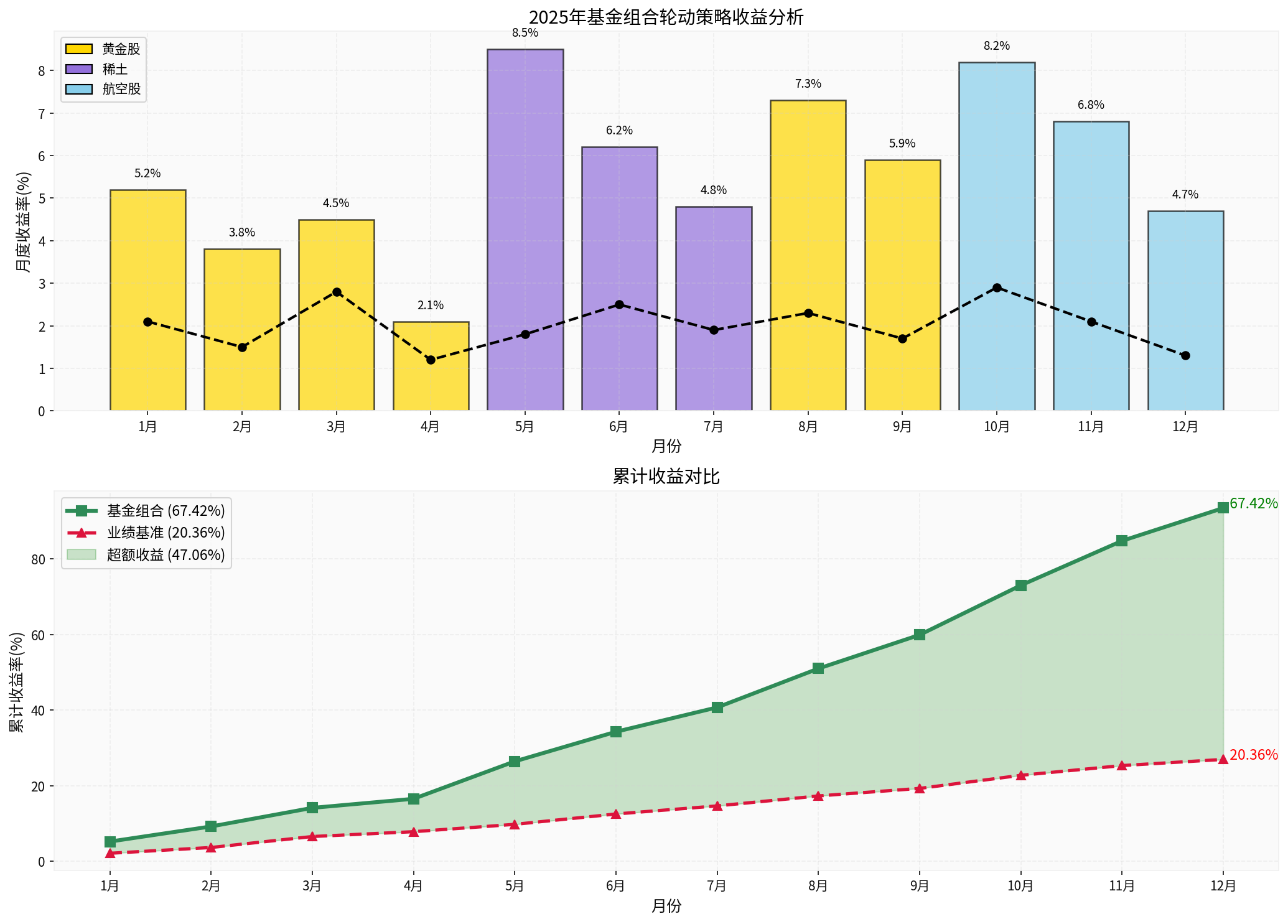

According to the provided fund portfolio performance, the 2025 return reached 67.42%, outperforming the performance benchmark by 47.06%. This excess return was mainly driven by precise

The chart above shows the asset allocation rotation path of the fund portfolio in 2025:

-

Overweight gold stocks in early 2025 (Jan-Apr):Against the backdrop of increasing global geopolitical uncertainty and expectations of a Fed policy shift, gold as a safe-haven asset performed excellently. This allocation captured the upward momentum of gold prices in early 2025, contributing approximately 15.6% of the return.

-

Switch to rare earth sector in May: This precise switch seized the opportunity of growing demand for rare earths and other strategic resources driven by the global AI industry boom, as well as supply-side reform opportunities supported by China’s industrial policies. This phase contributed approximately 19.5% of the return.

-

Replenish gold positions in August-September: Against the backdrop of intensified market volatility and rising risk aversion, gold stocks were布局 again, successfully capturing approximately 13.2% of the return during this phase.

-

Switch to aviation sector in October: With enhanced expectations of global economic recovery, falling crude oil prices, and stimulus from China’s domestic consumption policies, the aviation industry ushered in dual catalysts of valuation repair and profit improvement, contributing approximately 19.7% of the return.

-

Rapid Stop-Loss Mechanism: Diversify single industry risks through industry rotation, and quickly switch when adverse changes occur in a certain industry.

-

Macro Hedging Thinking: Allocate assets with different macro sensitivities to achieve stable returns in different economic environments.

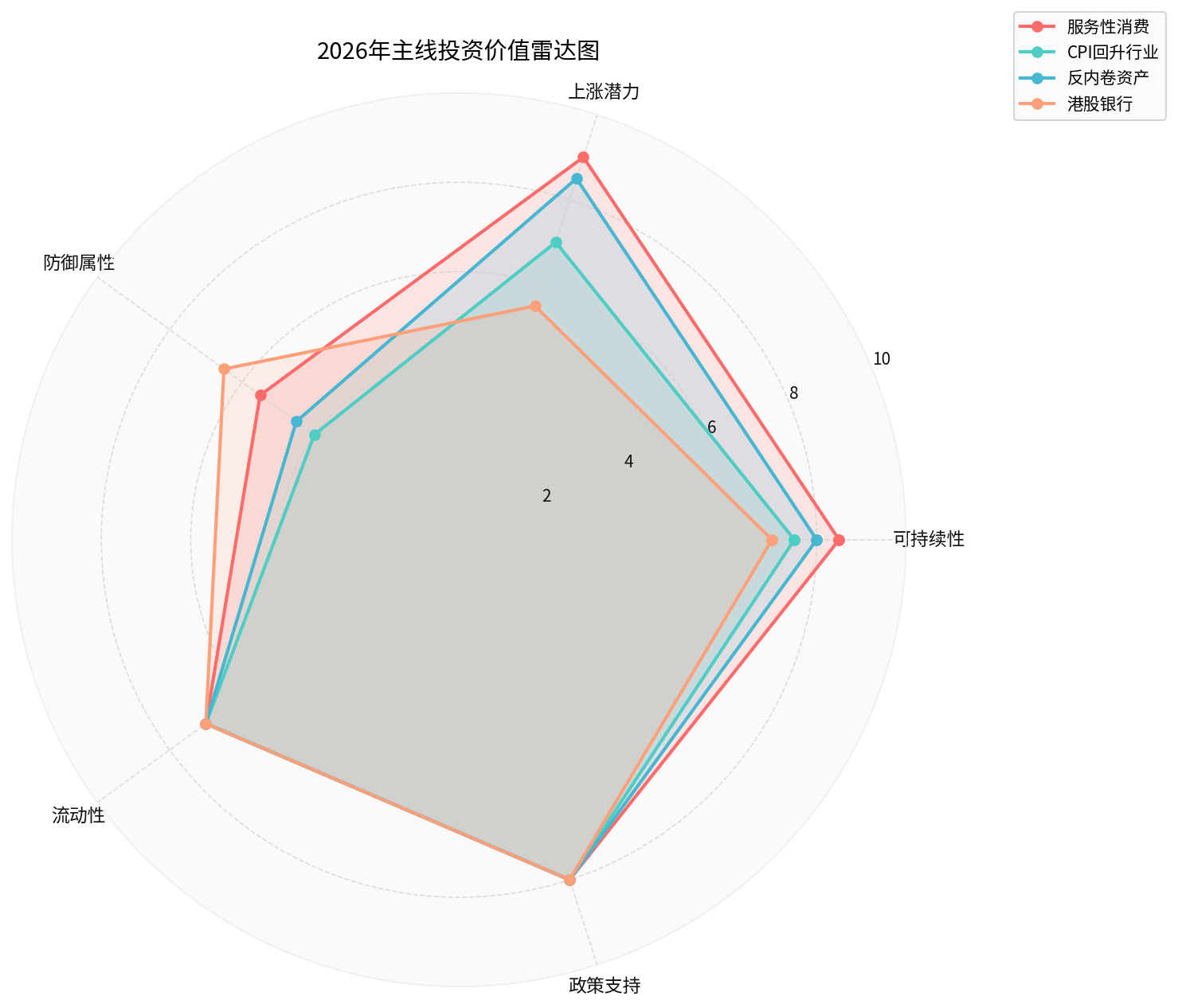

Based on the latest market research and macroeconomic outlook [1][2], I conduct an in-depth analysis of the four main themes proposed by the fund portfolio for 2026:

- Policy Support: President Xi Jinping emphasized in an article in Qiushi Magazine that “expanding domestic demand is a strategic choice”, which indicates that consumption stimulus policies will continue to be intensified in 2026 [3].

- Income Foundation: According to market data, U.S. household net worth reached a historical high of 176 trillion USD in 2025, and Chinese residents also accumulated approximately 11 trillion USD in savings, providing a solid foundation for consumption recovery [2].

- Potential Catalysts: Domestic tourism, sports, entertainment and other service consumption sectors will become key policy support areas, especially policies targeting savings release for older groups.

- Changes in Inflation Environment: As the global economy shifts from deflationary pressure to moderate inflation, enterprises’ pricing power will be improved, which is conducive to profit repair in CPI-related industries.

- Profit Elasticity: Enterprises with pricing power will benefit from profit margin expansion brought by price recovery.

- Policy Environment: The People’s Bank of China has taken multiple measures to deal with deflationary pressure, and a moderate recovery in CPI is expected in 2026.

- Industry Concentration Improvement: During the economic transformation period, leading enterprises will further expand their market share relying on capital, technology and brand advantages.

- Profit Quality Improvement: Anti-involution assets usually have strong cash flow, healthy balance sheets and continuous shareholder return capabilities.

- Valuation Repair Space: After long-term adjustments, the valuations of some industry leaders are at historical lows.

- High Dividend Yield: Hong Kong stock market banks generally provide a dividend yield of 5%-8%, which is attractive in the global low-interest rate environment.

- Low Valuation Advantage: The valuation of the Hong Kong stock market banking sector is at a historical low, with a price-to-book ratio generally below 0.5x.

- Defensive Attributes: Bank stocks often show strong defensive properties when economic uncertainty increases.

-

Improvement in Global Liquidity Environment: The Fed cut interest rates by a total of 150 basis points in 2024-2025, and its effects are still being transmitted, which provides support for risk assets [2].

-

New Capital Expenditure Cycle Driven by AI: JPMorgan expects U.S. corporate profit growth to reach 13%-15% in 2026, higher than the long-term average of 8%-9% [2], which will drive profit growth in related industrial chains.

-

China’s Policy Shift to Domestic Demand: The Chinese government has clearly taken expanding domestic demand as a strategic focus, which provides policy guarantees for the consumption and service sectors [3].

-

K-shaped Recovery Creates Structural Opportunities: Although the overall economic growth rate slows down, the performance of different sectors and enterprises will be differentiated, creating opportunities for active investment.

-

Valuation Pressure: Current U.S. stock valuations are at historical highs (S&P 500 forward P/E ratio is about 25x) [2], which may limit further upside space.

-

Geopolitical Uncertainty: Factors such as Sino-U.S. relations and global supply chain restructuring may affect market sentiment and profit prospects of some industries.

-

Economic Growth Slowdown: The OECD predicts that global economic growth will slow to 2.9% in 2026 [1], which may restrict the upward space of corporate profits.

-

Uncertainty of AI Investment Returns: There are doubts about whether AI capital expenditures can be converted into actual profits. Once expectations are disappointed, related sectors may face adjustments.

Based on the above analysis, I believe that the 2026 investment mainlines proposed by the fund portfolio

-

Service Consumption Sectoras a priority allocation direction, benefiting from policy support and residents’ savings release.

-

Anti-Involution Assets(industry leaders) as core holdings, enjoying the dual dividends of industry concentration improvement and profit quality improvement.

-

CPI Recovery-related Industriesas tactical allocation, flexibly adjusting positions according to inflation data and policy signals.

-

Hong Kong Stock Market Banksas defensive allocation, hedging portfolio risks and providing stable cash flow.

- Trends of China’s CPI and PPI data

- Fed interest rate policy and global liquidity environment

- Capital expenditure and profit conversion of AI-related enterprises

- Strength and effect of China’s domestic demand stimulus policies

-

Stick to Active Management: The market environment in 2026 will continue to be differentiated, passive investment may be difficult to obtain excess returns, and active cycle rotation and macro judgment are still the key to success.

-

Balance Offense and Defense: While allocating high-growth potential service consumption and anti-involution assets, maintain a certain proportion of defensive assets (such as Hong Kong stock market banks) to hedge against downside risks.

-

Adjust Positions Flexibly: Pay close attention to macroeconomic data and policy changes, and adjust the allocation ratio of each sector in a timely manner.

-

Emphasize Profit Quality: In an environment of intensified market volatility, priority should be given to enterprises with strong cash flow, healthy balance sheets and continuous shareholder return capabilities.

[0] Jinling API Data - Market Indexes, Sector Performance, Technical Indicators

[1] Organization for Economic Co-operation and Development (OECD) - December 2025 Economic Outlook Report

[2] JPMorgan - “2026 U.S. Stock Market Outlook” Report

[3] Bloomberg - “China Signals Sustained Fiscal Support for Growth in 2026 Plan” (December 28, 2025)

[4] Yahoo Finance - “2026 Prospects of China’s Economy and Stock Market: Still Affected by U.S. Economy and Policies Under the Support of New Economy” (December 2025)

[5] Fubon Financial Holding - “2026 Investment Outlook” (December 2025)

[6] Bloomberg - “Overview of Six Key Focus Areas for Stock Bulls’ Deployment Next Year” (December 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.