Seres (601127.SH) In-depth Investment Analysis: Can 'From the Depths to Prosperity' Be Realized?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- ✅ Huawei Collaboration:Deep integration brings brand and channel advantages, but faces ‘replacement’ risk (Xiangjie S9 directly impacts Wenjie M7, with 62% potential user overlap)

- ✅ Performance Outburst:2025Q3 revenue was 4.813 billion yuan, exceeding expectations by 74.7%, EPS 1.45 yuan, surging 9230% year-on-year

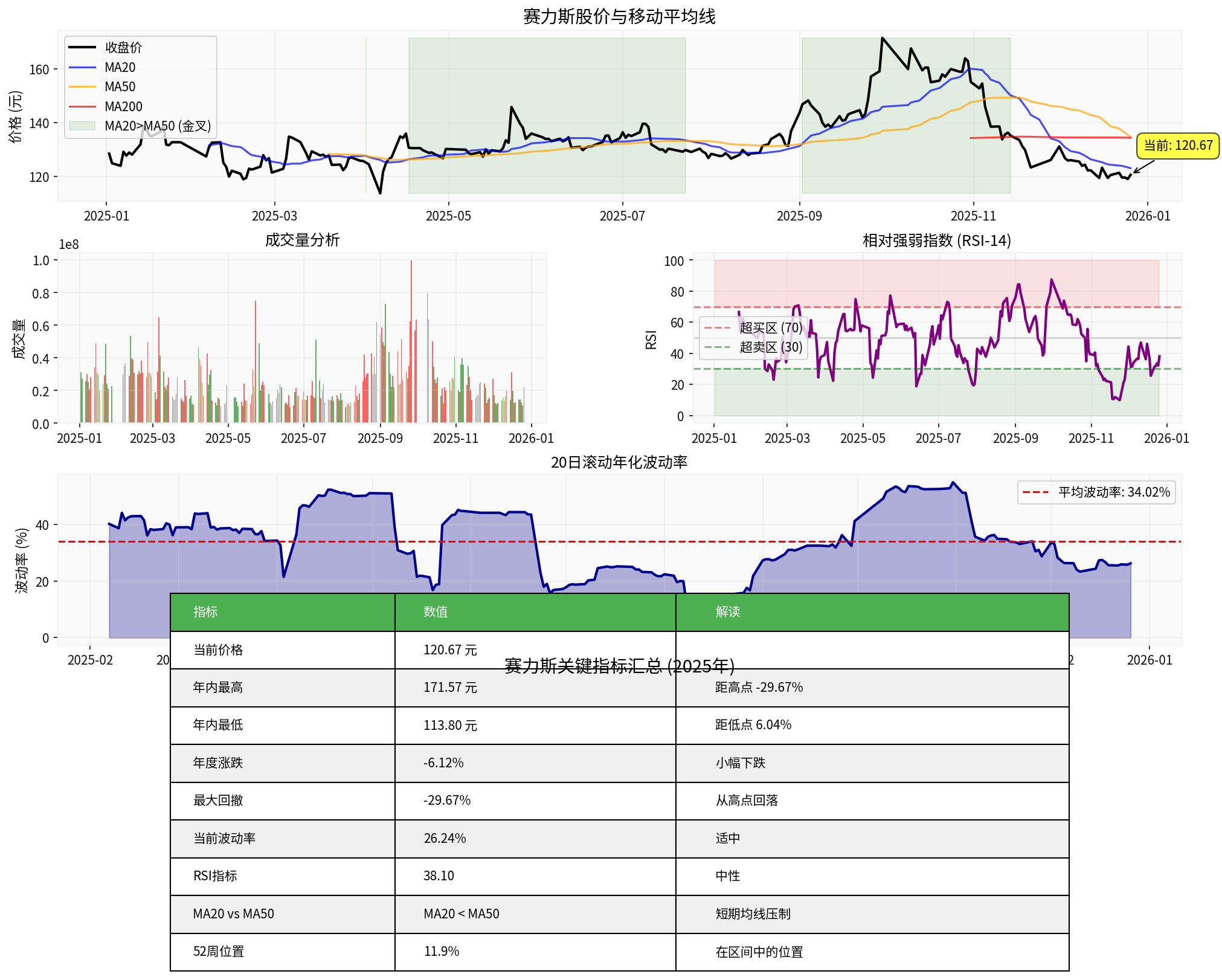

- ⚠️ Weak Technicals:MA20 (123.14) < MA50 (134.75), short-term moving average suppression, in sideways consolidation

- ⚠️ Valuation Pressure:P/E 27.3x, P/B 7.09x, not undervalued

- ❓ 250 Billion Target:Requires sustained high growth in 2025-2026, with uncertainty

- Current Price:120.67 yuan (+1.56%, intraday gain)

- Annual Performance:-6.12% (from 128.54 yuan to 120.67 yuan)

- Price Range:113.80 yuan - 171.57 yuan

- Drop from High:-29.67% (from 171.57 yuan high)

- Market Cap:197.1 billion yuan

- Trend Status:Sideways consolidation, no clear direction

- MA20 vs MA50:Short-term moving average below long-term, indicating weak structure

- RSI:38.10, in neutral to weak zone

- Volatility:26.24% (annualized), high volatility品种

- Support Level:119.21 yuan

- Resistance Level:123.14 yuan[0]

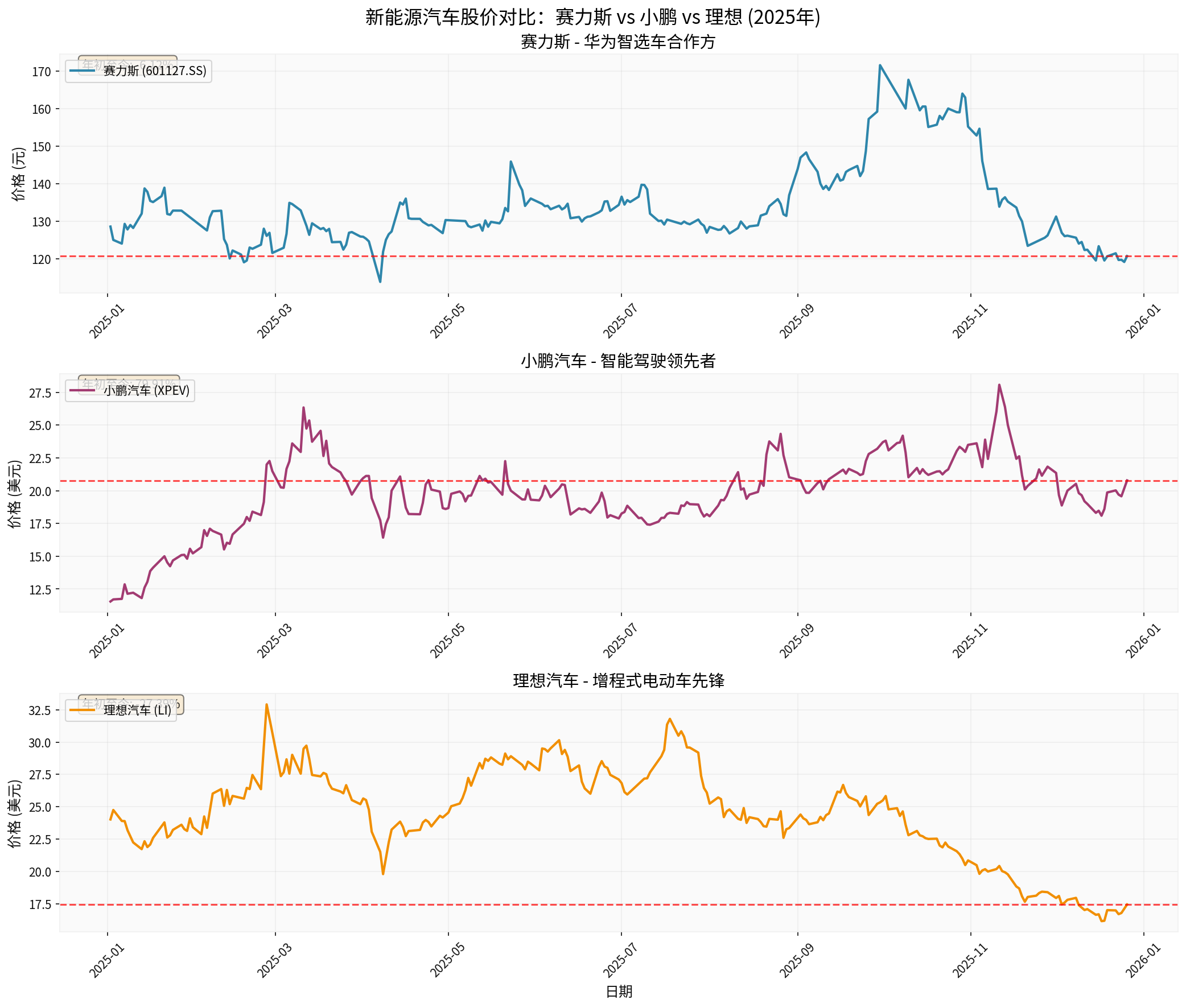

| Company | Current Price | Annual Change | P/E (TTM) | Market Cap | Features |

|---|---|---|---|---|---|

Seres |

120.67 yuan | -6.12% |

27.3x | 197.1 billion | Huawei Smart Selection collaboration, Wenjie brand |

XPeng Motors |

20.78 USD | +79.91% |

- | - | Leading intelligent driving, MONA series volume |

Li Auto |

17.44 USD | -27.39% |

- | - | Extended-range route, pure electric transformation pressure |

- Revenue:4.813 billion yuan (expected 2.755 billion yuan),exceeding expectations by 74.7%

- **EPS:**1.45 yuan (expected 0.02 yuan), exceeding expectations by 9,230%

- **Net Margin:**4.84%

- **ROE:**32.11% (excellent shareholder return)

- **Operating Margin:**4.96%[0]

- Cash Flow:Free cash flow 15.37 billion yuan, significant improvement in cash generation capacity

- Debt Risk:Medium risk level (need to focus on capital expenditure from expansion)

- Accounting Attitude:Conservative (high depreciation/capital expenditure ratio, profit has room for improvement)[0]

###3.2 Revenue Growth Trajectory

From historical data:

-2025Q1:1.865 billion yuan

-2025Q2:3.855 billion yuan

-2025Q3:

###4.1 Collaboration Advantages

- Huawei’s 5000+ experience stores nationwide directly drive sales[1]

- Wenjie brand established recognition in high-end SUV market (M7, M9 series)

- HarmonyOS cockpit, ADS intelligent driving technology support

- From monthly sales of less than 800 units during SF5 period to over 50,000 units monthly for Wenjie series

- Wenjie full line delivered over 50,000 units in November 2025, hitting a monthly high[2]

###4.2 ‘Replacement’ Risk

According to online search information:

- Xiangjie S9 Impact:Xiangjie sold 83,000 units in H1 2025,62% of users originally considered Wenjie M7

- Huawei’s ‘Four Boundaries’ strategy (Wenjie, Zhijie, Xiangjie, Zunjie) intensifies internal competition

- Seres is no longer Huawei’s ‘only’ deep partner[1]

###5.1 New Model Plan

Based on online information:

- Wenjie M9L:Large SUV flagship, targeting high-end market

- Wenjie L6:Mid-size SUV, expanding user coverage

- High-end Custom Models:Enhancing brand premium and profit margin

- Product differentiation positioning

- Pricing strategy balance

- Production capacity ramp-up speed

###5.2 Overseas Expansion Plan

- 2026:Indonesia, Mexico factories reach production capacity (target Southeast Asia, North America markets)

- 2027:Hungary factory goes into production (target European market)

- ✅ Opportunities:Diversify single market risk, open growth ceiling

- ⚠️ Challenges:High capital expenditure pressure, geopolitical risks (Mexico factory faces US tariff policy uncertainty)[3]

- ❓ Uncertainty:Long overseas factory construction timeline, execution risks

###5.3 Autonomous Driving Progress

- Huawei ADS system iteration

- No specific L3 commercial launch timeline found

###6.1 Target Breakdown

Assuming 2024 revenue is about 15-20 billion yuan (estimate), to reach the 250 billion yuan target:

| Scenario | CAGR | Achievement Time | Key Assumptions |

|---|---|---|---|

Optimistic |

100%+ | 2026 | M9L/L6 are blockbusters, overseas goes smoothly, annual sales double |

Neutral |

50-70% | 2027 | New cars succeed but growth slows, overseas gradual development |

Pessimistic |

30-40% | 2028-2029 | Intensified competition, overseas obstacles |

- From Q3’s 4.8 billion revenue, 2025 full-year revenue is about 15-18 billion yuan

- 250 billion target means needing over 10x growth in 2-3 years

- Extremely challenging, requires perfect coordination of multiple factors

###6.2 Peer Comparison

- 2023 revenue about 123.8 billion yuan (≈17.4 billion USD)

- Took about 4 years to reach 100 billion from zero

- But Chinese market has entered stock competition phase

- Higher starting point (with Huawei support)

- But more competitive market environment (new energy penetration over 40%)

- Overseas expansion is key variable

###7.1 Core Risks

-

Huawei Dependence Risk:

- Internal competition from Huawei’s ‘Four Boundaries’ strategy

- 62% user overlap data warning[1]

- Technology and brand not in own hands

-

Intensified Industry Competition:

- Tesla price reduction pressure

- Product iteration from peers like XPeng and Li Auto

- Electric transformation counterattack from traditional car companies

-

Sustainability of Profitability:

- Net margin only 4.84%, limited profit elasticity

- Price war may compress profit margins

- Sustained high growth in R&D investment

-

Overseas Expansion Execution Risk:

- High capital expenditure pressure (15.3 billion free cash flow still needs to support expansion)

- Geopolitical uncertainty (US-EU trade barriers)[3]

- Localization operation capability to be verified

###7.2 Catalysts & Upside Factors

- Wenjie M9L/L6 greatly exceed expectations

- Overseas order breakthrough

- Huawei further tilts resources to high-end market

- Industry policy benefits (trade-in, etc.)

###8.1 Current Rating

⚠️

###8.2 Core Logic

- ✅ Huawei ecosystem empowerment remains strong

- ✅ Q3 performance outburst verifies demand

- ✅ Wenjie brand recognition improved

- ✅ ROE 32% shows high profit quality

- ❌ Weak technicals, MA20 < MA50

- ❌ Valuation not cheap (P/E27.3x, P/B7.09x)

- ❌ Internal competition in Huawei’s ‘Four Boundaries’

- ❌ 250 billion target too aggressive

- ❌ High execution risk in overseas expansion

###8.3 Operation Strategy Recommendations

- Short-term: Hold but do not add positions, observe 120 yuan support level

- If breaks below 115 yuan (annual low): Consider reducing positions to stop loss

- If breaks above 125 yuan and stabilizes: May start rebound, can hold

- Wait for better entry points(suggest below 110 yuan or technical stabilization)

- Focus on market reaction after new model launch

- Focus on overseas factory construction progress

- Wenjie monthly delivery volume(can it sustain over 50,000 units)

- MA20 breaks above MA50(technical turning signal)

- New model reservation data

- Overseas factory construction progress

Seres has

- Huawei collaboration is a double-edged sword, with both empowerment and competition

- 250 billion revenue target too aggressive, needs 3-4 years in neutral scenario

- Current stock price has digested some expectations, insufficient safety margin

- Suggest waiting for clearer reversal signals or better prices

[0] Jinling API Data (Stock Price, Financial Data, Technical Analysis, Financial Health Analysis)

[1] Zhihu - ‘Starting from the Journey of Seres’ Chairman Over the Past Few Years…’ (https://www.zhihu.com/question/1954114567346036804)

[2] Yahoo Finance - ‘Seres (09927.HK) Wenjie Delivered Over 50,000 New Cars in November’ (https://hk.finance.yahoo.com/news/賽力斯-09927-hk-旗下問界11月交付新車逾5萬台-043734744.html)

[3] Wall Street Journal - ‘China Market Was Once a Cash Cow for Western Companies, Now It’s a Testing Ground’ (https://cn.wsj.com/articles/…)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.