Deep Analysis of Investment Value of Guangwei Composites (300699.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Domestic Substitution Dividend: As a strategic new material, domestic substitution of carbon fiber is accelerating. The global carbon fiber market size is expected to grow from 164.88 kilotons in 2025 to 266.14 kilotons in 2030 [1]. Guangwei Composites, as a leading domestic enterprise, will benefit first

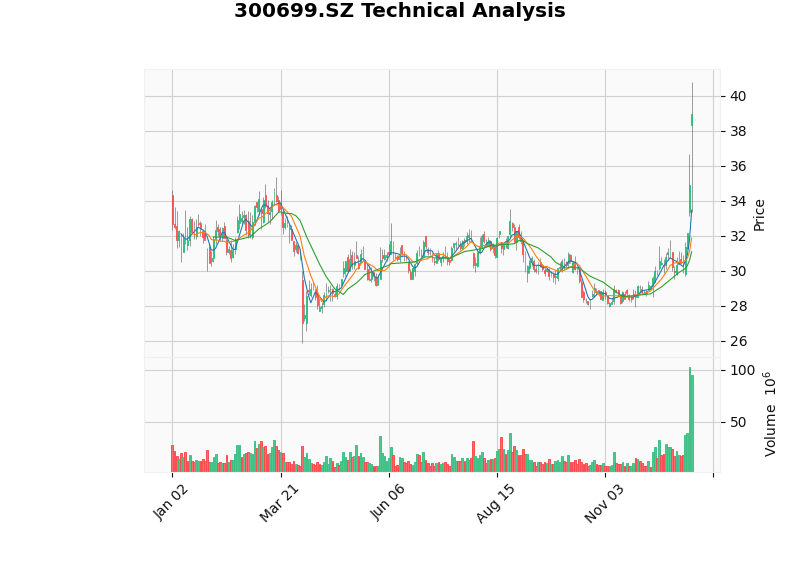

- Short-term Risks: Technical indicators show that RSI has entered the overbought zone [0]. Excessive short-term gains (+35.03% in 1 month [0]) and high valuation (P/E 59.72x [0])

- Long-term Value: The DCF baseline valuation is 52.51 yuan, with an upside potential of 35.3% compared to the current price [0]. In an optimistic scenario, the potential gain reaches 246%

| Indicator | Performance |

|---|---|

| Current Price | 38.82 yuan |

| Daily Gain | +11.33% ⭐ |

| 5-Day Gain | +26.53% |

| 1-Month Gain | +35.03% |

| 52-Week Range | 25.86 - 40.77 yuan |

| Market Cap | 320.4 billion yuan |

- Surge in Trading Volume: The latest trading volume is 96.19 million shares, far higher than the average of 15.61 million shares [0], indicating significant capital inflow

- The stock price has approached the 52-week high of 40.77 yuan [0]. Bullish momentum is strong, but we need to pay attention to correction pressure

| Indicator | Value | Signal |

|---|---|---|

| MACD | Golden Cross | Bullish |

| KDJ | K:74.7, D:64.8, J:94.5 | Bullish |

| RSI(14) | Overbought Zone | ⚠️ Need to be vigilant |

| 20-Day MA | 31.09 yuan | Support |

| 50-Day MA | 29.61 yuan | Support |

| Financial Indicator | Value | Evaluation |

|---|---|---|

| Net Profit Margin | 21.35% | ⭐ Excellent |

| Operating Profit Margin | 24.06% | ⭐ Excellent |

| ROE (Return on Equity) | 9.80% | Good |

| Gross Margin (estimated) | ~35-40% | Good |

- Net profit margin exceeds 20%, which is at an excellent level in the manufacturing industry, reflecting the characteristics of high-value-added products

- Operating profit margin of 24.06% indicates strong cost control capability

| Indicator | Value | Evaluation |

|---|---|---|

| Current Ratio | 2.11 | ⭐ Healthy |

| Quick Ratio | 1.74 | ⭐ Healthy |

| Debt Risk Rating | Low Risk | ⭐ Safe |

| Valuation Indicator | Value | Industry Reference | Evaluation |

|---|---|---|---|

| P/E (TTM) | 59.72x | Chemical Industry:15-30x | ⚠️ High |

| P/B Ratio | 5.80x | Median:2-4x | High |

| P/S Ratio | 12.64x | - | High |

| Scenario | Intrinsic Value | Relative to Current Price | Probability |

|---|---|---|---|

Conservative |

37.42 yuan | -3.6% | 30% |

Baseline |

52.51 yuan | +35.3% ⭐ |

50% |

Optimistic |

134.32 yuan | +246.0% | 20% |

- Baseline scenario: Revenue growth rate:3.7%, EBITDA margin:39.2%, WACC:6.6%

- Optimistic scenario: Revenue growth rate:12.3%, EBITDA margin:41.1%, WACC:5.2%

- Aerospace: Aircraft structural parts, missile components (high-end T800 level and above)

- Wind Power: Lightweight of large blades (mainly T700 level)

- Automotive Lightweight: Structural parts of new energy vehicles

- Pressure Vessels: Hydrogen storage tanks for fuel cells

- T300/T400 Level: Full localization achieved, fully competitive

- T700 Level: Domestic substitution accelerating; enterprises like Guangwei Composites and Zhongfu Shenying have made breakthroughs

- T800 Level: Partial breakthrough; localization achieved in military field

- T1000/M Series: Still in R&D phase

- Military Qualification: Has complete military qualifications and is a core supplier in the aerospace field

- Full Industry Chain Layout: Integrated production capacity from precursor to carbon fiber to composite products

- Technological Breakthrough: T800-level products have been applied in the military field, and promotion in the civilian field is accelerating

- Capacity Expansion: Continuous capacity expansion to meet domestic substitution demand

- Policy Support: National strategic new material plan, carbon fiber listed as a key development direction

- Supply Chain Security: Key fields like aerospace must achieve independent control

- Cost Advantage: The cost of domestic carbon fiber is 30-50% lower than imported products

- Demand Surge:

- Wind power large-scale trend is clear

- Demand for lightweight new energy vehicles is growing

- Demand for hydrogen storage tanks for hydrogen energy is released

| Dimension | Advantage | Sustainability |

|---|---|---|

| Technical Barrier | T800-level military certification | ⭐⭐⭐⭐⭐ High |

| Qualification Barrier | Complete military four certificates | ⭐⭐⭐⭐⭐ High |

| Industry Chain | Integrated from precursor to carbon fiber to products | ⭐⭐⭐⭐ High |

| Customer Stickiness | Aerospace central enterprise customers | ⭐⭐⭐⭐⭐ High |

| Capacity Scale | Top three in China | ⭐⭐⭐ Medium |

- Domestic Substitution Accelerating: Penetration rate of T700/T800-level products in wind power, automotive and other fields is increasing

- Stable Military Product Demand: Demand in aerospace field is highly certain, military product orders are stable

- Capacity Release: New capacity is gradually put into production to support revenue growth

- Valuation Repair: If performance resumes growth, the current high valuation is expected to be digested through performance

- Short-term Performance Pressure: Latest quarter EPS is lower than expected, profitability declined

- Valuation Pressure:59.72x PE is at a historical high, requiring strong performance growth to digest

- Increasing Industry Competition: Competitors like Zhongfu Shenying and Jinggong Technology are expanding capacity

- Technical Overbought: RSI overbought, short-term correction demand exists

- Domestic substitution is a medium-to-long-term trend, not a short-term speculation theme

- The company has irreplaceability in the high-end carbon fiber field

- DCF valuation shows there is still a 35% upside potential in the baseline scenario [0]

- Excessive short-term gains, technical aspects need to be digested

- Performance improvement below expectations may lead to valuation correction

- It is recommended to wait for a correction to around the support level of 31.88 yuan before considering entering

| Investor Type | Recommendation |

|---|---|

Short-term Investors |

⚠️ Be cautious about chasing highs; wait for correction to the 35-36 yuan range |

Medium-term Investors |

✅ Can build positions in batches below 35 yuan; target price:52 yuan (baseline DCF) |

Long-term Investors |

✅ Layout at low prices; hold for more than 3 years to enjoy domestic substitution dividend |

- Quarterly performance resumes growth, EPS returns to above 0.25 yuan

- T800-level products make major breakthroughs in the civilian field

- Obtain large military product orders or wind turbine blade orders

- Performance decline for two consecutive quarters

- Industry competition leads to price wars

- Macroeconomic downturn leads to downstream demand contraction

- Valuation Risk: Current 59.72x PE is at a historical high; performance below expectations may lead to valuation correction

- Technical Risk: RSI overbought, short-term correction pressure exists; support level:31.88 yuan

- Industry Competition Risk: Competitors like Zhongfu Shenying expanding capacity may lead to price competition

- Performance Volatility Risk: Latest quarter EPS is 40.3% below expectations; need to pay attention to profitability recovery

- Macroeconomic Risk: Macroeconomic downturn pressure may affect downstream demand like wind power and automotive

- ✅ Domestic substitution process is accelerating; the company has double barriers of technology and qualification in the high-end carbon fiber field

- ✅ Global carbon fiber market size doubles in ten years; China’s demand grows faster

- ✅ DCF baseline valuation is52.51 yuan, with a35% upside potential compared to current price

- ⚠️ Excessive short-term gains + high valuation; need to be vigilant about correction risks

[0] Gilin API Data (real-time market, financial analysis, technical analysis, DCF valuation)

[1] Futunnel News Image - Global Carbon Fiber Market Forecast (2019-2030) - https://newsfile.futunn.com/public/NN-PersistNewsContentImage/7781/20251128/65523612-13-b28e22d0382a762955c0aab1b4acff9b.jpg/big

[2] Futunnel - Analysis of Domestic Substitution Process of Carbon Fiber (https://newsfile.futunn.com/public/NN-PersistNewsContentImage/7781/20251128/65523612-11-547f7f14c11ab429b355691ea9ad3aad.png/big)

[3] Futunnel - Application Structure Diagram of Carbon Fiber in Aerospace (https://newsfile.futunn.com/public/NN-PersistNewsContentImage/7781/20251128/65523612-14-0decda5c1d4001a9171e894e0c43a3a6.png/big)

朸浚国际(01355.HK)热门行情分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.