Analysis of Jiangxi Copper's Surge and the Sustainability of the Non-Ferrous Metal Industry Cycle

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

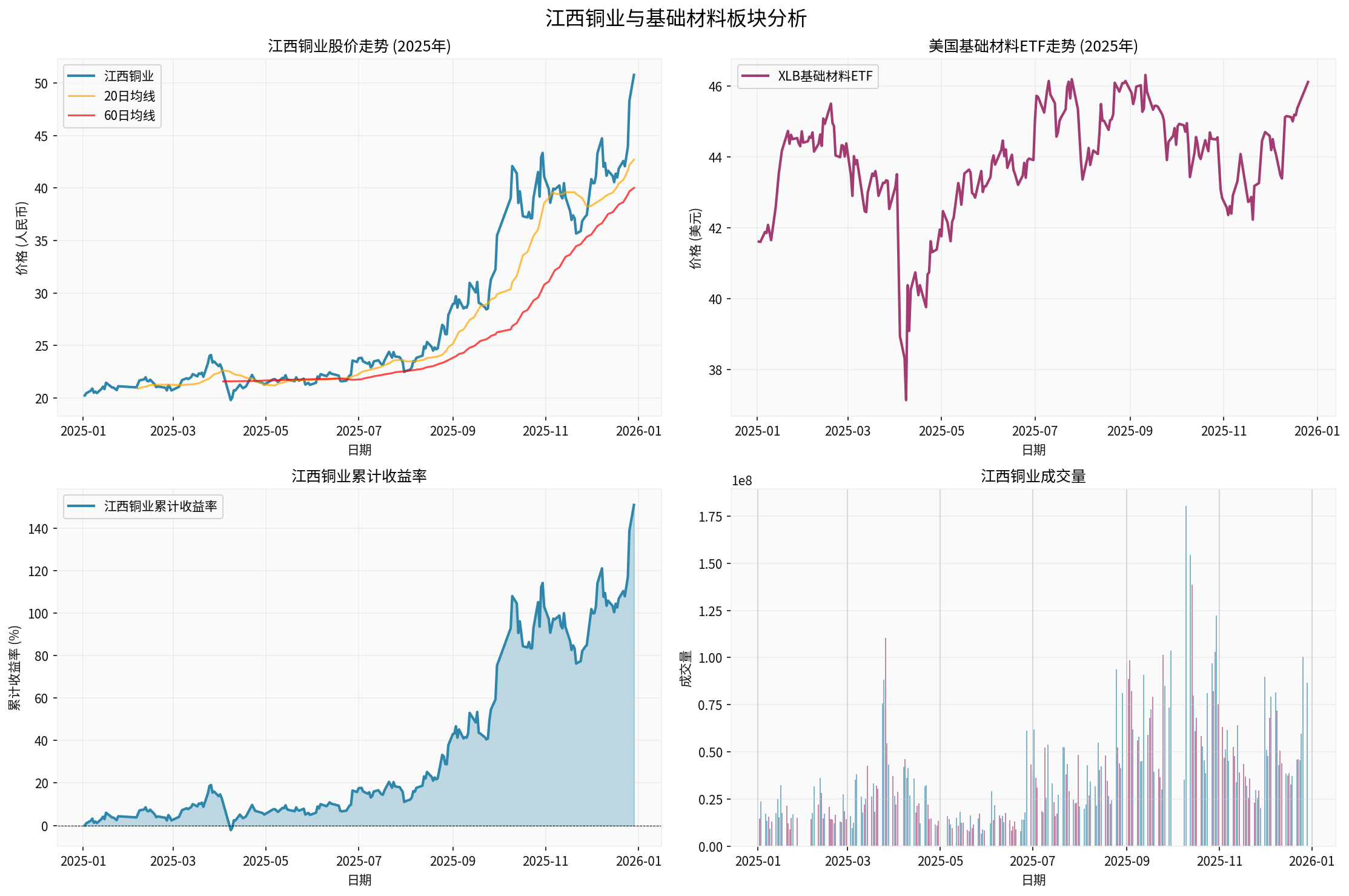

According to the latest market data [0], Jiangxi Copper’s stock performance is remarkable:

- Latest Price: 50.78 CNY (daily +5.11%)

- 2025 YTD Growth: +150.89%

- Past 3-month Growth: +75.10%

- Past 1-month Growth: +35.67%

- 52-week High: 51.50 CNY, a 17-year high

- Market Cap: 175.48 billion CNY

- Latest Price: 41.10 HKD (daily +10.37%)

- YTD growth is also significant

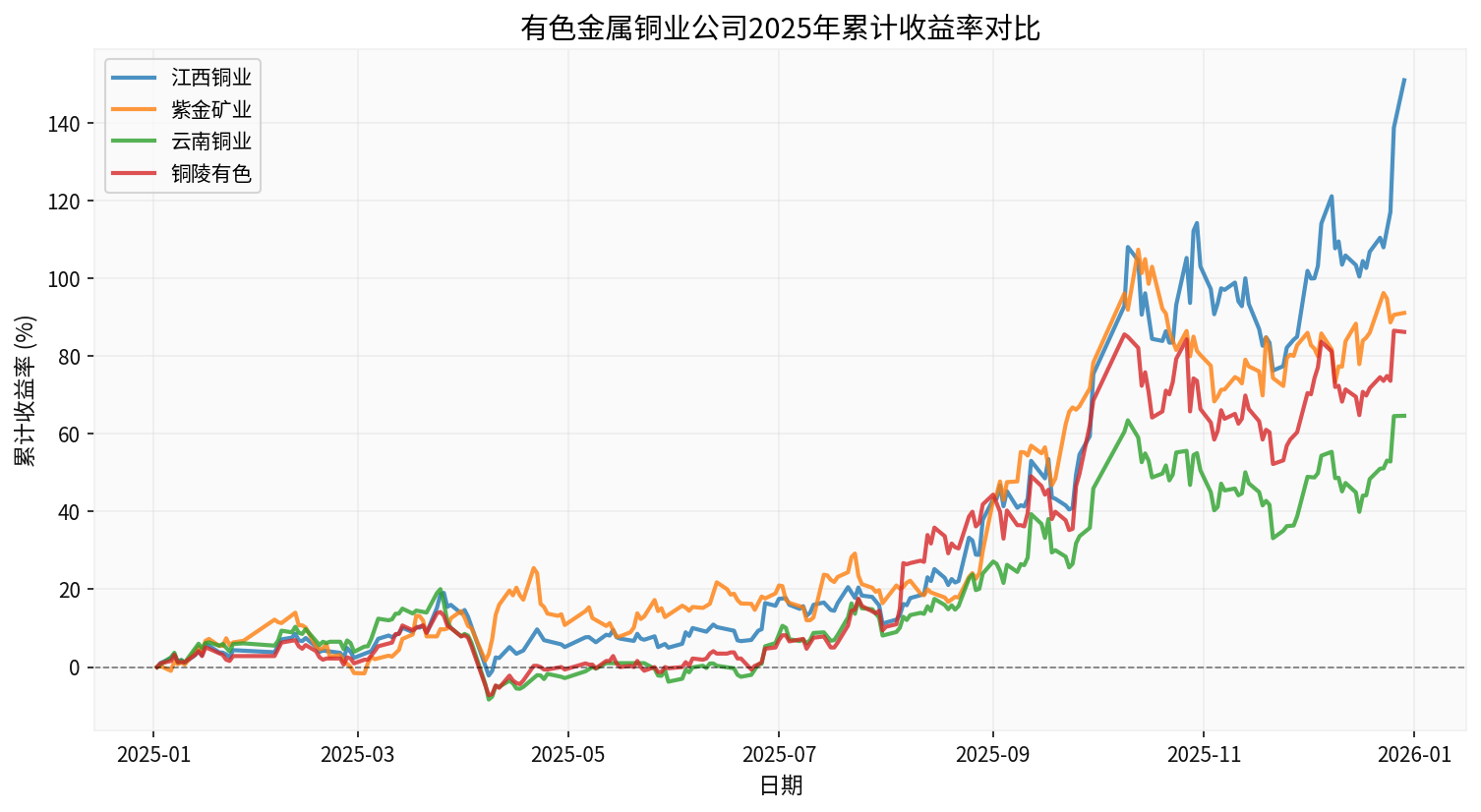

By comparing the 2025 performance of major copper companies [0]:

- Jiangxi Copper: +150.89%(significantly leading)

- Zijin Mining: +91.06%

- Tongling Nonferrous: +86.16%

- Yunnan Copper: +64.61%

From the chart, Jiangxi Copper’s cumulative return curve is clearly higher than other copper companies, showing

- LME 3-month copperbroke through$12,000/tonin December, setting a new record [1]

- 2025 YTD LME copper growth: ~37%, most of which occurred in the past month [2]

- COMEX copper futures rose over 30%, with U.S. copper contract prices remaining high

-

Frequent Global Copper Mine Accidents:Multiple major accidents at major global copper mines in 2025 led to supply decline [1]

-

Copper Concentrate Processing Fees Continue to Decline:

- Chinese copper smelters and Chilean miner Antofagasta finalized the 2026 long-term copper concentrate processing fee at $0/ton, indicating tight copper mine supply [3]

- At the end of November, the China Copper Raw Material Joint Negotiation Team (CSPT) announced that due to continuous decline in copper concentrate processing fees, member enterprises will reduce mineral copper production capacity by over 10% in 2026[3]

- Chinese copper smelters and Chilean miner Antofagasta finalized the 2026 long-term copper concentrate processing fee at

-

U.S. Tariff Policy Distorts Global Trade Flows:

- The U.S. announced a 50% tariffon imported semi-finished copper products starting August 1, 2025

- A large amount of copper resources flowed to the U.S., leading to refined copper supply shortages in other regions

- The global copper market shows a ‘two-tier’ pattern[2]

- The U.S. announced a

Jiangxi Copper issued an announcement on December 25, announcing a takeover offer for SolGold plc at a valuation of approximately

- It will further increase the company’s mineral reserves

- SolGold’s core asset is 100% equity of the Cascabel project in Ecuador

- Jiangxi Copper previously held 12.19% of SolGold’s shares, being the largest single shareholder

The Industrial Development Department of the National Development and Reform Commission released an article Vigorously Promote the Optimization and Upgrade of Traditional Industries, clearly stating:

- For resource-constrained industries like alumina and copper smelting, the key is to strengthen management and optimize layout

- Encourage large backbone enterprises to implement mergers and acquisitions to enhance scale and group-level capabilities [4]

- Promote a new round of mineral exploration breakthrough strategy and optimize overseas mineral resource exploration and development cooperation

Copper plays an irreplaceable role in the green energy transition:

- Electric Vehicles:Copper usage per EV is 3-4x that of traditional fuel vehicles

- Wind & Solar:Renewable energy power installation requires large amounts of copper

- Grid Investment:Global grid upgrading brings sustained demand

- Hualong Securities points out that U.S. economic growth expectations for 2026 are good

- The Federal Reserve’s ‘preventive rate cuts’ provide a guarantee for a soft economic landing [4]

- The non-ferrous metal sector strengthened overall; the CSI Industrial Non-Ferrous Metal Theme Index rose 3.94% on December 26 [4]

- The Industrial Non-Ferrous ETF (560860) reached a record high of 8.015 billion CNY in scale

- The global refined copper gap will reach approximately 330,000 tonsin 2026

- Copper prices will hit $12,500/tonin Q2 2026

- Annual average price: ~$12,075/ton

- Raised copper price expectations; copper prices may range between $11,500-$13,000/tonin 2026

- Jiangxi Copper’s domestic large open-pit copper mines have low costs and stable profits

- Rising precious metal prices further reduce copper mine costs

- Its stake in First Quantum is about to emerge from the trough, with great profit potential

- Capacity Expansion Constraints:Global copper mine investment cycles are long (usually 5-8 years), leading to delayed new capacity launch

- Declining Ore Grade:Average global copper ore grade continues to decline, increasing mining costs

- Geopolitical Risks:Major copper supply countries (Chile, Peru, Congo, etc.) face supply risks

- Environmental Pressure:Copper smelting faces environmental constraints; Chinese smelters have rising production cut expectations

- Short-Term:U.S. tariff policy, China’s growth-stabilizing policies

- Medium-Term:New energy transition (EVs, renewable energy, energy storage)

- Long-Term:Irreversible global electrification trend

- Macroeconomic Recession Risk:Global economic recession may hit copper demand

- Alternative Technologies:Long-term demand may be affected if copper substitutes emerge

- Price Volatility Risk:Excessive short-term gains may lead to correction risks

- Policy Risk:Uncertainty about the final implementation of U.S. tariff policies

- ✅ Strong supply-demand fundamentals (tight supply + growing demand)

- ✅ Institutions generally optimistic about 2026 copper prices

- ✅ New energy transition provides long-term demand support

- ✅ Industrial policies support mergers and acquisitions, benefiting leading enterprises

- ⚠️ Excessive short-term gains may lead to profit-taking pressure

- ⚠️ Uncertainty about U.S. tariff policies

- ⚠️ Risk of slowing global economic growth

- As an industry leader, it fully benefits from the copper price uptrend cycle

- Overseas M&A expands resource reserves

- Strong cost control capabilities; domestic large open-pit copper mines have low costs

- Significant market cap and liquidity advantages

- P/E Ratio: 21.98x (relatively reasonable)

- ROE (Return on Equity): 10.02%

- Current Ratio: 1.21 (adequate liquidity)

- Suggest布局 on dips; be cautious about chasing highs

- Monitor U.S. tariff policy implementation

- Watch for China’s growth-stabilizing policy efforts

- Maintain bullish view; optimistic about copper prices continuing to rise in 2026

- Leading enterprises (Jiangxi Copper, Zijin Mining) benefit first

- Focus on enterprises with high resource self-sufficiency rates

- New energy transition trend is irreversible

- Supply constraints exist long-term

- Structural investment opportunities in the industry are worth continuous attention

Jiangxi Copper’s surge is not accidental; it is the result of multiple factors:

- Strong Fundamentals:Tight supply and growing demand will continue in 2026

- Institutional Optimism:International investment banks like JPMorgan Chase and UBS are optimistic about 2026 copper prices

- Inevitable Short-Term Fluctuations:Huge cumulative gains may lead to corrections, but the uptrend remains unchanged

- Structural Differentiation:Leading enterprises will continue to benefit from cost advantages and resource reserves

- Long-Term Investors:Can continue to hold or布局 leading targets on dips

- Short-Term Investors:Control positions and watch for volatility risks

- Sector Allocation:Prioritize leading enterprises with high resource self-sufficiency and strong cost control capabilities

- LME copper price trend

- China’s copper import data

- Global copper mine supply disruptions

- U.S. tariff policy progress

- Strength of China’s growth-stabilizing policies

[0] Gilin API Data — Jiangxi Copper Stock Quotes, Financial Data and Industry Comparison Analysis

[1] Mitrade — “Copper Prices Break Through $12,200 to New High! Will They Rise to $15,000 in 2026?” (https://www.mitrade.com/cn/insights/commodity-analysis/more/20251226A02C)

[2] Caijing Magazine — “International Copper Prices Hit New Highs, Will They Continue to Rise?” (https://www.mycaijing.com/article/detail/561161?source_id=40)

[3] Daily Economic News — “Everyday Brand 100 Index Maintains High Volatility This Week; Component Stock Jiangxi Copper Rises Nearly 150% YTD” (https://www.nbd.com.cn/articles/2025-12-28/4198426.html)

[4] Jiemian News — “Industrial Non-Ferrous ETF (560860) Rises Over 4% Strongly, Setting New YTD High!” (https://www.jiemian.com/article/13814307.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.