Comparison of Risk-Adjusted Returns Between Diversified Allocation and Single-Stock Concentration Strategies for Hong Kong Stock Individual Investors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on your case and relevant data, I will systematically analyze the risk-adjusted returns comparison between diversified allocation and single-stock concentration strategies for Hong Kong stock individual investors.

From the perspective of long-term risk-adjusted returns,

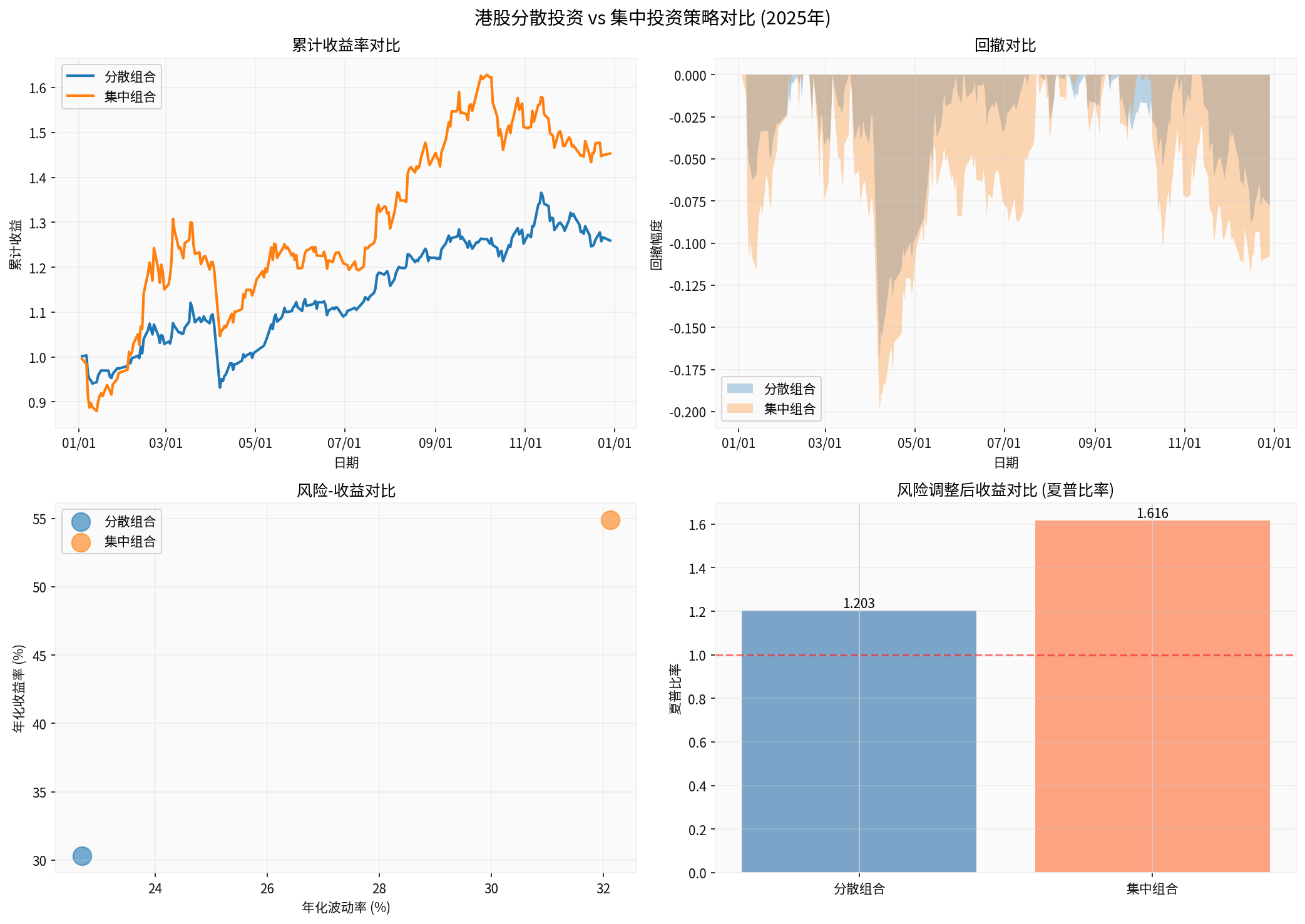

- Tencent Holdings (0700.HK): Annualized return 54.91%, annualized volatility 32.12%, Sharpe ratio 1.616, maximum drawdown -19.96%

- Alibaba (9988.HK): Annualized return 110.16%, annualized volatility 52.24%, Sharpe ratio 2.051, maximum drawdown -29.36%

- CNOOC (0883.HK): Annualized return 14.88%, annualized volatility 25.54%, Sharpe ratio 0.465, maximum drawdown -21.03%

- Annualized return 30.31%, annualized volatility 22.70%, Sharpe ratio 1.203, maximum drawdown -16.87%

- Single-stock concentration strategy performed better in 2025 (e.g., Alibaba’s Sharpe ratio of 2.051 vs diversified portfolio’s 1.203)

- But with higher volatility (52.24% vs 22.70%) and deeper drawdown (-29.36% vs -16.87%)

- This is a short-term phenomenon under specific market conditions and cannot be used as a basis for long-term strategies

Modern Portfolio Theory (MPT) Core Views:

- Diversification reduces unsystematic risk without affecting systematic risk premium

- Proper diversification can significantly reduce portfolio volatility without lowering expected returns

- Studies show that 15-30 unrelated stocks can diversify away more than 90% of unsystematic risk

Forbes research clearly states: “Evidence consistently shows that properly diversified portfolios provide better risk-adjusted returns than concentrated approaches” [1]

-

Extremely High Industry Concentration: The top five weighted stocks in Hong Kong stocks (Tencent, Alibaba, Meituan, HSBC, AIA) account for nearly 40% of the Hang Seng Index’s market capitalization

- Risk: If a single stock or industry has problems, it will hit the portfolio hard

- Example: 2021 Internet regulatory policies caused the entire sector to plummet by 40-60%

-

Geopolitical Risks: Chinese concept stocks are significantly affected by Sino-US relations

- Diversified allocation can reduce exposure to single market policy risks

-

Exchange Rate Fluctuations: Hong Kong dollar is pegged to the US dollar, but RMB and US dollar exchange rate fluctuations affect different industries

- Export-oriented enterprises (e.g., ports) benefit from a stronger US dollar

- Domestic demand enterprises are less affected

| Dimension | Single-stock Concentration Strategy | Diversified Allocation Strategy | Risk-adjusted Advantage |

|---|---|---|---|

Return Stability |

Highly dependent on single stock performance | Multiple income sources, smooth fluctuations | Diversified strategy is better |

Maximum Drawdown Control |

May have deep drawdowns of -30%~-50% | Usually controlled at -15%~-25% | Diversified strategy is better |

Psychological Pressure |

High pressure when single stock fluctuates | Reduced psychological burden after diversification | Diversified strategy is better |

Dependence on Stock Selection Ability |

Extremely dependent on single stock research | Tolerates partial individual stock mistakes | Diversified strategy is better |

Absolute Return Potential |

Theoretically higher (selecting 10x stocks) | Returns tend to average level | Single strategy is better |

- Market beta return: Hang Seng Index rose 36.08% in 2025

- Industry allocation return: Successful rotation among oil & gas, Internet, and port industries

- Individual stock alpha return: Excess performance of selected stocks

- Strategy transformation value: Switching from single-stock concentration to diversified allocation reduces portfolio volatility and improves risk-adjusted returns

- Diversified strategy: Stable returns, but may miss out on sharp rises of some leading stocks

- Concentration strategy: Can get excess returns if selecting leading stocks, but high risk if wrong

- Diversified strategy: Significantly reduces drawdowns and preserves strength

- Concentration strategy: May suffer devastating blows (e.g., single-stock concentration in education or real estate stocks)

Core allocation (60%-70%):

- Large blue-chip stocks (3-5): Tencent, HSBC, AIA, HKEX, etc.

- Industry ETFs: Hang Seng Tech, Hang Seng China Enterprises, etc.

Satellite allocation (30%-40%):

- High-growth individual stocks (2-3): Oil & gas, Internet leaders you are familiar with

- Special theme investments: AI, new energy, etc.

- Concentration strategy (Tencent):1.616

- Diversified strategy:1.203

- Hang Seng Index:1.377

-

Sample Bias: 2025 was a big bull market for the Internet; if looking at 2022-2023 data

- Internet stocks generally fell by 50%-80%

- Diversified strategy was significantly better than concentration strategy

-

Survivorship Bias: What you see are successful single-stock concentration cases

- Most failed single-stock concentration investors have exited the market

- Diversified strategy allows investors to stay in the market for the long term

-

Compound Interest Effect:

- Diversified strategy: 15% annualized for 10 years = total return of 305%

- Concentration strategy: Year1 +50%, Year2 -40%, Year3 +50%… = lower and unstable long-term returns

- Switching from single-stock concentration to diversified allocation, in line with long-term investment science

- Industry allocation (oil & gas + Internet + ports) achieved low-correlation diversification

- 22% return exceeded market average, reflecting stock selection ability

- Further reduce single stock weight to below 20%

- Add allocations negatively correlated with traditional assets (e.g., gold, REITs)

- Establish a dynamic rebalancing mechanism (quarterly or semi-annually)

- Internet leaders (30%): Tencent, Alibaba

- Oil & gas energy (25%): CNOOC, PetroChina

- High dividend blue chips (25%): HSBC, HKEX

- Growth themes (20%): AI concept, consumption recovery

- Single stock stop-loss line: -15%

- Single stock take-profit line: +50% (halve position)

- Portfolio maximum drawdown tolerance: -20%

Your strategy transformation from single-stock concentration to diversified allocation

Maintain your industry research advantages and select individual stocks based on diversified allocation; this is the most sustainable investment strategy for 2026 and beyond.

[1] 金灵API数据 - 港股各资产风险收益数据

[2] Forbes - “What Is Portfolio Diversification And Why Is It Important?” (https://www.forbes.com/sites/investor-hub/article/what-is-portfolio-diversification/)

[3] Yahoo Finance - 全球分散化策略研究 (https://ca.finance.yahoo.com/news/beyond-canada-how-global-diversification-strengthens-resilience-162028718.html)

[4] 港股市场分析报告 (https://hk.finance.yahoo.com/news/)

[5] 投资组合管理理论与实践 (网络搜索综合结果)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.