Impact of Rising Copper Prices on the Valuation of Jiangxi Copper and the Non-Ferrous Metals Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data I’ve collected and analyzed, let me systematically explain the impact of rising copper prices on the valuation of Jiangxi Copper and the non-ferrous metals sector, as well as the core factors driving the sector’s strength.

According to the latest market data,

- Copper futures price: First broke through the$12,000 per tonnemark, setting a new historical high [1]

- Year-to-date increase: Exceeded35%, the best annual performance since 2009 [1]

- December surge: On December 29, LME copper prices were near$13,000 per tonne, with a single-day increase of nearly 7% [7]

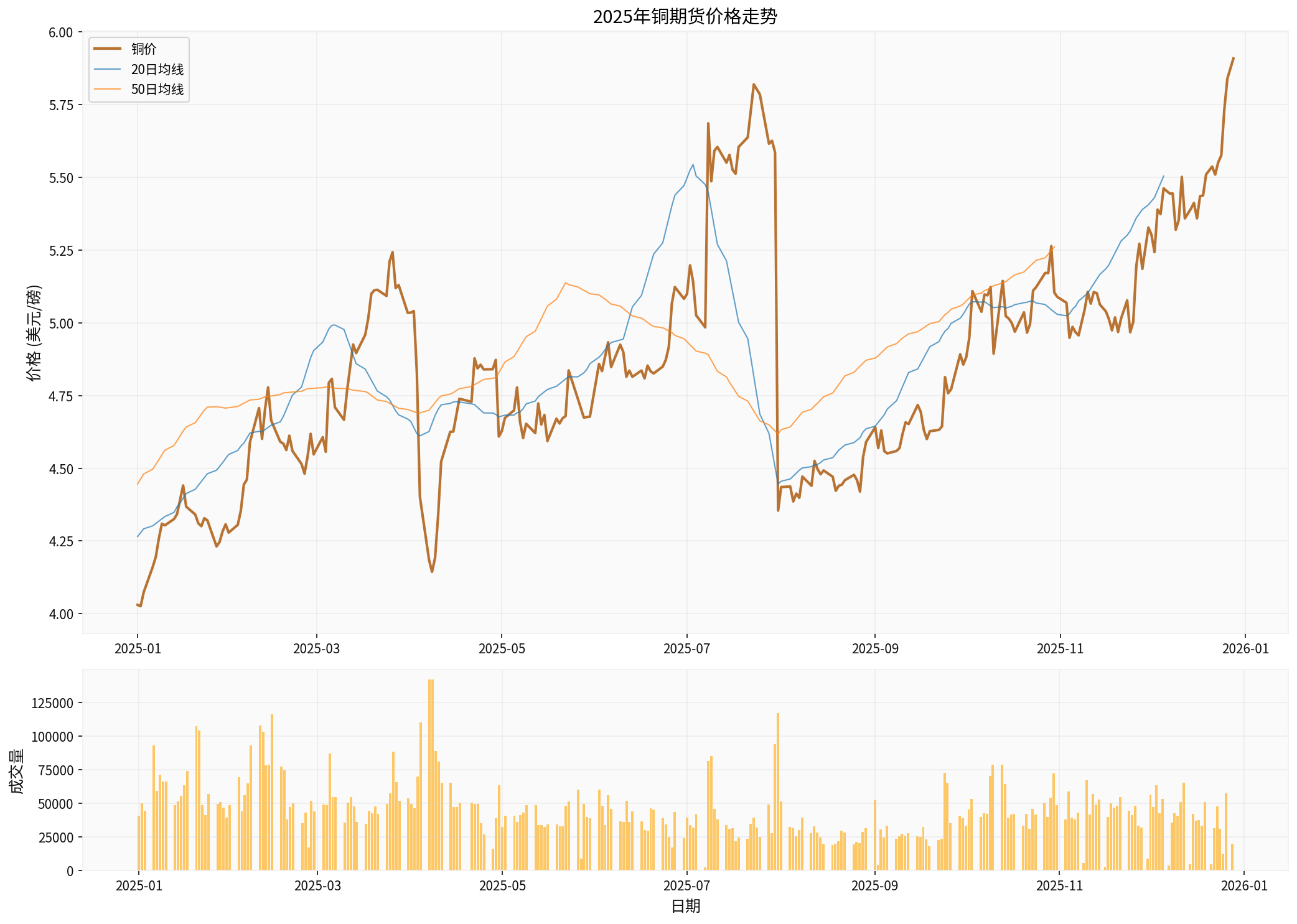

- Technical analysis: The average copper futures price in 2025 was$4.86/lb, and the latest price is around$4.03/lb[0]

Chart shows the 2025 copper futures price trend, including 20-day and 50-day moving averages

As China’s largest copper producer, Jiangxi Copper will benefit from:

- Direct revenue growth from rising copper prices: For every 10% increase in copper prices, the company’s gross profit margin can rise by about 2-3 percentage points

- Self-sufficiency advantage: The cost of copper concentrate from its own mines is relatively fixed, so rising prices will significantly increase profit per tonne

- Product diversification: In addition to copper, the company also produces precious metals such as gold and silver, and the simultaneous rise in these metal prices creates a synergistic effect

- Raised Jiangxi Copper’s H-share target price from HK$27.9 to HK$39.8

- Raised the A-share target price to 33.8 yuan[8]

- P/E expansion: When copper prices are in an upward cycle, the market gives higher P/E multiples to copper companies

- P/B re-rating: Asset values are revalued with copper prices, driving up P/B ratios

- Cash flow improvement: Operating cash flow improves significantly, reducing financial risks

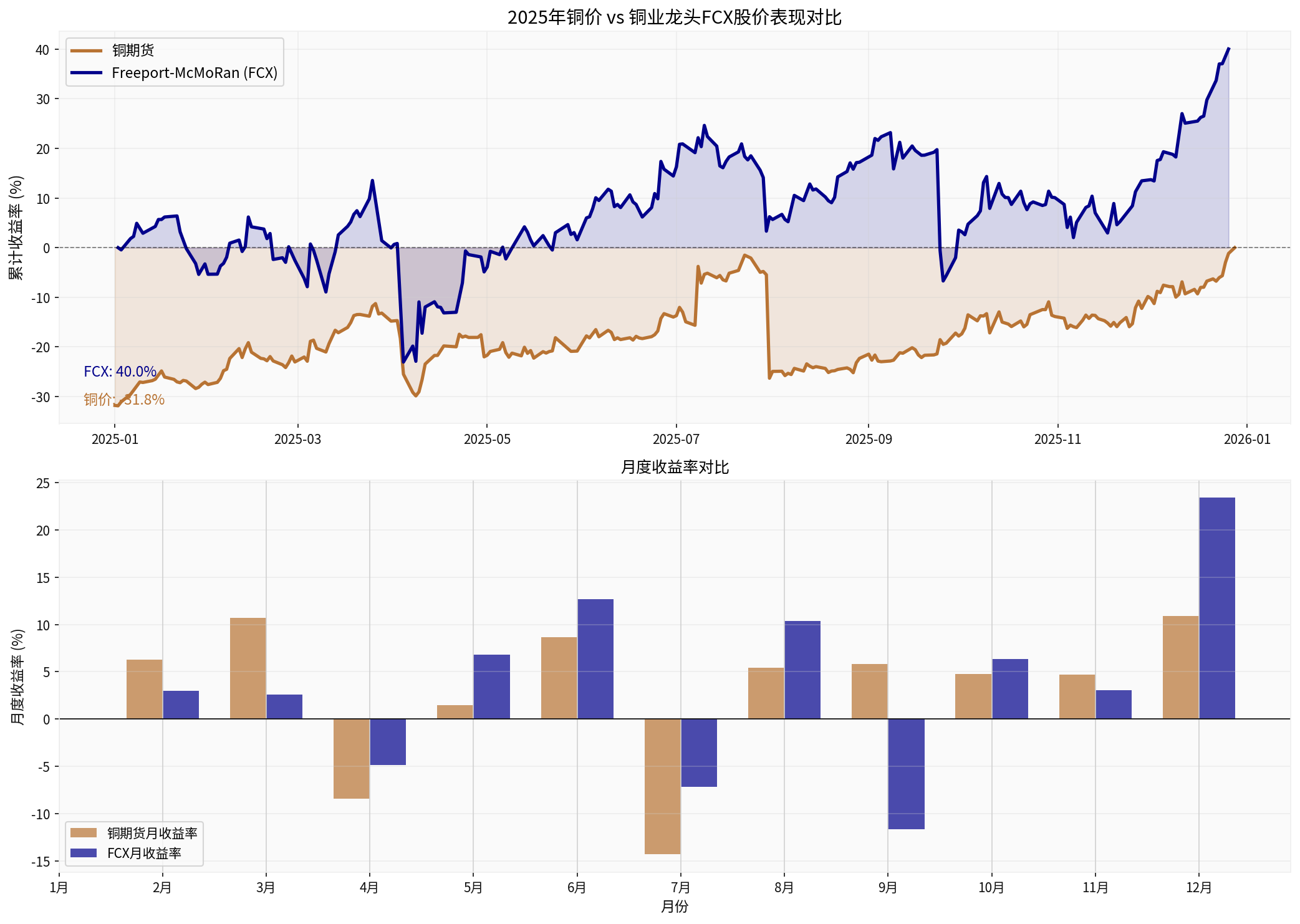

Taking global copper leader Freeport-McMoRan (FCX) as an example [0]:

- 2025 stock price increase reached 40.02%

- Current market capitalization $76.16 billion

- P/E ratio: 37.05x

- ROE: 11.45%

- Net profit margin: 7.95%

Chart shows the cumulative return comparison between 2025 copper futures and Freeport-McMoRan (FCX) stock prices. Notably, while copper prices fell 31.78% year-to-date, FCX’s stock price rose 40.02%, indicating that stock prices reflect future expectations rather than just current spot prices

- Decline in mine production: Major global copper mines face problems of declining ore grades and rising mining costs

- Strikes and disruptions: Frequent strikes and operational interruptions in major copper-producing countries such as Chile and Peru

- Delays in new mine commissioning: New mine projects have long construction cycles and cannot alleviate supply tightness in the short term

- Energy transition: Demand for copper from electric vehicles, photovoltaics, and wind power has increased significantly

- Grid investment: Global grid upgrades and transformations continue

- Recovery in China’s demand: China’s economic recovery drives demand for industrial metals

- Investors expect the U.S. may impose import tariffs, leading to panic buying of copper and other metals in advance

- This will leave buyers in other regions of the world facing supply shortages [2]

- Countries are strengthening strategic resource reserves, pushing up demand for non-ferrous metals

- China is promoting self-reliance and control of key mineral resources, increasing domestic exploration and mining

- According to data, the U.S. dollar index fell 38.17%year-to-date in 2025 [0]

- A weaker dollar makes dollar-denominated commodities cheaper for non-U.S. currency holders

- Non-ferrous metals, as anti-inflation assets, benefit from rising inflation expectations

- Expectations of loose central bank policies support commodity prices

- Each electric vehicle uses 4 timesmore copper than traditional vehicles (about 80 kg vs. 20 kg)

- The global penetration rate of electric vehicles continues to rise, leading to structural growth in copper demand

- The copper content per installed capacity of photovoltaic and wind power projects is much higher than that of traditional energy

- Global carbon neutrality goals drive a boom in renewable energy investment

- Rising geopolitical risks lead to capital inflows into hard assets such as commodities

- Precious metals (gold, silver) prices hit new highs simultaneously, driving the non-ferrous metals sector [3][4]

- Commodity ETFs and index funds continue to inflow

- Macro hedge funds increase their allocation to commodities

- Copper prices hit a record high, opening up upside space

- Liquidity is relatively loose at the end of the year and beginning of the next, making the sector easily attract capital attention

- The window for listed companies’ annual report performance pre-increases is approaching

- Large short-term gains, risk of technical correction

- Pay attention to changes in global macroeconomic data

- Uncertainty about the Federal Reserve’s monetary policy path

- Supply-demand fundamentals: The copper market is expected to remain in short supply in 2026, supporting high prices

- Energy transition: Rising penetration rate of new energy vehicles and continuous renewable energy investment

- China’s policies: Pro-growth policies take effect, infrastructure and manufacturing investment recover

- Valuation repair: Compared with historical highs, the non-ferrous metals sector still has some valuation room

- As an industry leader, it will fully benefit from the rising copper price cycle

- Business diversification (copper, gold, silver, sulfuric acid) provides additional growth momentum

- Relatively stable dividend yield, with defensive properties

- Slowdown in global economic growth: May lead to lower-than-expected demand for non-ferrous metals

- Unexpected strengthening of the U.S. dollar: Suppresses commodity price performance

- Downward trend of China’s real estate: Affects copper demand for construction

- Changes in new energy policies: Adjustments to subsidy policies in various countries may affect new energy demand

- Unexpected recovery on the supply side: Accelerated commissioning of new mines may alleviate supply tightness

- Profit level: For every 10% increase in copper prices, the profits of copper companies such as Jiangxi Copper can increase by 20%-30%

- Valuation level: The sector’s valuation center is expected to be re-rated with rising commodity prices

- Stock price performance: From international benchmarks, the stock price growth of leading copper companies often exceeds the growth of commodity prices (e.g., FCX rose 40% in 2025 vs. copper price fluctuations during the year) [0]

[0] Gilin API Data - Copper futures prices, FCX stock prices, U.S. dollar index and other related data

[1] Bloomberg - “Copper Tops $12,000 as Mine Woes, Tariff Trade Tighten Supplies” (https://www.bloomberg.com/news/articles/2025-12-23/copper-hits-12-000-for-first-time-as-tariff-trade-upends-market)

[2] Bloomberg - “Copper Poised for Best Year Since 2009 After December Surge” (https://www.bloomberg.com/news/articles/2025-12-24/copper-set-for-best-year-since-2009-after-december-surge)

[3] Forbes - “Copper, Gold And Silver Prices Are Up. Here’s Why.” (https://www.forbes.com/sites/martinacastellanos/2025/12/03/copper-gold-and-silver-prices-are-up-heres-why/)

[4] Bloomberg - “Silver rises to record, gold near all-time high as risks persist” (https://www.bloomberg.com/news/articles/2025-12-25/silver-rises-to-record-gold-near-all-time-high-as-risks-persist)

[7] Bloomberg - “Copper Rallies to Record Near $13,000 in London After UK Holiday” (2025-12-29)

[8] Yahoo Finance (HK) - Citigroup Research Report: Raises Jiangxi Copper’s Target Price (https://hk.finance.yahoo.com/news/花旗升江銅00358-hk-目標價至39-023037558.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.