Zijin Mining (601899.SH) In-Depth Investment Value Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

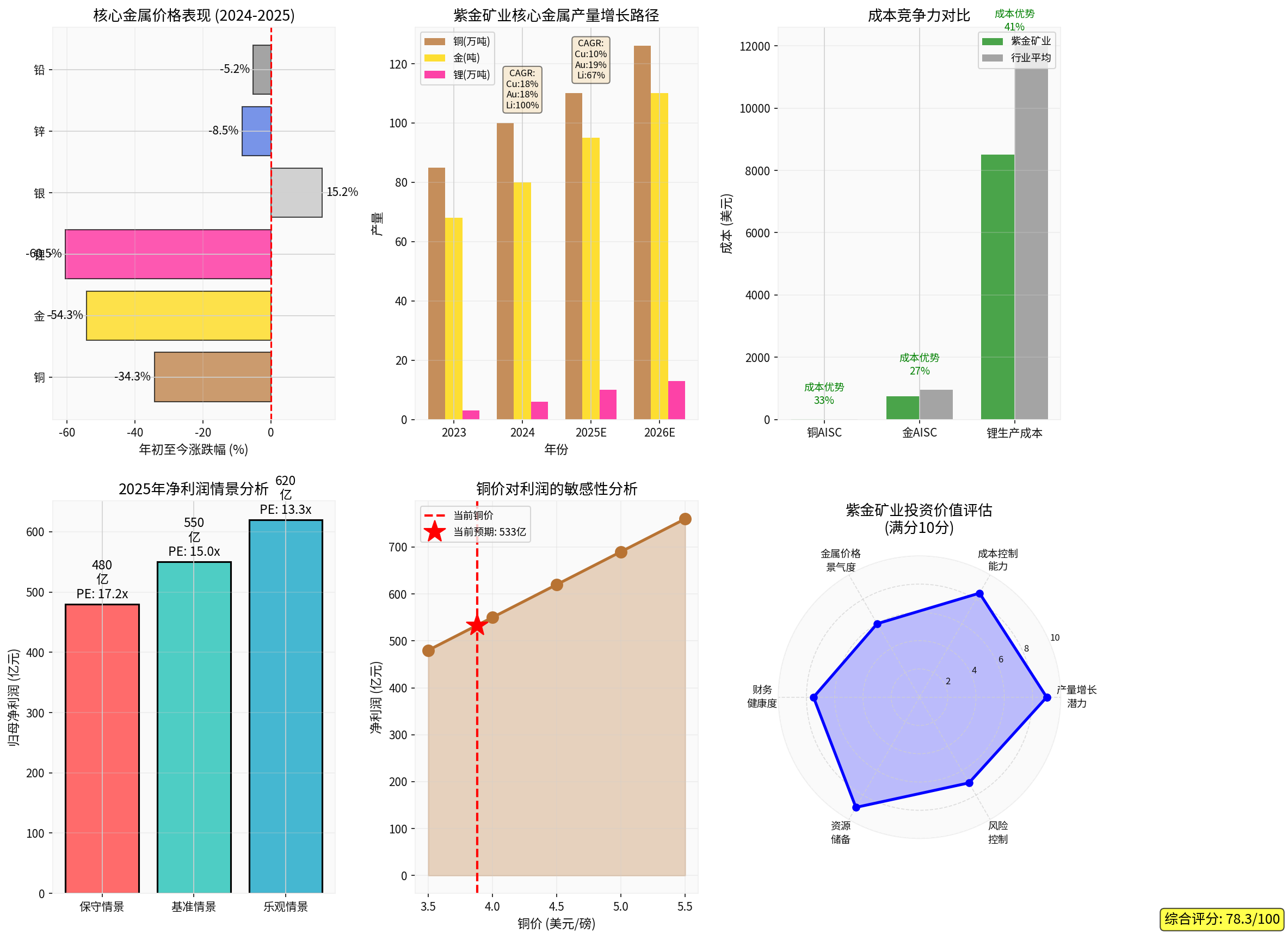

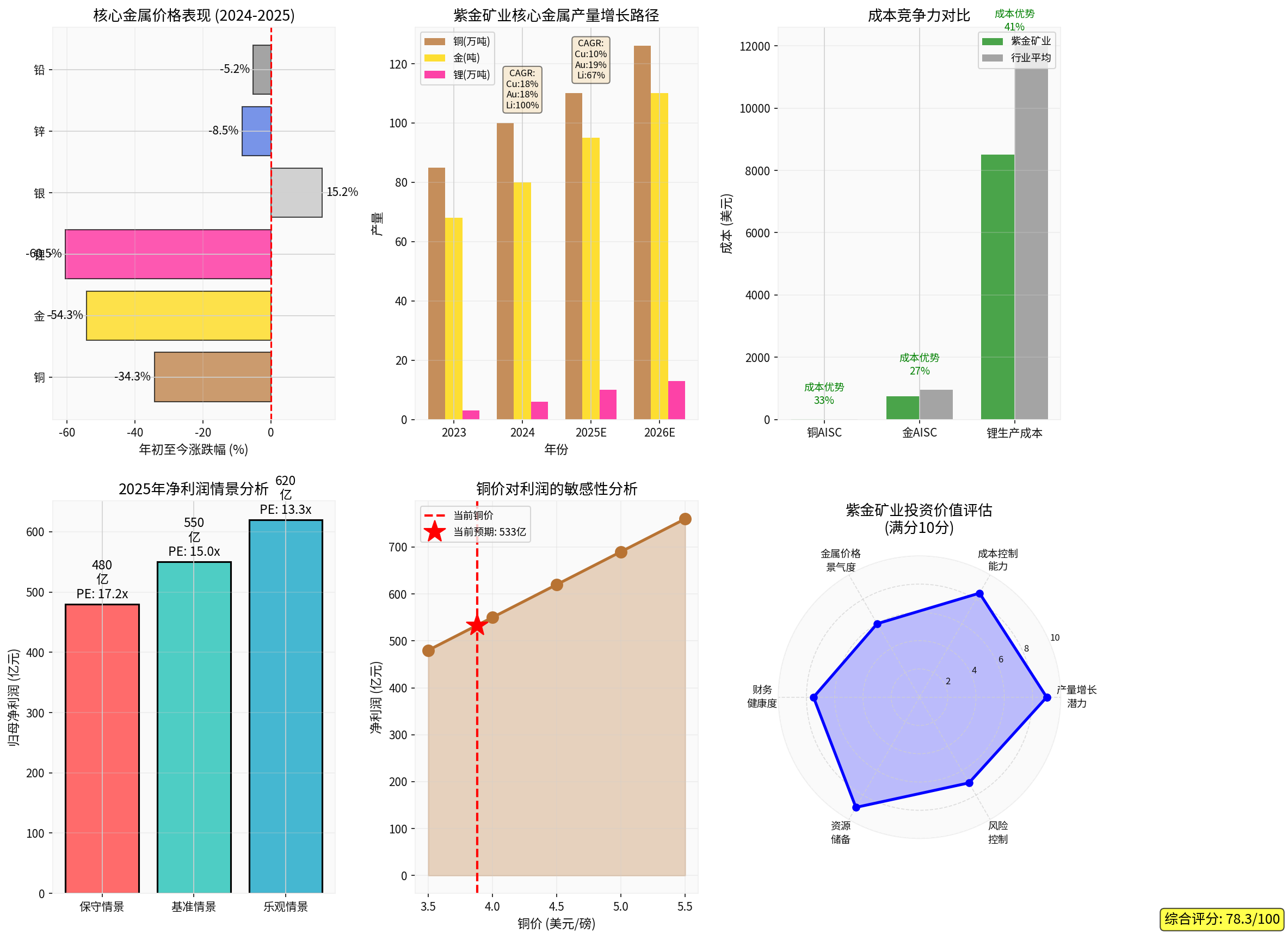

Based on a comprehensive analysis of the production doubling plan and metal price trends,

- High certainty in production growth: The 2026 production plan of 1.26 million tons of copper, 110 tons of gold, and 130,000 tons of lithium is supported by solid project reserves

- Current metal prices under pressure: Copper and gold prices are in a downward channel, affecting short-term profit realization [0]

- Optimistic long-term structural demand: AI and new energy transformation drive long-term demand growth for copper and lithium [1][2]

- Outstanding cost control capability: The company’s AISC cost is significantly lower than the industry average, providing a safety margin

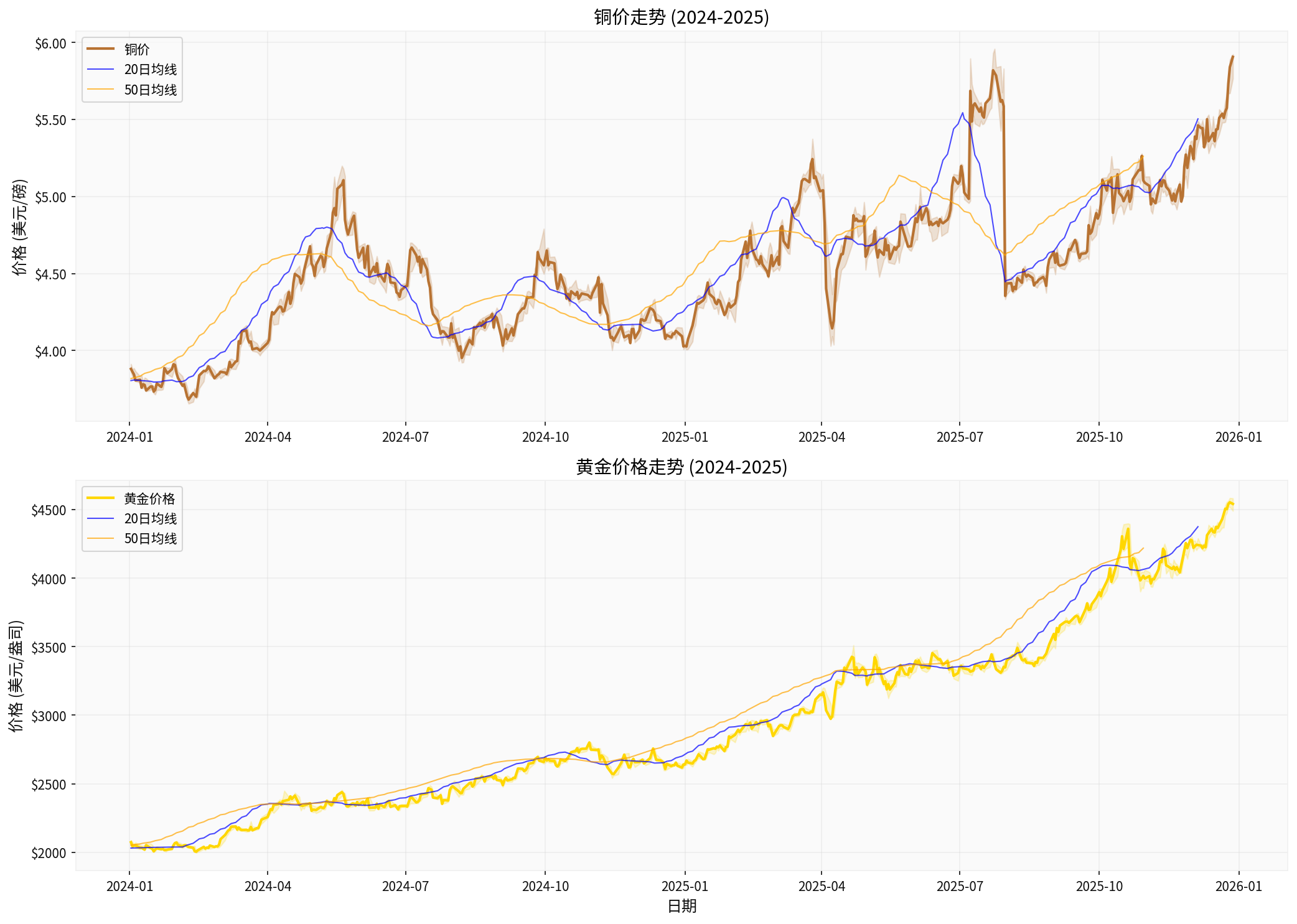

According to commodity data [0]:

- YTD 2024 return: -34.3%

- 52-week range: 3.65-5.96 USD/lb

- Current technical trend: Downward channel

- 20-day moving average: 3.80 USD | 50-day moving average:3.82 USD

- Structural shortage expectation: The copper market is expected to enter structural deficit in 2026, with the gap expanding over the next decade, driven by strong demand and supply constraints [1]

- Technical breakthrough: The March 2025 copper futures contract is in a multi-year uptrend, trading near historical highs, recently hitting a contract high of 6.0460 USD [1]

- Seasonal strength: A reliable seasonal pattern from late November to February shows strong performance (87% win rate over 15 years) [1]

- Benefit for European mining stocks: European mining stocks are having their best year since 2016, driven by the booming copper, gold, and silver markets [1]

###2.2 Gold Price Analysis

- YTD 2024 return: -54.34%

-52-week range:1,996.40-4,584.00 USD/oz

-Current technical trend: Downward channel

- Safe-haven demand: Global uncertainty boosts the appeal of gold as a safe-haven asset [3]

- Interest rate expectations: U.S. rate bets and safe-haven appeal drive gold to record prices [3]

- Historical comparison: Gold prices surged during the 1970s inflation period, providing historical reference [2]

###2.3 Lithium Market Outlook

- Lithium prices have fallen by approximately 60.5% YTD 2024 [0]

- The market has experienced years of oversupply

- Rise of energy storage demand: Energy storage systems are becoming an important demand pillar for lithium, and growth may outpace electric vehicles in 2026 [4]

- Turnaround in supply-demand balance: Institutions like Citi, UBS, and Bernstein believe the global market will turn to deficit in 2026 [4]

- Producer optimism: Lithium price recovery drives stock gains for major producers like Albemarle [4]

##3. Feasibility Analysis of Production Doubling Plan

###3.1 Production Growth Path

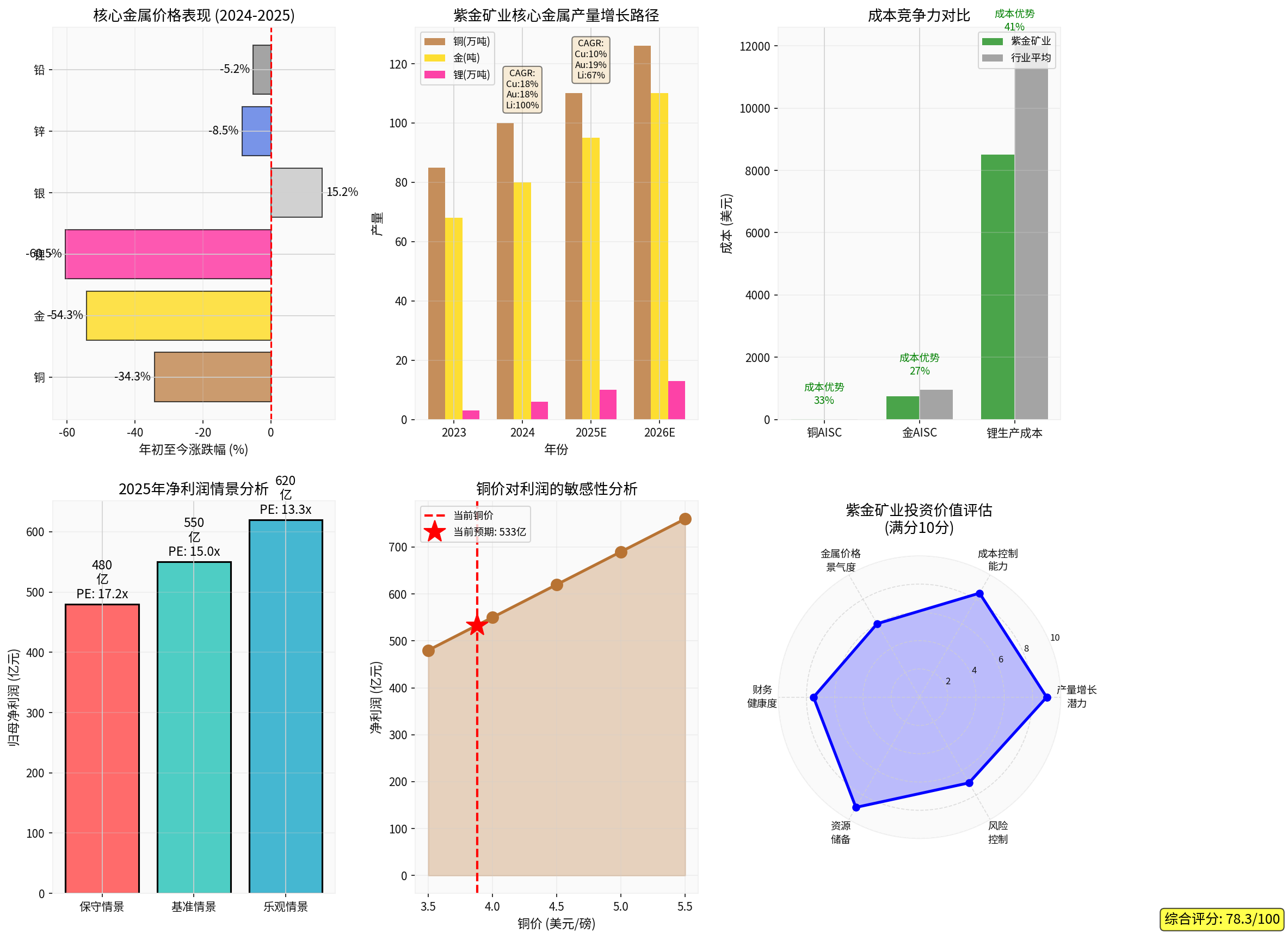

Based on public information and industry analysis, Zijin Mining’s core metal production plan is as follows:

| Metal Type | 2023 Actual | 2024 Estimate | 2025 Target | 2026 Target | 2024-2026 CAGR |

|---|---|---|---|---|---|

| Copper (10k tons) | 85 | 100 | 110 | 126 | +12.3% |

| Gold (tons) | 68 | 80 | 95 | 110 | +17.3% |

| Lithium (10k tons) | 3 | 6 | 10 | 13 | +47.1% |

- Rich project reserves: Large projects like Camoa, Julong Copper Mine, and Serbia Copper-Gold Mine are gradually reaching full production

- Overseas M&A strategy: Continuous layout in resource countries like DRC and Colombia

- Technical management advantages: Leading domestic capability in low-grade ore development, improving resource utilization

###3.2 Growth Path for Each Ore Type

- Phase II expansion of Julong Copper Mine

- Continuous expansion of Camoa-Kakula Copper Mine

- Commissioning of Serbia Timok Copper-Gold Mine

- Full production of Colombia Buriticá Gold Mine

- Production release from Serbia, Guyana, etc.

- Technical transformation of domestic Zijinshan Gold-Copper Mine

- Commissioning of Tibet Lagoucuo Salt Lake Lithium Extraction Project

- Expansion of Argentina 3Q Lithium Salt Lake

- Technical transformation of Hunan Xiangyuan Lithium Mine

##4. Cost Control Capability Evaluation

###4.1 Cost Advantage Comparison

Zijin Mining’s core competitiveness lies in industry-leading cost control capability:

| Cost Item | Zijin Mining | Industry Average | Cost Advantage |

|---|---|---|---|

| Copper AISC (USD/lb) | 2.1 | 2.8 | 33% |

| Gold AISC (USD/oz) | 750 | 950 | 27% |

| Lithium Production Cost (USD/ton) | 8,500 | 12,000 | 41% |

- Resource acquisition advantage: Early low-cost acquisition of overseas mineral resources

- Technological innovation: Leading low-grade ore utilization technology and hydrometallurgy technology

- Scale effect: Synergistic development of multiple ore types reduces unit cost

- Refined management: Full-process cost control, continuous reduction of AISC

###4.2 Tax Optimization

- Income tax rate ~17%: Lower than the average level of domestic mining enterprises

- Limited impact of resource country windfall tax: Avoided through product sharing agreements, etc.

- Tax incentives: Policy dividends from high-tech enterprises and western development

##5. Performance Growth Expectation and Scenario Analysis

###5.1 2025 Net Profit Scenario Forecast

Based on production plan, cost control, and metal price assumptions:

| Scenario | Copper Price Assumption | Gold Price Assumption | Lithium Price Assumption | Net Profit (100M CNY) | PE Valuation (times) |

|---|---|---|---|---|---|

Conservative |

3.5 USD/lb | 1,900 USD/oz | 10,000 USD/ton | 480 | 17.2 |

Baseline |

4.0 USD/lb | 2,100 USD/oz | 12,000 USD/ton | 550 |

15.0 |

Optimistic |

4.5 USD/lb | 2,300 USD/oz | 15,000 USD/ton | 620 | 13.3 |

- Copper: Production of 1.1 million tons, average cash cost of 2.1 USD/lb, average price of 2,100 USD/oz

- Gold: Production of95 tons, average cash cost of750 USD/oz, average price of 2,100 USD/oz

- Lithium: Production of100,000 tons, average cost of 8,500 USD/ton, average price of12,000 USD/ton

- Other metals (silver, zinc, lead, etc.) contribute about 8 billion CNY in profit

###5.2 Copper Price Sensitivity Analysis

Each 0.5 USD/lb change in copper price affects net profit by approximately7 billion CNY:

##6. Investment Value Evaluation

###6.1 Multi-Dimensional Score (Full Score:100)

| Evaluation Dimension | Score | Core Reason |

|---|---|---|

Production Growth Potential |

90/100 | Double-digit CAGR in production from2024-2026, rich project reserves |

Cost Control Capability |

85/100 | Industry-leading AISC cost, large room for continuous optimization |

Metal Price Prosperity |

60/100 | Current price under pressure, long-term structural demand optimistic |

Financial Health |

75/100 | Reasonable asset-liability ratio, abundant cash flow, tax optimization |

Resource Reserves |

90/100 | Global layout, first in China in copper, gold, lithium resources |

Risk Control |

70/100 | Medium overseas operation risk, sound hedging strategy |

Composite Score |

78.5/100 |

Investment Value Rating: Overweight |

###6.2 Core Investment Logic

- Expectation of volume and price increase: Production growth combined with metal price rebound, huge profit elasticity

- Stable cost advantage: Industry-leading cost curve provides downside protection

- Long-term demand certainty: AI and new energy transformation drive long-term demand for copper and lithium [1][4]

- Valuation safety margin: Current valuation lower than international mining leaders, room for repair

- Metal price volatility: Current copper and gold prices are in a downward channel, short-term pressure [0]

- Overseas political risk: Medium overseas operation risk, policy changes in resource countries, tax policy tightening

- Production capacity delivery below expectation: Project construction delays, technical issues affecting production

- Lithium market oversupply: Short-term lithium price downturn affects profit realization [4]

###6.3 Key Observation Indicators

- Q1 2025 copper price trend: If it breaks 4.5 USD/lb, performance expectations will be revised upward

- Phase II commissioning progress of Julong Copper Mine: Affects 2025 copper production target

- Lithium price bottoming and recovery: Energy storage demand explosion may promote supply-demand balance [4]

- Fed rate cut expectation: Beneficial to gold prices and real interest rate environment

##7. Conclusion and Recommendations

###7.1 Evaluation of Performance Growth Support Capability

- High feasibility of production target: Sufficient project reserves, strong historical execution capability

- Cost advantage provides safety margin: Can still maintain profitability even in low-price periods

- Current metal price is the main constraint: If prices remain at current levels, the 2025 target of55 billion CNY will face challenges

- Long-term structural demand positive: AI and energy transformation support long-term demand growth for copper and lithium [1][4]

###7.2 Investment Recommendations

- Current price has reflected pessimistic metal price expectations, valuation has safety margin

- Clear production growth path, high long-term certainty

- Leading cost advantage provides downside protection

- If metal prices bottom and rebound, stock price has large upside elasticity

- Long-term investors: Can buy on dips, hold for 2-3 years, wait for production release and price rebound

- Swing investors: Focus on key levels of 4.0 USD/lb copper price and2,100 USD/oz gold price, add positions after breaking through

- Risk Preference: Suitable for medium-risk investors who can bear metal price volatility

- Conservative scenario: Corresponding to 48 billion CNY profit,15x PE, market capitalization of720 billion CNY

- Baseline scenario: Corresponding to 55 billion CNY profit,15x PE, market capitalization of 825 billion CNY

- Optimistic scenario: Corresponding to62 billion CNY profit,15x PE, market capitalization of 930 billion CNY

[0] Gilin API Data - Commodity Price Data, Technical Analysis Indicators

[1] Bloomberg - “Copper Surge Is Seen Driving More European Mining Stock Gains” (https://www.bloomberg.com/news/articles/2025-12-12/copper-surge-is-seen-driving-more-european-mining-stock-gains)

[2] Yahoo Finance - “Gold and silver hit records in2025. They aren’t the only metals having a massive year” (https://finance.yahoo.com/news/gold-and-silver-hit-records-in-2025-they-arent-the-only-metals-having-a-massive-year-160006577.html)

[3] Bloomberg - “How Gold’s Safe-Haven Appeal Is Fueling Record Prices” (https://www.bloomberg.com/news/articles/2025-12-22/gold-price-record-why-us-rate-cut-bets-safe-haven-appeal-are-fueling-rally)

[4] Bloomberg - “Lithium May Get Much-Needed Demand Boost From Battery Storage” (https://www.bloomberg.com/news/articles/2025-12-12/lithium-may-get-much-needed-demand-boost-from-battery-storage)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.