Analysis of Xiaomi's Business Boundary, Valuation Logic and Long-Term Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The following is a systematic analysis focusing on three issues: business boundary, valuation logic, and long-term value.

-

From a “mobile phone company” to the ecosystem boundary of “phone × AIoT + smart car”. The financial reporting scope has transitioned from the original “smartphone + IoT + internet” to “phone × AIoT” and “smart electric vehicles and other innovative businesses”, forming four major segments: smartphone, IoT and consumer lifestyle products, internet services, and smart electric vehicles and AI-related innovative businesses [1].

-

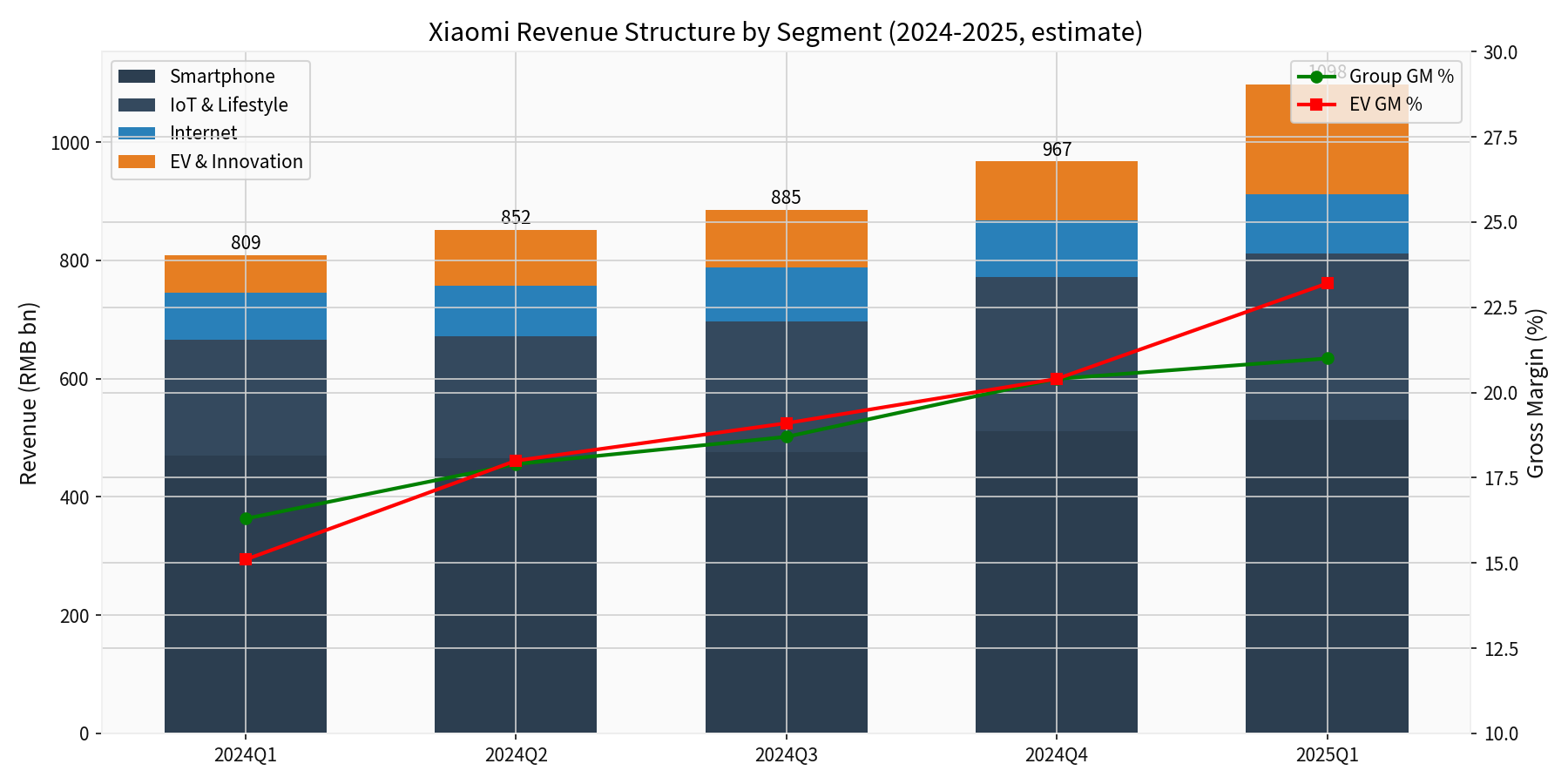

Rapid evolution of revenue structure (illustrative):

- Smartphone: Relatively stable in 2024-2025, with market share in the 4000-5000 yuan price segment in China rising to first place; high-endization has significantly driven ASP and brand premium [2][3].

- IoT and large home appliances: Revenue grew from approximately 798 billion yuan in 2022 to over 1350 billion yuan in 2025, covering categories such as home appliances, wearables, and tablets, serving as an important support for “sticky revenue and cash flow” [2].

- Internet services: Maintained high gross margin (about 70%+) and user scale growth; Q1 2025 revenue reached 91 billion yuan, with 719 million global MAUs and 181 million MAUs in mainland China [4].

- Smart electric vehicles: Delivered 137,000 units in 2024 with revenue of approximately 328 billion yuan; target 350,000 units in 2025 with revenue expected to approach/exceed 800-1000 billion yuan; gross margin rose from 18.5% in full-year 2024 to 20.4% in Q4, further increasing to 23.2% in Q1 2025, with continuous narrowing of losses (operating loss of about 5 billion yuan in Q1) [5][6].

- Scenario synergy: The three ends of phone, car, and home form an integrated “human-vehicle-home” closed loop, connected via accounts, AIoT platform, and car OS, enhancing user LTV; however, this also brings multi-dimensional challenges such as organizational complexity, channel and SKU management, and brand positioning.

-

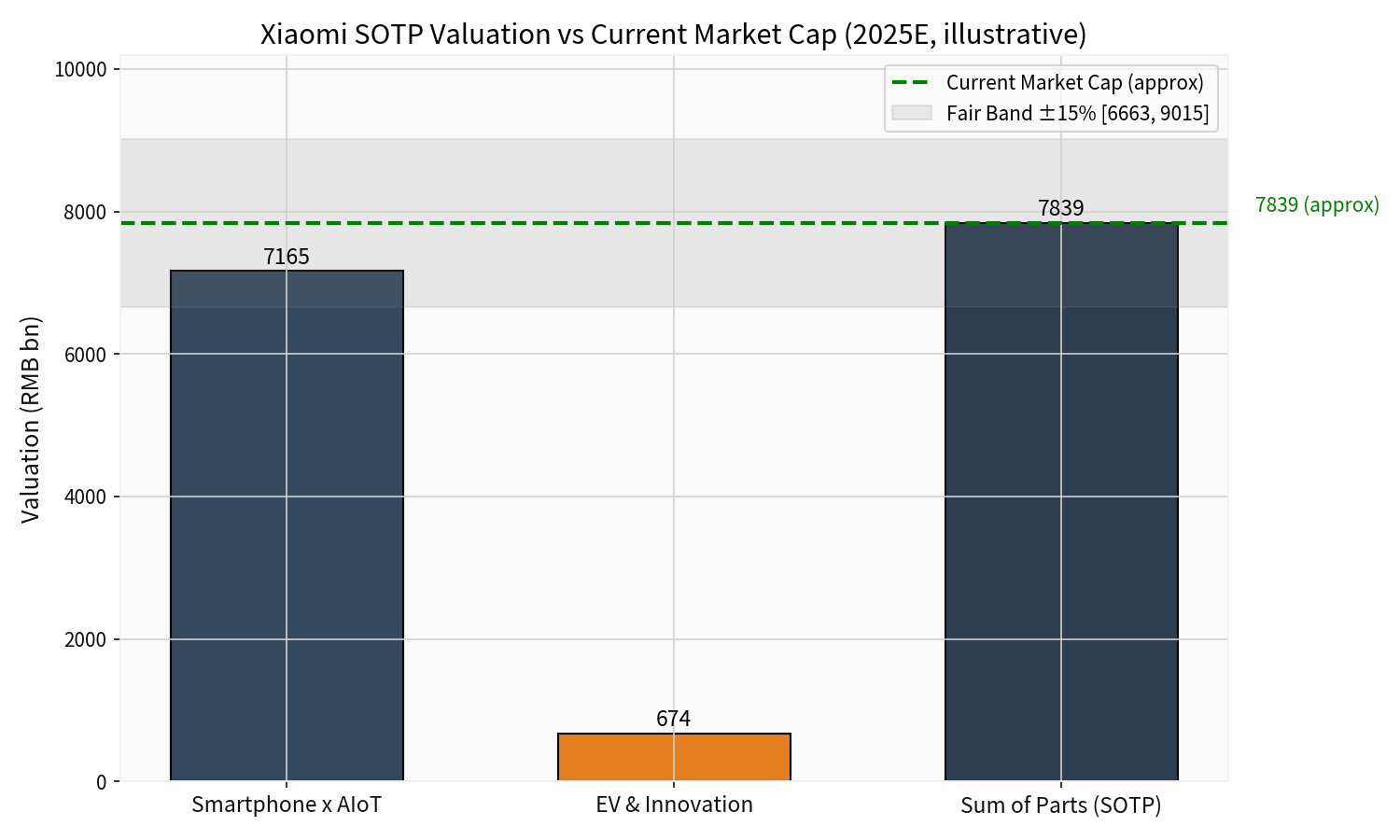

Early valuation as a “hardware company” mainly referenced smartphone shipments, global market share, and internet service monetization, with a relatively converged PE center. As automotive and other innovative businesses scale up, the market gradually adopts the “SOTP (Sum of the Parts)” and “PS+PE hybrid” methods for revaluation [7][9].

-

Example of SOTP valuation method (2025E, RMB denomination):

- Phone × AIoT: Adjusted net profit excluding automotive business is approximately 332 billion yuan, given a 22x PE ratio, the valuation is about 7165 billion yuan.

- Smart electric vehicles and other innovative businesses: Revenue is approximately 728 billion yuan, given a 0.9x PS ratio, the valuation is about 674 billion yuan.

- Total target market capitalization is approximately 7839 billion yuan (about 8475 billion Hong Kong dollars), corresponding to a target price of approximately 33.9 Hong Kong dollars, with about 21% upside potential relative to current levels (based on the broker report date) [9].

-

Coexistence of diversification valuation discounts and premiums:

- Discount factors: Hardware gross margin is highly affected by industry cycles; automotive capital expenditure is high with significant profit volatility; organizational complexity increases governance discounts.

- Premium factors: IoT ecosystem and internet services form a “hardware+software+subscription” stickiness premium; high-endization and self-developed AIOS/3nm SOC build technical premiums; scale and channel efficiency are higher than traditional automakers, with faster profit margin climbing than peers (e.g., automotive gross margin quickly rising to over 20%) [5][6].

-

Market reference: At the start of 2025, Xiaomi’s market capitalization exceeded one trillion Hong Kong dollars, ranking third among Hong Kong-listed internet companies after Tencent and Alibaba, reflecting the revaluation logic shift from “hardware company” to “hardcore tech + automotive ecosystem” [2].

-

Supporting factors:

- Cash flow and user base: Phones and IoT form a stable cash flow and user foundation; Q1 2025 revenue reached 1113 billion yuan (YoY +47.4%), R&D investment was 67 billion yuan (YoY +30.1%), R&D personnel accounted for nearly 47.7%, and patents exceeded 43,000 [4].

- High-endization and product strength: High-endization is the company’s emphasized “only way forward”; market share in the 4000-5000 yuan price segment in China ranks first; SU7/YU7 form a hit product sequence, with gross margin rising rapidly, expected to approach/achieve break-even in 2025 [2][5][6].

- Ecosystem synergy and moat: Integrated “human-vehicle-home” closed loop and self-developed AIOS build a “scenario + data + service” moat; new retail channel efficiency is 2-3 times that of traditional automakers, helping optimize cost structure and user experience [5].

- Industry position and space: Amid the trend of increasing penetration of smart electric vehicles and L3 autonomous driving, Xiaomi enters the market with a “billion-level 3C user base and marketing funnel”; short-term sales are production-driven, with considerable room for scale expansion and model lineup expansion in the medium term [9].

-

Risks and uncertainties:

- Smartphone industry cyclicality: Global smartphone growth slows, competition intensifies; uncertainty exists whether high-endization can continuously improve profit margins and market share.

- Automotive business volatility: Capacity ramp-up, supply chain, price wars, and subsidy withdrawal have significant impacts on gross margin and profitability timing; profit path is highly dependent on scale effect and cost reduction rhythm [5][6].

- Organizational and governance complexity: Multi-business parallelism places higher requirements on cross-departmental collaboration, capital allocation, and strategic focus; excessive diversification may分散 resources and drag down ROE.

- Valuation revaluation rhythm: Market acceptance of the shift from “hardware company → tech + automotive company” is uneven, leading to increased short-term valuation volatility.

-

Comprehensive judgment:

- Short to medium term (1-3 years): With automotive business ramp-up, deepening high-endization, and expansion of high-margin IoT categories, there is significant performance elasticity and valuation repair space; current market capitalization is near the center of the “reasonable valuation range” [9].

- Long term (3-5 years): If it can achieve the “human-vehicle-home” ecosystem closed loop, maintain R&D investment accounting for over 30% and implement key technologies such as self-developed 3nm SOC, while maintaining healthy cash flow and improving ROIC, Xiaomi has the potential to evolve into a “global hardcore tech platform”, which is expected to support its long-term value as a “clear investment target”. However, this premise requires effective management of business boundaries, capital expenditure, and organizational complexity.

-

Key verification indicators:

- Smartphone: Global shipments and market share, ASP, high-end model proportion, and inventory turnover.

- IoT: Growth rate of large home appliances, tablets/wearables, SKU efficiency, and channel inventory health.

- Automotive: Delivery volume and capacity utilization, gross margin trend, single-vehicle loss narrowing progress, orders and reputation of new models (e.g., YU7).

- Profit quality: Adjusted net profit, operating cash flow, free cash flow, ROE/ROIC.

- R&D and patents: Progress of AIOS/autonomous driving/chips, patent authorization, and standard discourse power.

-

Valuation and position strategy:

- Adopt “segment scenario valuation”: Three valuation tiers - conservative (automotive underperformance, high-endization受阻), neutral (on-schedule ramp-up), and optimistic (hit products + global expansion).

- Risk hedging: Diversify allocation to “pure new energy vehicle players” and “pure consumer electronics” to reduce the impact of single industry cycles and valuation volatility on the portfolio.

[0] Jinling API Data

[1] Securities Times - 《Trillion-Yuan Xiaomi: What Drives Its New Valuation Paradigm》 https://stcn.com/article/detail/1526946.html

[2] Ibid.

[3] Shenwan Hongyuan Research Report - 《Xiaomi Group-W (01810)》 https://pdf.dfcfw.com/pdf/H3_AP202411171640927776_1.pdf

[4] International Electronic Business News - 《Xiaomi’s Q1 Revenue Exceeds 100 Billion Yuan! Lei Jun Has Won Big!》 https://www.esmchina.com/news/13108.html

[5] Caixin Society - 《Q1 Gross Margin 23.2% Xiaomi Auto Management: Reservation Users for YU7 Are Three Times That of SU7》 https://cls.cn/detail/2042463

[6] ChinaVenture - 《Xiaomi’s “Strongest Annual Report in History”: Our Perspective》 https://www.chinaventure.com.cn/news/78-20250319-385541.html

[7] Xueqiu - 《A Simple Analysis of Xiaomi’s Current Valuation》 https://xueqiu.com/5472332030/358202731

[8] SPDB International - 《New Energy Vehicle Industry 2025 Outlook: Green Energy Wave, Overseas Navigation, Smart Driving Future》 https://www.spdbi.com/getfile/index/action/images/name/新能源汽车行业2025年展望:绿能浪潮、出海领航、智驾未来_浦银国际研究.pdf

[9] Soochow Securities - 《2025 Investment Strategy for Automotive Intelligence》 https://pdf.dfcfw.com/pdf/H3_AP202412081641219266_1.pdf

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.