Fed Rate Cut Expectations: Impact on Asian Equities and Precious Metals

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

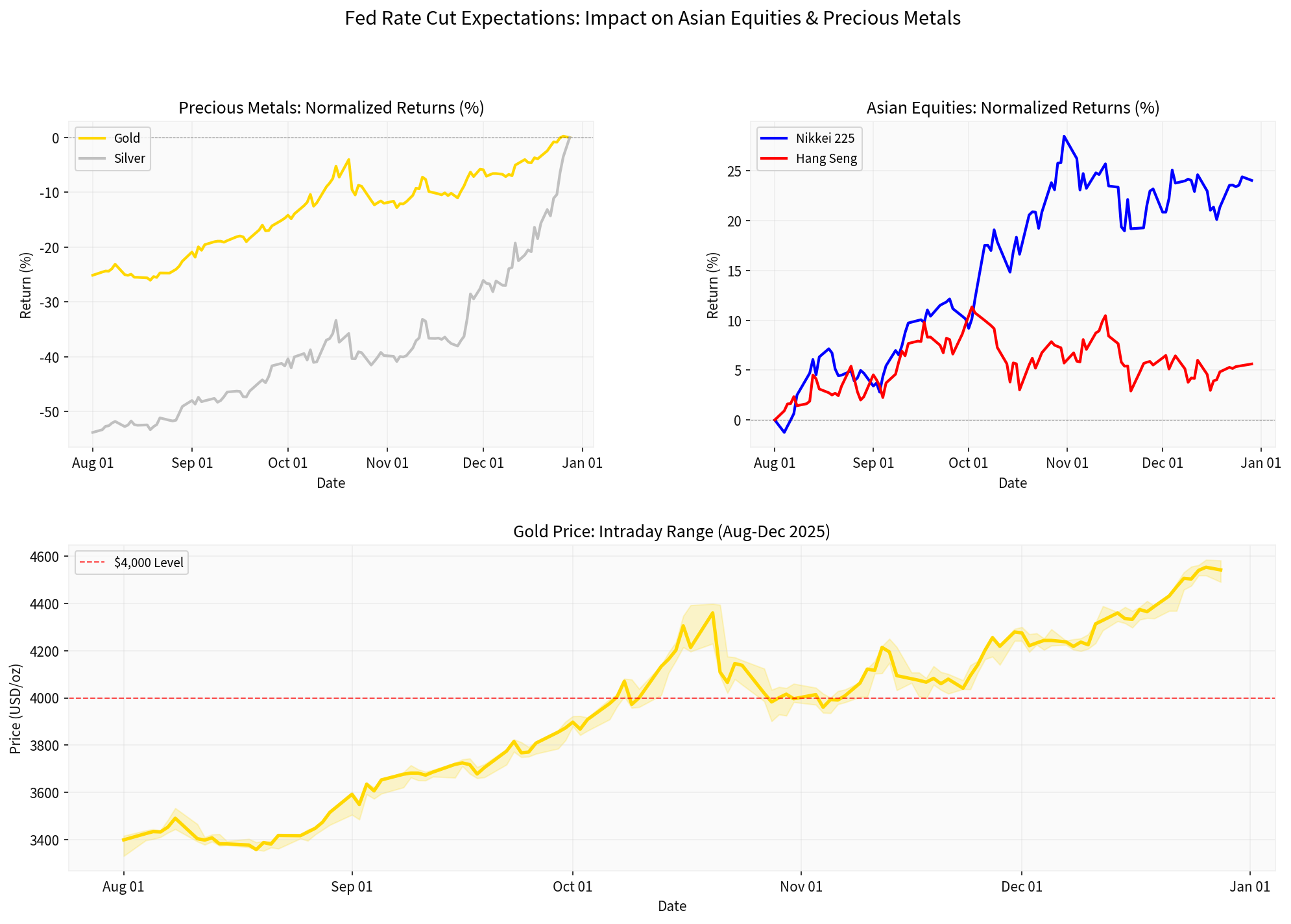

Based on comprehensive market data and current policy expectations, here is a detailed analysis of how Federal Reserve rate cut expectations are influencing asset valuations across Asian markets and precious metals.

| Asset Class | Current Level | Period High | Q4 Return | Daily Volatility |

|---|---|---|---|---|

Gold |

$4,014 | $4,584 | -11.61% | 0.91% |

Silver |

$48.05 | $82.67 | -39.94% | 2.49% |

Japan Nikkei 225 |

50,604 | N/A | -1.74% | 1.35% |

Hong Kong Hang Seng |

25,885 | N/A | -1.05% | 1.06% |

China Shanghai Composite |

3,976 | N/A | -0.02% | N/A |

Data: Nov-Dec 2025 period [0]

- 90% probabilitythe Fed will hold rates steady at the next FOMC meeting[1]

- Traders are betting on one quarter-point cut by mid-2026and potentially another later in the year[1]

- Fed has delivered three consecutive rate cuts in 2025, with markets highly anticipating each move (up to 90% probability priced-in prior to meetings)[2]

- The Fed’s final 2025 rate cut catalyzed gold’s surge above $4,300/oz[2]

- US Q3 GDP grew at a robust 4.3% annualized rate, suggesting the economy remains resilient despite falling consumer confidence[1]

- Strong economic data has been trimming rate-cut expectations, creating a delicate balance between growth and accommodation needs[1]

- Lower US rates reduce the discount rate applied to future cash flows, supporting higher equity valuations

- Asian exporters benefit from improved US consumer spendingsupported by lower rates

- Technology and growth stocks see the greatest valuation expansiondue to their longer-duration cash flows

- Fed rate cuts typically weaken the US dollar, making Asian exports more competitive

- USD weakeningimproves the translation of overseas earnings back to local currencies for Asian multinationals

- However, this is being partially offset by the Bank of Japan’s rate hike expectations(to 0.75% by December 2025)[3], which supports the yen and creates competitive headwinds for Japanese exporters

- Lower US yields historically drive capital flows toward higher-yielding Asian markets

- Asian dividend stocksare gaining attention, with well-covered payouts (29-43% payout ratios, 3.14% yields)[4]

- Japan remains attractive despite BOJ tightening as even after hikes, rates would sit at just 0.75% versus 3.75% in the US[3], maintaining yield differentials favorable to carry trades

- Asian markets are showing resilience with lower volatilitycompared to precious metals (0.91-2.49% for metals vs. 1.06-1.35% for equities)[0]

- Recent modest declines (-0.02% to -1.74%) reflect profit-taking rather than structural concerns

- Valuations remain supported by the anticipation of continued Fed accommodationin 2026

- Rate cuts reduce the opportunity cost of holding non-yielding assetslike gold

- Lower real yields make precious metals more attractive relative to bonds

- This was evident as gold surged to record highs above $4,300/ozafter the Fed’s final 2025 rate cut[2]

- Geopolitical tensions (Venezuela blockade, US conflicts)[2] have driven safe-haven buying

- Gold and silver climbed to fresh records alongside geopolitical risk escalation[2]

- This creates a dual support mechanism: monetary accommodation + risk hedging

- Central banks continue diversifying reserves away from the US dollar, with gold as a primary alternative

- Expectations of further Fed rate cuts in 2026reinforce this de-dollarization trend[1]

- Long-term structural demand supports higher price floors

- Gold’s record high of $4,584represents the peak of rate-cut anticipation[0]

- Recent pullback (-11.61% in Q4)reflects profit-taking as some rate cuts become priced-in

- Silver’s extreme volatility(down 40% from Q4 start, hitting $82.67 high)[0] reflects its dual role as monetary and industrial metal

- Daily volatility analysisshows silver at 2.49% vs. gold at 0.91%, indicating silver’s higher risk/reward profile[0]

- Lower Fed rates typically encourage risk-on behavior, benefiting equities over defensive assets

- However, the current environment shows a decoupling pattern: commodities peaked earlier while stocks show more stability[0]

- This suggests markets are transitioning from speculative positioning to fundamental valuation

- Japanese yen carry traderemains a factor, with investors borrowing in low-yielding yen to invest in higher-yielding assets[3]

- BOJ rate hike to 0.75% would be the highest since 1995, but still far below US rates[3]

- This maintains structural support for risk assetsbut with reduced leverage

- US markets outperforming: S&P 500 +3.86%, NASDAQ +4.65%, Russell 2000 +7.43% (Nov 14 - Dec 26)[0]

- Asian markets lagging: -0.02% to -1.74% over similar period[0]

- This reflects regional growth differentialsand the stronger US dollar’s impact on emerging market capital flows

- One more 25bp Fed cut in mid-2026, with markets pricing this gradually

- Asian equities: Modest upside (5-10%) as earnings growth and lower discount rates support valuations

- Precious metals: Range-bound with upward bias ($3,800-$4,300 gold) as rate cut anticipation moderates

- Currency: Gradual USD weakening, supporting Asian exporters

- Two or more Fed cuts in 2026due to economic slowdown

- Asian equities: Strong upside (10-20%) as capital flows aggressively toward growth markets

- Precious metals: Breakout to new highs (gold $4,500+)

- Trigger: Weaker-than-expected US data, aggressive Fed easing, geopolitical escalation

- No further Fed cuts or rate hikesdue to sticky inflation

- Asian equities: Consolidation with potential downside (-5% to -15%)

- Precious metals: Profit-taking accelerates (gold retesting $3,500)

- Trigger: Stronger US data, inflation resurgence, risk aversion

- US Data Surprises: Stronger jobs/inflation could delay Fed cuts

- BOJ Policy: Faster Japanese tightening could trigger carry trade unwinding[3]

- Geopolitical Escalation: Venezuela tensions, Middle East conflicts could spike safe-haven demand[2]

- Chinese Economic Recovery: Slower rebound would weigh on regional exports

- US Dollar Strength: Persistent dollar strength would pressure emerging market valuations

- Overweight export beneficiaries(technology, autos, electronics) from weaker USD and stronger US demand

- Focus on quality dividend payerswith strong balance sheets to navigate volatility[4]

- Japanese markets: Monitor BOJ policy trajectory; gradual normalization should be manageable

- Chinese exposure: Selective approach focusing on policy beneficiaries and domestic consumption

- Strategic allocationto gold (5-10% of portfolio) as hedge against monetary uncertainty and geopolitical risk

- Silver trading opportunity: Higher volatility offers attractive entry points on dips for risk-tolerant investors

- Timing consideration: Wait for post-rate-cut consolidation before adding aggressively

- Diversification across regionsto mitigate currency and policy risk

- Hedging USD exposurefor international investors

- Staggered entryrather than all-in positioning given elevated volatility

Fed rate cut expectations are creating a

-

Asian equitiesare benefiting from valuation support through lower discount rates and improved export competitiveness, though gains are moderated by regional headwinds and the lag effects of policy transmission

-

Precious metalshave already priced in significant rate cut expectations, hitting record highs, and are now experiencing a period of consolidation and profit-taking

The current market reflects a

[0]

[1]

[2]

[3]

[4]

沪深两市成交额突破万亿的深度分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.