Luzhou Laojiao's Strategy and Valuation Analysis to Navigate the 2026 Baijiu Industry 'Critical Juncture'

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

Drivers of the ‘Critical Juncture’:In 2025, the baijiu industry was still bottoming out amid the pains of transitioning from ‘channel-driven’ to ‘consumer-driven’. The industry’s price system and order structure continued to be under pressure due to macro-control, strict alcohol bans, and contraction in official-use alcohol supply. By the end of 2025, many mainstream liquor companies quickly adjusted or filled gaps in young consumer scenarios. Industry insiders generally believe Q1 2026 will be the ‘critical juncture’ node—high-frequency government and business scenarios continue to wane, while self-consumption and self-pleasure scenarios have not fully taken hold. Consumption growth must be fueled by more extensive youth-oriented, low-alcohol, and digital approaches [1][2][3].

-

Baijiu Consumption Shifts from ‘Face’ to ‘Quality’:Consumer preferences have shifted from ‘high alcohol content + price’ to ‘low alcohol content + experience’. Low-alcohol, healthy, and multi-scenario liquors have become growth drivers. Live-streaming e-commerce, private domain traffic, and instant retail are regarded as new growth engines; innovative communication of cultural IP and emotional value has become an important means for brands to ‘win people’s hearts’ [1][2][3].

-

Alignment with the ‘Personal Baijiu Era’ Strategic Path:

- It has clearly positioned 2025 as the year of digitalization implementation, investing RMB 2.136 billion to build an intelligent packaging ‘lighthouse factory’ with an intelligent filling capacity of 15,000 bottles/hour, and promoting end-to-end digitalization from raw grain planting, brewing, packaging to distribution, achieving automation + digital transformation [5].

- Focusing on youth orientation, it has built cultural landmark experiences (poetry and wine conferences, immersive exhibitions) to strengthen Gen Z and post-30s generation’s cultural recognition of the traditional ‘originator of strong aroma’ [4]. At the same time, it actively expands low-alcohol and new liquor categories (craft beer, Chinese-style fruit wine, etc.) and extended derivatives, attempting to integrate baijiu into young consumers’ daily lives [6].

- Revenue from emerging channels increased by 27.55% YoY in H1 2025, with gross margin rising by 4.52 percentage points, indicating that digital and scenario-based marketing has begun to optimize channel efficiency and cost structure [4].

-

Evaluation of Strategies to Navigate the ‘Critical Juncture’:

- Scenario Replacement and ‘Spiritual Service’ Communication:As official use alcohol scenarios decline, Luzhou Laojiao strengthens emotional links with consumers through the concept of ‘spiritual service’ (e.g., poetry and wine cultural IP, emotional marketing resonating with young people), which helps transition from ‘face consumption’ to ‘quality and emotional resonance consumption’ [2][3][4].

- Low-Alcohol + Scenario Composite Strategy:Relying on low-alcohol products like 38-degree Guojiao 1573, combined with technological processes to ensure taste and stability, it enhances competitiveness in meeting young people’s demand for ‘light intoxication without drunkenness’, and continues to expand its share in the low-alcohol liquor market [4].

- Digitalization and Consumer Data:The digital system not only improves production efficiency but also enables precise product placement and scenario matching through private domain operations and data analysis, increasing penetration among new consumer groups [5].

-

Fundamental Strength:Market capitalization: RMB 173.18 billion (equivalent to USD 173.18 billion), TTM net profit margin: 42.11%, ROE:26.10%, current ratio:3.61, indicating solid cash flow and asset structure. TTM P/E:13.7x, P/B:3.49x, still attractive valuation [0].

-

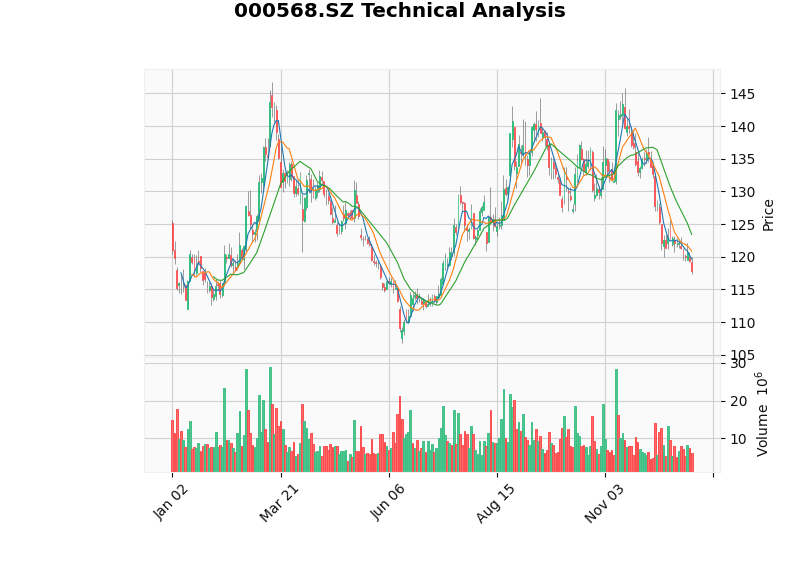

Technical and Capital Trends:2025 full-year stock price closed at $117.88, within the range of $116.60 support and $123.42 resistance; MACD did not issue a trend cross, KDJ/RSI indicated oversold opportunities, Beta:0.81, suggesting neutral to low risk appetite [0]. Relevant K-line chart link is as follows (system-generated):

Note: X-axis is 2025 dates, Y-axis is RMB stock price. The chart shows price oscillating between support/resistance levels, no significant volume increase, MACD indicates unconfirmed trend. Data source: Broker API Tool [0]. -

Valuation and DCF Results:DCF analysis shows the current stock price ($117.82) is significantly undervalued compared to the fair values of three scenarios—conservative: $194.81 (+65%), base: $250.05 (+112%), optimistic: $381.77 (+224%), WACC: ~9.9%, reflecting strong intrinsic value support under high net profit margin and stable cash flow [0].

-

Growth Engine Alignment with Expectations:

- Product end: Technical accumulation in low-alcohol products and diversified flavors matches the demand for ‘personal baijiu’ + ‘healthiness’.

- Channel and marketing: The combination of digitalization, private domain, and scenario-based activities provides touchpoints for future daily scenarios like self-consumption and gatherings, helping to fill the gap left by official consumption.

- Culture and brand: Poetry and wine culture, youth-oriented narratives, and emotional value communication strengthen resonance with post-80s/90s and even Gen Z, providing ‘spiritual service’.

-

Risks and Challenges:

- The industry as a whole is under ‘volume and price pressure’; if the evolution of ‘personal baijiu’ demand falls short of expectations, there is still downside risk to short-term bulk prices.

- Digitalization and low-alcohol strategies still need time to verify conversion efficiency and stable profitability, especially the need for careful balance between high-end brand positioning and youth orientation.

- If the ‘critical juncture’ phase in Q1 2026 is extended, product lines still relying on official consumption for high-end series will continue to be under pressure.

-

Recommendations:

- Monitor self-consumption + low-alcohol product shipments and channel inventory changes in Q1 2026; if emerging channel revenue maintains high growth, it indicates the ‘personal baijiu’ strategy is showing initial results.

- Based on DCF underlying valuation, if prices continue to consolidate around $120, it can be regarded as an undervalued zone; however, policy and industry credit risks need to be watched.

- Continue to pay attention to ROIC and gross margin changes of digitalization/scenario-based projects to ensure strategic transformation brings real profits.

[0] Jinling API Data (including company overview, real-time quotes, financial analysis, technical analysis, DCF valuation and annual stock price data)

[1] Hong Kong Commercial Daily - “Interpretation of China’s Liquor Industry 2025 Core Keywords and 2026 Outlook” (https://www.hkcd.com.hk/hkcdweb/content/2025/12/28/content_8732965.html)

[2] Securities Times - “‘Disappointed’ 2025: Baijiu Industry Explores Bottom in ‘Deep Water Zone’, Urgently Needs Value Reconstruction” (https://www.stcn.com/article/detail/3550135.html)

[3] 21st Century Business Herald - “Baijiu T9 Gathers in Yibin: Policy Opportunity Period Arrives, Shifting from Pursuing Growth to Seeking Value” (https://www.21jingji.com/article/20251220/herald/adeecbfaaa3751e97d2c540240947fdb.html)

[4] Caifuhao - “Luzhou Laojiao’s ‘Steady’ and ‘Practical’ Path: Building a Low-Alcohol Liquor Matrix to Activate Gen Z Market” (https://caifuhao.eastmoney.com/news/20251225084612997494440)

[5] Economic Reference News - “Q1-Q3 Performance Generally Declines, Baijiu Listed Companies Accelerate Digital Transformation to Break Through” (http://jjckb.xinhuanet.com/20251202/5ef3d6af35aa4f2d8aa118a81fe8c84a/c.html)

[6] China Finance Information Network - “000568 Luzhou Laojiao Investor Relations Management Information 20251226” (https://www.cfi.net.cn/p20251226003245.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.