Impact Assessment of North Korea's Missile Launch Activities on Northeast Asian Stock Markets and Defense Industry Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

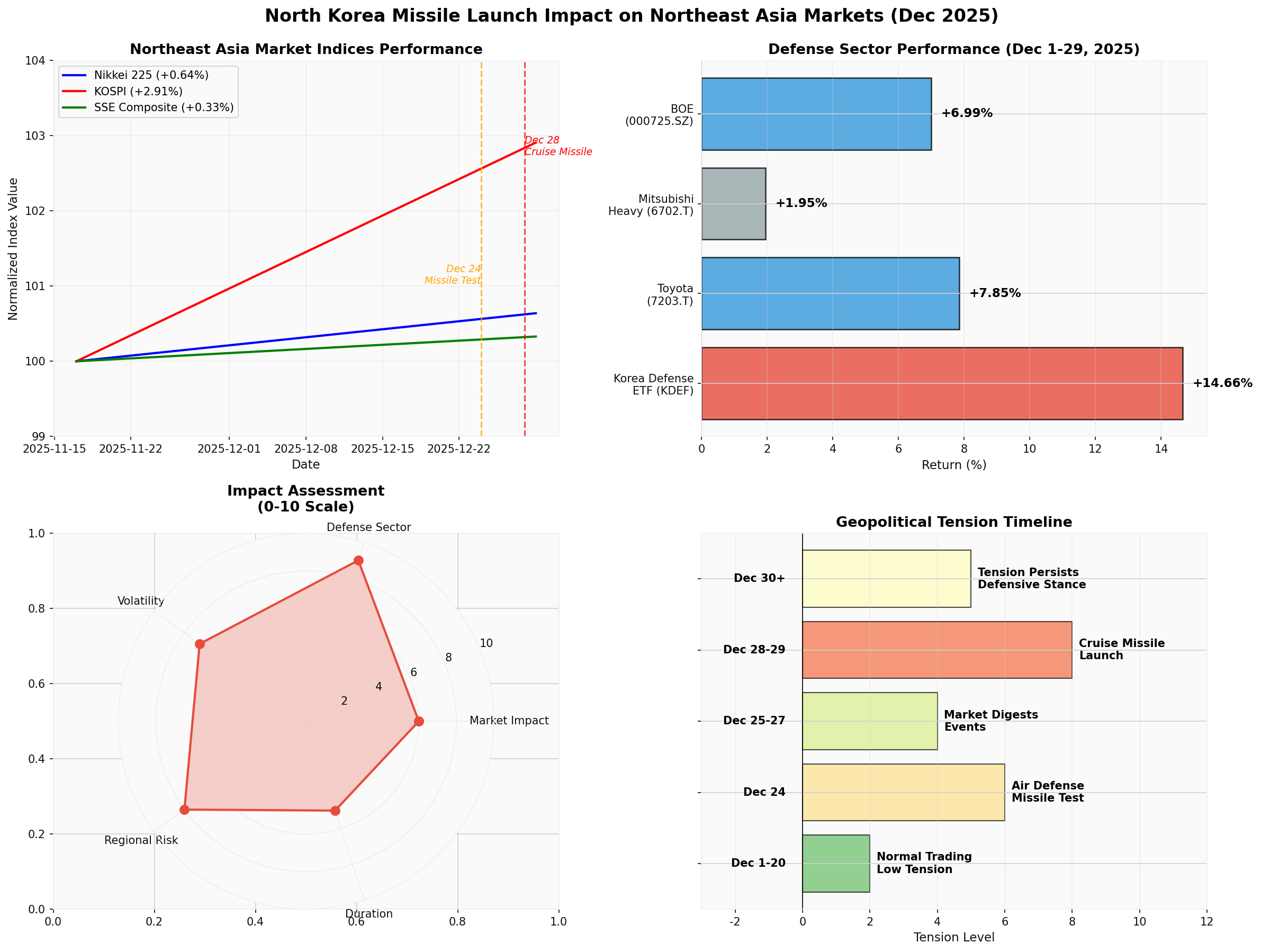

According to multiple international media reports, North Korea conducted two important missile test activities in late December 2025 [1, 2, 3]:

- December 24, 2025: North Korea test-fired a new high-altitude long-range air defense missile, accurately hitting a simulated high-altitude target 200 km away [2, 3]

- December 28-29, 2025: Kim Jong-un personally supervised the launch exercise of long-range strategic cruise missiles, which flew along the trajectory and hit the target [1]

These military actions occurred before North Korea’s upcoming 9th Workers’ Party Congress in early 2026 and are seen as important measures to demonstrate military strength [1].

According to market data, major Northeast Asian stock markets performed steadily overall from November 17 to December 29, 2025 [0]:

- Period performance: From 50,282.39 points to 50,603.61 points, +0.64%

- Volatility: 1.35%

- 20-day moving average: 50,200.36 points

- Period performance: From 4,078.57 points to 4,197.41 points, +2.91%

- Volatility: 1.57%

- 20-day moving average: 4,080.57 points

- Best performance, showing relative market resilience

- Period performance: From 3,962.44 points to 3,975.63 points, +0.33%

- Volatility: 0.69% (lowest)

- 20-day moving average: 3,902.91 points

- Overall market reaction was relatively mild, with all three indices maintaining an upward trend

- South Korea’s stock market had the largest increase (2.91%), possibly driven by the defense sector

- The market has gradually incorporated geopolitical risks into normalized expectations

- Volatility is within a controllable range, no panic selling occurred

The defense sector significantly outperformed the broader market in December [0]:

- South Korea Defense Industry ETF (KDEF): Surged+14.66%from December 1 to 29, rising from $39.57 to $45.37

- Volatility: 2.15%, higher than the market average

- Reflects strong investor confidence in South Korea’s defense industry

- Toyota Motor (7203.T): +7.85% (3,132 → 3,378 JPY)

- Mitsubishi Heavy Industries (6702.T): +1.95% (4,146 → 4,227 JPY)

- As defense contractors, relevant enterprises benefited from expected defense demand

- BOE A (000725.SZ): +6.99% (3.86 → 4.13 CNY)

- Shows that China’s defense industry chain was also boosted by geopolitical situations

Based on multi-dimensional analysis, the impact of North Korea’s missile launch activities is assessed as follows [7]:

| Impact Dimension | Assessment Grade (0-10 points) | Specific Performance |

|---|---|---|

Overall Market Impact |

6/10 |

Limited impact, market maintains resilience |

Defense Sector Boost |

9/10 |

Significantly drives defense stock上涨 |

Market Volatility |

7/10 |

Short-term volatility increases, controllable range |

Regional Risk Premium |

8/10 |

Geopolitical risk pricing rises |

Sustained Impact |

5/10 |

Short-term effect为主, long-term impact limited |

- Tensions on the Korean Peninsula usually prompt Northeast Asian countries to increase defense spending [7]

- Defense contractors receive more orders, and their stock prices outperform the broader market

- In 2025, major U.S. defense stocks rose significantly: RTX (+54%), GD (+32.3%), NOC (+23.6%) [7]

- After multiple similar events, the market has formed a “panic-adaptation-normalization”response model

- The initial event has a significant impact, and the marginal effect of subsequent similar events decreases

- Investors focus more on whether the event breaks the “red line” rather than the event itself

- Defense sector benefits → resource stocks under pressure → consumer sector relatively stable

- Capital flows from risky assets to safe-haven assets (gold, Japanese yen, etc.)

- Moderately allocate to defense stocks: Focus on major defense enterprises in South Korea, Japan, and China

- Utilize market volatility: Buy high-quality targets on dips during market panic

- Pay attention to foreign exchange hedging: Fluctuations in the Japanese yen and South Korean won may affect returns

- Focus on national defense modernization theme: Missile defense, space technology, autonomous systems [7]

- Balance risk exposure: Avoid over-concentration in a single geopolitically sensitive sector

- Track policy trends: Defense budget adjustments, military procurement contract signings

- Set stop-loss points, control the position of individual stocks

- Diversify investments to reduce concentrated geopolitical risks

- Keep cash positions to cope with sudden剧烈 market fluctuations

-

Impact Level: North Korea’s missile launches havelimited overall impacton Northeast Asian stock markets, butsignificantly boostthe defense industry sector

-

Market Resilience: Major stock markets in Northeast Asia have strong adaptability to geopolitical risks, with no systemic risks

-

Investment Opportunities: There are structural opportunities in the defense sector during geopolitical tensions, but short-term profit-taking pressure should be警惕

-

Continuous Attention: Military activities may continue before North Korea’s Workers’ Party Congress in early 2026, so close attention is recommended

-

Long-term Perspective: Geopolitical risks should be considered as a normalized factor in investment portfolios, rather than a temporary event driver

[0] Gilin API Data - Market Indices, Stock Prices, Financial Analysis Data

[1] DW - “North Korea tests long-range cruise missiles: state media” (December 29, 2025)

https://www.dw.com/en/north-korea-tests-long-range-cruise-missiles-state-media/a-75324531

[2] Al Jazeera - “North Korea’s Kim oversees test launch of long-range cruise missiles” (December 29, 2025)

https://www.aljazeera.com/news/2025/12/29/n-koreas-kim-oversees-test-launch-of-long-range-strategic-cruise

[3] U.S. News - “North Korea’s Kim Jong Un Oversees Cruise Missile Launches” (December 28, 2025)

https://www.usnews.com/news/world/articles/2025-12-28/north-koreas-kim-jong-un-oversees-long-range-strategic-cruise-missile-launching-drill-kcna-says

[4] China News Service - “North Korea Test-Fires New Air Defense Missile to Accurately Hit Simulated High-Altitude Target” (December 25, 2025)

https://www.chinanews.com.cn/gj/2025/12-25/10539817.shtml

[5] Bloomberg - “North Korea’s Kim Orders Arms Modernization Before Congress, Says KCNA” (December 26, 2025)

https://www.bloomberg.com/news/articles/2025-12-26/north-korea-kim-orders-arms-modernization-before-congress-kcna

[6] ACB News - “Aftermath of North Korea’s Missile Tests Shakes Market”

https://www.acbnews.com.au/index.php?m=content&c=tag&catid=22&tag=矿业股

[7] Yahoo Finance - “3 Stocks to Watch as Geopolitics Drives Defense Spending”

https://finance.yahoo.com/news/3-stocks-watch-geopolitics-drives-125900912.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.