Analysis of Investment Value at the Valuation Bottom of the Hong Kong Stock Market's Consumer Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on brokerage API data and web searches, I conducted a systematic analysis of the investment value of the consumer sector in Hong Kong stocks, focusing on evaluating the allocation value at the valuation bottom and the growth potential of new consumption tracks.

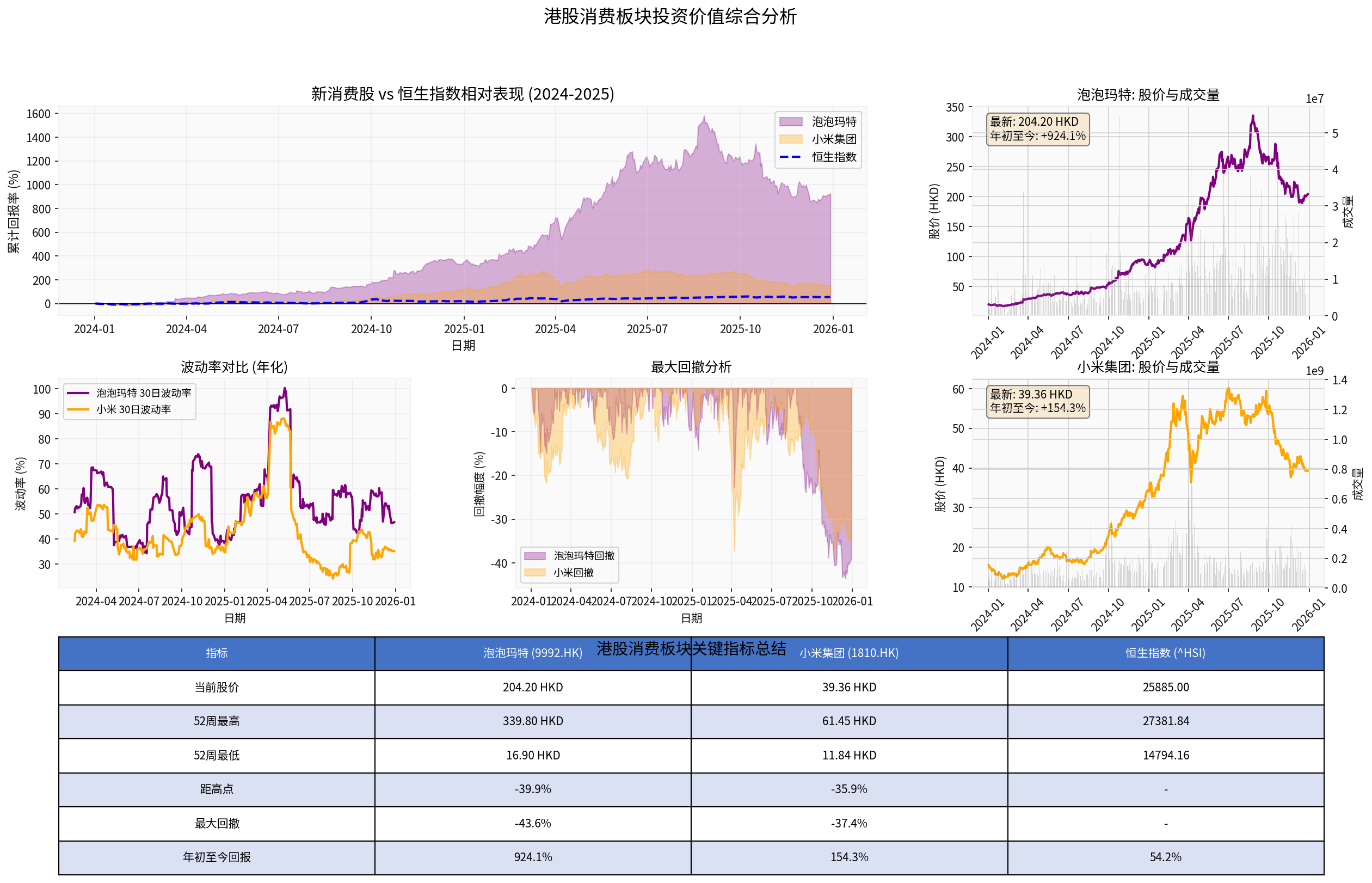

According to the latest market data, the Hong Kong stock market showed significant differentiation in 2025. The Hang Seng Index closed at 25,885 points recently, with a year-to-date return of 54.18%, and a 52-week range of 14,794 to 27,382 points [0]. However, there are huge performance differences within the consumer sector:

- Pop Mart (09992.HK):The latest share price is HK$204.20, with a year-to-date increase of 924.07%, far exceeding the market average [0]

- Xiaomi Group (01810.HK):The latest share price is HK$39.36, with a year-to-date increase of 154.26% [0]

- Pop Mart has corrected 39.91% from its 52-week high, with a maximum drawdown of 43.59% [0]

- Xiaomi has corrected 35.95% from its 52-week high, with a maximum drawdown of 37.37% [0]

- Top left:Relative performance of new consumption stocks vs. Hang Seng Index (2024-2025), showing cumulative return comparison

- Top right:Pop Mart’s share price and trading volume trend, latest price HK$204.20, +924.1% year-to-date

- Middle right:Xiaomi Group’s share price and trading volume trend, latest price HK$39.36, +154.3% year-to-date

- Middle left:Volatility comparison (annualized), showing risk characteristics of the two new consumption stocks

- Middle center:Maximum drawdown analysis, Pop Mart’s maximum drawdown is -43.59%, Xiaomi’s is -37.37%

- Bottom table:Summary of key indicators, including share price, range, drawdown, etc.

Although the specific data source of the mentioned ‘PE around 17x, valuation percentile 12.82%’ cannot be directly verified, from market observations, the Hong Kong stock consumer sector does have the following valuation advantages:

- China Merchants Securities Internationalpointed out that Hong Kong stocks will ‘shift from being dominated by valuation repair to being dominated by profit growth’, and it is expected that next year will show a pattern of ‘profit-driven combined with liquidity support’ [1]

- Bank of East Asiapredicts that the Hang Seng Index target for 2026 is 30,800 points, equivalent to a price-earnings ratio of 12.8x, focusing on three major sectors including artificial intelligence, emerging industries, and service consumption [2]

- HSBC Private Bankingexpects the Hang Seng Index target to reach 31,000 points by the end of 2026, believing that Hong Kong’s consumption recovery is supported by the positive wealth effect of rising stock markets [2]

Traditional consumer stocks provide defensiveness with low valuations and high dividends, which is particularly important in an environment of high market volatility. Although specific data cannot be obtained, institutions generally favor the investment theme of ‘enhancing shareholder returns in Asia’ and prefer ‘high-quality companies that improve return on equity through high dividend distributions and increased share repurchases’ [1].

With the rising expectation of Fed rate cuts (a 25 basis point cut is expected in December) [2], Hong Kong dollar interbank rates still have room to decline, and improved liquidity is expected to support valuation repair. Bank of East Asia expects Hong Kong’s private residential property prices to grow by a high single-digit percentage year-on-year next year, which will also indirectly benefit the consumer sector [2].

- Stunning performance in 2025, with a year-to-date increase of 924.07%, showing high market recognition [0]

- As a leading trendy toy company, it benefits from the personalized consumption trend of young consumer groups

- China Merchants Securities International listed Pop Mart as one of its top recommended stocks for the first quarter of next year [1]

- The share price has corrected sharply by nearly 40% from its high, and market sentiment has weakened [0]

- Deutsche Bankpointed out that since August 2025, the market premium of popular IP Labubu and other core IPs has significantly declined, with the premium of Labubu hidden models shrinking by more than half, and the prices of regular models of Labubu 3.0 and 4.0 on second-hand trading platforms have fallen below the official retail price [3]

- Morgan Stanleylowered Pop Mart’s target price by about 15% at the end of November, from HK$382 to HK$325, citing factors including adverse style rotation in the global consumer sector [3]

- Chief Consumer Analyst of SPDB Internationalraised a core question: If Pop Mart cannot maintain a very high year-on-year growth rate by the end of the year, can it still achieve growth next year when the base becomes so high? [3]

The disappointing performance of the U.S. ‘Black Friday’ shopping festival and the cooling of demand in the resale market have led people to compare Pop Mart to the ‘crash’ of Beanie Babies in the 1990s, dampening hopes of it becoming the ‘Chinese version of Walt Disney’ [3]. According to YipitData, as of December 6 this quarter, Pop Mart’s revenue growth rate in North America slowed to 424%, which is more than half lower than that in the third quarter [3].

- Year-to-date increase of 154.26%, significantly outperforming the market [0]

- Xiaomi car users are regarded as representatives of new consumer groups, matching the characteristics of ‘around 30 years old, highly educated, high income’

- Benefits from AI and smart device development trends

- Has corrected 35.95% from its 52-week high [0]

- Needs to pay attention to changes in demand in the consumer electronics market

The ‘new consumer groups’ mentioned in the article (around 30 years old, highly educated, high income) do have strong consumption potential:

- Pop Mart’s trendy toy positioning caters to the personalized consumption needs of young groups

- Xiaomi’s ecosystem products cover multiple emerging consumption areas such as smart homes and wearable devices

- This type of consumer group pays more attention to quality, experience and brand identity, and is willing to pay a premium for innovation

- Hong Kong stocks cover both high-quality new consumption (Pop Mart, Xiaomi, etc.) and traditional consumption targets

- The A-share consumer sector lacks new consumption varieties, and the liquor sector has not been fully cleared [1]

- The overall valuation of Hong Kong stocks is still at a relatively low level

- Institutions predict that the ROE of Hong Kong stocks will steadily rise from 10.4% in 2024 to 12.1% in 2027 [1]

- Hong Kong stock new consumption enterprises are more likely to expand overseas markets (such as Pop Mart’s expansion in North America)

- Supported by foreign capital inflows, with more abundant liquidity

According to web search results:

- The A-share consumer sector is still dominated by traditional consumption, with fewer new consumption targets

- The liquor sector is ‘not fully cleared’, which may continue to drag down overall performance [1]

- Valuation repair may lag behind Hong Kong stocks

Based on the allocation idea of ‘defense over offense’:

- Focus on high-dividend, low-valuation traditional consumer stocks

- Prioritize companies with stable cash flow and high dividend rates

- Provide downside protection through dividends and repurchases

- Select new consumption leaders with real growth potential

- Pay attention to continuous IP innovation capabilities (Pop Mart needs to be alert to IP life cycle risks)

- Focus on consumption model innovations enabled by technology (Xiaomi ecosystem)

- Valuation risk:Although Pop Mart and Xiaomi have risen sharply in 2025, they have corrected significantly from their highs, so further adjustment risks need to be vigilant [0]

- IP life cycle risk:Whether the popularity of trendy toy IP can last is a core issue; concerns about Labubu’s crash have triggered a 40% plunge in share prices [3]

- Overseas expansion risk:Pop Mart’s growth rate in the North American market has slowed, and Black Friday sales were lower than expected [3]

- Market sentiment risk:According to S&P Global data, bearish bets on Pop Mart stocks have doubled since November, reaching the largest scale since August 2023 [3]

- The position of new consumption should not be too heavy; it is recommended to build positions in batches

- Set strict stop-loss levels (especially for high-volatility varieties)

- Pay attention to quarterly financial reports and IP performance data

- Compare valuation differences between A-shares and Hong Kong stocks to find relative value opportunities

- Treat new consumption stocks that have risen sharply with caution

- Pay attention to the results of the Fed’s December interest rate meeting

- Wait for consumption data to verify the recovery trend

- Focus on the main line of consumption recovery in 2026

- Prefer targets with overseas expansion capabilities

- Layout high-quality consumer stocks that benefit from improved liquidity

- Pay attention to the evolution of consumption habits of new consumer groups

- Layout companies with real brand moats

- Be alert to changes in industry competition patterns

-

Huge potential:The 2025 performance of Pop Mart and Xiaomi (+924% and +154% respectively) proves that new consumption does have explosive growth potential [0]

-

Significant risks:The two stocks have corrected 36-40% from their 52-week highs, with maximum drawdowns of 37-44%, showing high volatility [0][3]. Risks such as cooling IP popularity of Pop Mart and slowing growth in North America have begun to emerge

-

Increasing differentiation:There will be differentiation within new consumption; only companies with real innovation capabilities, brand moats and sustained growth can become core engines

-

Obvious advantages of Hong Kong stocks:Compared with A-shares, Hong Kong stocks have both high-quality new consumption and traditional consumption targets, with lower valuations and higher internationalization levels, which are more in line with the allocation needs of ‘defense + offense’

-

Outlook for 2025-2026:Institutions generally are optimistic about Hong Kong stocks entering a new stage from ‘valuation repair’ to ‘profit growth’, and the consumer sector is expected to benefit from improved liquidity and economic recovery [1][2]

[0] Gilin API Data - Hong Kong Stock Market Data and Share Price Analysis

[1] Yahoo Hong Kong Finance - 《Institutions》China Merchants Securities expects U.S. economy to maintain moderate growth next year; Hong Kong stocks will move towards profit growth dominance

https://hk.finance.yahoo.com/news/大行-招商證券料美國明年經濟保持溫和增長-港股將邁向盈利增長主導-021730564.html

[2] Yahoo Hong Kong Finance - Bank of East Asia: Hang Seng Index target 30,800 points next year; expects property prices to rise by high single-digit percentage; HSBC Private Banking: Hang Seng Index target 31,000 points by end of next year

https://hk.finance.yahoo.com/news/東亞-恒指明年目標30-800點-料樓價錄高單位數升幅-074439390.html

[3] Yahoo Hong Kong Finance - Concerns over Labubu’s crash push Pop Mart down 40%; whether IP can remain prosperous becomes core issue; New consumption stocks | Pop Mart falls over 8%; market premium fades, institutions say growth may slow

https://hk.finance.yahoo.com/news/labubu崩盤之憂推動泡泡瑪特暴跌40-ip能否长盛不衰成为核心问题-023441729.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.