Hong Kong Cyclical Stocks Investment Strategy: Rotational Allocation of Gold, Rare Earth, and Aviation Sectors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Annual return: 67.42%

- Excess return: Outperformed the benchmark by 47.06%

- Sharpe ratio: 2.18

- Early year: Overweight gold sector (Hong Kong gold stocks)

- April: Took profits on gold after reciprocal tariff policy

- May: Reallocated to rare earth sector

- August-September: Re-overweighted gold

- October: Switched to aviation sector

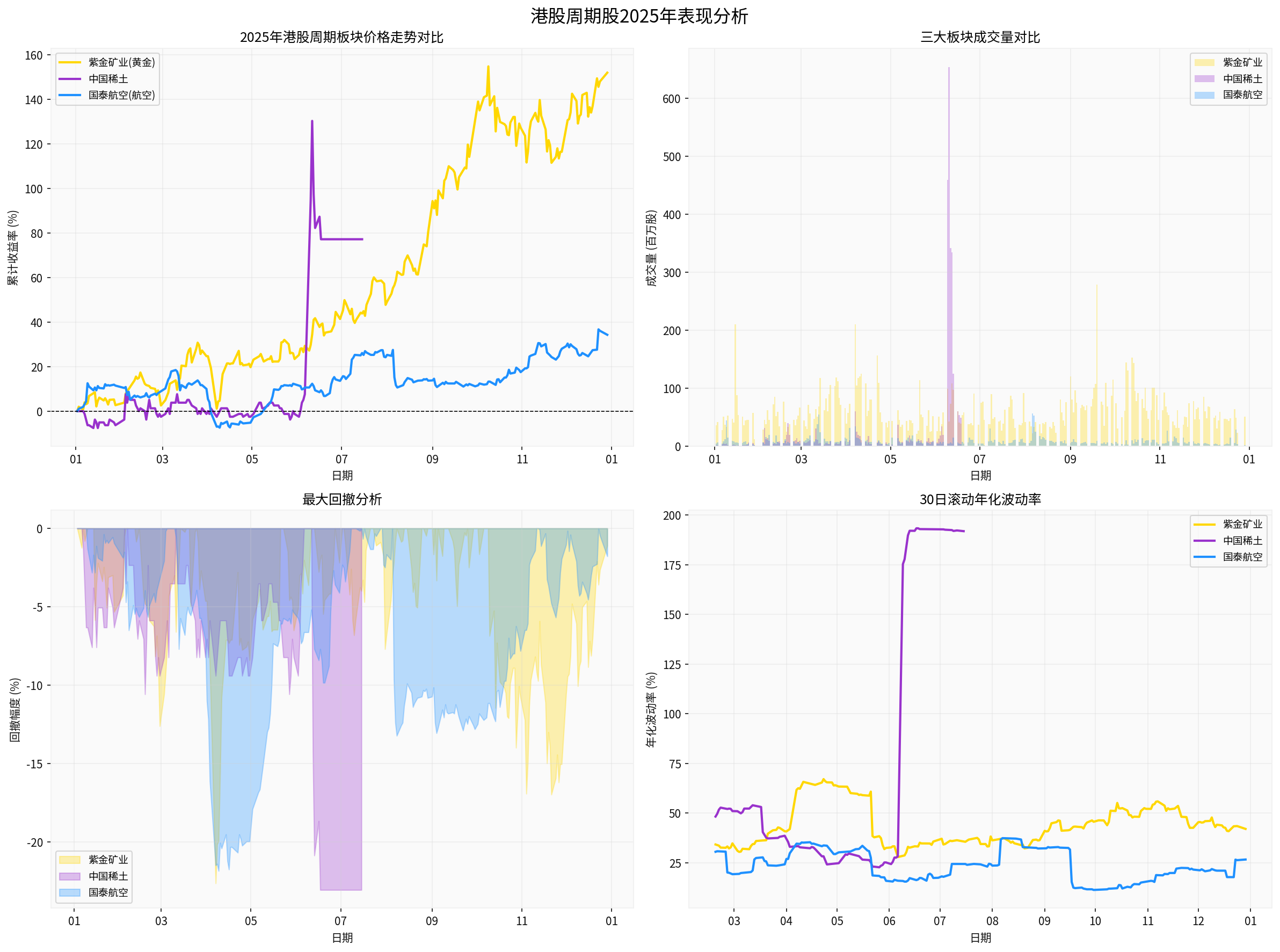

| Sector (Representative Stock) | Annual Gain | Annualized Volatility (Daily Frequency Annualized) | Maximum Drawdown (Cumulative Return Drawdown) |

|---|---|---|---|

| Gold (Zijin Mining 2899.HK) | +152.05% | 43.49% | -22.65% |

| Rare Earth (China Rare Earth 0769.HK) | +77.22% | 98.03% | -23.08% |

| Aviation (Cathay Pacific Airways 0293.HK) | +34.29% | 25.91% | -21.86% |

Data and Visualization:

- The annual price trends, trading volume distribution, drawdowns, and 30-day rolling volatility of the three sectors are shown in the figure below. The chart shows: Gold and rare earth had higher annual returns but greater volatility; aviation had lower volatility and mild drawdowns; the rare earth sector had extremely high volatility, requiring strict position control and stop-loss [0].

- Gold opened at approximately $14.02, peaked at $36.92, bottomed at $13.86, and closed at $35.74 for the year, with an annual change of +154.92% and average daily trading volume of 61.58M [0].

- China Rare Earth data covers approximately 131 trading days, opening at approximately $0.40, peaking at $0.91, bottoming at $0.36, closing at $0.70, with an interval change of +75.00% and average daily trading volume of 23.03M [0].

- Cathay Pacific Airways opened at approximately $9.50, peaked at $12.99, bottomed at $8.50, closed at $12.65 for the year, with an annual change of +33.16% and average daily trading volume of 8.92M [0].

- Gold (Zijin Mining, 2899.HK):

- Technical pattern: SIDEWAYS, support/resistance at approximately $33.59/$36.39; MACD has no crossover (bullish bias), KDJ is bullish; RSI indicates overbought risk; Beta vs. HSI =1.25, amplifies market volatility [0].

- Valuation: P/E 19.61x, P/B5.33x, ROE30.60%, net profit margin13.91%, Current Ratio1.20 [0].

- Real-time: Latest price $35.74 (2025-12-29), market capitalization approximately $948.29B [0].

- Rare Earth (China Rare Earth,0769.HK):

- Technical pattern: SIDEWAYS, support/resistance at approximately $0.69/$0.71; MACD has no crossover (bearish bias), KDJ is bullish; Beta vs. HSI≈1.04, close to market volatility [0].

- Valuation: P/E is negative (TTM -15.62x), P/B0.85x, ROE-5.37%, net profit margin-13.87%, Current Ratio17.17, Quick Ratio14.75 (short-term liquidity is abundant but profitability is under pressure) [0].

- Real-time: Latest price $0.70 (2025-12-29) [0].

- Aviation (Cathay Pacific Airways,0293.HK):

- Technical pattern: UPTREND (pending), buy signal triggered on 12/18, next target at $13.25, support at $12.15, resistance at $12.99; MACD has no crossover (bullish bias), KDJ is bullish; RSI indicates overbought risk; Beta vs. HSI≈0.2, volatility significantly lower than market [0].

- Valuation: P/E8.49x, P/B1.63x, ROE19.06%, net profit margin9.10%; Current Ratio0.35, Quick Ratio0.32 (need to pay attention to liquidity management) [0].

- Real-time: Latest price $12.65 (2025-12-29), market capitalization approximately $81.46B [0].

###1. Market Stage and Sector Attribute Mapping

- Early recession/risk aversion rising → Gold dominates: When real interest rates decline, the U.S. dollar weakens, and geopolitical risks resonate, gold stocks’ β>1 amplifies upside [0][1][2].

- Credit/policy stimulus and industrial prosperity recovery → Rare earth dominates: When new energy vehicles, new infrastructure demand is implemented, and supply and policy support overlap, rare earth has strong elasticity (but extremely high volatility) [0].

- Economic recovery and demand repair → Aviation dominates: When passenger/cargo volume recovers, and oil price and exchange rate environment are stable, profit elasticity is significantly released; Cathay Pacific Airways has low β and reasonable valuation, with better volatility and drawdown control [0].

###2. Rotation Signals and Thresholds (Framework Method)

- Macro and interest rates:

- Fed rate cut expectations/weakening real interest rates → Bullish for gold; if rate hike expectations rise or real interest rates rebound → Gold is under pressure [1][2].

- PMI/Retail Sales of Consumer Goods/Service Sector Index continuous improvement → Aviation’s pro-cyclical allocation value increases.

- Industry chain and prosperity:

- New energy vehicles, wind and solar power, robotics production and sales and orders → Rare earth demand signals; domestic industrial policies, export control rhythm → Supply-side catalysts [3].

- Load factor, ASK, RPK, oil price and jet fuel cost structure, airline foreign exchange gain/loss → Aviation profit recovery signals.

- Valuation and sentiment:

- Gold stocks’ premium/discount relative to gold futures, stock-bond relative cost-effectiveness → Add position/take profit thresholds.

- Rare earth sector P/B and crowding degree (trading volume, financing/ETF inflow) → Risk control and rhythm adjustment.

- Aviation stocks’ P/E and P/B relative to historical quantiles, passenger flow recovery degree → Medium and long-term allocation window judgment.

###3. Risk Management and Position Discipline (Key to High Win Rate and High Sharpe Ratio)

- Gold: Stop-loss near $33.59, can add positions顺势 when breaking through $36.39; β is high, need to dynamically control exposure to prevent high volatility from eroding returns [0].

- Rare earth: Strict position upper limit (suggest ≤20-25% of portfolio net value), stop-loss close to $0.69; in high volatility environment, enter/exit in batches and roll to reduce volatility [0].

- Aviation: Rely on upward trend, stop-loss at $12.15, after breaking through $12.99, target moves up to $13.25; low β attribute makes it more suitable as a portfolio “stabilizer” and pro-cyclical ballast [0].

- Portfolio level: The total exposure of the three sectors is controlled within a certain proportion, leaving sufficient defensive assets (such as high dividends/utilities) to smooth drawdowns.

- Gold: Gold futures peaked at approximately $4584 in 2025, supported by factors including “de-dollarization” and central bank gold purchase trends, Fed rate cut cycle, geopolitical risk premium; in 2026, high-level wide fluctuation probability is high, with pressure above and support below, emphasizing strategic allocation value rather than unilateral trend [1][2].

- Rare earth: Medium and long-term benefit from high-end manufacturing and industry chain upgrading; short-term is significantly affected by policy, export and order fluctuations, extremely high volatility and fundamental differentiation (such as some companies losing money), need to select targets carefully and strictly control risks [0][3].

- Aviation: Economic repair and travel recovery drive profit improvement; Cathay Pacific Airways’ technical side has entered an upward trend, valuation is relatively reasonable, low β helps reduce portfolio volatility, suitable as the core of pro-cyclical allocation [0].

- Hong Kong allocation direction reference (web search): CITIC Securities suggests focusing on resource products (non-ferrous metals, rare earth) benefiting from overseas inflation and de-dollarization, travel chain (hotels, aviation, OTA) and other directions [3].

- Signal-driven reallocation framework:

- Add position/launch gold: When real interest rate trend weakens or U.S. dollar weakens significantly, geopolitical tensions rise; at the same time, gold stocks’ technical side stands above key moving averages, and valuation does not overheat relative to gold spot.

- Add position/launch rare earth: When industrial policy or export control expectations rise, new energy vehicles/wind and solar power and other industry chain orders and production scheduling resonate; valuation is not over-premium and trading volume is not over-crowded.

- Add position/launch aviation: When economic and travel data continue to repair, oil price and exchange rate environment are stable; technical side forms an upward channel and stabilizes after retracing support.

- Take profit/reduce weight:

- Gold: Reduce positions when real interest rates rebound, U.S. dollar strengthens or geopolitical premium fades quickly; when technical side breaks key support or RSI continues to be overbought and then weakens.

- Rare earth: Quickly reduce weight when policy or export expectations cool marginally, demand-side signals weaken; actively reduce risk when technical side has volume stagnation, volatility rises quickly.

- Aviation: Reduce exposure when macro economy is under pressure, oil price rises sharply or exchange rate fluctuates sharply; when technical side breaks upward trend support or RSI is continuously overbought and then weakens.

- Fed/interest rate path repetition: Gold and aviation are sensitive to interest rate and credit environment, need to dynamically adjust exposure according to data and expectations [1][2].

- Geopolitical and supply shocks: Rare earth and gold are greatly affected by geopolitical and supply chain disturbances, should reserve tactical hedging or rapid adjustment capabilities.

- Exchange rate and oil price: Aviation profit is affected by both oil price and exchange rate, need to track cost curve and hedging strategy to avoid cost erosion of profits.

- Sentiment and valuation risks: Gold and rare earth have increased volatility in high-level fluctuations, overheated sentiment or overvalued valuation will amplify drawdowns; aviation has performance downward revision risk when demand is falsified.

- Position structure recommendations: Gold as ballast and trend allocation (moderately control exposure to hedge high β volatility), rare earth as offensive band (strict position and stop-loss), aviation as pro-cyclical stabilizer (rely on upward trend and low β advantages) [0].

- Execution principles:

- Layout at low positions: Build positions when sectors pull back to support/valuation low positions, avoid chasing high.

- Cycle reversal:果断 reallocate when macro and industry inflection point signals are clear, but evidence-driven rather than time-driven.

- Strictly control volatility: Dynamically adjust weights, control portfolio volatility within target range, maintain Sharpe ratio advantage.

- [0] Gilin API Data (Including real-time quotes, technical analysis, company overview, annual price data, Python calculation and visualization charts)

- [1] Securities Times “Hong Kong Allocation Has High Cost-Effectiveness”, 2025-12-24, https://www.stcn.com/article/detail/3554800.html

- [2] Securities Times “Gold Frenzy “Sad and Happy Record””, 2025-12-29, https://stcn.com/article/detail/3561116.html

- [3] Various institutions/media research and news reports summary on 2025-2026 Hong Kong strategy and gold/rare earth/aviation related industry chains, https://news.futunn.com/post/66456603; https://caifuhao.eastmoney.com/news/20251224134108946461130; https://deriv.com/zh-cn/blog/posts/gold-price-fed-rate-cuts-momentum

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.