Analysis of Trump-Zelenskiy Talks' Impact on European Defense Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On December 28, 2025, US President Trump and Ukrainian President Zelensky held talks at Mar-a-Lago in Florida to discuss a peace plan to end the Russia-Ukraine conflict. According to public information:

- Zelensky: 90% agreement has been reached on the 20-point peace plan, and the security guarantee agreement has been fully reached [1]

- Trump: The security guarantee agreement is “nearly 95%” complete; European countries will “bear most” of the security guarantee work, with the US providing support [2][3]

- Core Obstacle: The territorial issue in the Donbas region remains a “very thorny” unresolved problem; Trump hinted that territorial concessions may be needed [4]

- Russia controls approximately 12% of Ukraine’s territory, including 90% of the Donbas region, 75% of Zaporizhzhia and Kherson regions, and the entire Crimean Peninsula annexed in 2014 [1][5]

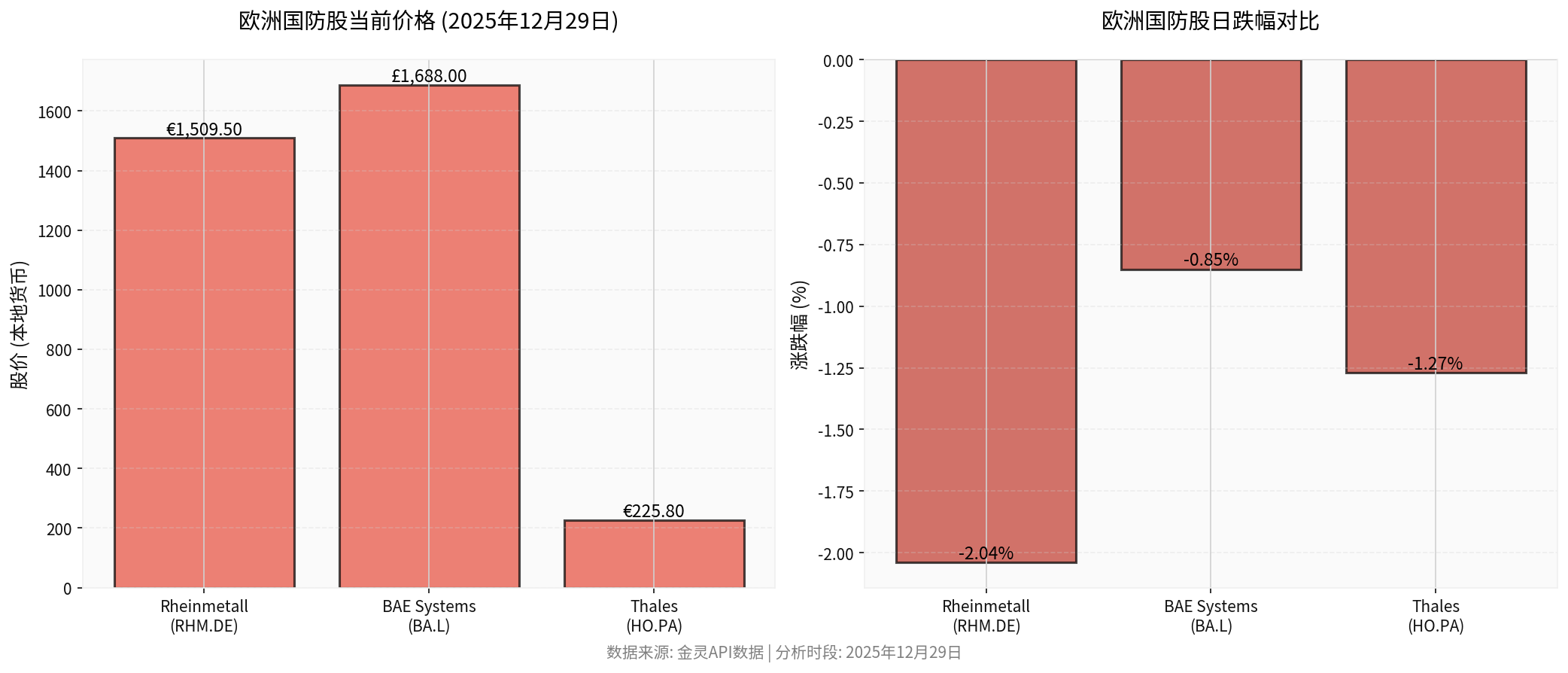

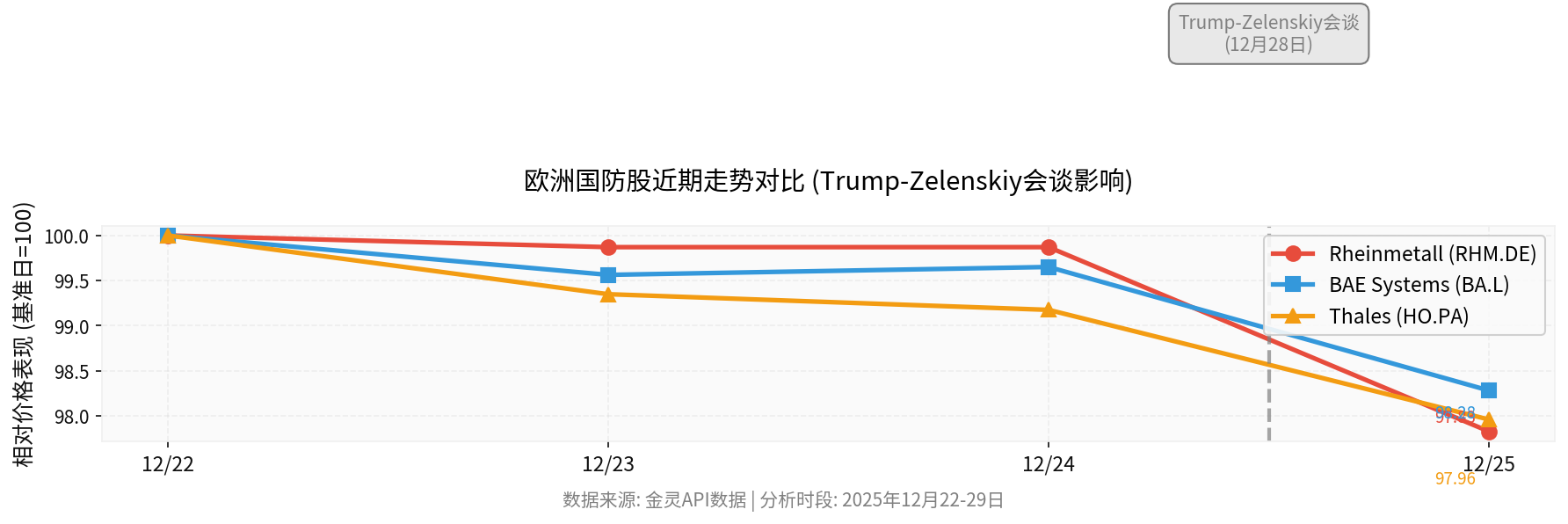

After the news of the talks broke, the European defense sector saw significant adjustments:

- Rheinmetall (RHM.DE): Fell 2.04% to €1,509.50 (market capitalization €68.7 billion) [0]

- BAE Systems (BA.L): Fell 0.85% to £1,688.00 [0]

- Thales (HO.PA): Fell 1.27% to €225.80 [0]

Progress in peace talks has triggered a revaluation of geopolitical risk premium by the market:

- Expectation of Conflict Mitigation: If a peace agreement is reached, it will significantly reduce the direct military threat in Eastern Europe

- Concerns about Arms Sales Demand: Investors worry that peace may lead to a slowdown in emergency arms procurement

- Budget Pressure Relief: European countries may re-evaluate the priority of defense spending

- After the outbreak of the Ukraine war (February 2022), the Bloomberg European Defense Index continued to outperform the broader market, with a cumulative increase exceeding 150% [6]

- This peace talk has led to short-term profit-taking in the sector

Despite short-term pressure, there are multiple supports for long-term risk premium:

- The 2022 Madrid Summit established a 2% GDP defense spending target

- The 2024 Washington Summit reaffirmed the commitment, and most European countries promised to maintain or increase spending levels

- Germany established a €10 billion special defense fund, and France promoted the Military Planning Law (2024-2030)

- Russia’s long-term strategic threat remains (even if a peace agreement is reached)

- Non-traditional threats such as hybrid warfare, cyber attacks, and energy security are on the rise

- The demand for European strategic autonomy is increasing

- Companies like Rheinmetall and BAE continue to expand capacity (ammunition, tanks, artillery)

- Long-term contracts and high supply chain restructuring costs create strong exit barriers

- P/E Ratio (TTM): 80.29x

- EPS (TTM): €18.80

- 52-week Range: €593.20 - €2,008.00

- Current stock price is at the upper-middle level of the 52-week range (approximately 75th percentile)

- Historical Comparison: Current valuation is far higher than the historical average, reflecting war premium

- Growth Support: Backlog of orders reaches a historical high, with strong performance visibility for the next 2-3 years

- Risk Discount: Peace uncertainty leads to valuation correction pressure

- Order Backlog: Companies like Rheinmetall have record backlogs (mainly government contracts)

- Long-term Demand: Demand for equipment modernization in NATO countries (replacing Soviet-era equipment)

- Capacity Investment: Companies have significantly expanded capacity over the past two years, forming fixed cost investments

- Geopolitical Diversification: Although the Ukraine conflict may ease, demand in other global hotspots (Indo-Pacific, Middle East) is rising

- Peace Agreement Uncertainty: Territorial issues remain a key obstacle, and negotiations may break down

- Budget Priority Adjustment: Europe faces economic slowdown pressure, and defense spending may be cut

- Political Cycle: Multiple elections in 2025 may affect the continuity of defense policies

Comparison with US Defense Stocks:

- US defense giants(Lockheed Martin, RTX) are less affected, as their demand comes more from the Indo-Pacific and Middle East

- European defense stocksare more sensitive to the Ukraine conflict due to higher direct geopolitical relevance

| Risk Type | Current Status | After Peace Agreement | Impact Degree |

|---|---|---|---|

| Direct Military Conflict | High | Medium-Low | ⭐⭐⭐⭐⭐ |

| Long-term Strategic Threat | High | Medium-High | ⭐⭐⭐⭐ |

| Defense Budget Pressure | High | Medium | ⭐⭐⭐⭐ |

| Emergency Arms Procurement | High | Medium-Low | ⭐⭐⭐⭐⭐ |

| NATO Unity Degree | High | Medium | ⭐⭐⭐ |

- Increased volatility, following the progress of peace talks

- Key Observations: Donbas issue resolution, details of security guarantees

- Recommendation: Wait for clearer signals of a peace agreement before entering

- Even if a peace agreement is reached, defense spending is difficult to cut quickly (long-term contracts, capacity investments)

- Strategic autonomy and NATO commitments provide demand resilience

- Recommendation: Deploy high-quality leaders on dips, focus on order execution

- Long-term security investment in a multipolar world

- The Russia-Ukraine conflict has reshaped European defense thinking; normalization of spending is a high-probability event

- Recommendation: Hold core assets, focus on technological upgrades (drones, electronic warfare, cyber defense)

- Complete territorial concessions (including recognition of Crimea’s ownership)

- Vague European security guarantees

- Expanded internal divisions in NATO (US withdrawal, Europe taking more but insufficient investment)

- Compromise on territorial issues but retain sovereignty claims

- Clear multilateral security guarantee mechanism

- European defense spending maintains the 2% GDP target

- Unexpected Peace Agreement: If the agreement includes major territorial concessions and sufficient security guarantees, the market may further lower the valuation of defense stocks

- European Economic Recession: Increased economic pressure may force countries to cut defense budgets

- Geopolitical Reversals: Russia violating the agreement or other conflicts breaking out (e.g., Indo-Pacific) may change investment logic

- Overvaluation: Current valuation already reflects a lot of positives, insufficient safety margin

- Diversified Investment: Allocate to US defense stocks at the same time (more diversified demand sources)

- Option Strategy: Buy put options to protect against downside risk

- Timing: Wait for clearer peace agreement before making major allocation decisions

- Geopolitical risk premium declines, sector valuation is under pressure

- Market worries that peace leads to a slowdown in emergency arms procurement

- Technical profit-taking occurs (all three leaders fell 0.85%-2.04%)

- NATO’s 2% target commitment is difficult to reverse

- Long-term demand for European strategic autonomy

- Defense industry capacity investment forms exit barriers

- Normalization of security investment in a multipolar world

- Recommendation: Wait and see or reduce positions

- Wait for key details of the peace agreement to become clear (especially the Donbas issue resolution)

- Risk/reward ratio is not attractive currently

- Can deploy high-quality leaders on dips (Rheinmetall, BAE)

- Adopt a phased buying strategy to avoid one-time heavy positions

- Focus on order execution rate and capacity utilization indicators

- Set stop-loss levels (e.g., Rheinmetall falls below €1,400)

- Pure Long: Recommend no more than 5-8% of the portfolio

- Hedging Strategy: Equip with put option protection, or hold US defense stocks to diversify geopolitical risk

[0] Gilin API Data - Stock Prices, Market Data, Valuation Indicators

[1] USA Today - “‘Makings of a deal.’ Trump meets Zelenskyy, speaks with Putin on Ukraine” (https://www.usatoday.com/story/news/politics/2025/12/28/donald-trump-vladimir-putin-volodymyr-zelenskyy-ukraine-russia/87935520007/)

[2] BBC - “Ukraine-Russia latest: Trump says progress made after Ukraine peace plan talks but ‘thorny issues’ remain” (https://www.bbc.com/news/live/c7732j0jvnnt?page=2)

[3] Fox News - “Trump, Zelenskyy say Ukraine peace deal close but ‘thorny issues’ remain after Florida talks” (https://www.foxnews.com/politics/trump-zelenskyy-say-ukraine-peace-deal-close-thorny-issues-remain-after-florida-talks)

[4] New York Post - “Trump willing to travel to Ukraine, pitch parliament on ceding land to Russia in bid to end war” (https://nypost.com/2025/12/28/us-news/trump-willing-to-travel-to-ukraine-pitch-parliament-on-ceding-land-to-russia-in-bid-to-end-war/)

[5] The Times of Israel - “US and Ukraine ‘a lot closer’ on peace deal, Trump says after meeting with Zelensky” (https://www.timesofisrael.com/us-and-ukraine-a-lot-closer-on-peace-deal-trump-says-after-meeting-with-zelensky/)

[6] Yahoo Finance - “Rheinmetall AG (RHM.DE) Stock Price, News, Quotes and Records” (https://hk.finance.yahoo.com/quote/RHM.DE/)

[7] NBC News - “Trump meets with Zelenskyy at Mar-a-Lago as peace talks advance” (https://www.nbcnews.com/video/trump-meets-with-zelenskyy-at-mar-a-lago-as-peace-talks-advance-255086149769)

[8] ABC News - “Volodymyr Zelenskyy arrives at Mar-a-Lago for peace talks with President Trump” (https://abcnews.go.com/Politics/volodymyr-zelenskyy-arrives-mar-lago-peace-talks-president/story?id=128736611)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.