Analysis of the Impact of Germany's Economic Downturn and Layoff Wave on European Stock Market Investment Layout

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QVMIRHICVBNL5HGCLRINMWYGZI.jpg)

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

European stock markets showed a

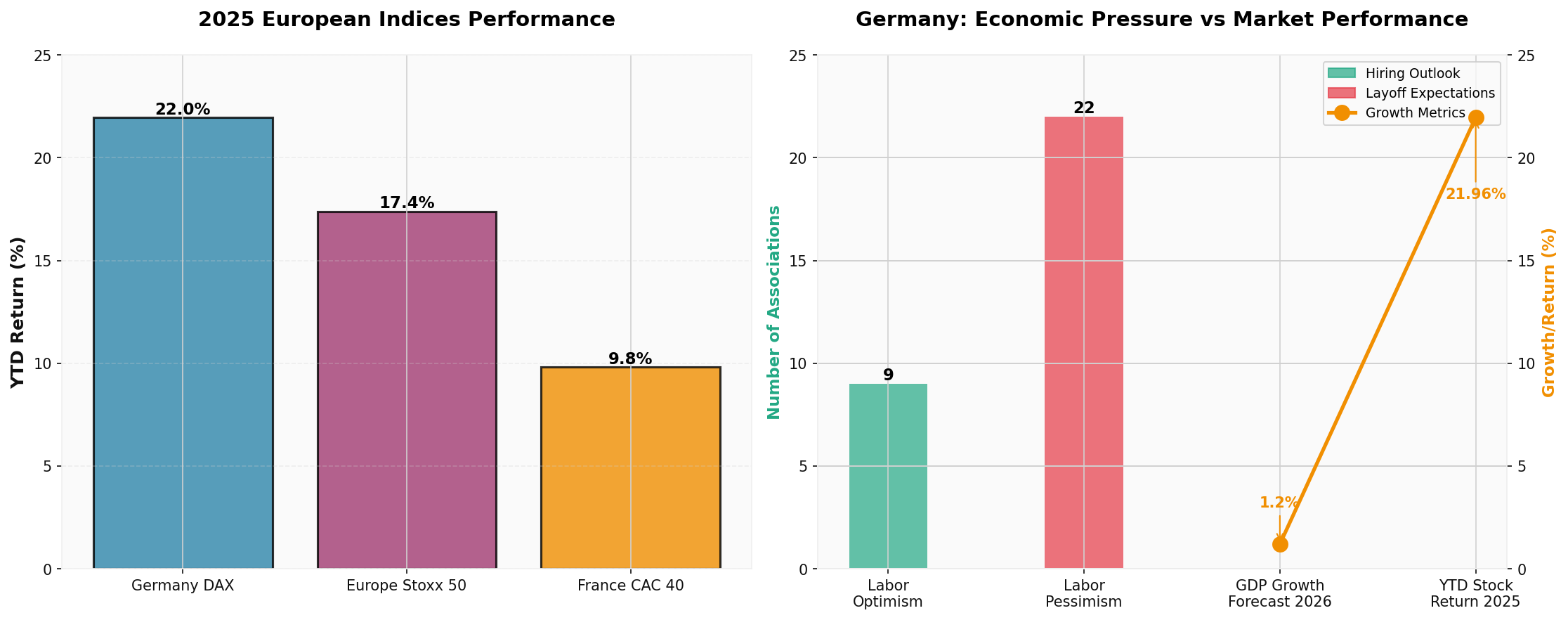

According to brokerage API data [0], the performance of major European indices in 2025 is as follows:

- German DAX Index: Rose 21.96% for the year, from 19,923 points to 24,298 points,leading major European markets

- Euro Stoxx 50 Index: Rose 17.39%, from 4,891 points to 5,741 points

- French CAC 40 Index: Rose 9.81%, from 7,375 points to 8,098 points

This seemingly contradictory phenomenon—economic weakness yet strong stock market—reflects the

According to survey data from the German Economic Institute IW,

- Among 46 industry associations, 22 expect to reduce employment scale in 2026(accounting for 47.8%)

- Only 9 associations plan to increase recruitment (19.6%)

- The industrial sector is the hardest hit, facing dual pressures from rising global protectionism and weak exports

According to the latest economic forecast [1]:

- The ifo Institutesharply lowered Germany’s 2026 economic growth forecast from 1.3% to0.8%

- The 2027 growth forecast was lowered to 1.1% (down 0.5 percentage points from previous forecast)

- U.S. tariff policyis expected to drag down Germany’s GDP growth by 0.3 percentage points in 2025 and further expand to 0.6 percentage points in 2026

Latest research shows [2], the number of corporate bankruptcies in Germany is expected to

- Financial losses from bankruptcies in 2025 are expected to be about 57 billion euros

- The average loss per bankruptcy exceeds 2 million euros

- Small and micro enterprises (with no more than 10 employees) account for 81.6% of bankruptcy cases

Despite weak current economic data,

- Bloomberg surveyshows thatfor the first time in eight years, no strategist predicts a significant decline in European stock markets

- The Stoxx Europe 600 Indexis expected to rise about 7% by the end of 2026 to 620 points

- JPMorganset a target of 640 points (about 10% increase)

- UBS strategy teamstated: “After three years of valuation-driven performance and consensus earnings disappointment, we predict earnings growth will return for the first time in three years”

- Short-term risks: Layoff waves and corporate bankruptcies may suppress market sentiment in the first half of 2026

- Long-term opportunities: Domestic demand recovery (expected 1.2% GDP growth in 2026) [7] and government investment plans will provide support

- Investment advice:Selective allocation, focusing on companies with strong cash flow and diversified overseas income

- French CAC 40 has a smaller gain (9.81%) but more attractive valuation

- Luxury giants like LVMH(market capitalization 314.3 billion USD) [12] andAirbus(market capitalization 154 billion USD) [11] provide global exposure

- Industrial manufacturing: Facing triple challenges of weak export demand, protectionism pressure and domestic layoffs

- Automobiles and parts: Germany’s pillar industry is severely impacted by global trade tensions

- Chemicals and materials: High energy costs and weak demand suppress profit prospects

- The ongoing Russia-Ukraine conflict and global geopolitical tensions drive a surge in military spending

- Bloomberg European Defense Index has significantly outperformed the market since 2020 [4]

- Airbus, as a European defense leader, currently has a stock price of $195.06 and a P/E ratio of 30.43 times [11]

- Defensive属性: Stable performance during economic downturns

- Innovative growth potential: Biotech and pharmaceutical innovation provide long-term growth momentum

- Web search shows that the healthcare sector combines “defensive stability and explosive growth potential from drug innovation” [8]

- One of the best-performing sectors in 2025 [8]

- Resilient digital advertising spending

- Provides a balanced combination of reasonable valuation and profit growth

- Capital Economics expects hyperscale enterprises to spend over $500 billion on AI-related capital expenditures[8]

- German tech leader SAP: Despite a 12.97% decline year-to-date, it has a reasonable valuation (P/E ratio of 37 times) and an analyst consensus rating of “Buy” [9][10]

- AI data center construction and energy demand will drive related stocks

- Reduce allocation to Germany’s cyclical industries and export-dependent enterprises

- Avoid high-leverage, low-liquidity small and medium-sized enterprises

- Increase the weight of healthcare, consumer staples and utilities sectors

- Increase holdings of companies with strong cash flow and stable dividends

- AI infrastructure investment

- Energy transition and green technology

- National defense and security

| Country/Region | Allocation Recommendation | Key Logic |

|---|---|---|

Germany |

Neutral to Cautious |

Short-term pressure, but 2026 recovery expectations are already reflected in stock prices; selective allocation to leaders |

France |

Overweight |

Luxury goods, defense, nuclear energy and other advantage sectors have reasonable valuations |

Southern Europe (Italy, Spain) |

Neutral |

Progress in banking sector restructuring and tourism recovery potential |

Northern Europe (Sweden, Netherlands) |

Overweight |

Outstanding advantages in technology, pharmaceuticals and clean energy |

- U.S. tariff policy: May further drag down German exports and U.S. economic growth

- Energy price volatility: European energy crisis is not fully resolved

- Geopolitical escalation: Russia-Ukraine conflict and Middle East situation may push up risk aversion

- Consider allocating part of goldordollar assetsin the portfolio

- Use put optionsto protect key positions

- Increase holdings of low-volatility defensive stocksto reduce portfolio Beta

- Wait and see: Wait for further clarity on Germany’s layoff wave and corporate bankruptcy data

- Buy the dip in defensive sectors: Healthcare, consumer staples

- Focus on central bank policies: ECB interest rate cut expectations may provide market support

- Increase allocation to cyclical sectors: When confirming economic bottoming and recovery signals

- Focus on 2026 profit growth: Select companies with upward profit expectations

- Use market volatility: Buy the dip in corrections triggered by weak economic data

- Structural growth themes: AI, green transition, national defense security

- European valuation repair: European stock market valuations are still significantly lower than the U.S.

- Dollar weakening expectations: May drive capital back to European markets

Germany’s sustained economic downturn and expected layoff wave will undoubtedly exert

- From German industry to European diversification: Reduce reliance on Germany’s cyclical industries and increase holdings in advantage markets like France and Northern Europe

- From cyclical to defensive and structural growth: Focus on sectors with long-term support such as defense, healthcare and AI infrastructure

- From passive tracking to active selection: In the context of economic divergence, select leading enterprises with pricing power, cash flow and diversified overseas income

[0] Gilin API Data - Market index data, company profiles, real-time quotes

[1] Yahoo Finance - “Economic experts pessimistic about German growth in 2026-2027” (https://finance.yahoo.com/news/economic-experts-pessimistic-german-growth-121114636.html)

[2] Reuters - “German corporate bankruptcies to surge to a decade high in 2025” (https://finance.yahoo.com/news/german-corporate-bankruptcies-surge-decade-115122197.html)

[3] Bloomberg - “German Business Activity Misses Forecasts on Industry Weakness” (https://www.bloomberg.com/news/articles/2025-12-16/german-business-activity-misses-forecasts-on-industry-weakness)

[4] Bloomberg Professional - Bloomberg European Defense Index performance data (https://www.bloomberg.com/professional/products/indices/quote/EUSTITT:IND)

[6] Yahoo Finance - “Last Time Strategists Were This Bullish, European Stocks…” (https://finance.yahoo.com/news/last-time-strategists-were-bullish-081001137.html)

[7] Yahoo Finance - “Domestic demand to drive German recovery in 2026” (https://uk.finance.yahoo.com/news/domestic-demand-drive-german-recovery-083518018.html)

[8] Yahoo Finance - “Sector Rotation: 2 Smart Money Moves for 2026” (https://finance.yahoo.com/news/sector-rotation-2-smart-money-121500546.html)

[9] Gilin API Data - SAP.DE company profile

[10] Yahoo Finance - SAP.DE stock information (https://ca.finance.yahoo.com/quote/BMW.DE/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.