Hengda Hi-Tech (002591) Limit-Up Analysis and Trend Prediction

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Hengda Hi-Tech (002591) closed at the limit-up on December 29, 2025, at 8.20 yuan, with an increase of 10.07%, achieving two consecutive limit-up days (2 consecutive limit-ups) and a cumulative increase of 35.54% in 20 trading days [0].

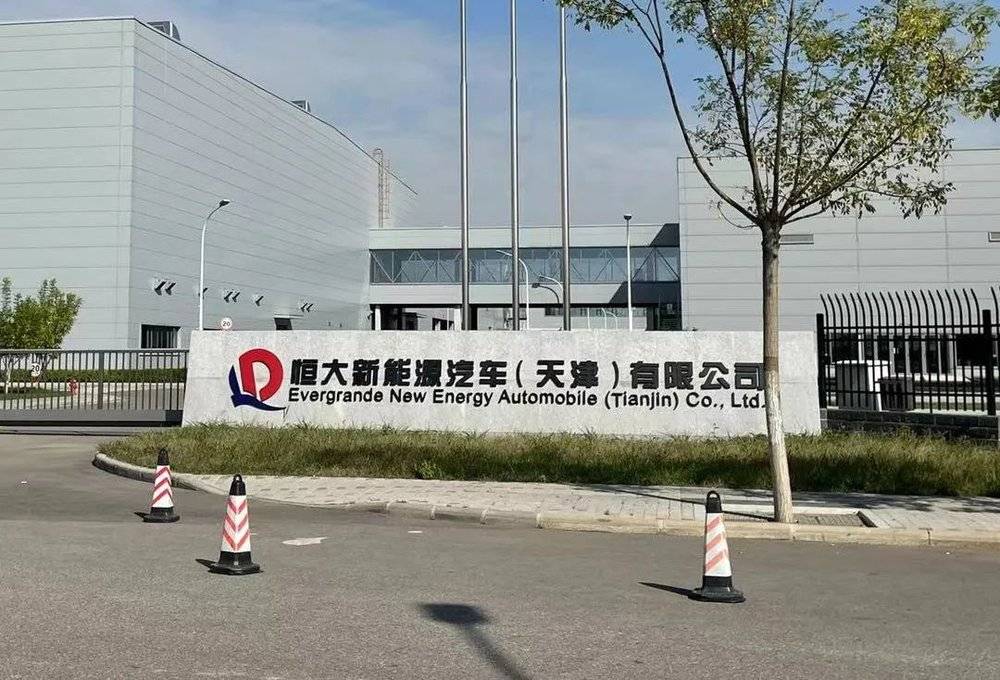

The reasons for the limit-up mainly include two aspects: First, the continuous promotion of positive fundamental factors in the early stage, including the company’s new energy transformation layout, governance structure optimization to boost market confidence, and the positive impact on performance from gains through debt transfer [1]; Second, the drive from the overall positive market trend—the A-share Shanghai Composite Index recorded nine consecutive rising days, and the optimistic market sentiment provided a good environment for individual stock performance [2].

The company issued an announcement on the same day, confirming that production and operation activities are normal, there are no major changes in internal and external operating environments, the controlling shareholder has no undisclosed major matters, and no company shares were bought or sold during the period, while also denying any unpublicized media reports affecting the stock price recently [3].

- Multiple Factors Resonance: The individual stock’s limit-up is the result of the joint action of the company’s positive fundamental changes and the market’s optimistic sentiment, rather than being driven by a single factor.

- Rising Market Sentiment: The trend of consecutive limit-ups and the rapid sealing of the limit-up after opening reflect investors’ high attention and buying enthusiasm for the company.

- Stabilizing Effect of Announcement: The company’s timely clarification announcement has avoided excessive market speculation to a certain extent and provided a relatively clear information background for the stock price trend.

- Main Risks:

- High-level Pullback Risk: After consecutive limit-ups, the stock price is at a high level in the past 20 trading days, with short-term pullback pressure [0].

- Trading Volume Signal: If trading volume increases significantly in the future but the stock price fails to continue rising, it may indicate a short-term peak [0].

- Market Volatility Risk: If the overall trend of A-shares reverses, it will have an adverse impact on individual stock performance [2].

- Potential Opportunities:

- If the company’s positive layouts such as new energy transformation make substantial progress, it may support the stock price to further improve.

- The continuous strength of the market may also provide momentum for the individual stock to continue upward.

- Priority Assessment: Short-term high-level risks need to be focused on, while the market trend and the company’s subsequent operating dynamics are secondary concerns.

Hengda Hi-Tech (002591) achieved two consecutive limit-ups due to multiple positive factors and market drive, and the company confirmed normal operations and no undisclosed major matters. Investors need to pay attention to the risk of pullback at high stock prices, changes in trading volume, and market trends, while tracking subsequent progress such as the company’s new energy transformation.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.