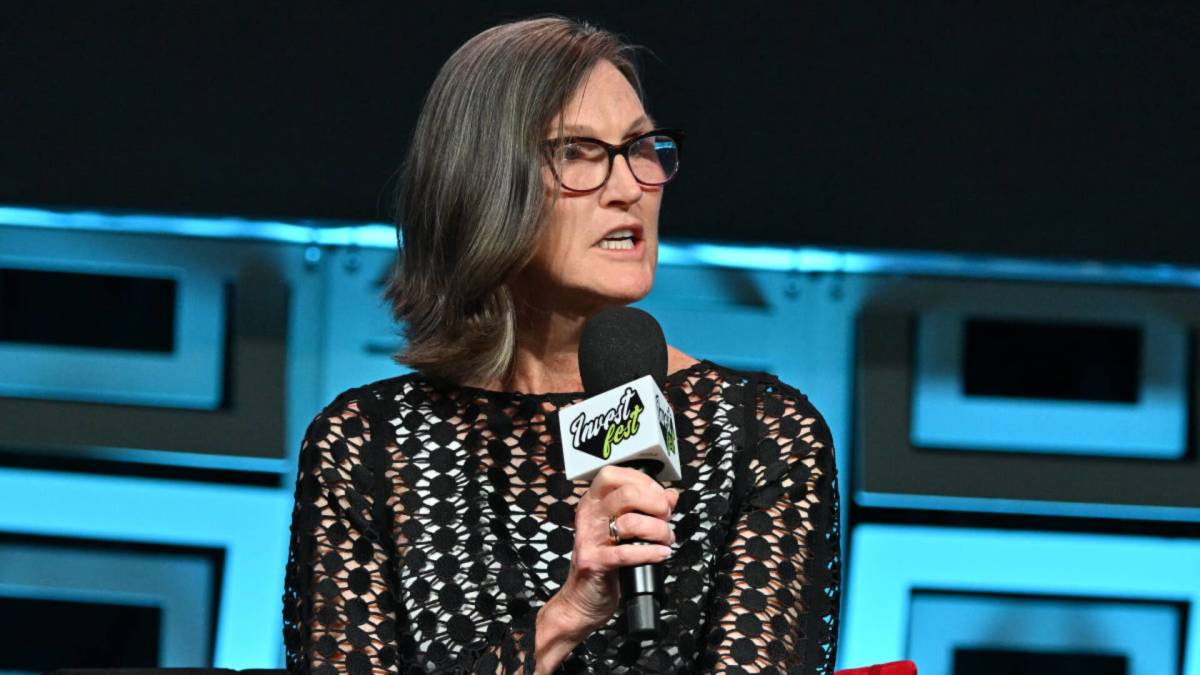

Analysis of Cathie Wood’s ARK Funds 2025 Outperformance and 2026 Investment Bets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Barrons report [2] and internal market data [0] to examine Cathie Wood’s ARK funds’ 2025 performance and 2026 investment strategy. The ARK Innovation Fund (ARKK) returned +39.58% in 2025, outperforming the S&P 500’s +17.39% [0], driven by investments in growth sectors like technology, AI, and innovation. Key assets mentioned in the report—Tesla (TSLA), Roku (ROKU), AMD (AMD), Alibaba (BABA), and Bitcoin (BTC)—exhibited mixed 2025 performance: AMD (+75.80%) and BABA (+80.40%) led gains, buoyed by AI demand and China’s economic recovery [0], while Bitcoin saw a ~-6.25% YTD decline amid macro headwinds [1]. Wood’s 2026 bets align with her consistent thematic focus on AI, self-driving technology (including Tesla), and crypto assets, which may shape market sentiment toward these sectors.

- Thematic Alignment with Market Trends: The strong 2025 performance of AMD and BABA underscores the market’s appetite for AI and China recovery plays, themes Wood has long prioritized.

- Potential Crypto Sentiment Shift: Bitcoin’s 2025 decline [1] contrasts with ARK’s bullish 2026 stance, possibly signaling an anticipated shift in sentiment, potentially driven by unannounced catalysts or regulatory clarity.

- Thematic Investing Momentum: ARKK’s outperformance relative to the S&P 500 may reaffirm investor interest in thematic growth strategies focused on innovation and emerging technologies.

- Thematic Growth: Long-term upside potential in AI and self-driving technology benefits assets like AMD and Tesla.

- Short-Term Inflows: ARK’s 2025 outperformance may attract inflows into ARK ETFs and the mentioned assets, supporting near-term momentum.

- China Recovery Tailwinds: Alibaba may continue to benefit from China’s economic recovery.

- Crypto Volatility: Bitcoin’s historical volatility and regulatory uncertainties pose risks [1].

- Valuation Pressures: High valuations in AMD and Tesla could limit future upside.

- China Regulatory Risk: Alibaba faces ongoing regulatory uncertainties in China.

- Thematic Investing Volatility: ARK’s focus on high-growth, potentially unprofitable companies increases portfolio volatility.

- ARKK returned +39.58% in 2025, outperforming the S&P 500’s +17.39% [0].

- 2026 bets include TSLA, ROKU, AMD, BABA, and Bitcoin, aligned with AI, self-driving, and crypto themes [2].

- AMD and BABA led 2025 gains, while Bitcoin declined ~6.25% [0], [1].

- Monitoring points include ARK’s 2026 portfolio disclosures, Bitcoin’s macro environment, and tech/China regulatory developments.

恒大高新(002591)涨停分析与走势预判

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.