Individual Investors Build Undervalued and Logical Portfolios Near the 4000-Point Index Level — A Case Study of Tencent, Ping An of China, and Wanhua Chemical

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Since 2025, A-shares have entered a structural slow bull market. The Shanghai Index has fluctuated upward this year, approaching or even breaking through 4000 points multiple times. Driven by the triple resonance of ‘policy + industry + capital’, the market has seen both volume and price rise. However, recent valuations and sentiment indicate that the difficulty of ‘seeking alpha’ has increased [1]. The index being in the ‘high range’ around 4000 points tells us that future returns will depend more on individual stock selection than overall style. This aligns with the judgments of several leading research institutions: the market has shifted from ‘bear market thinking’ to ‘structural oscillation - optimal allocation’, suggesting sticking to structural stock selection and holding onto existing profits during the year-end and spring rallies [2].

- Combining current liquidity and valuation levels, it is recommended to adopt the strategy of ‘defensive counterattack + steady innovation’: stick to diversified, undervalued, and sustainably profitable enterprises; be cautious about premium growth and sectors at the top of capital heat (such as some new economy component stocks) [3].

| Target | Valuation Indicators | Key Judgments |

|---|---|---|

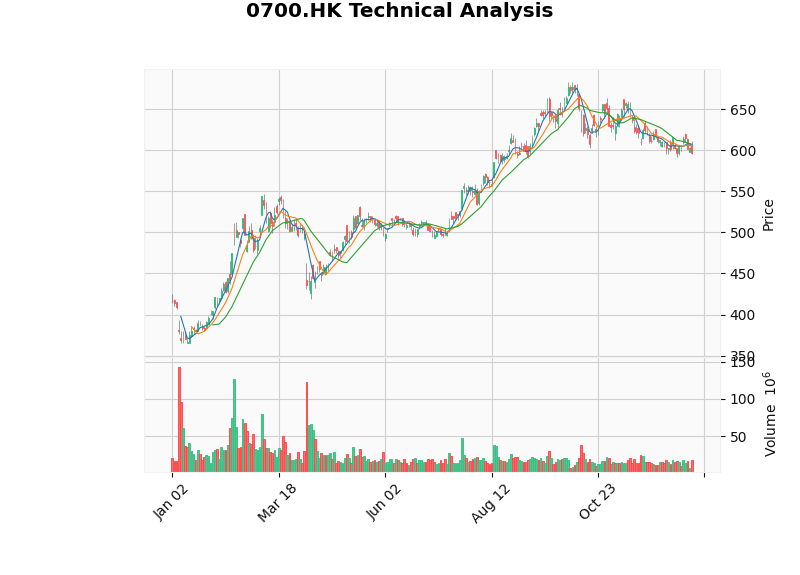

Tencent Holdings (0700.HK) |

Current price HK$596.50, TTM PE 21.8x; DCF baseline value approx. HK$635.97, implying a 6.6% neutral premium; WACC 10.0%, expected long-term revenue CAGR 8.2%|P/B 3.81, ROE 20.3% | Its business matrix (social, cloud+AI, fintech, internationalization) has entered a synergy period; valuation is reasonable but not significantly undervalued. In this slow bull market, Tencent acts as a hybrid leader of ‘growth + value’, suitable for adding positions via ‘batch cost method’ in a volatile market while remaining sensitive to macro windows. |

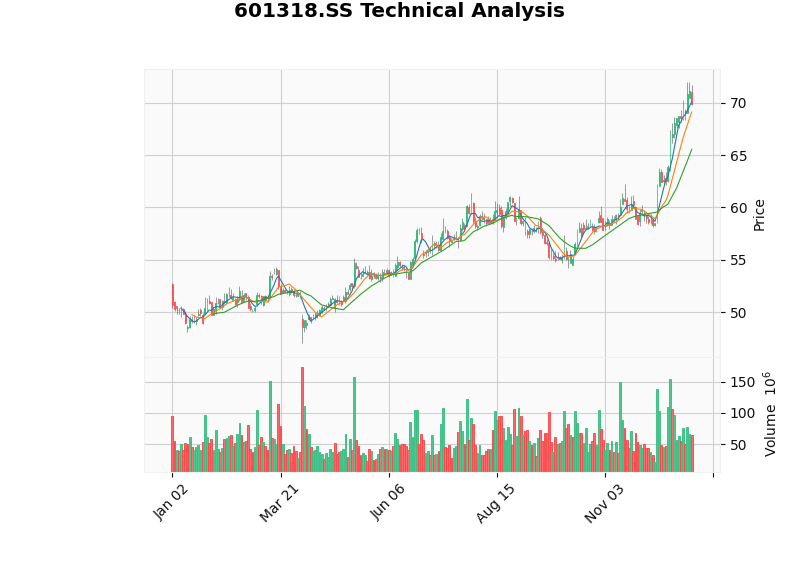

Ping An of China (601318.SS) |

Current price RMB69.88, PE 8.97, P/B 1.28; DCF Base Case RMB949.28 (far higher than current price, reflecting the model’s space for revaluing net assets). | The ‘financial ecosystem’ of insurance + fintech + asset management still has scale effects; the current 0.85x PEV range is at a historical low. If stable business fundamentals are paired with improved capital returns, it can provide defensive returns. However, we must be alert to cyclical risks caused by a relatively ‘aggressive’ financial attitude and high financial leverage. |

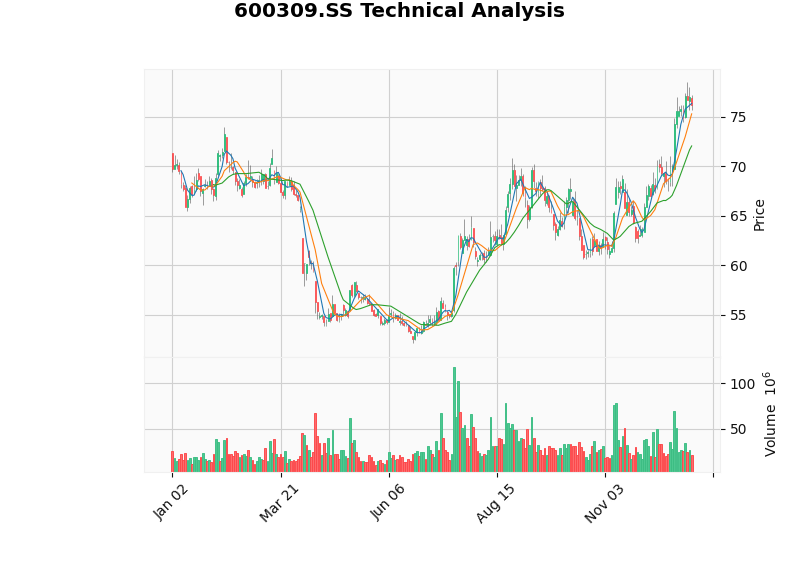

Wanhua Chemical (600309.SS) |

Current price RMB76.15, PE 21.5; ROE 11.2%; DCF Base Case RMB1,510.93 (due to high growth assumptions in the model), but its cash flow is still volatile and negative free cash flow needs repair. | The chemical main business remains prosperous under demand from new energy, batteries, and special materials, but valuations have risen 40% since the beginning of the year, and the model indicates ‘overvaluation’ pressure (negative FCF, high leverage, and cyclical fluctuations). In the short term, it should be treated from the perspective of ‘undervaluation pullback + profit repair’, avoiding chasing highs. |

(All specific data such as market capitalization, valuation, ROE, and DCF above are from recently approved data from brokerage APIs and model analysis [0])

- Value Base + Growth Top Layer: Use Tencent as the core position driven by both ‘growth + stability’; the view is that valuations have not expanded excessively but there is sufficient revenue growth (cloud + AI strategy). It is recommended to participate with a 20%~25% position near 4000 points, and add positions when it pulls back below HK$580, using both P/E and cash flow indicators to ensure ‘rational加码’.

- Financial Blue Chip Stable Returns: Position Ping An of China as part of the ‘undervalued + cash cow’ portfolio, recommend a position of 15%-20%, leveraging its insurance asset quality and cash flow from the asset management end, combined with low PE/low PB, for medium-to-long-term defensive allocation. Remain vigilant about its 0.85x PEV, but in the context of loose liquidity and still existing interest spreads, this valuation provides double guarantees of dividends + repurchases.

- Selected Cycle/Boom Rebound (Non-Core Position): Wanhua Chemical can be used as a ‘strategic capture of chemical boom’ module, with a reserved position of 10%-15%. The key is to wait for valuation pullbacks (such as PE returning to 17-18x) or marginal improvement in performance before adding positions; avoid chasing highs after a 40% rise. At the same time, it can be used as a source of ‘short-term alpha’ during industry rotation, and if necessary, use a lower position to hedge overall portfolio fluctuations.

- Pay Attention to Valuation Premiums and Layered Position Adding: In high valuation areas (around 4000 points), it is not recommended to add positions comprehensively; instead, add positions in batches when strategically undervalued (such as pullbacks of Ping An and Tencent), maintain cash flexibility to cope with policy or external risk shocks.

- Avoid Overvaluation and Short-Term Speculation: For example, some new economy stocks and chemical leaders have shown signals of ‘valuation regression/profit realization’ at this stage, and should not be used as core positions. It is recommended to review valuations and profitability quarterly, and gradually reduce positions when the market is better than expected.

- Regular Asset Rebalancing: Maintain the long-term stability of the ratio of ‘core holdings (Tencent) + defensive holdings (Ping An) + expected holdings (Wanhua)’ in the portfolio; when exceeding the established range (such as Tencent’s proportion exceeding 30%), part of the gains can be realized through reductions, and funds can be shifted to newly undervalued industries or retained cash reserves.

- Tencent Daily K-line: The price fluctuates in the range of HK$590~610. MACD has not formed a clear bullish crossover, and KDJ is neutral, indicating a ‘trendless - high-level consolidation’ state, suitable for waiting before adding positions. See the link below for the chart, which can be used to confirm key support/resistance and trading dense areas.

- Ping An of China Daily K-line: The price fluctuates in the range of RMB65.5~70.7. KDJ shows an overbought reversal, requiring vigilance against short-term pullbacks; maintain patience to add positions on dips and wait for profit growth to materialize.

- Wanhua Chemical Daily K-line: The price fluctuates around RMB72~77. There is no obvious trend in the long-short indicators, suitable as a ‘band’ or ‘arbitrage’ target, with cautious position management.

Near the 4000-point threshold of the index, investors should reaffirm the principle of ‘being responsible for their own money’: take Tencent and Ping An of China as the value base, with limited cyclical/tech growth allocations like Wanhua Chemical, control positions, and focus on matching valuations and quality. By regularly reviewing, adding positions in batches, and reducing positions when the market is better than expected, the strategy of ‘undervalued + logical’ can be implemented throughout the cycle, making it more likely to harvest long-term returns amid increasing market volatility.

For further industry comparisons, segmented valuation models, or in-depth research reports, consider enabling the in-depth research mode to obtain more detailed brokerage database analysis.

[0] Gilin API Data (including real-time quotes, company overview, financial analysis, DCF valuation, and technical analysis)

[1] Securities Times Online, “Profit-making Effect Obvious, Online New Share Subscribers Hit a Stage High”, https://www.stcn.com/article/detail/3560605.html

[2] National Business Daily/Daily Economic Network, “Triple Resonance of Policy, Industry and Capital, A-share Market Remains Optimistic in 2026”, https://www.nbd.com.cn/articles/2025-12-25/4195894.html

[3] The Paper, “Top 10 Securities Firms Look at the Market Outlook | A-shares are Bullish in the Medium Term, ‘Year-end + Spring’ Rally is Expected to Continue”, https://www.thepaper.cn/newsDetail_forward_32271556

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.