Asset Allocation Strategy Amid Increasing Market Volatility: Building a Robust 'All-Weather' Portfolio

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

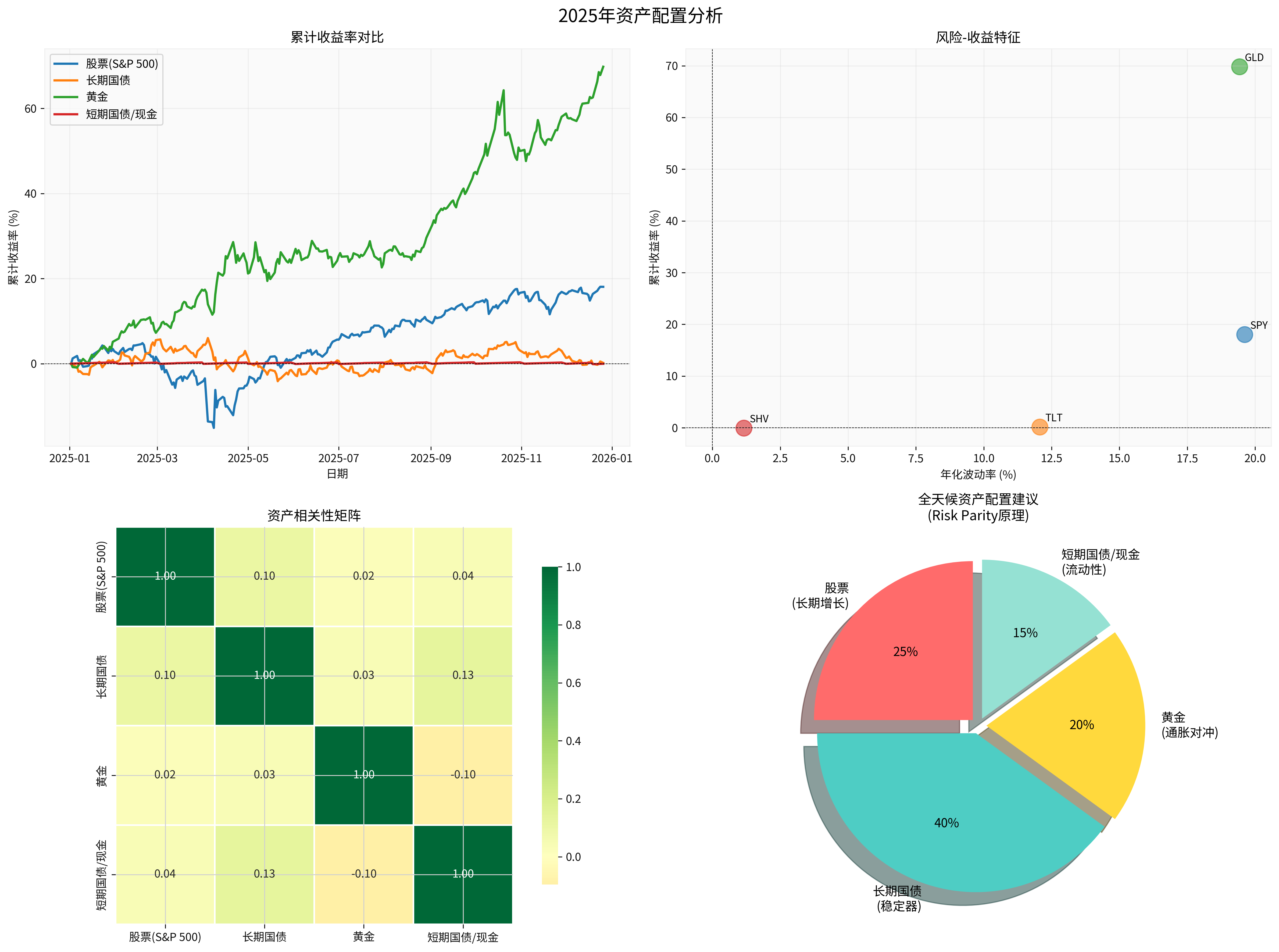

According to the latest data, major asset classes showed a clear differentiation trend in 2025 [0]:

From the above, different asset classes exhibit the following characteristics:

- Gold (GLD): The cumulative annual return reached 69.81%, making it the best-performing asset in 2025, with an annualized volatility of 19.42% and a Sharpe ratio of 2.79, reflecting excellent risk-adjusted returns

- Stocks (SPY): Cumulative return of 18.07%, but with a high volatility of 19.61%, reflecting the characteristics of increasing market volatility

- Long-term Treasury Bonds (TLT): Only slightly increased by 0.19%, with an annualized volatility of 12.06%, and its role as a stabilizer has weakened somewhat

- Short-term Treasury Bonds/Cash (SHV): Return of -0.02%, with a volatility of only 1.16%, providing a stable value anchor for the portfolio

The asset correlation matrix shows [0]:

| Asset Class | Stocks | Long-term Treasury Bonds | Gold | Short-term Treasury Bonds/Cash |

|---|---|---|---|---|

| Stocks | 1.000 | 0.104 | 0.022 | 0.039 |

| Long-term Treasury Bonds | 0.104 | 1.000 | 0.033 | 0.133 |

| Gold | 0.022 | 0.033 | 1.000 | -0.096 |

| Short-term Treasury Bonds/Cash | 0.039 | 0.133 | -0.096 | 1.000 |

- Highest historical annualized return (7-10%)

- Highest volatility, with annualized volatility up to 15-20%

- Performs best during economic booms

- 2025 Performance: S&P 500 rose by 18.07% cumulatively [0]

- Investors with strong risk tolerance: Allocate 40-60%

- Investors with moderate risk tolerance: Recommend allocating 25-40%

- Should choose broad-based indices (such as CSI 300, S&P 500) to reduce individual stock risk

- Provide stable cash flow

- Low correlation with stocks, able to diversify risks

- Interest rate-sensitive: Prices fall when interest rates rise

- 2025 Performance: Long-term Treasury Bonds slightly increased by 0.19% [0]

- Conservative investors: Allocate 40-50%

- Balanced investors: Recommend allocating 30-40%

- Aggressive investors: Allocate at least 15-25%

- Should diversify durations: Long-term Treasury Bonds + Medium-term Treasury Bonds + Short-duration Bonds

- Extremely low (or even negative) correlation with stocks and bonds

- 2025 Performance of Gold: Cumulative increase of 69.81% [0]

- Performs well during geopolitical risks and inflation concerns

- Does not generate cash flow, belonging to ‘pure hedging’ assets

- Recommend allocating 10-20%

- Prioritize Gold ETFs (good liquidity)

- Can moderately allocate crude oil, agricultural products and other commodities

- Note the risk when commodity prices are at historical highs

- Extremely low volatility (annualized ~1%), but also low returns

- Provide options for rebalancing

- Provide ‘ammunition’ when the market crashes

- 2025 Performance: Return of -0.02%, almost no volatility [0]

- Recommend allocating 5-15%

- Can be achieved through Money Market Fund ETFs (such as Yinhua Rili)

-应对 emergency situations (3-6 months of living expenses) - Can moderately increase the proportion when the market is overvalued

Core Concept: Do not predict the future, defense and balance [1]

- Stocks: 25%

- Long-term Treasury Bonds:25%

- Gold:25%

- Cash:25%

- Stocks: CSI 300 ETF (20%) + STAR 50 ETF (5%)

- Bonds: 10-Year Treasury Bond ETF (25%)

- Gold: Gold ETF (25%)

- Cash: Yinhua Rili ETF (25%)

- Simple and easy to understand, easy to implement

- Historically stable performance in various economic environments

- Equal-weight allocation of four assets, risk diversification

###3.2 All-Weather Strategy

Core Concept: Risk parity, making each asset contribute equally to portfolio risk [2]

- Stocks:30%

- Long-term Treasury Bonds:40%

- Medium-term Treasury Bonds:15%

- Gold:7.5%

- Commodities:7.5%

- 2025 Return:14.49%

- 10-Year Annualized Return:6.47%

- Sharpe Ratio:0.74 for 10 years [2]

- Allocate based on risk rather than capital

- Higher bond allocation ratio, further reducing volatility

- Performs well in interest rate下降 environments

###3.3 60/40 Portfolio

Traditional classic strategy, but facing challenges in recent years [3]:

- Stocks:60%

- Bonds:40%

- Cumulative Return:14.92%

-10-Year Annualized Return:9.88%

-10-Year Sharpe Ratio:0.86 [3]

###3.4 Simulation Comparison of Different Strategies (2025)

Based on Python simulation results [0]:

| Strategy | Cumulative Return(%) | Annualized Volatility(%) | Sharpe Ratio |

|---|---|---|---|

| Aggressive (70% Stocks) | 19.66 | 14.22 | 1.24 |

| Balanced (50% Stocks) | 16.07 | 11.04 | 1.27 |

| Conservative (30% Stocks) | 15.97 | 8.61 | 1.62 |

| All-Weather Strategy | 15.97 | 8.61 | 1.62 |

- Aggressive strategy has the highest return but also the highest volatility

- Conservative and All-Weather strategies have slightly lower returns but the highest Sharpe ratios, with better risk-adjusted returns

- 30% stock allocation seems to reach the optimal balance of risk and return

###4.1 Three Steps to Determine Allocation Ratios

| Risk Type | Characteristics | Recommended Stock Allocation |

|---|---|---|

| Conservative | Prioritize value preservation, cannot tolerate more than 20% loss | 15-25% |

| Balanced | Pursue moderate value addition, can tolerate 20-30% volatility | 25-40% |

| Aggressive | Pursue maximum returns, can tolerate more than 30% volatility | 40-60% |

- When stock market valuations are low (e.g., P/E ratio below historical average): Can moderately increase stock allocation

- When stock market valuations are high: Should reduce stock allocation and increase bonds and cash

- Current gold is at historical highs: Can moderately reduce gold allocation [1]

It is recommended to check the portfolio once a year and rebalance when the proportion of an asset deviates from the target by more than 5%. This is essentially a disciplined operation of ‘sell high and buy low’ [1].

###4.2 Recommended Allocation Plans

Stocks (Broad-based Indices):30%

- CSI300 ETF:20%

- STAR50 ETF:5%

- S&P500 ETF:5%

Bonds:40%

- 10-Year Treasury Bond ETF:25%

- Medium-term Treasury Bond ETF:10%

- Convertible Bond ETF:5%

Gold:15%

- Gold ETF:15%

Cash/Money Market Fund:15%

- Money Market Fund ETF:15%

- Annualized Return:10-15%

- Annualized Volatility:8-12%

- Maximum Drawdown:15-25%

- Sharpe Ratio:1.2-1.6

Stocks:20%

- CSI300 ETF:15%

- High Dividend ETF:5%

Bonds:45%

-10-Year Treasury Bond ETF:30%

- Medium-term Treasury Bond ETF:10%

- Short-term Bond ETF:5%

Gold:15%

- Gold ETF:15%

Cash/Money Market Fund:20%

- Money Market Fund ETF:20%

Stocks:45%

- CSI300 ETF:25%

- STAR50 ETF:10%

- Sector Theme ETFs (Technology, Pharmaceuticals, etc.):10%

Bonds:30%

-10-Year Treasury Bond ETF:20%

- Convertible Bond ETF:10%

Gold:15%

- Gold ETF:15%

Cash/Money Market Fund:10%

- Money Market Fund ETF:10%

###5.1 Real Causes of Investment Anxiety

According to your mentioned views, investment anxiety often stems from:

- Excessive focus on short-term performance: Overreaction to quarterly, monthly or even daily fluctuations of assets

- Lack of long-term perspective: Treating asset allocation as a short-term gaming tool rather than a long-term wealth management method

- Misunderstanding of asset responsibilities: Expecting every asset to perform well in every period

###5.2 Correct Investment Mentality

- Stocks perform best during prosperity

- Bonds provide protection during recession

- Commodities preserve value and increase value during inflation

- Cash provides options during deflation or crisis

- No perfect allocation plan can perform well in all environments

- The goal is to obtain stable risk-adjusted returns throughout the market cycle

- It is normal for an asset to underperform in a certain period

- These strategies are designed for the long term (more than 5 years) [1]

- Avoid frequent position adjustments due to emotions

- Regular rebalancing is more important than timing

###6.1 Implementation Steps

- Determine Risk Preference: Honestly evaluate your own risk tolerance

- Choose Allocation Plan: Select the appropriate allocation ratio according to the above recommended plans

- Choose Specific Tools: Prioritize ETF products with good liquidity and low fees

- Build Positions in Batches: Avoid one-time investment, can gradually build positions over 3-6 months

- Regular Rebalancing: Check once a year and rebalance when deviation exceeds 5%

###6.2 Risk Warnings

- Market Risk: Even diversified allocation cannot completely eliminate market risk

- Exchange Rate Risk: Allocating overseas assets needs to consider exchange rate fluctuations

- Liquidity Risk: Some commodity and bond ETFs may have insufficient liquidity

- Inflation Risk: Excessively high cash allocation may lead to loss of purchasing power

- Model Risk: Past performance does not represent the future, changes in economic environment may affect strategy effectiveness

###6.3 Advanced Optimization Directions

For experienced investors, can consider:

- Factor Allocation: Increase exposure to factors such as value, quality, and low volatility in the stock part

- Dynamic Allocation: Moderately adjust allocation ratios according to macroeconomic indicators

- Alternative Investments: Moderately allocate alternative assets such as REITs and private equity

- Option Strategies: Use strategies such as covered calls and protective puts to manage risks

In an environment of increasing market volatility, building an asset allocation portfolio that balances long-term growth, stability and options is key to:

- Understand the core responsibilities of each asset: Stocks for growth, bonds for stability, commodities for hedging, cash for options

- Adhere to low-correlation allocation: Use low correlation between assets to reduce portfolio volatility

- Match personal risk preference: Choose appropriate allocation ratios according to your own situation

- Maintain long-term perspective and discipline: Regular rebalancing and avoid emotional decisions

- Accept imperfection: There is no ‘holy grail’ strategy, the goal is stable performance throughout the cycle

Investment is not about predicting the future, but about preparing for all possible futures. Through scientific and disciplined asset allocation, investors can remain calm amid market volatility and achieve the goal of long-term wealth appreciation.

[0] Gilin API Data - Price data and related indicator calculations for stocks, bonds, gold, cash and other assets

[1] Taiyi Quantification - “Classic Asset Allocation Strategies”, Wealth Account, December 25, 2025 (https://caifuhao.eastmoney.com/news/20251225090956801561550)

[2] Ray Dalio All Weather Portfolio - PortfoliosLab (https://portfolioslab.com/portfolio/ray-dalio-all-weather)

[3] Stocks/Bonds 60/40 Portfolio - PortfoliosLab (https://portfolioslab.com/portfolio/stocks-bonds-60-40)

[4] AllianceBernstein - “Keeping Cool in Volatile Markets”, December 08, 2025 (https://www.alliancebernstein.com/gb/en-gb/adviser/market-matters/keeping-cool-in-volatile-markets.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.