Zijin Mining (601899.SS) In-Depth Analysis: Sustainability of Multi-Metal Production Growth and 2026 100 Billion Profit Expectation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

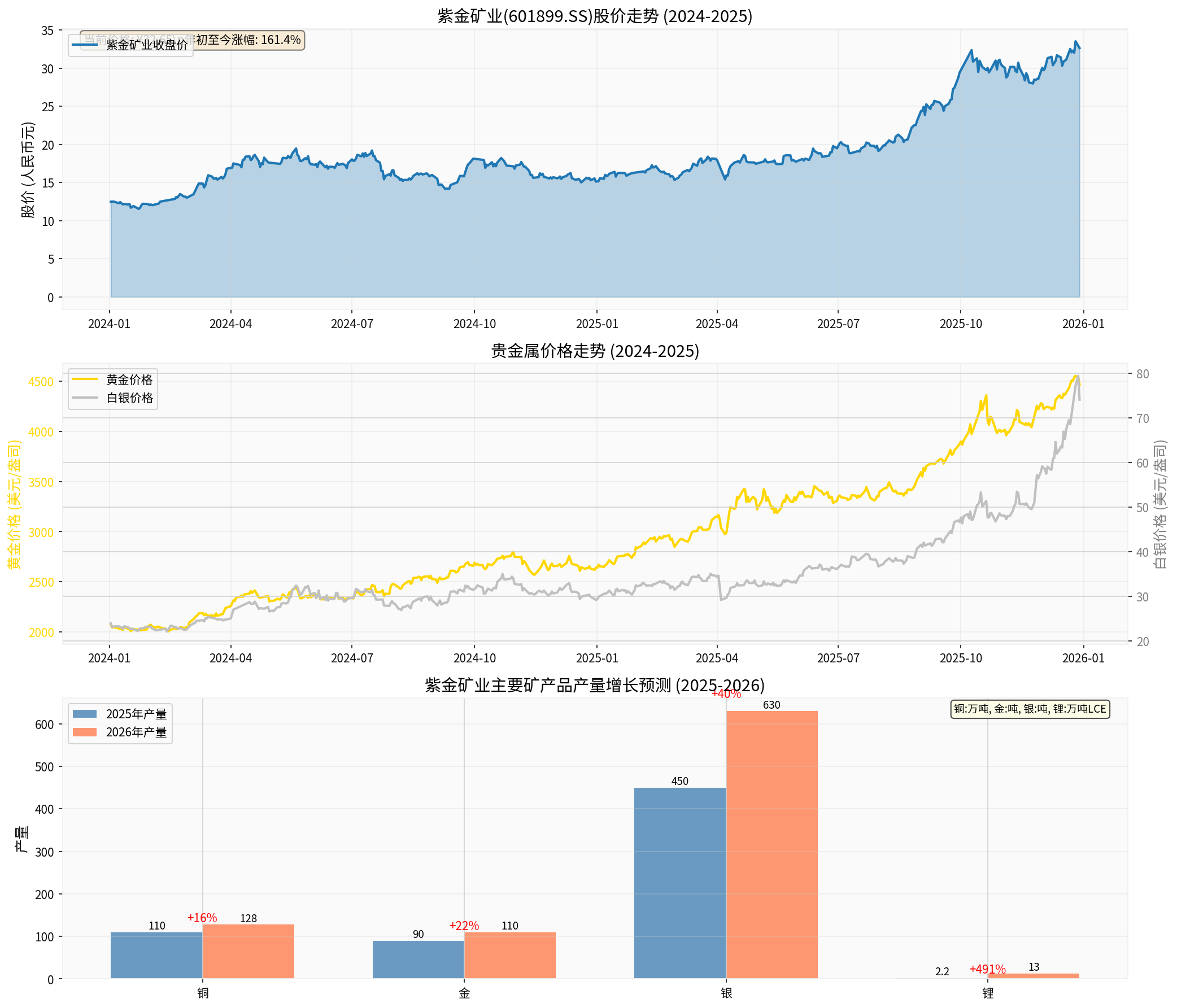

Zijin Mining’s current stock price is 32.65 yuan, with a market capitalization of approximately 866.3 billion yuan. From the beginning of 2024 to now, the stock price has increased by about 163%, showing an outstanding performance [0]. The company’s ROE reaches 30.6%, net profit margin is 13.91%, with excellent profitability [0]. In the first three quarters of 2025, it achieved operating revenue of 254.2 billion yuan, a year-on-year increase of 10.33%; net profit attributable to shareholders was 37.864 billion yuan, a year-on-year increase of 55.45% [0][2].

- Figure 1: Zijin Mining’s stock price trend from 2024 to 2025, current price is 32.65 yuan, up 163% year-to-date

- Figure 2: Precious metal price trend (Jan 2024-Dec 2025), both gold and silver prices have risen significantly

- Figure 3: Production growth forecast of major mineral products (2025-2026), lithium expansion is the most aggressive

According to web search disclosures, the company’s main production plans and growth for 2025-2026 are as follows [1][2]:

| Mineral Type | 2025 Output | 2026 Output | Growth Rate |

|---|---|---|---|

| Copper (10k tons) | 110 | 128 | +16.4% |

| Gold (tons) | 90 | 110 | +22.2% |

| Silver (tons) | 450 | 630 | +40.0% |

| Lithium (10k tons LCE) | 2.2 | 13 | +491% |

- Kamoa-Kakula Copper Mine: Continuous expansion, high grade (4.3%-6%), significant cost advantage. Expected to reach 600k tons/year in 2026 and plan for 800k tons/year in the long term [3][5].

- Julong Copper Mine Phase II: 200k tons/day mining and processing, put into production at the end of 2025; long-term plan for Phase III to 600k tons/year [3].

- Risk points: Overseas power and logistics, policy changes in resource countries, construction progress, etc. [1][3].

- New acquisition projects (e.g., RG, Akim, Arena) and technical transformation expansion (Shuiyindong, Suriname, Guyana Underground Mining Phase I) contribute to increments [1].

- Haiyu Gold Mine is expected to start production in mid-2026, contributing output gradually during the ramp-up phase [1][2].

- Bograra Gold Mine’s resumption brings equity increments, with annual output ramping up to 21 tons (24.5% equity) [1].

- Argentina 3Q Salt Lake: Phase I 50k tons has been put into production, long-term plan to 200k tons/year, cost in the global first tier [3][5].

- Tibet Lagoucuo Salt Lake: Put into production in 2025, planned 150k tons/year [3].

- Risk points: Lithium price fluctuations, salt lake lithium extraction technology and operational stability, overseas project progress rhythm [1][8].

- Silver is associated with lead-zinc, growing with Julong expansion.

- Molybdenum is mainly associated with Julong; Shapinggou independent molybdenum mine (high grade) is planned to start production in 2029, further enhancing long-term supply [2][3].

- Historical execution: Zijin has strong execution in investment, construction and production ramp-up of large domestic and overseas copper-gold projects (e.g., Kamoa, Timok, Wulidika) [3][5].

- Cost advantage: Kamoa copper mine cost is about 18k USD/ton, in the global first tier; salt lake lithium extraction cost <35k yuan/ton, significant profit elasticity in lithium price upward cycle [3][8].

- Tax environment: The company’s overall income tax rate is about17%, Julong copper mine ~9%, Serbia ~15%, significantly lower than some peers (e.g., CMOC ~38%), which is beneficial to maintain net profit margin [1].

- LME copper price recently reported around 11697-12276 USD/ton, up nearly30% year-to-date [6][7].

- Institutional expectations (web search):

- JPMorgan: ~12500 USD/ton in Q2 2026, annual average ~12075 USD/ton [6][7].

- Citi: May reach13000 USD/ton in next6-12 months; bull scenario may challenge15000 USD/ton in2026 [6].

- Goldman Sachs: Relatively cautious,预计2026 may be in10000-11000 USD/ton range [7].

- Drivers: Mine accidents, geopolitics and tariffs, structural demand growth from AI data centers/new energy electrification [6][7].

- Lithium carbonate futures recently broke through130k yuan/ton, low point this year ~58k yuan, up over90% [8].

- Research views (web search): 2026 price center is expected to move up, supply-demand may tend to tight balance, but short-term high volatility risk exists; expected range ~80k-120k yuan/ton [8].

- For Zijin: Salt lake lithium extraction projects with obvious cost advantages will contribute high profit elasticity in price upward cycle [3][8].

- International gold price rose about47.2% in first three quarters of2025 (financial media statistics) [2].

- Pricing logic change: Switch from “real interest rate anchor” to “USD credit hedge”, supported by central bank gold purchases and safe-haven demand [2].

###3.2 Profit Elasticity of Price and Production

- Copper: Volume and price increase is one of core drivers. Assuming copper price center rises in2026 and production grows as scheduled, copper sector profit is expected to increase significantly.

- Gold: Obvious volume-price resonance. If gold price remains high and production grows, gold sector’s profit contribution will further increase [2].

- Lithium: Price center rise plus production jump will bring considerable profit elasticity, but need to警惕 high volatility and uncertainty of capacity release rhythm [8].

###4.1 Consensus Expectation and Optimistic Scenario

###4.2 Profit Calculation Logic

Based on calculation framework summarized from web search [1][2]:

- Relationship between pre-tax profit and net profit attributable to shareholders:Historical rules show net profit attributable to shareholders is about half of pre-tax profit.

- Equity income and participating company increments:Profits of holding companies (e.g., Zangge, Longjing) and participating companies (Ivanhoe, Zhaojin, Wanguo, etc.) will increase significantly with metal price rise.

- Non-recurring income:Company holds a large number of listed company shares with several times floating profit, which can contribute sustainable non-recurring income.

- Tax and regional advantages:Projects in low-tax regions like Julong copper mine (~9% income tax), Serbia (~15%) help improve net profit margin [1].

###4.3 Key Assumptions and Uncertainties

- Gold price above5000 USD/oz, LME copper above12500 USD/ton, lithium price above120k yuan/ton [1][2].

- Key projects reach production on schedule, copper 1280k tons, gold110 tons, silver630 tons, lithium 130k tons production targets are realized.

- Cost control capability remains leading, unit net profit maintains global first tier [3][8].

- Windfall tax/tax rate changes: Some resource countries may increase tax rates or impose windfall taxes, compressing profit margins [1][3].

- Price retracement: If copper, lithium, gold and silver prices fall from high levels, profit elasticity will be significantly affected [6][7][8].

- Project production falls short of expectations: Overseas power, logistics, construction cycle, resource country policies may affect production rhythm [1][3].

- Macro and demand: Global economic growth rate, new energy penetration rate, AI data center construction rhythm affect demand side [6][7].

According to DCF scenario valuation provided by brokerage API [0]:

| Scenario | Fair Value | Relative to Current Stock Price |

|---|---|---|

| Conservative | 32.49 yuan | -0.5% |

| Benchmark | 38.54 yuan | +18.0% |

| Optimistic | 60.39 yuan | +85.0% |

- Conservative: Revenue growth0%, EBITDA Margin13.9%, terminal growth 2%, WACC ~14.8%.

- Benchmark: Revenue growth15.4%, EBITDA Margin14.6%, terminal growth2.5%, WACC ~11.9%.

- Optimistic: Revenue growth21.2%, EBITDA Margin15.4%, terminal growth3.0%, WACC ~10.8%.

###6.1 Core Conclusions

-

Sustainability of multi-metal production growth: High

- Copper, gold, silver, lithium production plans rely on global top resources and mature project echelon, with significant execution capability and cost advantages.

- 2026 copper1280k tons, gold110 tons, lithium130k tons production targets have high achievability, lithium sector has the largest elasticity.

- Key variables: Overseas project construction rhythm, resource country policies and infrastructure, lithium price and cost control.

-

2026 100 billion profit expectation: Significant scenario differences

- Consensus expectation:~62.78 billion yuan, corresponding to2026E PE ~15x (neutral price and production assumptions).

- Optimistic scenario:If gold, copper, lithium prices remain high and projects reach production on schedule, net profit is expected to approach100 billion yuan, corresponding to current market capitalization valuation ~15x PE (based on 866.3 billion yuan market capitalization) [0][1].

- Conclusion:The100 billion expectation is an optimistic scenario, which needs to be supported by favorable prices or more than expected production and cost performance; the current more robust expectation center is still in the range of60-65 billion yuan.

###6.2 Investment Suggestions

- Long-term optimistic:Company has outstanding advantages in resources, cost, global layout and execution capability; gold/copper/lithium price upward cycle will amplify profit elasticity.

- Short-term rhythm:Pay attention to metal price trends and project production verification in Q42025/Q12026;警惕 lithium price high retracement and overseas project progress risks.

- Valuation perspective:If the company evolves towards the “benchmark to optimistic” scenario, current valuation is attractive; if prices and projects fall short of expectations, valuation will be under pressure.

###6.3 Main Risks

- Price risk:Copper, lithium, gold and silver prices retrace sharply.

- Project risk:Overseas projects fail to reach production as expected (power supply, logistics, policy).

- Policy risk:Windfall tax, tax rate increase, environmental protection and community policy changes.

- Operational risk:Overseas geopolitics, exchange rate, safety and cost overruns.

- Market risk:Macro cycle fluctuations and sentiment disturbances.

[0] Gilin API Data: Company overview, real-time quotes, financial analysis, DCF valuation, stock price and precious metal price data

[1] Xueqiu - 100 billion profit next year? Detailed discussion on Zijin Mining’s production plan and profit calculation (https://xueqiu.com/1641200866/367988583)

[2] Sina Finance - Gold stocks enter the golden age (https://finance.sina.com.cn/roll/2025-12-14/doc-inhaukmc3271978.shtml)

[3] Eastmoney Fortune - Zijin Mining focuses on copper + gold + lithium, supplemented by zinc, lead, silver, molybdenum, etc. (https://caifuhao.eastmoney.com/news/20251224100622315257300)

[4] Tonghuahsun F10 - Zijin Mining profit forecast (https://basic.10jqka.com.cn/601899/worth.html)

[5] Sina Finance - The end of computing power is electricity, the end of electricity is copper (https://finance.sina.com.cn/roll/2025-12-12/doc-inhapwfi5130162.shtml)

[6] Mitrade - Copper price breaks through12200 USD to new high! Will it rise to15000 USD in2026? (https://www.mitrade.com/cn/insights/commodity-analysis/more/20251226A02C)

[7] Phoenix Net -2025 Copper Market Year-end Review: Supply Imbalance and Structural Demand Reshape Pricing Logic (https://i.ifeng.com/c/8pA8YiAhX3g)

[8] Huatai Futures - Capital enthusiasm bursts, lithium carbonate price breaks through two-year high (https://www.xincai.com/article/nhemqas7959897)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.