In-Depth Analysis of Eightco Holdings (ORBS) $125 Million Stock Repurchase Program

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

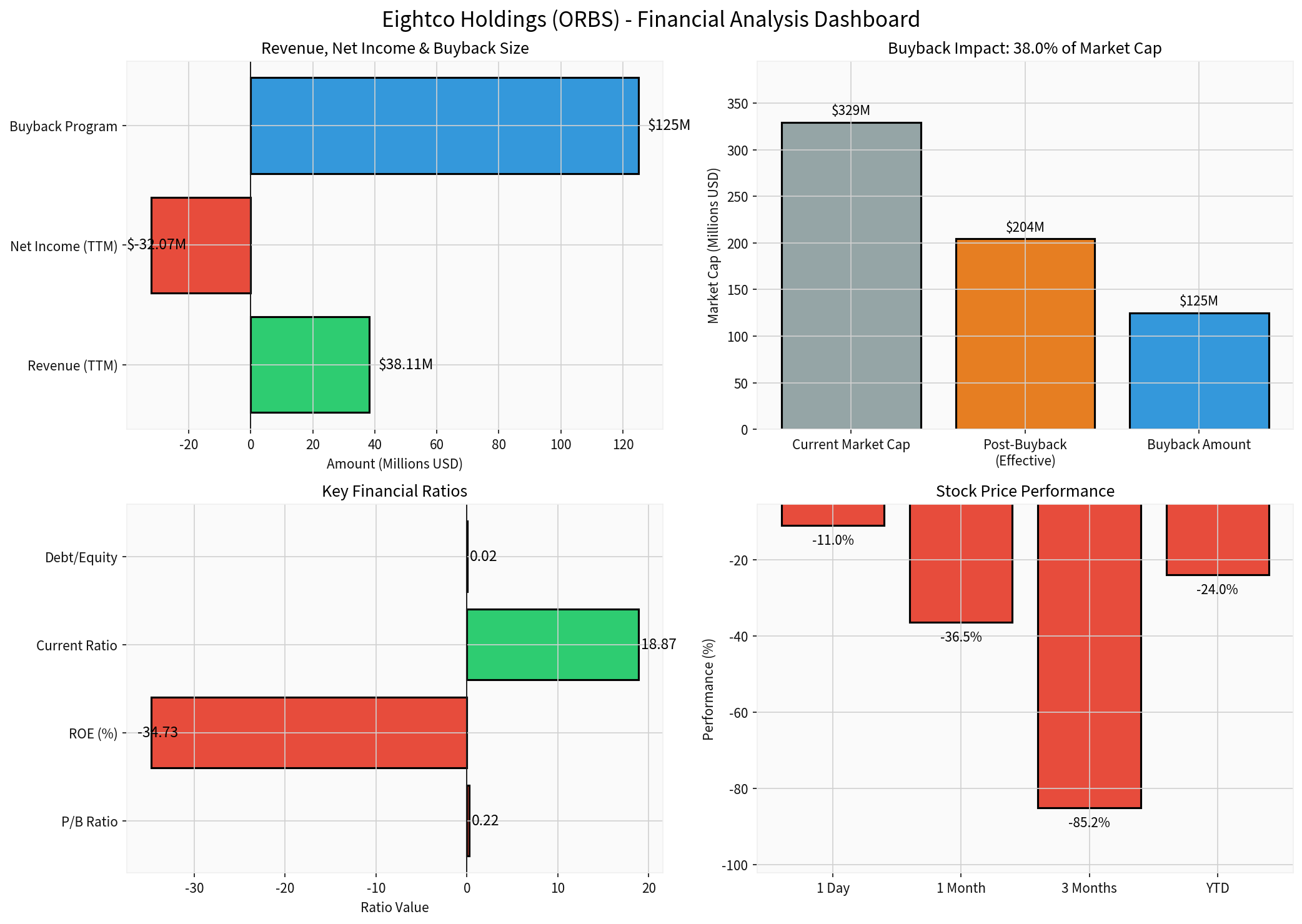

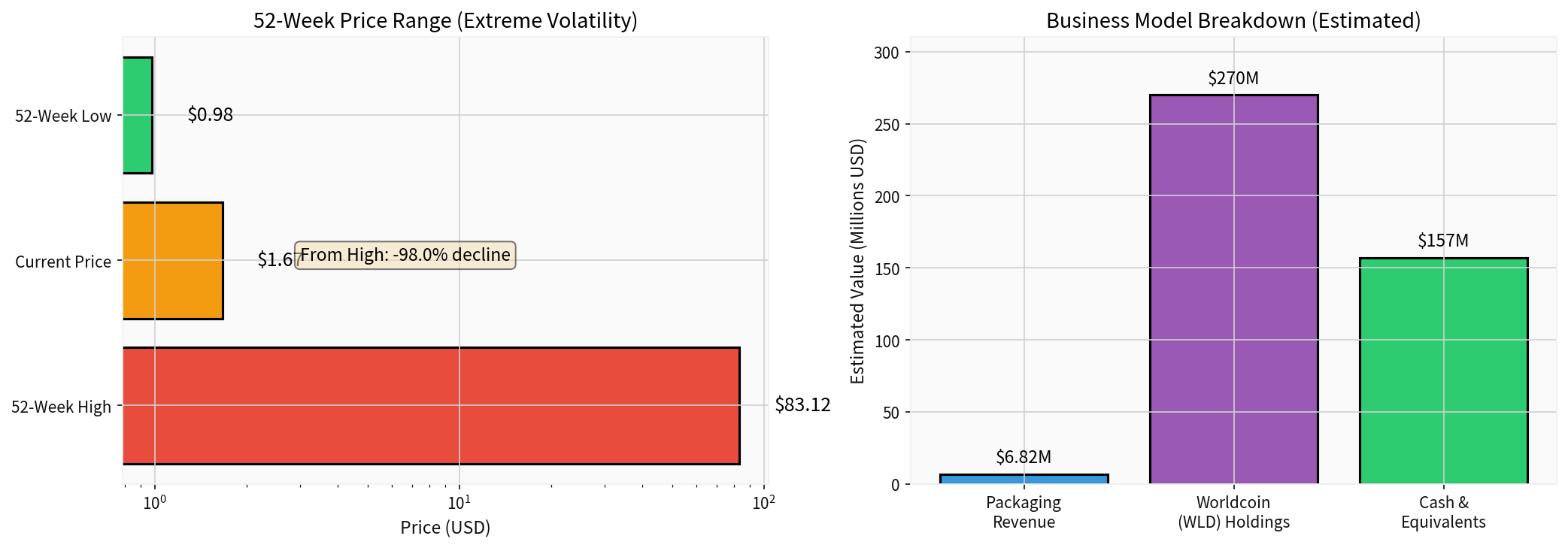

Eightco Holdings Inc. (NASDAQ: ORBS) completed its IPO on September 10, 2025[0], with a current market capitalization of $329 million[0]. On December 29, 2025, the company’s board of directors announced authorization for a stock repurchase program of up to $125 million[1], accounting for approximately 38% of its current market capitalization. Management stated that this move is a vote of confidence in the company’s valuation, strategy, and partnerships[1].

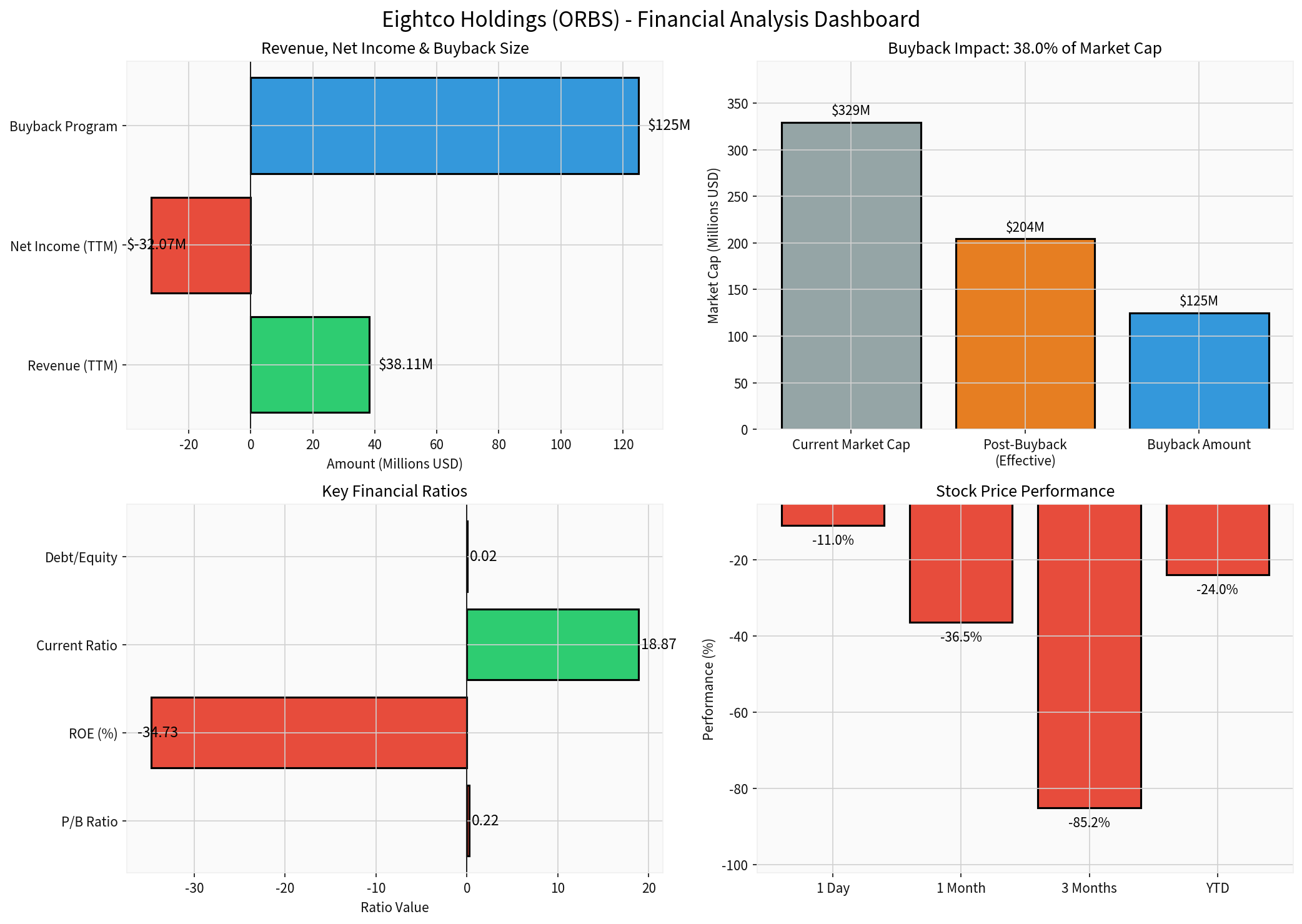

- Current Price: $1.67 (-10.96% daily decline)

- 52-Week Range: $0.98 - $83.12 (showing extreme volatility)

- Market Capitalization: $329.27M

- P/E Ratio: -0.48 (in loss position)

The chart above shows: Revenue vs. Net Income comparison, impact of Buyback on market capitalization (accounting for ~38%), key financial ratios, and recent price performance. Data sources and calculations: Real-time quotes, company overview, daily line data, Python analysis (proportion, etc.)[0]

Eightco has adopted a unique ‘digital asset treasury strategy’ and become the first treasury strategy company for Worldcoin (WLD) tokens[1]. The company’s business consists of two parts:

- Packaging business revenue: $6.82M (traditional business)

- Worldcoin (WLD) holdings: approximately $270M

- Cash and cash equivalents: approximately $157M

- Digital assets account for the majority of the company’s value

The chart above: 52-week extreme volatility (from $83.12 to $1.67) and estimated business composition based on public information. Sources: Company overview, news and industry information (WLD holdings proportion, etc.), Python calculation and plotting[0][0]

- Revenue: $38.11M

- Net Loss: $32.07M

- Net Profit Margin: -84.15%

- ROE: -34.73%

- EPS: -$3.47

- Digital asset (WLD) fair value loss: $18.6M (accounting for ~72%)

- Operating loss: approximately $7.2M (accounting for ~28%)

- Total Q3 net loss: $25.8M

The chart above: Composition of Q3 2025 losses, with digital asset volatility as the main cause (~72%). Data sources: Financial report disclosures, company overview, Python calculations[0]

- Current Ratio: 18.87 (excellent)

- Quick Ratio:18.55 (excellent)

- Debt/Equity:0.02 (extremely low)

- Abundant cash, very light debt burden

- 1-day: -10.96%

-1-month: -36.45%

-3-month: -85.16% (plunge)

-Extreme volatility within the year

- Strong Signal of Undervalued Stock Price

- The stock price has fallen by approximately 98% from its 52-week high[0], and the repurchase scale accounts for 38% of the current market capitalization[0], conveying a strong undervaluation signal from management

- Reduce Outstanding Shares and Improve Per-Share Metrics

- The repurchase will significantly reduce the number of outstanding shares, improving metrics such as EPS (currently negative) and BVPS[0][0]

- Support Stock Price and Market Confidence

- Against the backdrop of sustained stock price pressure and investor investigations (Purcell & Lefkowitz LLP’s investigation into the company[0]), the repurchase program helps stabilize market expectations

- Severe Financial Losses

- TTM net loss of $32.07M, Q3 loss of $25.8M; persistent losses consume cash[0]

- High Dependence on Digital Asset Price Volatility

- Approximately 72% of Q3 losses came from digital asset fair value losses[0], with WLD price volatility as the main cause[0]

- Business Model Controversies and Legal Risks

- The company faces shareholder litigation investigations[0], and its business model is questioned

- Unclear Repurchase Execution and Funding Sources

- The $125M repurchase accounts for a high proportion of current cash (disclosures show cash per share is approximately $1.57[0]), and there is a possibility of using crypto assets for repurchase, with a lack of clear disclosure

- Impact on shareholder value: Short-term signal is clear, but long-term value improvement depends on the company’s ability to turn losses around and asset quality.

- Financial health: Excellent liquidity and extremely low debt, but persistent losses and digital asset volatility are major risks.

- Risk warning: The business model is highly sensitive to crypto asset price fluctuations, and there are legal and governance uncertainties.

- Short-term speculators: The repurchase may bring trading opportunities, but volatility is extreme; strict position management and stop-loss are recommended.

- Medium-to-long-term value investors: Currently lack stable profitability and visible sustainable growth; maintaining a wait-and-see stance is recommended.

- Crypto asset-preferring investors: Need to independently evaluate WLD’s long-term trend and regulatory risks; non-crypto investors are advised to avoid.

- Repurchase execution details (timeline, funding sources, actual execution proportion and disclosure)

- Q4 financial report and 2026 operational guidance (path to loss convergence and business focus)

- Impact of WLD price fluctuations and accounting treatment on financial statements

- Progress of shareholder litigation and signals of governance improvement

- Synergy or divestment decisions between traditional packaging business and digital asset strategy

Eightco’s $125 million repurchase program conveys management’s view that the company is undervalued, but considering severe losses, high dependence on digital asset volatility, business model and legal risks, investors should remain cautious. It is recommended to wait for clearer paths to turn losses around and repurchase execution details before making decisions.

[0] Jinling API Data (includes real-time quotes, company overview, daily/interval/volatility data, financial analysis, Python calculations and charts)

[1] Stock Titan - Eightco (ORBS) authorizes share buyback of up to $125M (https://www.stocktitan.net/news/ORBS/eightco-orbs-announces-share-buyback-program-for-up-to-125-cat11lluok0f.html)

[2] PR Newswire - Shareholder Alert: Purcell & Lefkowitz LLP Announces Shareholder Investigation of Eightco Holdings Inc. (https://www.prnewswire.com/news-releases/shareholder-alert-purcell--lefkowitz-llp-announces-shareholder-investigation-of-eightco-holdings-inc-nasdaq-orbs-302629885.html)

[3] MarketBeat - Eightco (NASDAQ:ORBS) Stock Price Up 7.6% - Here’s Why (https://www.marketbeat.com/instant-alerts/eightco-nasdaqorbs-stock-price-up-76-heres-why-2025-12-16/)

[4] Gate.io Web3 Analysis - Worldcoin Future: Can AI and Investment Drive WLD to $4 by 2030? (https://web3.gate.com/en/crypto-wiki/article/worldcoin-future-can-ai-and-investment-drive-wld-to-4-by-2030-20251221)

[5] Newsheater - Eightco Holdings Inc (ORBS) vs. Its Peers: A Comparison (https://newsheater.com/2025/12/09/eightco-holdings-inc-orbs-vs-its-peers-a-comparison/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.