EVE Energy (300014.SZ) Energy Storage Business Analysis Report: The Second Growth Curve Takes Shape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest disclosed financial data, EVE Energy’s energy storage business achieved a historic breakthrough in 2024—

From the 2025 Q1 data, this trend is further strengthened. In Q1 2025, energy storage battery shipments were 12.67 GWh, a year-on-year increase of 80.54%; power battery shipments were 10.17 GWh, a year-on-year increase of 57.58%[1]. Energy storage batteries not only maintain a leading growth rate but also continue to expand their leading edge over power batteries in absolute scale.

The explosive growth of EVE Energy’s energy storage business is closely related to the rapid expansion of the global energy storage market. According to SNE Research data, global energy storage battery demand remained strong in 2024, and EVE Energy successfully seized market opportunities with high-quality products and stable delivery capabilities[1][2]. The company’s global energy storage battery market share reached 13.3% in 2024, an increase of 2 percentage points year-on-year, ranking second globally[1][2].

The overseas layout of the company’s energy storage business is one of its core competitive advantages. The energy storage project at the Malaysia factory is progressing steadily and is expected to start mass production in early 2026, which will support global overseas delivery needs[1][2]. In addition, the company’s 60 GWh super factory was officially put into operation in December 2024, and its core product, 600Ah+ cells, has become a new industry technical benchmark. In April 2025, the company further released a 6.9 MWh energy storage system based on the large-cell technology route, which reduces Pack costs by 10% and increases energy density per unit area by 20%[2].

EVE Energy continues to consolidate its customer structure in the energy storage field and maintain a stable development trend. Compared with the power battery business, the energy storage business has more diversified customers, covering multiple application scenarios such as power generation side, grid side, and user side. This effectively reduces the risk of dependence on a single customer and enhances the stability and sustainability of the business[1].

In 2024, the company’s energy storage battery business achieved revenue of 19.027 billion yuan, a year-on-year increase of 16%[1][2]. Although the revenue growth rate has slowed compared to the previous two years (the energy storage business growth rate was about 70% in 2023), considering the company’s large scale and high base in 2023, a 16% growth rate still reflects good growth potential. From the perspective of shipments, the 50.45 GWh sales volume increased by 92% year-on-year, indicating that the company is seizing market share through a “volume for price” strategy.

The gross margin of energy storage batteries in 2024 was 14.72%, a year-on-year decrease of 2.30 percentage points[1][2]. The decline in gross margin is mainly affected by two factors: first, the price fluctuation of upstream raw materials such as lithium carbonate is transmitted to the downstream; second, intensified industry competition leads to increased price pressure. However, compared with the 14.21% gross margin of the power battery business, the energy storage business still maintains a slight profit advantage, and the company is improving profitability through product iteration and scale effects[2].

According to the forecast of Soochow Securities Research Institute, the company’s total shipments of power and energy storage batteries will reach 80 GWh in 2024, contributing 1.4-1.5 billion yuan in profit; in 2025, the shipments of power and energy storage batteries are expected to be about 115 GWh, contributing nearly 3 billion yuan in profit[2]. As the proportion of the energy storage business continues to increase, its contribution to the company’s overall profit will become more significant.

Although the energy storage business is booming, the power battery business also shows positive trends. In 2024, the revenue of power batteries was 19.167 billion yuan, a year-on-year decrease of 20%, but the gross margin was 14.21%, an increase of 0.63 percentage points year-on-year[1][2]. This indicates that the company’s power battery business is undergoing a transformation from scale expansion to quality improvement.

In Q1 2025, power battery shipments reached 10.17 GWh, a year-on-year increase of 58% and a month-on-month increase of 6%, showing obvious recovery signs[1]. In the passenger car field, the company has in-depth cooperation with leading new energy vehicle customers such as Xpeng, Leapmotor, and GAC, and supporting models will be delivered one after another; in the commercial vehicle field, the company’s Open Source battery brand has formed market influence since its launch last year[1].

The company’s ROE is 9.57%, and the net profit margin is 6.22%. The overall profitability is at the upper-middle level in the industry[0]. Financial analysis shows that the company adopts conservative accounting policies, and the high depreciation/capital expenditure ratio means there is room for future profit improvement[0].

The company’s current ratio is 1.05, and the quick ratio is 0.92, indicating that the short-term solvency is basically stable[0]. The debt risk rating is “medium risk”, which is acceptable during the current industry expansion period.

The free cash flow is negative (-1.112 billion yuan), which is mainly related to the company’s large-scale expansion and overseas layout investment[0]. In the long run, these capital expenditures are strategic investments to reserve production capacity for future growth.

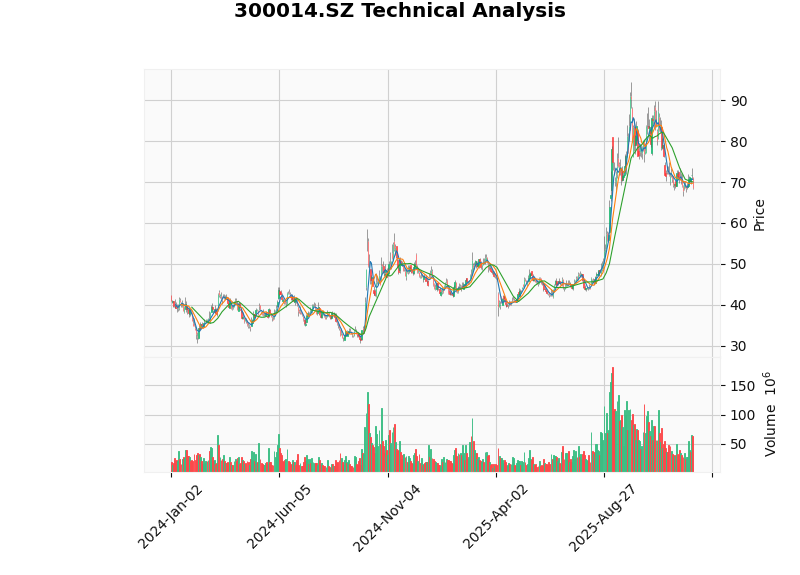

As of December 29, 2025, EVE Energy’s closing price was 68.62 yuan, an increase of 52.83% from the beginning of the year, and a year-on-year increase of 41.34%[0]. However, it has been under pressure in the past three months, with a decline of 18%, indicating that the market has corrected the company’s valuation to a certain extent.

From the technical analysis perspective, the current stock price is in a sideways consolidation stage. The MACD indicator shows a bullish pattern but no golden cross, the KDJ indicator is in the bearish area, and the RSI fluctuates in the normal range[0]. The short-term support level is 67.21 yuan, the resistance level is 70.04 yuan, the 20-day moving average is 70.04 yuan, and the 50-day moving average is 75.61 yuan[0]. Considering that the stock price has回调超过24% recently and the valuation has returned to a relatively reasonable range, there is a rebound demand at the technical level.

Based on the above analysis, we believe that

- Scale Dimension: Energy storage battery shipments have exceeded power batteries, and the leading edge is expanding

- Profit Dimension: The profit contribution ratio of the energy storage business continues to increase, and it is expected to become the largest profit source in 2025

- Growth Dimension: The 92% shipment growth rate is far higher than the industry average, and the market share continues to increase

- Strategic Dimension: The company has developed the energy storage business unit as a core business segment, with obvious resource allocation tilt

However, it should also be noted that the gross margin pressure and industry competition faced by the energy storage business still need continuous attention. Investors are advised to focus on the progress of the company’s overseas factory production, the volume of large-cell products, and the rhythm of gross margin improvement.

| Indicator | Value/Status |

|---|---|

| Current Price | 68.62 yuan |

| Market Capitalization | 139.91 billion yuan |

| P/E Ratio | 37.91 times |

| P/B Ratio | 3.55 times |

| 52-Week Range | 30.73-58.54 yuan |

| Technical Trend | Sideways Consolidation |

[0] Gilin API Market Data - EVE Energy Company Overview, Financial Analysis and Technical Indicators (2025-12-29)

[1] Huizhou EVE Energy Co., Ltd. 2025 First Quarter Report - Official Announcement (http://static.cninfo.com.cn/finalpage/2025-04-25/1223271444.PDF)

[2] Guosen Securities - EVE Energy (300014.SZ) Energy Storage Battery Shipments Grow Rapidly, Overseas Layout is Solidly Advanced (2025-04-25)

[3] Soochow Securities - EVE Energy (300014) Uphold Integrity and Innovate, Cross the Cycle, New Products + Overseas Expansion Achieve Breakthrough (2025-03)

京沪高铁货币资金管理与发债融资策略分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.