Cloudastructure (CSAI) Founder Share Sale & Investment Value Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

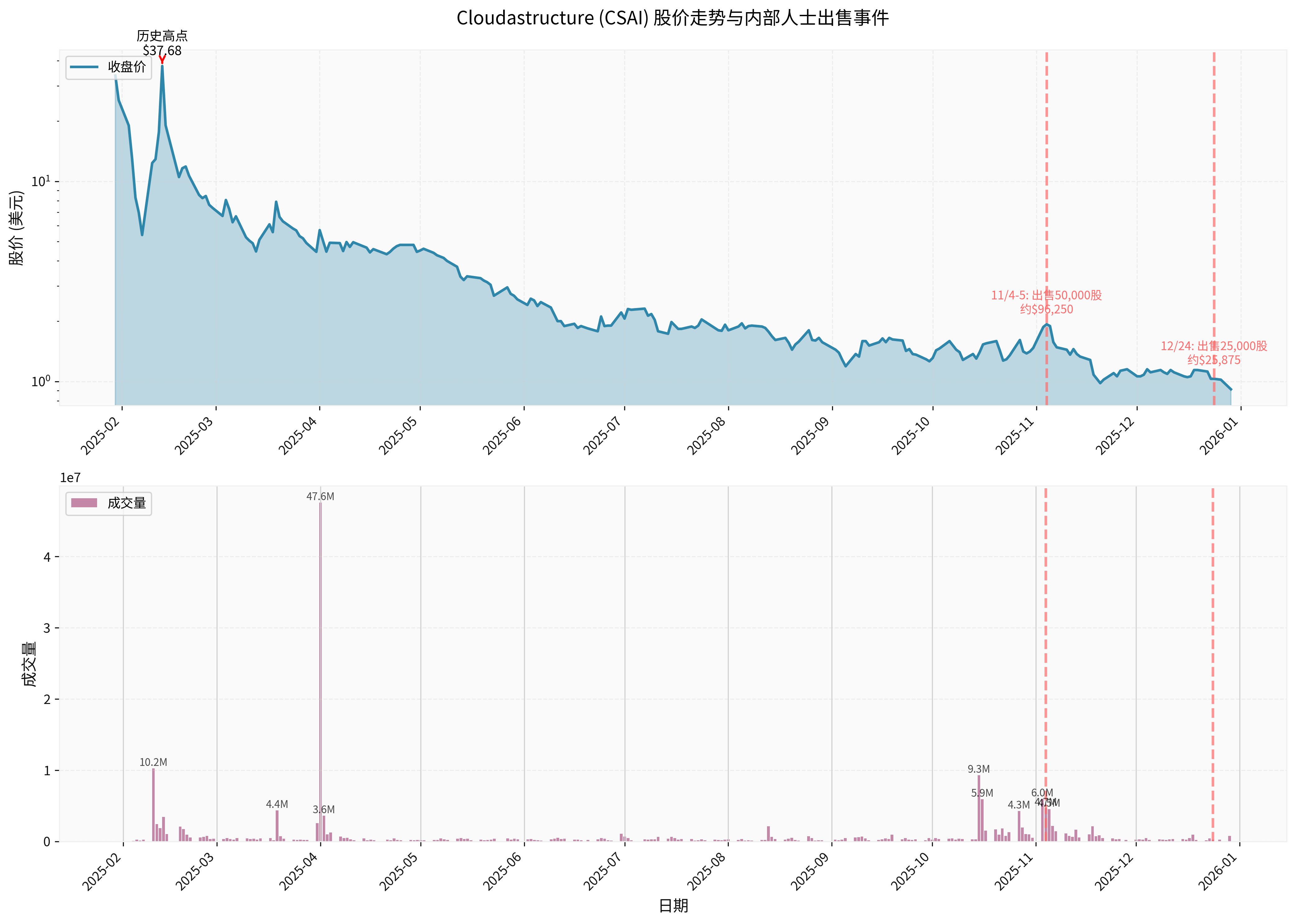

Based on brokerage API data and public disclosures, Bentley’s share sale details are as follows [1]:

- November 4-5, 2025: Sold 50,000 Class A common shares, worth approximately $96,250

- December 24, 2025: Sold 25,000 shares, worth approximately $25,875 (price range: $1.01-$1.035)

- After the sale, Bentley still directly holds 150,000 shares [1]

- February 13, 2025: Hit an all-time high of $52.43

- December 29, 2025: Closed at $0.90

- Annual Decline: -97.33% [0]

- 52-Week Price Range: $0.90 - $52.43 [0]

- Trend Status: Clear downtrend (to be confirmed) [0]

- MACD: Death cross, bearish signal [0]

- KDJ: Oversold zone (oversold opportunity) [0]

- Support Level: $0.91 |Resistance Level: $1.21 |Next Target: $0.82 [0]

- Net Margin: -210.71%

- Operating Margin: -202.05%

- ROE (Return on Equity): -147.57%

- EPS (TTM): -$0.51

- P/E Ratio: -1.72x

- Current Ratio: 4.44

- Quick Ratio: 4.27

- Revenue: $1.45 million, up 272% YoY [2]

- Gross Profit: $720,000, up 1070% YoY [2]

- Still in loss (EPS: -$0.13) [0]

- Contract Signing: Announced on December 15, 2025, the signing of a master service agreement with a major U.S. truck parking lot operator

- Industry Recognition: Won the 2025 MHN Technology Excellence Award

- Customer Financing Partnership: Launched a customer financing partnership program

- Total Annual Contract Value: As of Q3 2025, it was $4.79 million, more than three times the total for 2024

- The SEC once accused the company and its executives of participating in fraudulent promotion activities

- The company paid a $558,071 fine to settle the SEC charges [1]

- This is a major corporate governance warning signal

- Total of two sales: approximately $122,000

- Compared to the company’s market capitalization ($17.57 million), it accounts for less than 0.1%

- Compared to Bentley’s remaining shares (150,000 shares, worth approximately $135,000), the sale ratio is about 47%

- Although the ratio is small, continuous sales against the backdrop of a stock price crash still send a negative signal

- Especially the second sale (December 24) occurred when the stock price had fallen to around $1

- Stock price around $1.90

- On the eve of Q3 earnings release

- Possible motivations: Locking in gains, diversifying investment portfolio

- Stock price had fallen to $1.01-$1.035

- Plunged 98% from the all-time high

- Warning Signal: Continuing to sell at such a low price indicates that management lacks confidence in the company’s short-term prospects

| Factor | Evaluation | Weight |

|---|---|---|

| Transaction Scale | Small (<0.1% of market cap) | 20% |

| Sale Timing | Continuous sales amid stock crash | 30% |

| Frequency | Two sales in short period | 20% |

| Company Fundamentals | Revenue growth but deep losses | 20% |

| Regulatory History | SEC violation record | 10% |

-

Lack of Management Confidence

- Founder still chose to sell when the stock price was at an extremely low level (around $1)

- In stark contrast to “insiders increasing holdings at low levels usually indicates confidence”

- May imply that management is pessimistic about the company’s turnaround or stock price rebound

-

SEC Violation History

- Company was penalized by SEC for fraudulent promotion [1]

- Seriously damages corporate governance and integrity

- Investors should be highly vigilant about such history

-

Extreme Valuation Risk

- Plunged from $52 to $0.90, a drop of 98.17%

- Negative P/E ratio indicates the market does not recognize its profit model

- High Beta value (1.85) indicates extremely high volatility [0]

-

Deep Losses

- Net margin: -210.71%, operating margin: -202.05% [0]

- Although revenue grew by 272%, it has not yet turned profitable [2]

- Cash burn rate is worrying

-

Strong Business Growth

- Q3 revenue up 272% YoY [2]

- Gross profit up 1070% YoY, showing economies of scale [2]

- New customer contracts continue to be signed

-

Positive Industry Outlook

- AI video surveillance and remote guarding are growing markets

- Received industry award recognition

- Customer financing partnerships may accelerate expansion

-

Technical Oversold

- Both KDJ and RSI show oversold [0]

- Technically, there is a possibility of a rebound

- Note: Oversold does not mean bottom

-

Healthy Liquidity

- Current ratio of 4.44, good short-term solvency [0]

- But against the backdrop of deep losses, cash burn rate is key

-

Remaining Holdings

- Bentley still holds 150,000 shares

- Shows a certain degree of interest binding

- But the shareholding ratio has been significantly reduced

- Recommendation: Avoid / High-Risk Speculation

- Stock price in clear downtrend [0]

- Technical indicators are bearish, MACD death cross [0]

- Insider selling continues to pressure the stock

- Next support level at $0.82 [0]

- Recommendation: Wait for clear signals; currently not investment-worthy

- Key Observation Indicators:

- Profit path: When to achieve break-even?

- Cash runway: How long can it last at current loss rate?

- Governance improvement: Any substantive corporate governance reforms?

- Insider behavior: Will there be any share increase actions?

- Only suitable for speculative investors with extremely high risk tolerance

- Need to accept the possibility of total loss

- Not suitable for conservative or moderate risk-preference investors

The share sale by Cloudastructure founder Bentley, combined with the company’s

Although the company has shown certain growth momentum at the business level (Q3 revenue growth of 272%), it has fatal flaws in the following aspects:

- Lack of management confidence(still selling at extremely low prices)

- Lack of sustainable profit path(net margin -210%)

- Corporate governance stain(SEC penalty record)

- Deteriorating stock price trend(comprehensively bearish technically)

- Insiders (especially the founder) increase holdings in the open market

- Company announces a clear profit timeline

- Substantial improvement in governance structure

- SEC-related issues are fully resolved and recognized by the market

At the current stage,

[0] Gilin API Data (real-time quotes, company overview, financial analysis, technical analysis, historical price data)

[1] Web Search Results:

- “Bentley, Cloudastructure Founder Sells Shares Worth $96,250” - Investing.com Chinese Edition (https://cn.investing.com/news/insider-trading-news/article-93CH-3069252)

- “Cloudastructure Founder Bentley Sells Shares Worth $51,500” - Investing.com Chinese Edition (https://cn.investing.com/news/insider-trading-news/article-93CH-3144333)

- “Adam E. Levin; Rick Bentley - SEC.gov” - U.S. Securities and Exchange Commission (https://www.sec.gov/enforcement-litigation/litigation-releases/lr-25857)

- “SEC Settles Actions Against Two Reg A Issuers…” - SEC.gov (https://www.sec.gov/enforcement-litigation/administrative-proceedings/33-11243-s)

[2] Web Search Results:

- “Earnings call transcript: Cloudastructure Reports Robust Q3 2025…” - Investing.com (https://www.investing.com/news/transcripts/earnings-call-transcript-cloudastructure-reports-robust-q3-2025-growth-amid-market-challenges-93CH-4356418)

- “Cloudastructure Reports 272% Year-Over-Year Revenue Growth in Q3 2025…” - Yahoo Finance (https://finance.yahoo.com/news/cloudastructure-reports-272-over-revenue-141000240.html)

- “Cloudastructure Signs Master Service Agreement to Secure Major U.S. Truck-Parking Operator” - Yahoo Finance (https://finance.yahoo.com/news/cloudastructure-signs-master-agreement-secure-140000566.html)

- “Cloudastructure Wins 2025 MHN Excellence Award for Technology” - Business Insider (https://markets.businessinsider.com/news/stocks/cloudastructure-wins-2025-mhn-excellence-award-for-technology-1035621817)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.