Micron Technology (MU) Stock Price High Analysis & Semiconductor Investment Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

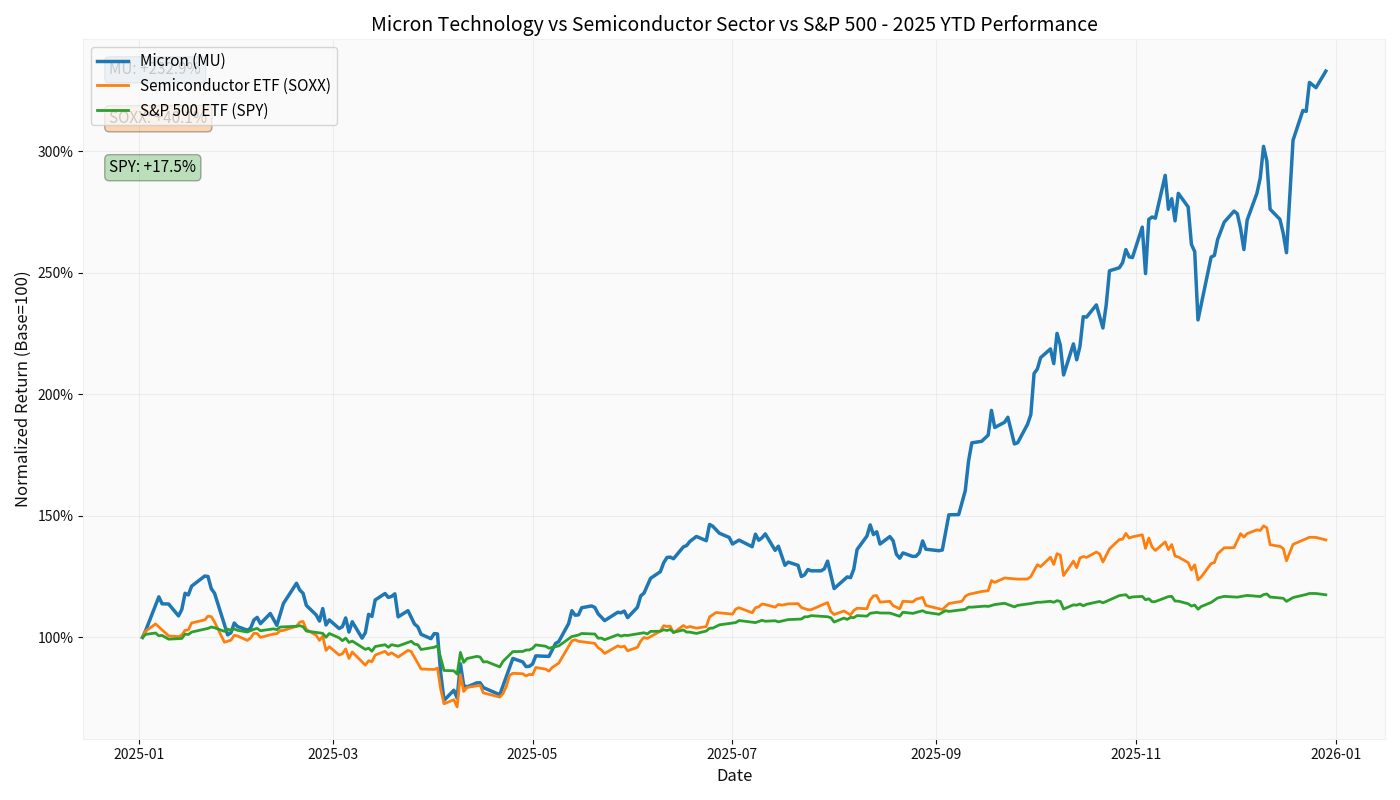

Micron Technology (MU) recently hit an all-time high of $290.87, with the current trading price at $290.92 and a market capitalization of $325.68 billion [0]. The company’s stock performance over the past year has been remarkable:

- Year-to-Date (YTD): +233.12% [0]

- Past Year: +241.01% [0]

- Past Three Years: +474.36% [0]

- Past Five Years: +314.35% [0]

This performance significantly outperformed the semiconductor sector and broader market indices:

- Strong Server Demand: Micron CEO Sanjay Mehrotra stated that server unit demand achieved “high teens” growth in 2025 [1]

- Rapid Growth in HBM Market Share: By Q2 2025, Micron had captured 21% of the global HBM market share, a rapid rise that surprised analysts [3]

- Strategic Partnerships: NVIDIA CEO Jensen Huang and AMD CEO Lisa Su have both publicly praised their collaboration with Micron, stating it is critical for their respective Blackwell and Instinct MI350 platforms [3]

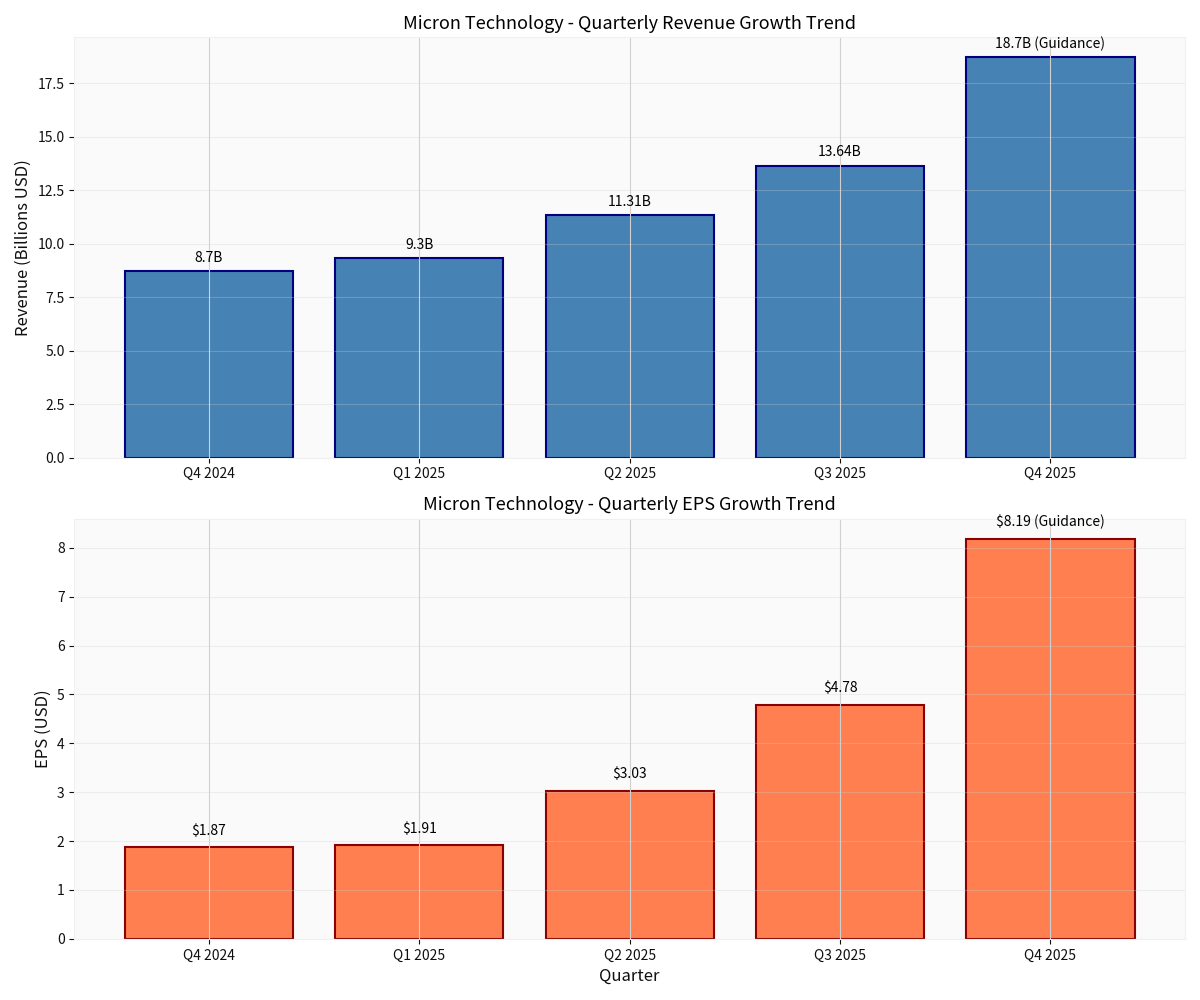

- Latest Quarter (Q1 2025): Revenue of $13.64 billion, +56% YoY, EPS of $4.78

- Outperformance: Revenue exceeded the midpoint of the company’s previous guidance of $12.5 billion, and EPS exceeded analysts’ expectations of $3.95

- Historic Quarter: Net income grew from $1.87 billion in the same period last year to $5.24 billion, an increase of over 180%

- Revenue Guidance: $18.7 billion (midpoint)

- EPS Guidance: $8.19 (midpoint)

- Management Statement: “The Q2 outlook will set significant records in revenue, gross margin, EPS, and free cash flow”

The memory chip industry has emerged from the trough and entered a new boom cycle:

- Enhanced Pricing Power: Memory prices continue to recover, driving improvements in revenue and profit margins

- Improved Supply-Demand Balance: AI demand has led to structural shortages in the DRAM and NAND markets

- Gross Margin Improvement: The company’s gross margin is expected to exceed 50%, showing strong pricing power [2]

- Micron’s 12-layer HBM3E product is used by AMD in its Instinct MI350X accelerator [3]

- Its advantages in power efficiency and density make it the “preferred” supplier for NVIDIA’s GB200 system [3]

- Micron is competing with SK hynix and Samsung for NVIDIA’s 16-layer HBM4 orders, which are expected to be launched in Q4 2026 [5]

Micron has demonstrated a flexible capital allocation strategy:

- Accelerate Idaho Factory: Speed up domestic manufacturing progress to meet current strong demand for AI memory

- Delay New York Factory Expansion: Avoid the risk of oversupply later while preserving capital [2]

This balanced strategy not only seizes current profit opportunities but also manages long-term risks.

| Metric | Value | Assessment |

|---|---|---|

ROE (Return on Equity) |

22.43%[0] | Excellent |

Net Profit Margin |

28.15%[0] | Outstanding |

Operating Profit Margin |

32.69%[0] | Outstanding |

Current Ratio |

2.46[0] | Healthy |

| Metric | Value | Industry Comparison |

|---|---|---|

P/E Ratio (Price-to-Earnings) |

27.46x[0] | Below semiconductor industry average of 96.61x[6] |

P/B Ratio (Price-to-Book) |

5.56x[0] | Close to industry average of9.47x[6] |

P/S Ratio (Price-to-Sales) |

7.69x[0] | Below industry average of12.37x[6] |

###3.3 Analyst Ratings and Target Prices

- Consensus Target Price: $300.00 (+3.1% upside from current price) [0]

- Target Range: $190.00 - $443.00 [0]

- Deutsche Bank: Raised target price from $280 to $300, maintained Buy rating

- Morgan Stanley: Raised target price from $338 to $350, maintained Overweight rating, calling it a “top AI stock”

- B of A Securities: Upgraded from Neutral to Buy

- Cantor Fitzgerald, Needham, Wedbush: All maintained Buy/Overweight ratings

Based on technical analysis data [0]:

| Indicator | Value/Status | Interpretation |

|---|---|---|

Current Price |

$290.73 | All-time high range |

Beta Coefficient |

1.55 | Volatility higher than market |

MACD |

Bullish | No crossover signal |

KDJ |

K:90.5, D:81.4, J:108.6 | Overbought Warning |

RSI (14) |

Overbought Risk | May face short-term correction pressure |

Key Support Level |

$253.28 | Downward support |

Key Resistance Level |

$297.93 | Upward pressure |

###5.1 AI-Driven New Semiconductor Cycle

Micron’s success story reveals new investment logic for the semiconductor industry:

-

Shift from Cyclical to Structural Growth:

- Traditional memory chip industry has obvious cyclical characteristics

- The sustainability and scale of AI demand are transforming some segments into structural growth areas

-

Value Chain Redistribution:

- In the AI value chain, not only GPU/accelerator manufacturers benefit

- Key links such as memory, advanced packaging, and materials also have great investment value

-

High-Barrier Segments Worth Attention:

- High-end products like HBM have high technical barriers and scarce suppliers

- Companies that can break through technical barriers will enjoy excess profits

###5.2 Sector Comparison Analysis

- SK hynix:62% market share (Q22025)

- Samsung:17%

- Micron:21% (rapid growth)

Although SK hynix still dominates the HBM market, Micron’s rapid rise shows its technical strength and execution capabilities.

- NVIDIA (NVDA): GPU leader with stable and diversified HBM supply chain

- AMD (AMD): Uses Micron’s HBM3E for its MI350X accelerator [3]

- SOXX ETF: The semiconductor sector as a whole benefits from AI demand

###5.3 Investment Strategy Recommendations

-

Identify Key Nodes:

- Focus on companies with irreplaceable positions in the AI value chain

- Areas like high-bandwidth memory, advanced packaging, and AI-specific chips have long-term potential

-

Pay Attention to Capacity-Demand Matching:

- Micron’s strategy of flexible capacity adjustment is worth learning

- Avoid investing in areas that may face oversupply later

-

Balance Between Valuation and Growth:

- Despite the huge increase, Micron’s valuation remains relatively reasonable

- Prioritize companies with strong profitability and healthy cash flow

-

Risk Diversification:

- Consider sector allocation through semiconductor ETFs (e.g., SOXX)

- Single-stock risk is high; proper diversification is needed

###6.1 Key Risks

- Valuation Risk: Short-term technical indicators show overbought status, may face correction pressure [0]

- Increased Competition: Samsung and SK hynix will compete more fiercely in the HBM4 field [5]

- Cyclical Risk: Despite strong AI demand, memory chips still have cyclical characteristics

- Geopolitical Risk: Sino-US tech competition may affect the global supply chain

- Demand Shortfall Risk: If AI investment slows down, it may affect memory demand

###6.2 Outlook for 2026

According to The Motley Fool’s analysis [9]:

- Micron is expected to continue achieving significant growth in 2026

- Strong order backlog (orders sold out until 2026) provides visibility [2]

- Gross margin will continue to improve, and profitability will further strengthen

Micron Technology’s stock hitting an all-time high is a

- Explosive AI Data Center Demand- HBM becomes a necessity for AI infrastructure

- Financial Results Exceed Expectations- Revenue and profit margins continue to improve

- Technological Leadership- Competitive advantages in HBM3E and upcoming HBM4

- Excellent Capacity Management- Flexible capital allocation strategy optimizes returns

- AI-Driven Structural Opportunities: Identify key nodes and scarce suppliers in the value chain

- From Cycle to Growth: Some semiconductor segments are undergoing fundamental changes

- Valuation Discipline: Even in high-growth areas, pay attention to valuation rationality

- Risk Management: Achieve risk diversification through sector allocation and individual stock selection

- Short-Term: Technical indicators show overbought status; investors can wait for correction opportunities

- Long-Term: Micron has structural advantages in the AI memory field and is worth long-term attention

- Sector Allocation: Consider participating in sector opportunities through semiconductor ETFs like SOXX, while focusing on leading companies in segments like HBM and advanced packaging

[0] Jinling API Data - Real-time quotes, company profiles, technical analysis, financial analysis

[1] CNBC - “Micron forecasts surging revenue as memory demand for AI” (https://www.cnbc.com/2025/12/17/micron-q1-earnings-forecast-memory-demand-ai.html)

[2] MarketBeat - “Micron Just Changed the AI Cycle—and the Market Knows It” (https://www.marketbeat.com/originals/micron-just-changed-the-ai-cycleand-the-market-knows-it/)

[3] Financial Content Markets - “How Micron’s HBM Boom Redefined the AI Landscape in 2025” (https://markets.financialcontent.com/stocks/article/marketminute-2025-12-25-the-memory-wall-crumbles-how-microns-hbm-boom-redefined-the-ai-landscape-in-2025)

[4] Insider Monkey - “Micron (MU) Jumps 7% on Christmas Rush, Strong Earnings” (https://www.insidermonkey.com/blog/micron-mu-jumps-7-on-christmas-rush-strong-earnings-1667220/)

[5] TweakTown - “SK hynix, Samsung, and Micron fighting for NVIDIA supply contracts for new 16-Hi HBM4 orders” (https://www.tweaktown.com/news/109495/sk-hynix-samsung-and-micron-fighting-for-nvidia-supply-contracts-new-16-hi-hbm4-orders/index.html)

[6] Benzinga - “Competitor Analysis: Evaluating Micron Technology And Competitors In Semiconductors” (https://www.benzinga.com/insights/news/25/12/49610516/competitor-analysis-evaluating-micron-technology-and-competitors-in-semiconductors-amp-semiconducto)

[7] ETF.com - “Semiconductors in Focus: Trends Shaping the Next Wave Innovation” (https://www.etf.com/sections/news/semiconductors-focus-trends-shaping-next-wave-innovation)

[8] Seeking Alpha - “Micron: Suffering From AI Success - Still Cheap At All Time Peak” (https://seekingalpha.com/article/4856097-micron-suffering-from-ai-success-still-cheap-at-all-time-peak)

[9] The Motley Fool - “Prediction: This Will Be Micron Technology’s Stock Price in 2026” (https://www.fool.com/investing/2025/12/27/prediction-this-will-be-micron-technologys-stock/?source=iedfolrf0000001)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.