Analysis of the Impact of Strengthened Antitrust Enforcement and Crackdown on Involutionary Competition on A-share Industry Competitive Landscape and Valuation of Leading Enterprises

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The State Administration for Market Regulation (SAMR) has deployed key tasks for 2026, marking a new stage in China’s antitrust and fair competition governance. Core content includes:

- Continuously deepen fair competition governance: Strengthen efforts to break administrative monopolies, and intensify antitrust and anti-unfair competition law enforcement

- In-depth crackdown on involutionary competition: Focus on rectifying vicious price wars and unfair competition practices

- Improve market systems: Promote reform of market access and exit systems, and strengthen protection of intellectual property rights and trade secrets

This policy orientation has been concretely reflected in multiple industries. For example, SAMR recently warned solar energy enterprises against price collusion and fraud, emphasizing that it will strengthen product quality supervision and crack down on illegal activities to maintain fair market competition [2]. At the same time, the Cyberspace Administration of China (CAC) issued new regulations to standardize the pricing behavior of internet platform operators, clarifying that merchants can independently set prices in accordance with the law when selling goods or services on different platforms, and platforms are not allowed to impose unreasonable restrictions on merchants [4].

- From 2020 to 2021, China strengthened antitrust supervision over the platform economy, leading to a sharp drop in the stock prices of internet giants such as Tencent, Alibaba, Meituan, and JD.com [4]

- In December 2025, CAC’s new regulations further standardized platform pricing behavior, requiring platforms not to impose unreasonable restrictions on merchants’ independent pricing [4]

- Break monopoly barriers: Prevent platforms from using market dominance to engage in practices such as ‘choose one from two’ and ‘big data price discrimination’

- Promote fair competition: Merchants can independently set prices on multiple platforms, reducing platforms’ monopolistic pricing power

- Raise entry barriers: Strengthen intellectual property protection, which is beneficial to technology-innovative enterprises

| Impact Dimension | Short-term Effect | Long-term Effect |

|---|---|---|

| Profitability | Negative - Restriction on monopolistic pricing power | Positive - Promote healthy industry development |

| Growth Space | Negative - Inhibit disorderly expansion | Positive - Innovation-driven growth |

| Risk Premium | Increase - Policy uncertainty | Decrease - Clear regulatory framework |

- Photovoltaic industry: LONGi Green Energy reported a net loss of 8.62 billion yuan in 2024, its first loss in a decade, reflecting the consequences of fierce price wars [11]

- Policy response: SAMR explicitly warned solar energy enterprises to curb deflationary price wars and prohibit price collusion and fraud [2]

- Eliminate inefficient capacity: Accelerate the elimination of enterprises lacking technological and cost advantages

- Increase industry concentration: Leading enterprises further expand market share by virtue of technological, capital, and scale advantages

- Promote industry integration: Drive mergers and acquisitions to optimize resource allocation

Take CATL (300750.SZ) as an example:

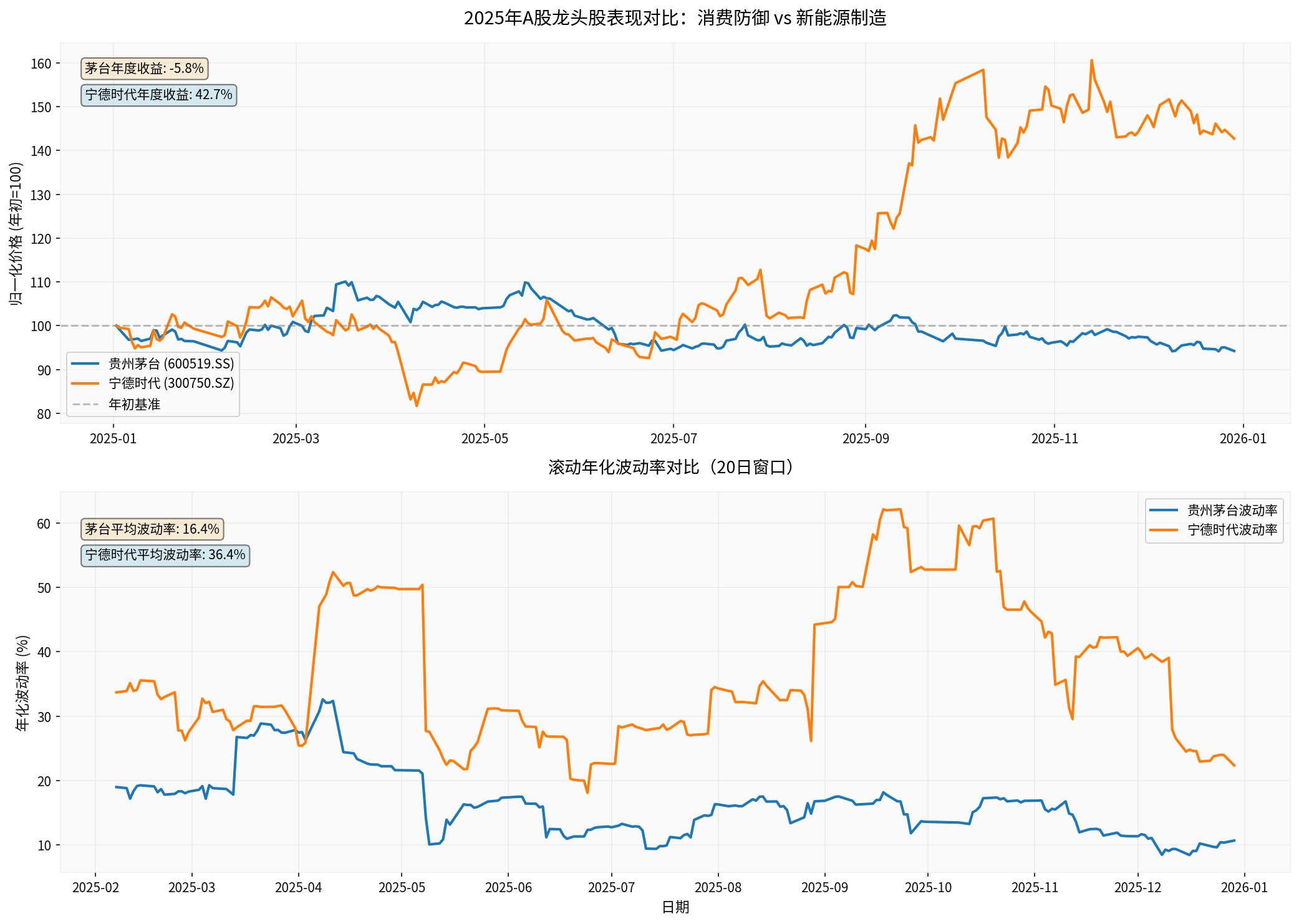

- In 2025, its stock price rose by 42.71%, market capitalization reached 1.63 trillion yuan, and PE ratio was 26.28 times [14]

- ROE reached 22.84%, showing strong profitability [10]

- Stock price rose by 47.14% within 6 months, reflecting the market’s expectation that it will benefit from industry integration [10]

- From ‘scale expansion’ to ‘quality competition’: Valuation focuses more on technological barriers and profit quality rather than pure market share

- Increased premium for leading enterprises: Valuation premium for leading enterprises with technological leading advantages expands

- Valuation discount for small and medium-sized companies: Companies lacking differentiated competitiveness face downward pressure on valuation

Chart shows: In 2025, CATL (new energy leader) had a return rate of 42.71%, while Kweichow Moutai (consumer defense leader) fell by 5.78%. This reflects that under different policy environments, the valuation performance of manufacturing leaders and consumer leaders has shown significant differentiation. Data source: Gilin API [0]

- High concentration: High-end liquor markets such as Kweichow Moutai and Wuliangye have high concentration, but competition is mainly through brand and quality rather than vicious price wars

- Stable price system: Moutai and Wuliangye have strong brand pricing power, and the risk of price wars is low

- In 2025, its stock price fell by 8.01%, and PE ratio was 19.51 times [8][12]

- ROE reached as high as 36.48%, and net profit margin was 51.51%, showing extremely strong profitability [8]

- Market capitalization was 1.76 trillion yuan, with abundant cash flow [8]

- In 2025, its stock price fell by 21.12%, and PE ratio was 14.75 times [9][13]

- ROE was 20.15%, and net profit margin was 34.59% [9]

- Market capitalization was 419.4 billion yuan [9]

- Short-term pressure: Weak consumer demand and intensified industry competition lead to valuation correction

- Long-term benefit: Crackdown on involutionary competition is conducive to maintaining the stability of the high-end liquor price system

- Defensive attribute: High ROE and strong cash flow make it relatively defensive in an environment of stricter regulation

- Strongly regulated industry: The financial industry is already subject to strict regulation, and the additional impact of antitrust policies is limited

- Breaking administrative monopolies: Mainly involves issues such as local protection and market segmentation, with little impact on the valuation of leading enterprises

- Neutral to positive: Breaking administrative monopolies is conducive to expanding market space

- Increased differentiation: Leading institutions with national layouts benefit relatively

- Policy uncertainty premium: Strengthened antitrust law enforcement increases corporate compliance costs and operational uncertainty

- Profitability compression: Restriction on monopolistic pricing power may compress profit margins in the short term

- Restricted mergers and acquisitions: Large-scale M&A transactions face stricter review

- Optimized competitive landscape: Elimination of inefficient competitors, leading to increased market share of leading enterprises

- Improved profit quality: Shift from ‘scale expansion’ to ‘quality competition’ makes profits more sustainable

- Long-term value revaluation: A fair competition environment is conducive to long-term healthy development of the industry

| Valuation Dimension | Traditional Model | New Regulatory Environment |

|---|---|---|

| Growth Driver | Scale expansion, M&A | Technological innovation, efficiency improvement |

| Competitive Advantage | Market share, channel monopoly | Technological, brand, management barriers |

| Profit Quality | High leverage, high turnover | High ROE, strong cash flow |

| Risk Pricing | Low volatility, low premium | Rising policy risk premium |

The following trends are expected:

| Industry Type | Concentration Trend | Driving Factors |

|---|---|---|

| Platform Economy | First decline then stabilize | Competition intensifies after breaking monopolies, and stabilizes at a reasonable level in the long term |

| New Energy Manufacturing | Significantly increase | Technological thresholds and scale effects drive industry integration |

| High-end Consumer Goods | Basically stable | High brand barriers, relatively solid pattern |

| Financial Industry | Slowly increase | Breaking local protection benefits national leaders |

From ‘Involutionary Competition’ to ‘High-Quality Competition’:

- Price war → Value war: From pure price reduction competition to competition in technology, brand, and service

- Scale first → Efficiency first: From pursuing market share to improving operational efficiency

- Homogenization → Differentiation: From imitation and following to innovation leadership

- Characteristics: Possess core technologies, patent barriers, and high R&D investment

- Representatives: New energy technology leaders such as CATL [10]

- Logic: Antitrust crackdown on involutionary competition is beneficial to technology-leading enterprises

- Characteristics: Strong brand awareness, pricing power, and high ROE

- Representatives: High-end liquor leaders such as Kweichow Moutai [8]

- Logic: Brand barriers enable them to maintain premium capabilities in competition

- Characteristics: Have operational efficiency advantages in a fair competition environment

- Logic: After standardized development, platforms with real competitiveness will stand out

- Enterprises lacking core competitiveness and mainly profiting from market dominance face downward pressure on valuation

- Enterprises deeply involved in price wars and lacking differentiated competitiveness face dual pressure on profitability and valuation

- Enterprises dependent on M&A expansion rather than endogenous growth face regulatory resistance

| Industry | Allocation Recommendation | Key Considerations |

|---|---|---|

| New Energy | Overweight | Technological barriers, industry integration, policy support |

| High-end Consumption | Slightly overweight | Brand barriers, profit quality, defensive attributes |

| Platform Economy | Selective allocation | Competitiveness differentiation, regulatory clarity |

| Traditional Manufacturing | Underweight | Intensified competition, elimination pressure |

- Policy implementation intensity exceeds expectations: If the intensity of antitrust law enforcement exceeds expectations, it may have a greater impact on the profits of relevant enterprises

- Macroeconomic fluctuations: Economic downward pressure may intensify industry competition and amplify the short-term impact of involutionary competition crackdown

- Changes in international competition environment: Changes in the global trade environment may affect the domestic industrial competitive landscape

- Technology iteration risk: Rapid technology iteration in emerging industries may lead to sudden changes in the competitive landscape

[0] Gilin API Data - Market data, corporate financial indicators, stock price data

[1] Reuters - “China warns solar firms against price collusion, fraud” (https://www.reuters.com/sustainability/climate-energy/china-warns-solar-firms-against-price-collusion-fraud-2025-12-26/)

[2] Bloomberg - “China Tightens Oversight of Internet Platform Pricing Practices” (https://www.bloomberg.com/news/articles/2025-12-20/china-tightens-oversight-of-internet-platform-pricing-practices)

[3] Zhihu - “LONGi Green Energy reported a net loss of 8.62 billion yuan in 2024, its first loss in a decade, when will the photovoltaic price war end…” (https://www.zhihu.com/question/1900855355782689039)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.