In-depth Analysis Report on Major Asset Restructuring of Minmetals Development (600058)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Minmetals Development issued an announcement on December 29, 2025, announcing the planning of a major asset restructuring. The company’s stock has been suspended from trading since December 30, 2025, and the suspension is expected to last no more than 10 trading days. The core content of this restructuring includes:

- Equity stake in Minmetals Mining Co., Ltd.

- Equity stake in Luzhong Mining Co., Ltd.

- Main assets related to the company’s original business

- Asset swap

- Share issuance

- Cash payment

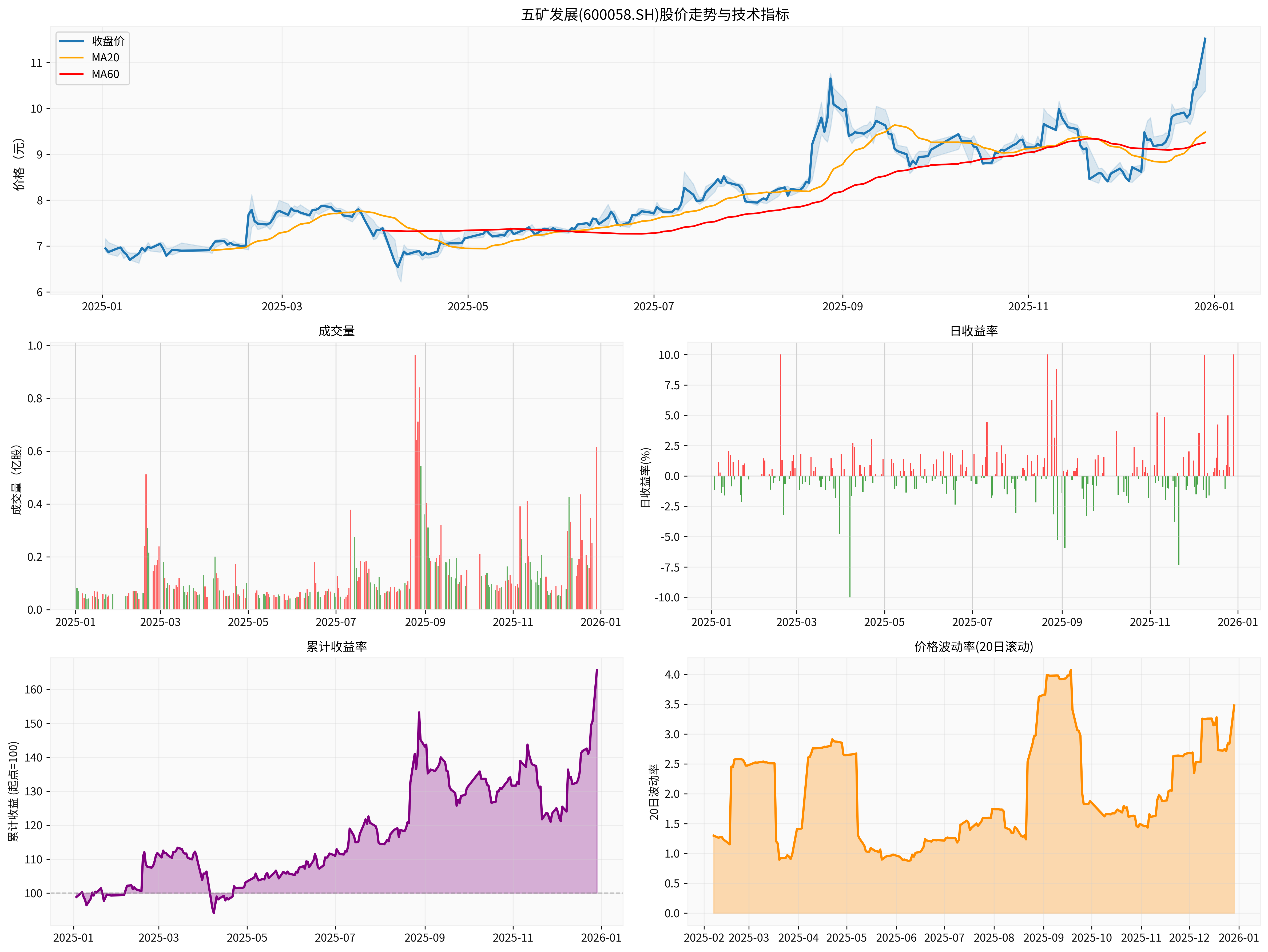

According to brokerage API data, Minmetals Development showed a strong upward momentum before the restructuring announcement:

- Closing Price on December 29, 2025:11.52 CNY (+10.03%, daily limit-up)

- YTD Increase:+65.76%

- 52-Week Increase:+57.16%

- Annual High Price:11.52 CNY (record high)

- Annual Low Price:6.22 CNY

- Annualized Volatility:35.98%

- Sharpe Ratio:1.65

- Maximum Drawdown:-21.03%

According to the latest technical analysis [0]:

- Trend Judgment:Uptrend (breakthrough day, pending confirmation)

- Support Level:10.03 CNY

- Resistance Level:11.52 CNY

- Next Target Price:11.95 CNY

- Trend Score:4.0/5.0

- KDJ Indicator:K:89.1, D:81.9, J:103.7 (overbought warning)

- MACD:Bullish signal

- Beta Value:0.64 (relative to SPY, volatility lower than the market)

According to online search information [3], this restructuring is an important measure to respond to the historical commitment of the actual controller of China Minmetals. As a Fortune 500 enterprise, China Minmetals has total assets exceeding 1 trillion CNY and owns 8 listed companies. Injecting high-quality mining assets into Minmetals Development this time is a specific action to implement the State Council’s policy on promoting high-quality development of the capital market.

- Return on Equity (ROE):Only 1.64%

- Net Profit Margin:0.18%

- Operating Profit Margin:0.74%

- Price-Earnings Ratio (TTM):119.50x (overvalued)

- Price-to-Book Ratio:2.47x

-

Resource Scarcity:According to Bloomberg reports, the China Iron and Steel Association is urging domestic iron ore producers to accelerate key projects to cope with the dependence on imported iron ore [5]. The injection of Minmetals Mining is in line with the national resource security strategy.

-

Industry Integration Opportunity:China’s steel production has entered a plateau, with 2024 output maintaining around 1 billion tons [6]. Domestic iron ore resource development will receive policy support.

-

Vertical Integration of the Industrial Chain:Extending from trade distribution to upstream mineral resources to enhance the industrial chain’s voice and profitability.

-

Resolution of Horizontal Competition:Resolving potential horizontal competition issues with other mining companies under China Minmetals through the injection of mining assets.

- Total Market Capitalization:12.348 billion CNY

- Price-Earnings Ratio (TTM):119.50x

- Price-to-Book Ratio:2.47x

- Price-to-Sales Ratio:0.22x

Although the specific transaction consideration and asset evaluation have not yet been announced, according to online search information [1][2], Minmetals Mining has a large registered capital scale and is considered a “mining asset with registered capital exceeding 8 billion CNY”. If valued at a typical mining company’s P/B ratio of 2-3x, the value of the injected assets may be in the range of 16-24 billion CNY.

- Asset Quality Improvement:Mining assets have significantly higher gross and net profit margins than trading businesses

- Profit Stability Enhancement:Mining cash flow is stable, relatively less affected by economic cycles

- Valuation System Switch:From low-valued trading stocks to high-valued resource stocks

- Industrial Chain Premium:Vertical integration brings synergies

- Net profit margin of injected assets reaches 10-15% (excellent industry level)

- Net asset scale of injected assets: 15-20 billion CNY

- Annual net profit after restructuring is expected to reach 1.5-3 billion CNY

- Given a P/E ratio of 15-20x, reasonable market capitalization: 22.5-60 billion CNY

- Corresponding to the current 12.3 billion market capitalization, there is still an upside potential of 82%-388%

- Net profit margin of injected assets: 5-8%

- Net assets of injected assets: 10-15 billion CNY

- Annual net profit after restructuring: 500 million-1.2 billion CNY

- Given a P/E ratio of 20-25x (considering transformation premium), reasonable market capitalization:10-30 billion CNY

- Corresponding to the current market capitalization, it is basically flat to an increase of144%

- Sharp drop in iron ore prices

- Low valuation of disposed assets

- Restructuring approval or integration not meeting expectations

- Stock price may retrace by30-50%

##5. Risk Factor Analysis

###5.1 Valuation Risk

- The current stock price has already reflected restructuring expectations in advance, and the valuation is at a historical high

- If the profitability of the injected assets is lower than expected, it may face a Davis double kill

###5.2 Industry Risk

- Iron ore prices are highly volatile and significantly affected by global steel demand

- China’s steel production has peaked, and long-term demand growth is weak

- Domestic iron ore mining costs are higher than imported ores, and competitiveness is questionable

###5.3 Restructuring Execution Risk

- There may be disputes over asset evaluation and pricing

- There is uncertainty in restructuring approval

- Business integration and management system integration take time

- Disposal of disposed assets may affect short-term cash flow

###5.4 Market Risk

- Technical indicators show short-term overbought (KDJ values reach89.1/81.9/103.7)

- After resumption of trading, there may be a correction due to good news being realized

- Overall market volatility may affect individual stock performance

###5.5 Policy Risk

- Adjustments to mining policies may affect asset value

- Increased environmental protection requirements may increase mining costs

- Changes in state-owned enterprise reform policies affect the restructuring process

##6. Investment Recommendations

###6.1 Short-term Strategy (1-3 Months)

- During Suspension:Holders can continue to hold and wait for details of the restructuring plan to be announced

- Early Resumption Period:It is recommended to pay attention to the market reaction after resumption and be alert to the “good news realized” correction

- Technical Position:Currently in a technical overbought area, short-term support level at 10.03 CNY, if it pulls back to this level, consider appropriate position building

###6.2 Medium-to-Long-term Strategy (6-12 Months)

- Correct business transformation direction, in line with national strategy

- If high-quality mining assets are successfully injected, profitability is expected to improve significantly

- Industrial chain integration will enhance risk resistance

- Asset securitization under the background of state-owned enterprise reform continues to advance

- Details of the restructuring plan:Transaction consideration, payment method, performance commitment

- Quality of injected assets:Resource reserves, mining costs, profitability

- Synergy effect:Whether it can achieve the effect of1+1>2

- Industry prosperity:Iron ore price trend, steel demand changes

###6.3 Specific Operation Recommendations

- Long-term investors can continue to hold and pay attention to performance realization after the restructuring is completed

- Short-term investors can consider partial profit taking when the stock price surges after resumption to lock in profits

- Not recommended to chase highs:The current stock price has risen sharply, and short-term risks are high

- Wait for correction:It is recommended to wait for possible correction opportunities after resumption, or consider entering at positions below10 CNY

- Batch position building:If you are optimistic about the long-term transformation logic, you can consider batch position building to control risks

###6.4 Target Price and Stop-Loss Level

- **Short-term target (3 months):**11.95 CNY (technical resistance level)

- **Medium-term target (6 months):**13-15 CNY (based on restructuring completion expectations)

- **Long-term target (12 months):**15-20 CNY (based on performance improvement expectations, specific depends on the restructuring plan)

- **Conservative:**9.50 CNY (break below 20-day moving average)

- **Aggressive:**10.03 CNY (technical support level)

##7. Conclusion

Minmetals Development’s major asset restructuring this time is a key step in its strategic transformation. By injecting high-quality mining assets, it is expected to fundamentally improve the company’s profitability and asset quality. From the strategic logic perspective, this restructuring is in line with the national resource security strategy, the direction of state-owned enterprise reform, and the trend of industrial chain integration.

- Significant Strategic Value:Transforming from low-margin trading to high-margin resource business has long-term strategic value

- Short-term Risk Accumulation:The stock price has risen sharply, technical indicators are overbought, and short-term correction risks have increased

- Medium-to-Long-term Potential is Considerable:If the restructuring is successfully completed, the company’s fundamentals are expected to undergo fundamental improvement

- Uncertainties Remain:Specific transaction plans, asset evaluations, and integration effects still have uncertainties

- Long-term value investors who are optimistic about state-owned enterprise reform and resource integration

- Investors who can bear short-term volatility and focus on medium-to-long-term transformation benefits

- Industrial investors with in-depth understanding of the mining and steel industrial chain

- Speculators pursuing short-term quick gains

- Conservative investors with low risk tolerance

- Follow-the-crowd investors who lack understanding of restructuring risks

[0] Gilin API Data - Minmetals Development (600058.SS) Real-time Quotes, Financial Data, Technical Analysis, Historical Price Data

[1] Tencent News - “Responding to Historical Commitment: Minmetals Development Suspends Trading for Restructuring, Planning to Inject Mining Assets with Registered Capital Exceeding 8 Billion CNY” (https://news.qq.com/rain/a/20251229A06UVP00)

[2] Sina Finance - “Planning Major Asset Restructuring, Minmetals Development Suspends Trading from December 30” (https://finance.sina.com.cn/jjxw/2025-12-29/doc-inhenrqk4685024.shtml)

[3] Daily Economic News - “Is the Restructuring Promised by the Actual Controller Finally Coming? Minmetals Development Plans to Purchase Equity Stakes in Minmetals Mining and Luzhong Mining” (https://www.nbd.com.cn/articles/2025-12-29/4200406.html)

[4] Yicai - “Minmetals Development: Plans to Purchase Equity Stakes in Minmetals Mining and Luzhong Mining, Stock Suspends Trading Tomorrow” (https://www.yicai.com/news/102979801.html)

[5] Bloomberg - “China Urges Domestic Producers to Accelerate Iron Ore Projects” (https://www.bloomberg.com/news/articles/2025-12-02/china-urges-domestic-producers-to-accelerate-iron-ore-projects)

[6] Yahoo Finance - “China’s Iron Ore Trading Giant Issues Warning on Price ‘False Fire’ Claiming It Is the Result of Speculative Hype” (includes iron ore price fluctuation chart analysis)

[7] Wikipedia - “China Minmetals” (https://zh.wikipedia.org/wiki/中国五矿)

*ST长药财务造假退市风险对A股医药板块投资者的警示意义

紫光国微收购瑞能半导体控股权分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.