2026 In-depth Assessment Report on Investment Value of the Container Shipping Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me provide you with a comprehensive investment value assessment report for the container shipping industry:

Based on current market data analysis,

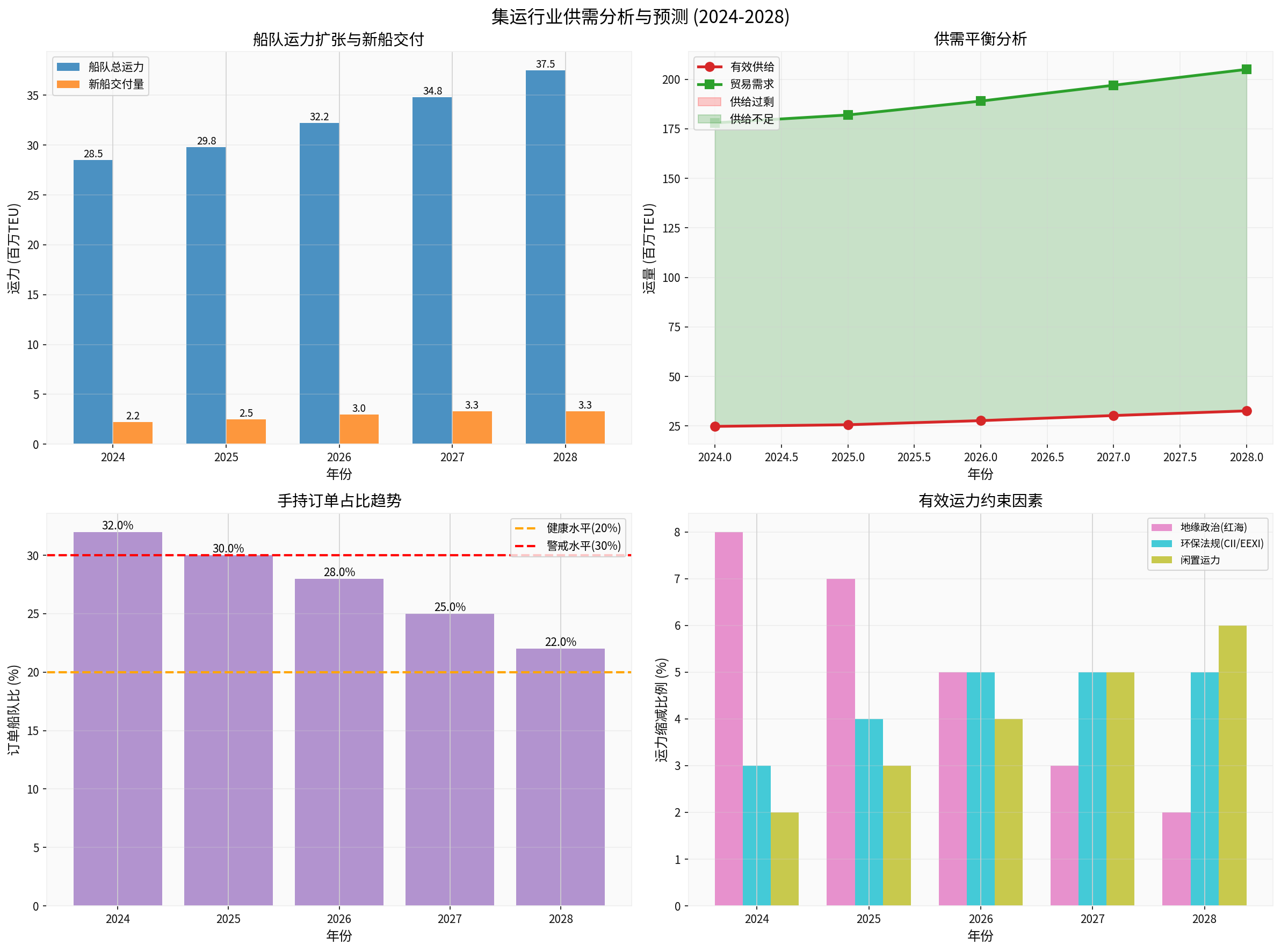

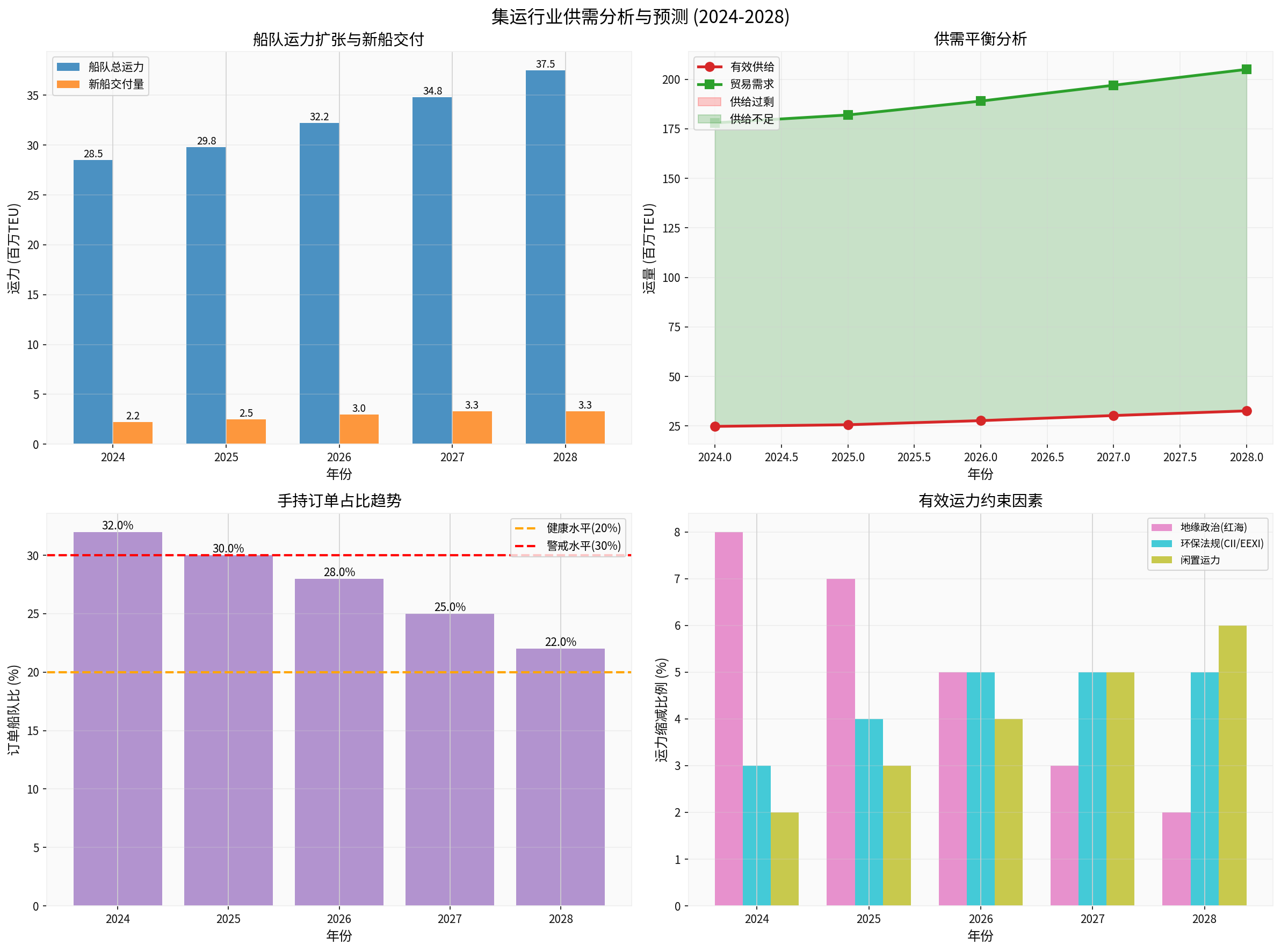

- Record-high order backlogs (approximately 11 million TEU), with order-to-fleet ratio reaching 30%

- A delivery peak of 3.3 million TEU will be reached in 2028

- After geopolitical disruptions ease, approximately 7-9% of the shipping capacity that detoured around the Red Sea will return to the market

- Freight index has dropped by 36% from its 2024 high [1]

- Valuations of leading companies are at historical lows (COSCO SHIPPING Holdings has a P/E ratio of only 6.19x) [0]

- Environmental regulations (CII/EEXI) continue to constrain supply efficiency by approximately 3-5% [2]

- 2026 tariff expectations may drive short-term shipments to be advanced

- Global container fleet grew from approximately 6 million TEU in 2000 to nearly 30 million TEU in 2025

- Current order backlog is approximately 11 million TEU, with order-to-fleet ratio of about30%, which is at a historical warning level

- The expected delivery volume in 2028 will reach a historical peak of 3.3 million TEU[2]

The chart shows the forecast of fleet capacity expansion, supply-demand balance, and effective capacity constraints in the container shipping industry from 2024 to 2028. Key findings: Fleet capacity will grow by 31.6% from 2024 to 2028, and the order-to-fleet ratio will reach the 30% warning line in 2025.

- Large Vessels Dominate: New orders are mainly concentrated on large vessels of 12,000+ TEU

- Increasing Proportion of Green Vessels: Methanol/LNG dual-fuel vessels have become investment priorities

- Accelerated Phase-out of Old Vessels: Vessels delivered between 2008 and 2010 (about 15 years old) face dismantling pressure

According to your background information, effective capacity is constrained by three factors:

- Current Impact: Absorbs approximately 7-9% of global supply (about 2.1-2.7 million TEU)

- 2026 Outlook: Geopolitical disruptions may ease

- Capacity that detoured around the Cape of Good Hope will return to the Red Sea-Suez Canal route

- Voyage time will be shortened by 10-14 days, improving turnover efficiency

- Potential Risk: Approximately 2 million TEU of capacity will return to the market, exacerbating supply-demand imbalance [1]

- Impact Degree: Reduces vessel turnover efficiency by approximately 3-5%

- Mechanism:

- CII (Carbon Intensity Indicator) forces vessels to sail at reduced speeds

- EEXI (Energy Efficiency Existing Ship Index) limits main engine power

- Some old vessels need to be retrofitted or retired early

- Long-term Impact: Constraints will further strengthen from 2026 to 2027 [2]

- Current Idle Capacity: Approximately 2-3% (about 0.6-0.9 million TEU)

- 2026 Forecast: May rise to 4-6%

- Under oversupply pressure, shipping companies will take the initiative to suspend sailings

- Non-environmentally friendly vessels are forced to exit the market

- Route consolidation and capacity allocation optimization

- CAGR from 2024 to 2028 is approximately 3.5%(lower than the supply side’s growth rate of 6-7%)

- Key Drivers:

- Trade growth in emerging markets

- Regional trade increments brought by industrial chain restructuring

- Cross-border logistics demand from e-commerce

- Tariff Expectations (2026): May drive advanced shipments from late 2025 to early 2026

- Geopolitical Easing: Reduces trade costs and stimulates demand growth

- Global Economic Slowdown: Suppresses container shipping demand

- November 28, 2025: 1,403.13 points

- Compared to the 2024 median (2,303.44 points): down 36.19%

- Compared to the 5-year median (2,163.19 points): down 32.05%[1]

The chart shows the downward trend of the Shanghai Export Container Freight Index (SCFI), which has continued to decline from its 2023 high to 2025.

- In December 2025, SCFI rose for two consecutive weeks to 1,552.92 points

- Freight rates on the Europe route rose, with the US West Coast route up more than 10%

- Driving Factor: Tariff expectations drive advanced shipments [3]

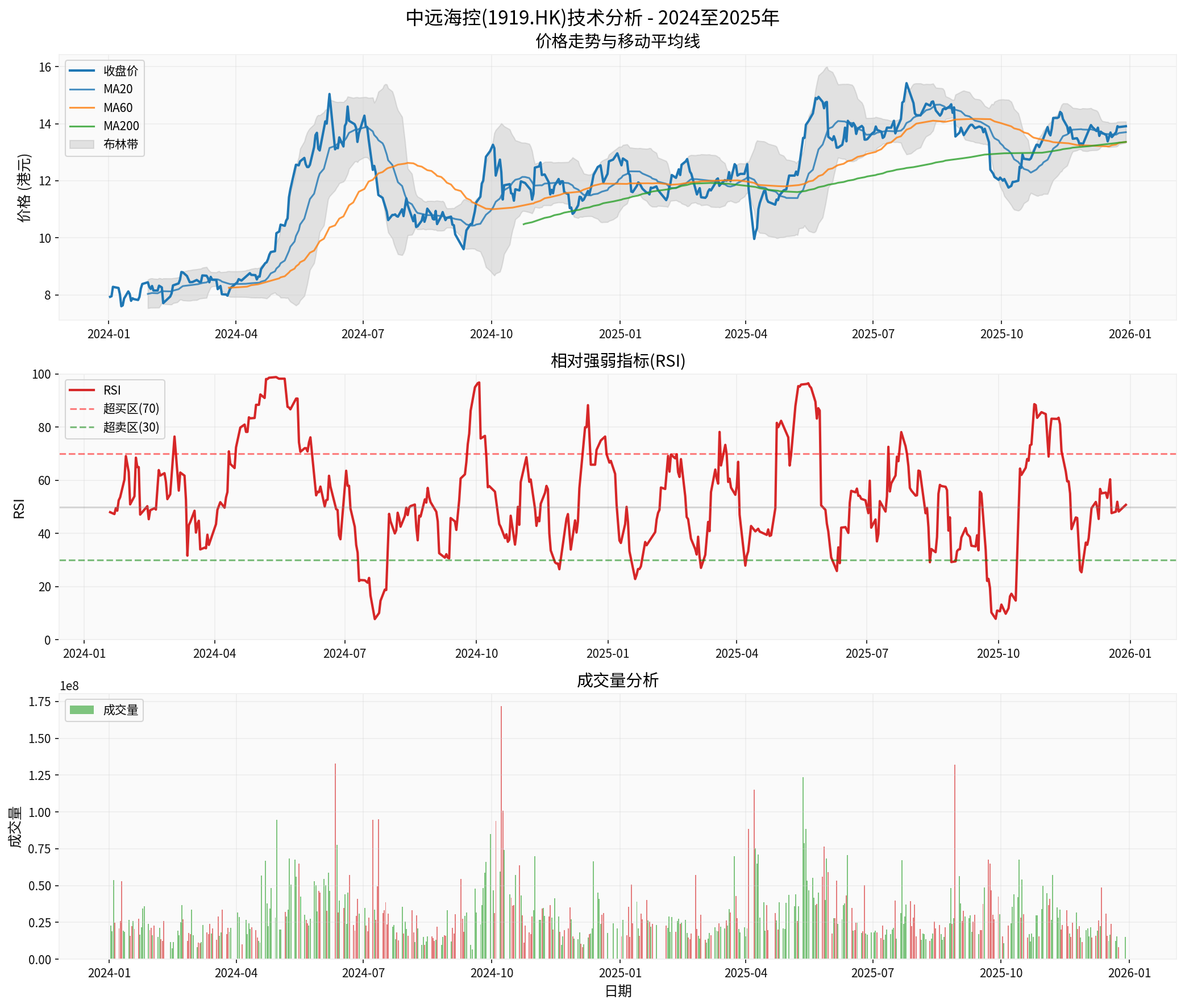

- P/E Ratio: 6.19x (significantly lower than the industry average of 10-15x)

- P/B Ratio: 1.01x (close to book value)

- ROE: 16.14% (high profitability)

- Market Capitalization: $216.94B [0]

The chart shows the stock price trend, trading volume, and technical indicators of COSCO SHIPPING Holdings (1919.HK) from 2024 to 2025. The current stock price is HK$13.91, MA20 is 13.70, MA60 is 13.36, and RSI is 50.77 (neutral zone).

- Conservative Scenario: $161.51(+1,061% upside potential)

- Base Scenario: $121.37(+773% upside potential)

- Optimistic Scenario: $189.09(+1,259% upside potential) [0]

- Trend: Sideways Consolidation (support at $13.70, resistance at $14.04) [0]

- KDJ: Bullish (K:78.4, D:64.2, J:106.7)

- Beta: 0.93 (moderate correlation with the market)

- Red Sea Crisis resolved in H1 2026

- 7-9% of detoured capacity returns to the market

- New vessel deliveries proceed as planned (3 million TEU delivered in 2026)

- Effective Capacity Increase: Approximately 2-2.5 million TEU

- Supply-Demand Gap: Oversupply of approximately 1.5-2 million TEU

- Freight Rate Impact: SCFI may fall below 1,000 points (another 30% drop from current levels)

- Profit Impact: Industry net profit may drop by 40-60%

- Leading companies’ stock prices may drop by 30-50%

- Focus on companies with strong risk resistance and sound financials

- Red Sea Crisis persists until end of 2026

- Strict enforcement of environmental regulations, efficiency loss expands to5-7%

- Accelerated dismantling of some old vessels

- Effective Capacity Constraint: Approximately10-12% (Red Sea:7% + Environmental:5%)

- Supply-Demand Balance: Basic balance or slight shortage

- Freight Rate Performance: SCFI remains in the range of1,400-1,600 points

- Profit Level: Industry maintains moderate profits

- Leading companies have large valuation repair potential

- Focus on companies leading in green transformation

- Global trade growth exceeds expectations in2026 (4-5%)

- New vessel deliveries delayed or canceled (shipyard capacity bottlenecks)

- Tariff policies drive large-scale advanced shipments

- Demand Increment: Approximately1-1.5 million TEU

- Supply Constraint: New vessel deliveries delayed by20-30%

- Supply-Demand Gap: Shortage of approximately0.5-1 million TEU

- Freight Rate Rebound: SCFI may rebound to1,800-2,000 points

- Leading companies’ stock prices are expected to double

- Focus on companies with high capacity flexibility and excellent cost control

###5.1 Short-Term Strategy (0-6 Months): Cautious Observation

- Freight rates are in a downward channel, but there may be a seasonal rebound at the end of2025

- High geopolitical uncertainty, severe short-term volatility

- Valuations have reflected some pessimistic expectations, but the bottom is not clear

- Wait for Better Entry Opportunities

- Consider building positions when SCFI falls below 1,200 points

- Focus on COSCO SHIPPING Holdings’ support range of $12-13

- Focus on Short-Term Catalysts

- 2026 tariff policy implementation

- Substantial progress in Red Sea Crisis

- Shipment peak before Spring Festival

###5.2 Mid-Term Strategy (6-18 Months): Structural Opportunities

- Supply-demand relationship will be clearer in Q2-Q3 2026

- Environmental constraint effects will gradually emerge

- Leading companies are expected to integrate the market through mergers and acquisitions

- Certainty: Leading Companies

- COSCO SHIPPING Holdings (1919.HK): P/E6.19x, ROE16.14%, strong risk resistance [0]

- Maersk (AMKBY): Up 21.68% from2024-2025, lagging behind the industry [0]

- Growth: Green Transformation Leaders

- Companies with a high proportion of methanol/LNG dual-fuel vessels ordered

- Companies with young fleets and lower environmental compliance costs

- Flexibility: Capacity Optimization Capability

- Companies that can quickly adjust capacity allocation

- Companies with strong cost control capabilities during periods of rising idle capacity

###5.3 Long-Term Strategy (18+ Months): Industry Pattern Reshaping

- After the delivery peak from2026-2028, the order-to-fleet ratio will return to normal

- Environmental regulations will accelerate the phase-out of old vessels

- Industry concentration will further increase, and leading companies’ bargaining power will strengthen

- Layout at the Bottom of the Cycle

- The second half of2026 may be the start of a new cycle

- Current valuations provide sufficient safety margins

- Industrial Chain Integration

- End-to-end capabilities in terminals, logistics, and digital services

- Value chain extension from “port-to-port” to “door-to-door”

###6.1 Key Risks

| Risk Type | Specific Performance | Impact Degree |

|---|---|---|

Oversupply |

3.3 million TEU new vessels delivered from2026-2028 | ⭐⭐⭐⭐⭐ |

Geopolitical Easing |

Red Sea route resumes, 2 million TEU capacity returns | ⭐⭐⭐⭐ |

Weak Demand |

Global trade growth lower than expected | ⭐⭐⭐ |

Rising Environmental Costs |

Increased CII/EEXI compliance costs | ⭐⭐ |

Price War |

Intensified industry competition, continuous freight rate decline | ⭐⭐⭐⭐ |

###6.2 Response Measures

- Allocate shipping companies from different regions and with different vessel types

- Focus on upstream and downstream links such as logistics and terminals

- Adjust positions timely based on freight index changes

- Set stop-loss levels (e.g., if key support levels are broken)

- Market share increase brought by mergers and acquisitions

- Industry pattern optimization after capacity clearance

###7.1 Overall Judgment

###7.2 Investment Clock

2025 Q4: Observation Period

├─ Seasonal rebound in freight rates

├─ Tariff expectations drive advanced shipments

└─ Recommendation: Wait for better entry opportunities

2026 Q1-Q2: Stress Test Period

├─ New vessel delivery peak begins

├─ Possible resolution of Red Sea Crisis

└─ Recommendation: Light positions, focus on risks

2026 Q3-Q4: Differentiation Period

├─ Supply-demand relationship gradually clarifies

├─ Environmental constraint effects emerge

└─ Recommendation: Layout high-quality leading companies

2027+: Start of New Cycle

├─ Delivery peak ends

├─ Industry integration accelerates

└─ Recommendation: Long-term holding of high-quality targets

###7.3 Core Investment Logic

- Freight rate downward trend unchanged

- High geopolitical uncertainty

- Wait for better entry opportunities (SCFI <1,200 points)

- Valuations of leading companies like COSCO SHIPPING Holdings are at historical lows

- Environmental constraints and fleet renewal support long-term value

- Focus on companies with both “green transformation + cost control” advantages

- After the delivery peak from2026-2028, supply pressure eases

- Industry concentration increases, leading companies’ bargaining power strengthens

- End-to-end logistics services open a second growth curve

[0] Gilin API Data (stock prices, financial data, technical analysis, DCF valuation)

[1] International Maritime Information Network - “Review of China Container Freight Index from January to November 2025” (http://www.simic.net.cn/news-show.php?id=275090)

[2] Lloyd’s List - “Shipping in 2026 and beyond: the future isn’t what it used to be” (https://www.lloydslist.com/LL1155940)

[3] Sina Finance - “SCFI Rises for Two Consecutive Weeks! Container Shipping Market Rebounds in Off-Season” (https://finance.sina.com.cn/roll/2025-12-24/doc-inhcwaft4612948.shtml)

[4] Hapag-Lloyd Official Website - “Hapag-Lloyd orders eight new dual-fuel methanol container ships” (https://www.hapag-lloyd.com/en/company/press/releases/2025/12/hapag-lloyd-orders-eight-new-dual-fuel-methanol-container-ships.html)

[5] Shipping Information/Maritime Network - Related to “Container Shipping Market Rebounds in Off-Season”

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.