Analysis of Seres' Differentiated Growth Strategy Amidst 2026 Auto Market Growth Pressure

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data and industry information I collected, I will comprehensively analyze Seres’ differentiated growth strategy amidst the 2026 auto market growth pressure.

According to market forecast data, the overall growth rate of China’s passenger car market in 2026 is expected to be only

- BEV Marketbecomes the main source of increment

- Overseas Marketsprovide new growth space

- Mid-to-low-end modelsface severe price pressure, and price wars continue

Leading enterprises like BYD warn that about

According to the latest financial report data, Seres shows a strong momentum of profit growth:

- First three quarters of 2025: Operating income110.534 billion yuan, net profit5.312 billion yuan, up 31.56% year-on-year

- First half of 2025: Net profit2.941 billion yuan, up 81.03% year-on-year

- Improved profit quality: From a loss of 2.45 billion yuan in 2023 to a profit of 5.946 billion yuan in 2024, achieving a fundamental reversal

- Cumulative deliveries exceed 260,000 units, ranking first in sales of models above 500,000 yuan

- Market share exceeds 70%: For every 10 new energy vehicles sold in the Chinese market above 500,000 yuan, 7 are Wenjie M9

- Monthly delivery peak exceeds 15,000 units, setting a new record for Chinese luxury cars

- Residual value rate ranks first: Reigns as the first in residual value rate of Chinese plug-in hybrid models for four consecutive months

Wenjie M5: 200,000-250,000 yuan → Sporty/Youthful Positioning

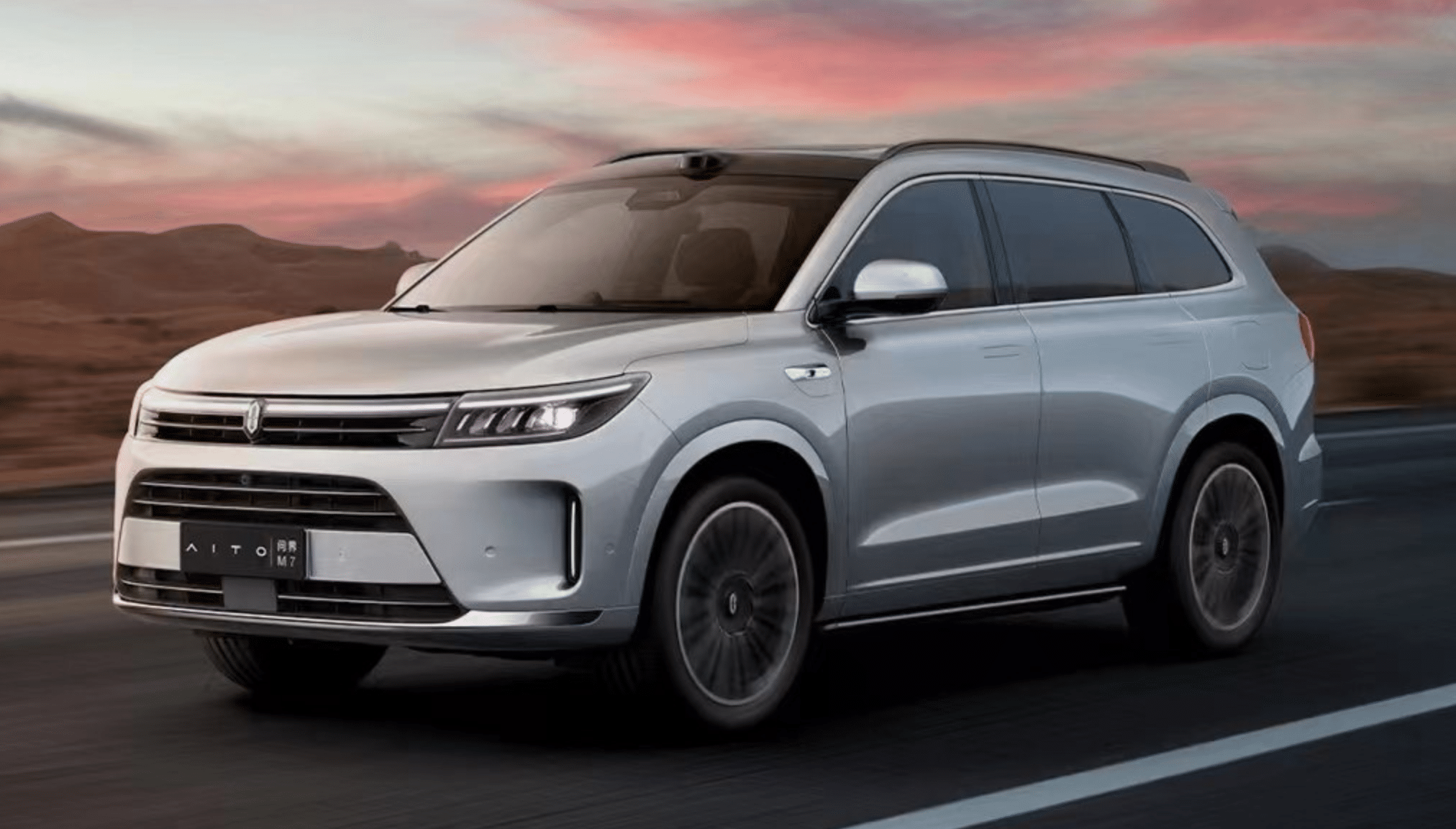

Wenjie M7: 279,800-379,800 yuan → Mid-to-large SUV, 40,000 units delivered in 68 days

Wenjie M8: 400,000 yuan class → 4,320 units sold in the first week of September, surpassing Mercedes-Benz GLC

Wenjie M9:469,800-569,800 yuan → Flagship luxury SUV, cumulative deliveries exceed 260,000 units

- Positioning: Fill the price gap between M5 and M7

- Target customer group: Young families pursuing high-end quality with limited budgets

- Strategic significance: Expand user base and explore larger markets

- Expected launch time: Second quarter of 2026

- Positioning: Ultra-luxury flagship, targeting the market above 600,000 yuan

- Technical upgrades: Equipped with “14-in-1 integrated extended-range system” and 800V high-voltage platform

- Goal: Raise the average brand price and strengthen luxury attributes

- M5 Major Facelift: New exterior and interior + new generation HarmonyOS Cockpit + ADS 4.0

- M7 Version 3.0: Optimize space layout and enhance family comfort

- M8/M9 Facelifts: Improve luxury and quietness

A complete puzzle of “can冲高 upward, can expand downward”:

- M5/M6: Expand the basic market and enhance scale effect

- M7/M8: Stabilize the main market of 300,000-400,000 yuan

- M9/M9L: Establish luxury benchmarks and enhance brand premium

This matrix layout achieves

All Wenjie models are equipped with Huawei’s latest intelligent driving system, featuring:

- 34 high-precision sensorsto build a 360-degree perception network

- WEWA architectureto reduce end-to-end latency by 50% and improve traffic efficiency

- Level 3 autonomous driving capability, seizing opportunities in high-growth and high-premium tracks

- HarmonyOS 4/5.0 Intelligent Cockpitenables seamless connection between vehicle and mobile devices

- Huawei StarRiver Communicationand other ten major functions

- Software-defined car: Continuous iterative upgrades through OTA

Seres strategically invested

- Technology locking: Ensure priority access to Huawei’s ADS system

- Investment returns: Based on Yinwang’s forecasted net profit of 5 billion yuan in 2025, Seres can obtain about 500 million yuan in investment returns

- Deep binding: Upgrade from “business cooperation” to “business cooperation + equity cooperation”

According to market expectations, Wenjie’s 2026 sales target is

- M9+M8: 300,000 units (stabilize the market above 500,000 yuan)

- M7: 200,000 units (maintain sales champion of 300,000 yuan class SUVs)

- M5+M6:50,000 units (expand the basic market)

- Overseas increment:50,000 units (breakthrough in European market)

- Total:600,000 units (+30% growth)

- M6 fills the 250,000 yuan class market: Compete directly with Xiaomi YU7 and Li Auto L6, relying on Huawei’s intelligent driving differentiation advantage

- M9L raises average price: Executive extended version meets high-end user needs and enhances brand premium

- Facelifted model iteration: M7 Version 3.0 consolidates its position in the 300,000 yuan class market

- Leading advantage of L3 intelligent driving: Current penetration rate is only 1.6%, expected to reach 7% in 2026, with huge market space

- 800V high-voltage platform: Improve energy replenishment efficiency and power performance

- Intelligent cockpit ecosystem: HarmonyOS system continues to iterate, with strong user stickiness

- European market layout: Launch right-hand drive versions of M9 and M8 in Germany and Norway in 2026

- Rely on Huawei’s overseas channels: Over 1,000 stores achieve rapid penetration

- Low penetration dividend: European L3 penetration rate is less than 0.5%, and Chinese brands’ market share is only 8%

- Slow industry growth: Overall market growth is only 1-3% in 2026

- Continuous price wars: Mid-to-low-end models face price reduction pressure

- Intensified competition: Competitors like BYD, Xiaomi, and Li Auto continue to exert efforts

- Raw material price increases: Rising battery costs affect gross profit margin

- Wenjie M9’s hot sales at a starting price of 569,800 yuan prove that “technical premium” is feasible

- Avoid falling into the price war quagmire through intelligent experience and brand premium

- Focus on the intelligent luxury car market above 300,000 yuan, avoiding the mid-to-low-end red sea

- M9’s dominant position (70% share) in the market above 500,000 yuan provides strong cash flow

- Scale effect: Increased sales lead to fixed cost amortization

- Supply chain optimization: Deep cooperation with Huawei improves supply chain efficiency

- First-mover advantage in low-penetration markets

- Synergy effect of Huawei’s overseas channels

-

High growth of intelligent luxury car track:

- L3 intelligent driving penetration rate increases from 1.6% to 7%, with huge market space

- High-end market breaks away from price wars and shifts to value competition

-

Systematic advantages of Huawei ecosystem:

- Leading technology: ADS 4.0 + HarmonyOS cockpit build a moat

- Channel synergy: Over 1,000 overseas stores

- Equity binding: Investment returns from Yinwang Intelligence增厚利润

-

Completeness of product matrix:

- Full price range coverage of 200,000-600,000 yuan

- M9 establishes luxury benchmark, M6 expands basic market

Based on current market data and industry trends:

- 2025: Net profit is expected to exceed 8 billion yuan (5.312 billion yuan completed in the first three quarters)

- 2026: With the sales target of 550,000 units, net profit is expected to exceed10 billion yuan

- Compound annual growth rate 2025-2027: Expected to reachover 40%

The current market value corresponds to a PE ratio of about

- High growth of intelligent luxury car track

- Absolute leading position of Wenjie M9

- Systematic advantages of Huawei ecosystem

- Incremental space of overseas markets

The valuation is highly attractive.

Based on the above analysis, the three core pillars of Seres Wenjie’s differentiated growth amidst the 2026 auto market growth pressure are:

- M9 establishes benchmark: 70% share in the market above 500,000 yuan, becoming a new benchmark for luxury SUVs

- M6 fills the gap: 250,000 yuan class market expands the basic market and achieves scale effect

- Facelifted model iteration: M7 Version 3.0 and M5 major facelift continue to strengthen product power

- M9L raises average price: Executive extended version meets high-end needs and enhances brand premium

- Huawei ADS 4.0 intelligent driving system: 34 sensors + WEWA architecture, reducing end-to-end latency by 50%

- HarmonyOS cockpit ecosystem: HarmonyOS 5.0 enables seamless connection between vehicle and mobile devices

- 800V high-voltage platform: Improve energy replenishment efficiency and power performance

- Yinwang Intelligence equity: Double benefits of technology locking and investment returns

- High-end market positioning: Focus on the intelligent luxury car market above 300,000 yuan, avoiding mid-to-low-end red sea

- Overseas increment breakthrough: Rely on Huawei’s over 1,000 overseas stores, targeting 50,000 units of exports in 2026

- Brand premium capability: Wenjie M9 ranks first in residual value rate and NPS user recommendation rate

[1] Sina Auto - Seres’ Net Profit Reaches 5.312 Billion Yuan in the First Three Quarters (https://tags.sina.com.cn/brand_wenjie)

[2] Sohu - 40,000 Units Delivered in 68 Days, the New Wenjie M7 “Does Not Talk Empty Words” (https://m.sohu.com/a/961508197_118579)

[3] Xcar - Residual Value Rate First! Wenjie M9 Defines the Choice of High-end User Value with Strength (https://aikahao.xcar.com.cn/item/3725731.html)

[4] BitAuto - Spy Photos Exposed, Wenjie’s 250,000 Yuan Class Model is About to Be Released (https://www.bitauto.com/article/1003105988455/)

[5] Sina Finance - Seres MPV Plan Emerges, Wenjie M6 Will Disrupt the Family SUV Market in the Second Quarter of Next Year (https://www.news18a.com/news/storys_214680.html)

[6] Xueqiu - Under the High Growth Expectation of L3 Intelligent Luxury Car Track, the Underlying Support for Seres’ High Growth in Revenue and Net Profit (https://caifuhao.eastmoney.com/news/20251219124745165221510)

[7] Baidu Youjia - Five Domains Compete! Hongmeng Zhixing’s 2026 New Energy Market Battle (https://youjia.baidu.com/view/articleDetail/9921965149360834629)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.