Analysis of Investment Value and Valuation Premium of A-Share Listed Companies with Continuous Dividends

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

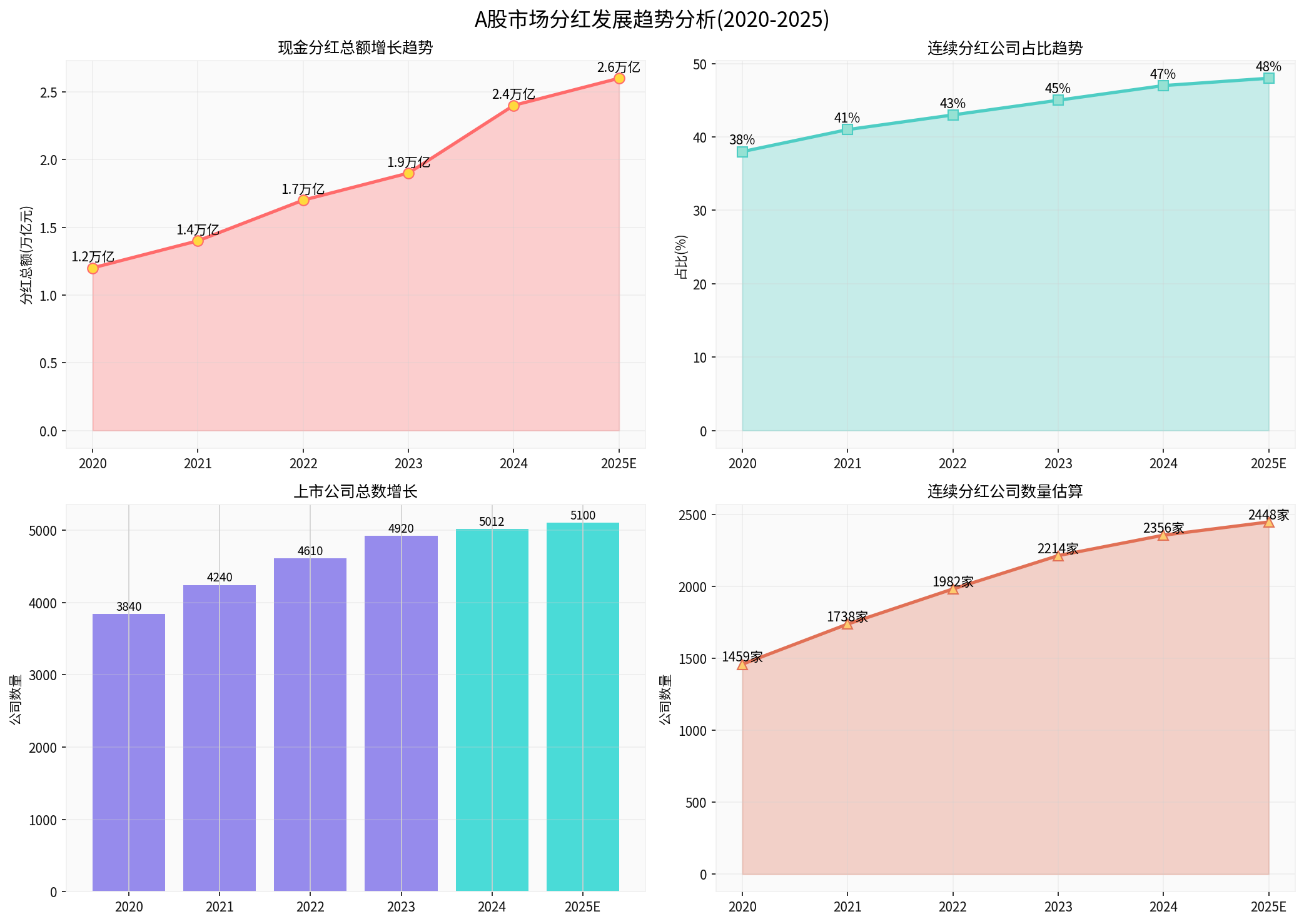

According to the 2025 Report on Corporate Governance of Listed Companies released by the China Association for Public Companies, the A-share market shows an obvious trend of

- 2024 annual cash dividend totalreached 2.4 trillion yuan, a record high

- Number of companies with continuous dividends: Among the 3569 companies listed for more than five years, 1681 have achieved continuous cash dividends for the past five years, accounting for 47.1%

- Companies with growing dividends: 210 companies have seen continuous dividend growth over the past five years, accounting for 5.9%

- Research objects: Covers 5012 listed companies in Shanghai and Shenzhen A-shares

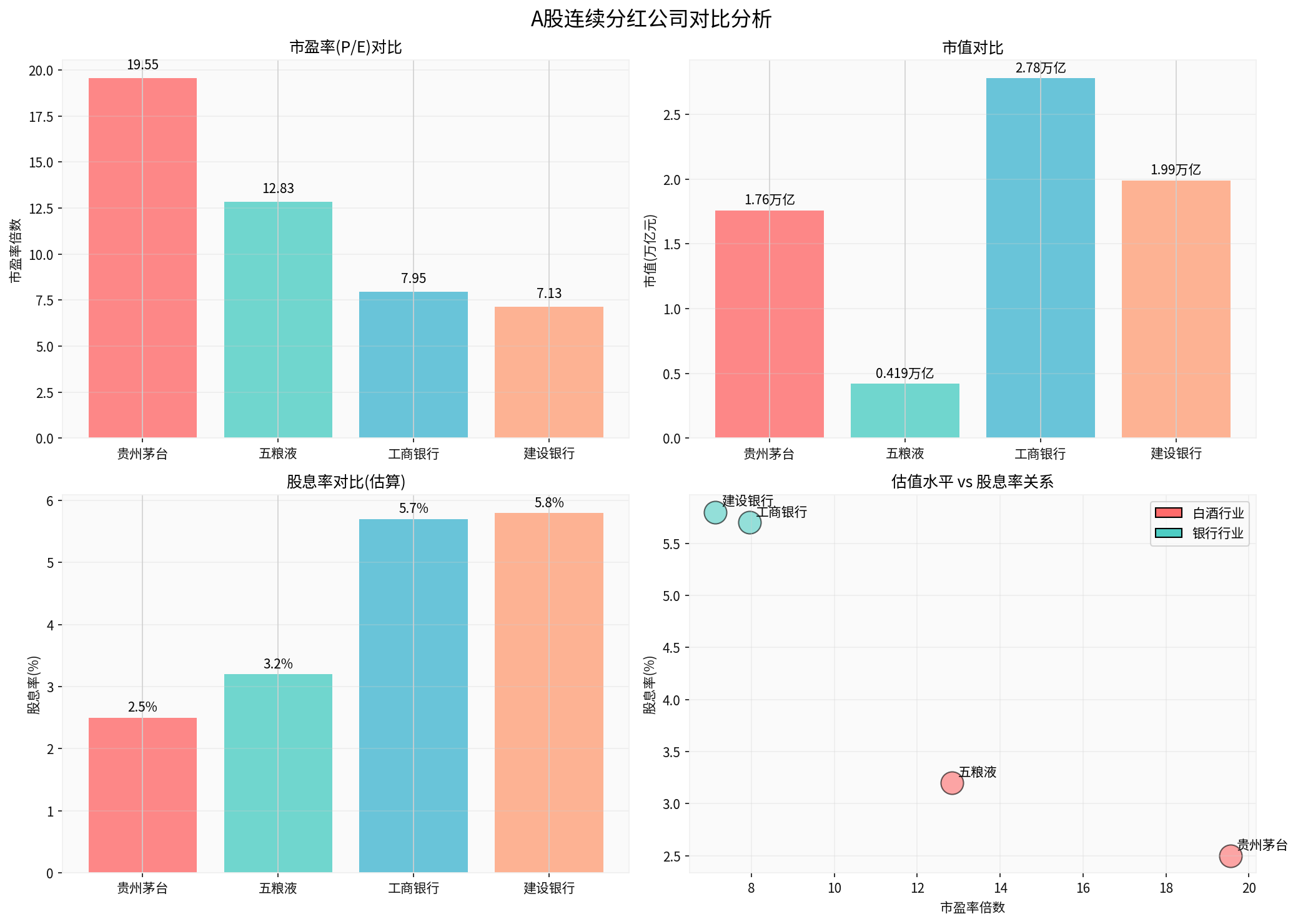

- Market capitalization: 1.76 trillion yuan

- P/E ratio: 19.55x

- Free cash flow: 877.85 billion yuan

- Financial health: Low risk [0]

- Market capitalization: 4194.44 billion yuan

- P/E ratio:12.83x

- Free cash flow:312.73 billion yuan

- Financial health: Low risk [0]

- Market capitalization:2.78 trillion yuan

- P/E ratio:7.95x

- Free cash flow:5436.09 billion yuan

- Dividend yield: ~5.7% [0][1]

- Market capitalization:1.99 trillion yuan

- P/E ratio:7.13x

- Free cash flow:3088.51 billion yuan

- Dividend yield: ~5.8% [0][1]

Companies with continuous dividends generally have

- Leading liquor companies (Moutai, Wuliangye) maintain profit growth amid consumption upgrade trends

- Banking giants (ICBC, CCB) benefit from improved net interest margins and optimized asset quality

- Such companies often show strong defensive attributesduring economic downturn cycles

Continuous dividends reflect the management’s

###1. Valuation Level Comparison

From the valuation perspective:

- Consumer leaders: Moutai (PE19.55x), Wuliangye (PE12.83x) enjoy brand premiums

- Banking stocks: ICBC (PE7.95x), CCB (PE7.13x) are in a historically low valuation range

- Banking dividend yield: Generally in the range of5-6%, much higher than the10-year government bond yield [0][1]

###2. Sources of Valuation Premium

Continuous dividend companies enjoy valuation premiums mainly from:

The market is willing to pay a higher valuation for stable profit growth. Moutai has maintained a high ROE for many years, and the market gives it a certainty premium.

Large-cap, high-liquidity stocks are easier to attract institutional capital allocation and enjoy liquidity premiums.

Sustained shareholder returns align with ESG investment concepts and attract long-term capital inflows.

Public funds, insurance, and other long-term funds prefer high-dividend stocks, forming a positive cycle.

###1. Current Market Environment Characteristics

- Increased volatility: Geopolitical, interest rate environment and other factors increase market uncertainty

- Rising defensive demand: Investors pay more attention to risk-adjusted returns

- Stock-bond cost-effectiveness: The5-6% dividend yield of banking stocks is significantly higher than bond yields [1]

###2. Advantages of High-Dividend Strategy

From the analysis chart of online searches, during the four major market corrections from2018 to2022, the MSCI Global High Dividend Index generally fell less than the MSCI Global Index, reflecting the

Taking a banking stock with a5% dividend yield as an example:

- 10-year cumulative dividend yield can reach62% (assuming no stock price change and dividend reinvestment)

- If the stock price rises by3% annually, the total return can exceed90%

- Compounding effectis powerful in long-term investment

Currently, the PB of the banking sector is generally between0.4-0.6x, at a historically extremely low level [1]. If economic recovery expectations strengthen, there is room for valuation repair.

###3. Investment Risk Assessment

High-dividend companies are mostly concentrated in traditional industries such as banking, energy, liquor, etc., with the risk of

High-dividend companies are often mature enterprises with relatively limited growth. Excessive pursuit of high dividends may miss opportunities in growth stocks.

Changes in financial regulation, tax policies, etc., may affect the profitability and dividend willingness of high-dividend companies.

###1. Allocation Recommendations

- Core position (60-70%): Allocate high-dividend, low-valuation banking stocks, utilities, etc.

- Satellite position (30-40%): Allocate consumer and tech leaders with good growth

- Banking: ICBC, CCB, etc., state-owned large banks, dividend yield5-6%, PB0.4-0.6x [0][1]

- Consumer: Moutai, Wuliangye, etc., leading brands with deep moats and abundant cash flow [0]

- Energy: Oil, coal, etc., central enterprises with high dividends and low valuations

###2. Stock Selection Criteria

- Continuous dividend years ≥5 years

- Dividend yield ≥3%

- Dividend payout ratio:30-70% (sustainable dividend range)

- Stable growth of free cash flow

- ROE≥10%

- Reasonable asset-liability ratio

###3. Buying Timing

- Valuation at historical low (e.g., current banking PB0.4-0.6x)

- Dividend yield significantly higher than risk-free rate (current5-6% vs government bond ~2%)

- When market sentiment is pessimistic: Reverse layout of high-quality targets

###4. Risk Control

- Diversified investment: No single industry exceeds40%

- Dynamic adjustment: Adjust positions according to valuation changes

- Focus on fundamentals: Beware of “high-dividend traps” (deteriorating profits but maintaining high dividends)

-

Companies with continuous dividends have significant investment value: Abundant cash flow, stable profits; standardized governance, strong shareholder return awareness; high probability of outperforming the market in long run.

-

Valuation premium is reasonable: Profit certainty premium; liquidity premium; ESG premium and institutional holding premium.

-

High-dividend strategy has outstanding cost-effectiveness now: Dividend yield5-6% vs bond yield ~2%; defensive value prominent amid market volatility; banking and other sectors at historical low valuations with repair space.

- Conservative investors: Focus on banking stocks, utilities to get stable dividend income

- Balanced investors:70% high-dividend +30% growth stocks, balance income and growth

- Active investors: Add growth-oriented segment leaders on top of core high-dividend positions

[0] Gilin API Data (real-time stock quotes, financial analysis data, Python calculation charts)

[1] Yahoo Finance - Latest Valuation and Dividend Yield Forecast of Mainland Chinese Banks (https://hk.finance.yahoo.com/news/大行-中金列出內銀股最新估值及股息率預測-表-032601984.html)

[2] Cnyes - Analysis of High-Dividend Defensive Investment Strategy (https://www.cnyes.com)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.